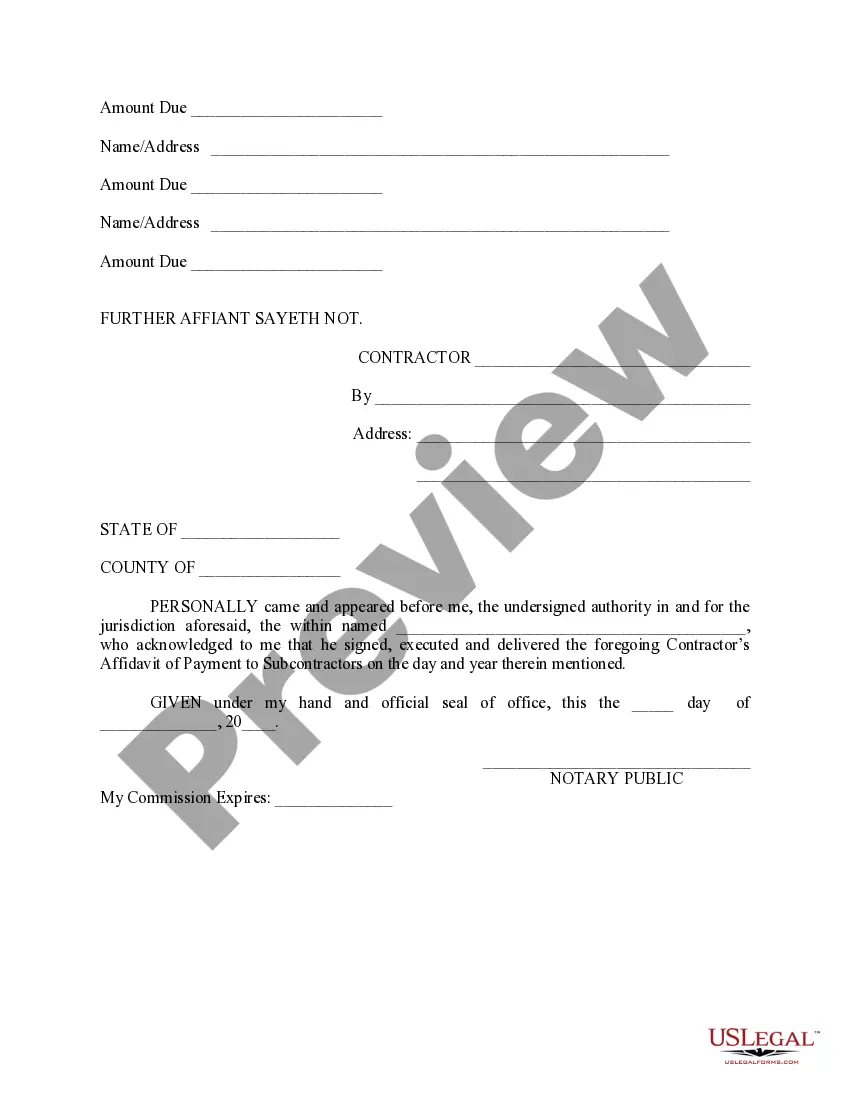

Illinois Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can obtain or print.

Through the website, you can find thousands of forms for business and personal needs, categorized by types, states, or keywords. You can access the latest editions of forms such as the Illinois Contractor's Affidavit of Payment to Subs in just minutes.

If you have a monthly subscription, Log In to acquire the Illinois Contractor's Affidavit of Payment to Subs from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Select the file format and download the form to your device.

Make adjustments. Fill out, modify, print, and sign the downloaded Illinois Contractor's Affidavit of Payment to Subs. Every template you add to your account has no expiration date and is your property indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Illinois Contractor's Affidavit of Payment to Subs with US Legal Forms, one of the most extensive repositories of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the correct form for your city/county. Click the Review button to examine the form`s details.

- Review the form information to make sure you have chosen the correct one.

- If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your information to create an account.

- Process the payment. Use your credit card or PayPal account to complete the payment.

Form popularity

FAQ

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

AIA Document G706 is intended for use when the Contractor is required to provide a sworn statement verifying that debts and claims have been settled, except for those listed by the Contractor under EXCEPTIONS in the document. AIA Document G706 is typically executed as a condition of final payment.

AIA Document G702®1992, Application and Certificate for Payment, and G703A®1992, Continuation Sheet, provide convenient and complete forms on which the contractor can apply for payment and the architect can certify that payment is due.

The courts recognize the subcontractor's right to sue the owner directly for the payment of its claim to the extent that the master contract creates an express obligation on the owner's part (must) as opposed to a mere option (may) to make payment to the general contractor conditional upon the latter's having

The prime contractor has a direct contractual agreement with the property owner. If the contractor isn't paid, he can sue on the contract and record a mechanic's lien. But subcontractors, workers and suppliers don't have a contract with the property owner.

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.

But the IRS auditor says you cannot deduct an expense if you did not send out Form 1099. Your subcontractor labor can be a pretty significant amount, maybe your largest expense. The tax you would owe if your subcontractor labor expense is disallowed would be staggering. But you paid the expense, and can prove it.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

Must Illinois lien waivers be notarized? No. Illinois does not require mechanics lien waivers to be notarized in order to be effective. Furthermore, electronic signatures are valid on lien waivers in Illinois, as well.

The ability to withhold payment needs to be written out in the contract because, in most states, verbal agreements for commercial work are not binding and will not hold up in court. With a written contract that both parties agree to, it's safe for a contractor to withhold payment if a vendor becomes non-compliant.