The Illinois Disabled Persons Exemption is a property tax relief program for Illinois homeowners who are disabled or blind. It allows for disabled homeowners to receive a reduction in their property taxes, with the amount of the reduction depending on their income. There are two types of Illinois Disabled Persons Exemption: the General Homestead Exemption and the Disabled Persons Homestead Exemption. The General Homestead Exemption is available to all homeowners and reduces the amount of total taxable equity on the home by up to $6,000. The Disabled Persons Homestead Exemption is available to those with a disability or blindness and reduces the amount of total taxable equity on the home by up to $8,000. To be eligible for either exemption, applicants must meet certain requirements, such as owning and occupying the home as their primary residence.

Illinois Disabled Persons Exemption

Description

How to fill out Illinois Disabled Persons Exemption?

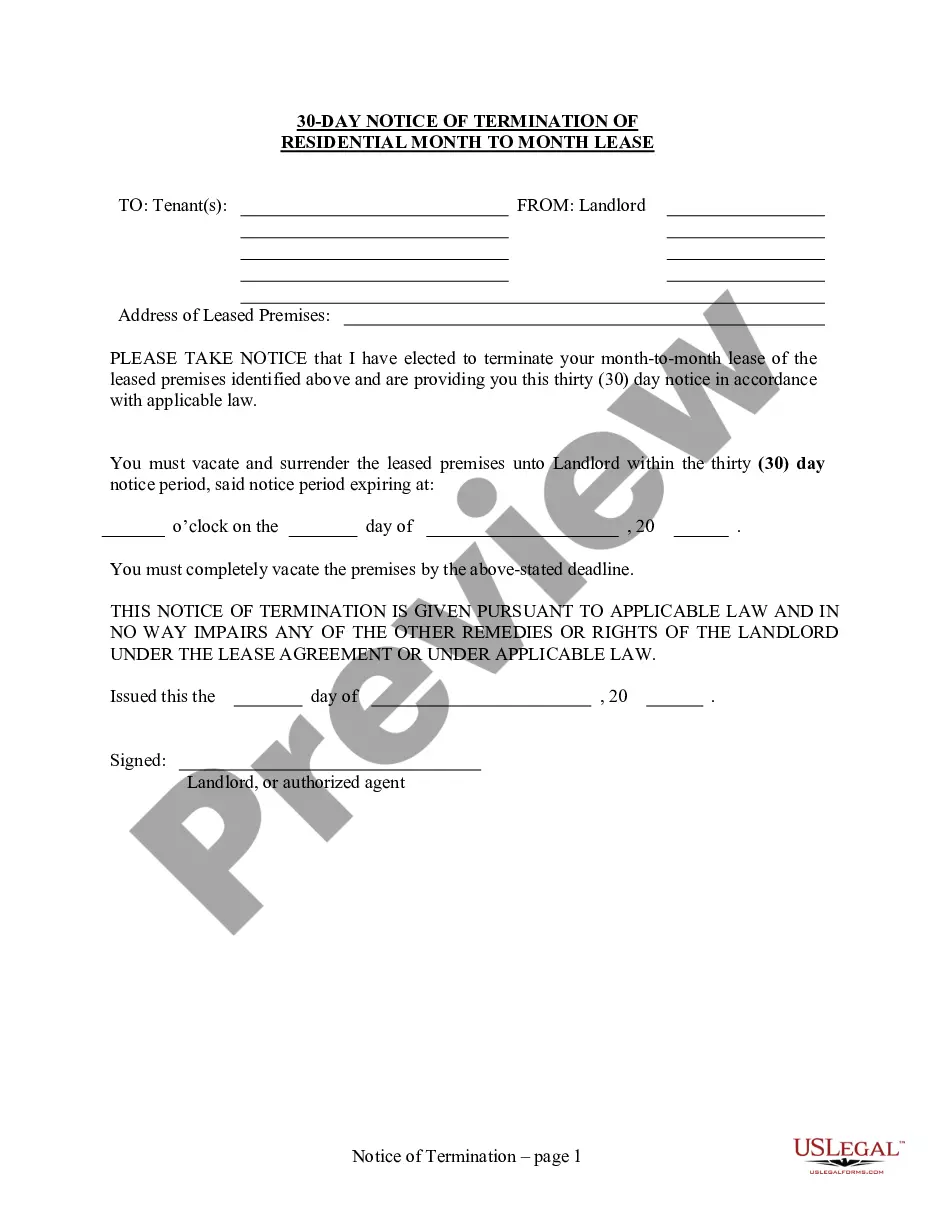

Handling legal documentation requires diligence, precision, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide in this regard for 25 years, so when you select your Illinois Disabled Persons Exemption template from our collection, you can be confident it complies with federal and state regulations.

All documents are designed for multiple uses, like the Illinois Disabled Persons Exemption you see here. If you require them again, you can complete them without additional payment - simply access the My documents section in your profile and finish your document whenever needed. Try US Legal Forms and quickly prepare your business and personal paperwork in full legal compliance!

- Ensure to carefully examine the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Look for an alternative official template if the previously accessed one does not correspond to your situation or state rules (the option for that is on the upper page corner).

- Log in to your account and save the Illinois Disabled Persons Exemption in the format you desire. If this is your first time using our service, click Buy now to continue.

- Create an account, select your subscription plan, and make a payment using your credit card or PayPal account.

- Choose the format in which you wish to receive your form and click Download. Print the blank version or upload it to a professional PDF editor to submit it electronically.

Form popularity

FAQ

In Illinois, individuals who meet certain criteria related to age, disability, or income may qualify for tax-exempt status. Specifically, the Illinois Disabled Persons Exemption is designed for those who can demonstrate their need for assistance due to their disability. Understanding these qualifications helps eligible individuals access the benefits that can improve their circumstances.

The Illinois Disabled Persons Exemption provides a reduction in property taxes for homeowners who are recognized as having disabilities. This exemption lowers the assessed value of the property, making it more affordable for those who qualify. It is important to apply for this exemption to take advantage of potential savings on your property taxes. Always check the state guidelines to ensure you meet all requirements.

The exemption for a person with a disability in Illinois primarily concerns property tax relief intended for homeowners. This exemption reduces the assessed value of the property, resulting in lower tax bills. It is crucial for eligible persons to apply for the Illinois Disabled Persons Exemption annually to maximize the savings. Using resources like uslegalforms can assist in managing the application process effectively.

A Person with Disabilities Exemption is for persons with disabilities and provides an annual $2,000 reduction in the equalized assessed value (EAV) of the property.

Medical Expenses. People with disabilities who itemize can deduct medical expenses and out of pocket expenses not covered by insurance as well as health insurance premiums.

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

In most cases, Disability Insurance (DI) benefits are not taxable. But, if you are receiving unemployment, but then become ill or injured and begin receiving DI benefits, the DI benefits are considered to be a substitute for unemployment benefits, which are taxable.

If Social Security disability is your only source of income, your benefits usually aren't taxable. However, if you (and your spouse, if you're married) earn other income, your benefits may be taxable, depending on your income level.

Veterans 70% or more disabled receive an EAV reduction of $250,000, and because of this can be totally exempt from property taxes on their home. The automatic renewal of this exemption due to the COVID-19 pandemic has ended. All applicants must reapply annually.