Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Understanding this form

This Fiduciary Deed is a legal document used for transferring property by someone acting in a fiduciary capacity, such as an executor, trustee, or guardian. Unlike a standard deed, this form is specifically designed for transactions carried out by fiduciaries under the authority granted to them. It ensures the proper transfer of property in accordance with the legal obligations and responsibilities of the fiduciary.

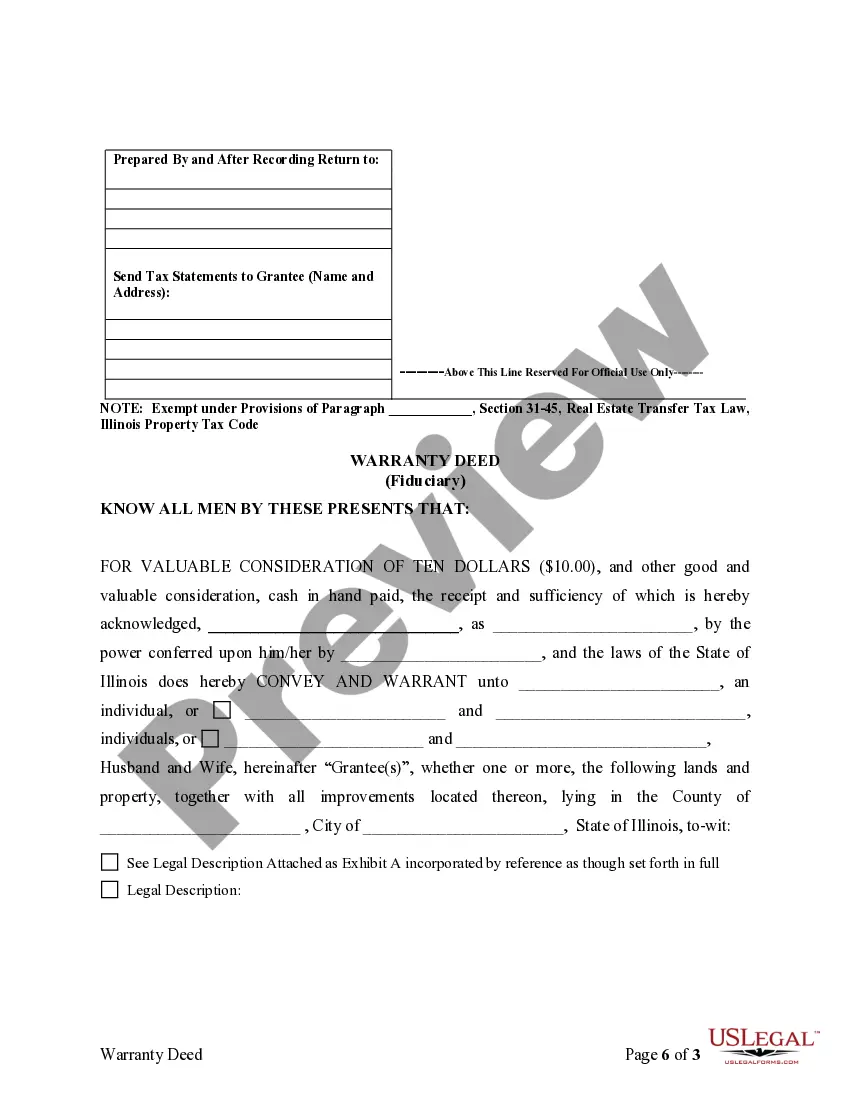

Form components explained

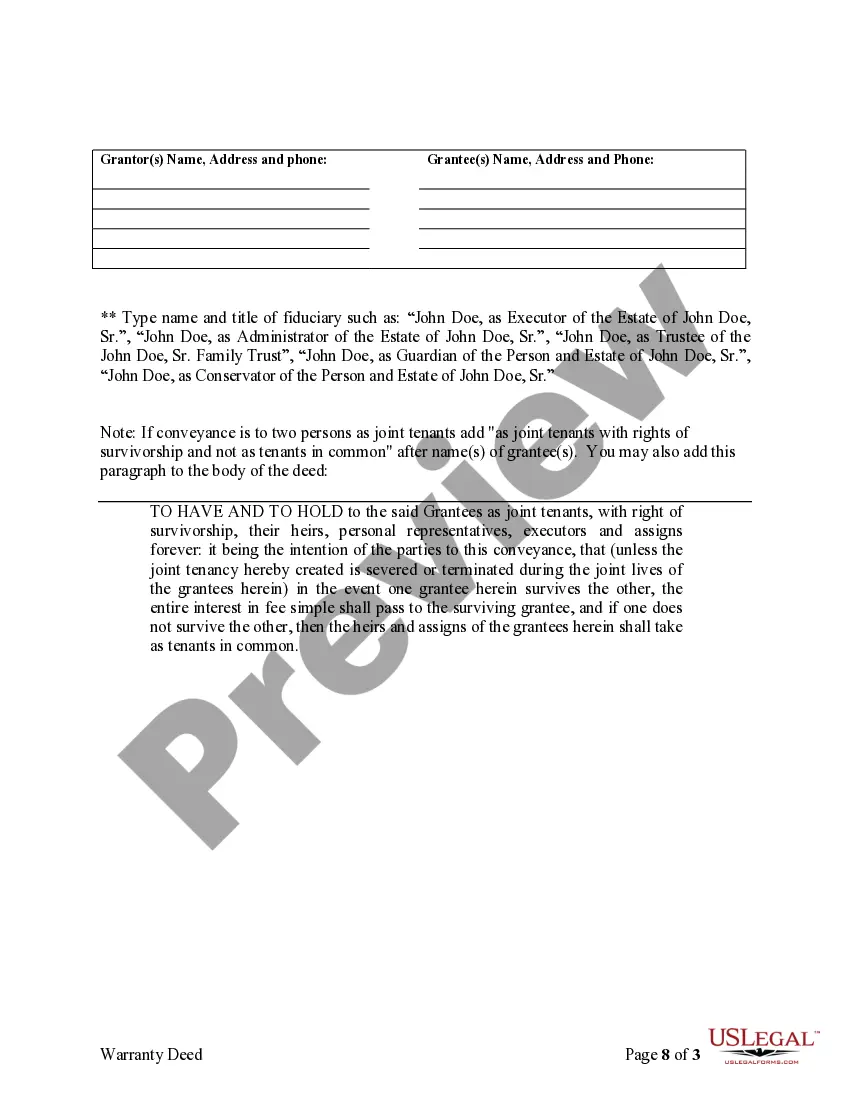

- Identification of the grantor (fiduciary) and grantee.

- Description of the property being transferred.

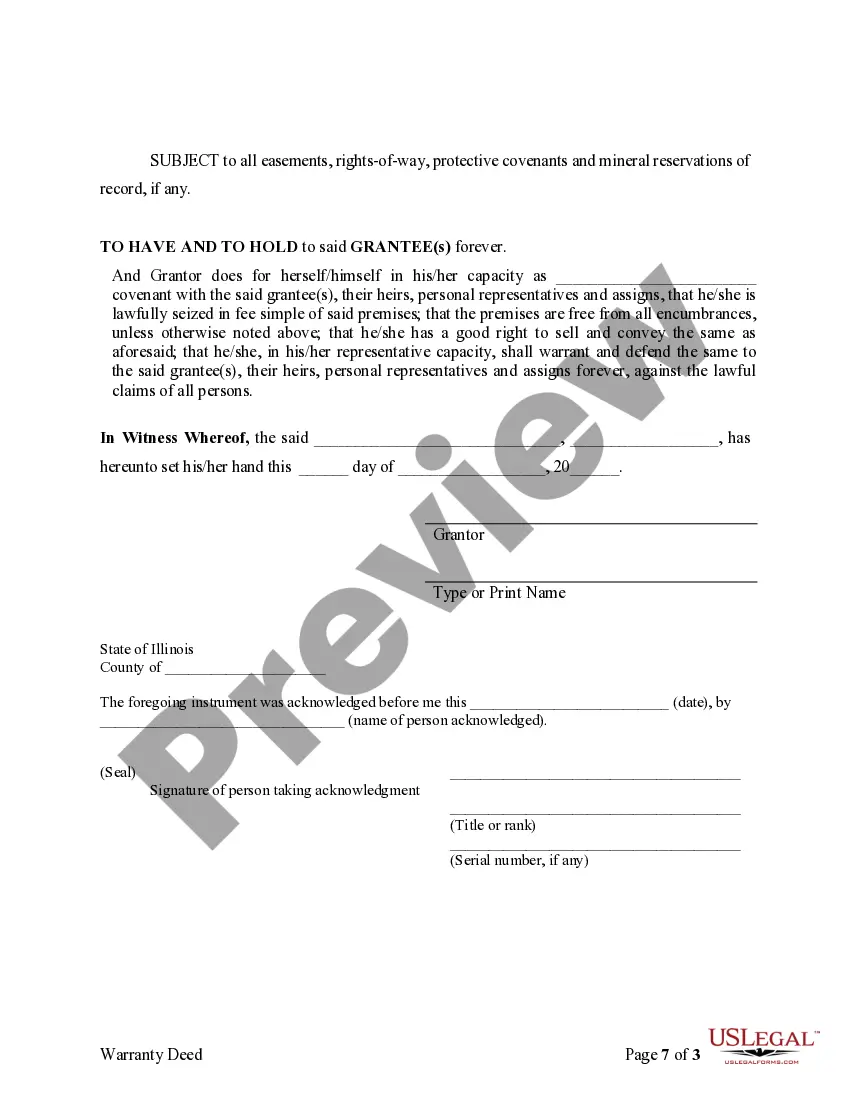

- Legal assurances regarding the condition of the property.

- Signatures of the fiduciary and witnesses as required.

- Date of transfer.

Situations where this form applies

This form is typically used when an individual acting as an executor of a will, trustee of a trust, guardian, or conservator needs to transfer real estate. It is essential in situations where the property must be conveyed to beneficiaries according to a will or trust agreement, or when managing the estate of a person who is unable to act on their own behalf.

Who should use this form

- Executors of wills who are tasked with distributing property among heirs.

- Trustees managing and transferring assets held in a trust.

- Guardians or conservators responsible for managing the affairs of minors or adults unable to manage their own affairs.

- Individuals overseeing the liquidation of an estate.

How to prepare this document

- Identify the parties involved by entering the names of the grantor and grantee.

- Describe the property being transferred, including a full legal description if applicable.

- Specify any encumbrances or conditions tied to the property, if necessary.

- Enter the date of the transfer and include signatures where required.

- Ensure the document is witnessed or notarized if required by local law.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately describe the property, leading to disputes over ownership.

- Not obtaining the necessary signatures or failing to have the document notarized when required.

- Omitting important details about any encumbrances on the property.

- Using outdated forms that may not comply with current legal standards.

Why complete this form online

- Convenience of downloading and printing the form, ready for immediate use.

- Editability allows for easy customization to fit specific circumstances.

- Access to professionally drafted content ensures legal compliance.

Looking for another form?

Form popularity

FAQ

Upon death, the house held in a trust in Illinois bypasses probate, ensuring a smooth transition to the named beneficiaries. The trustee will manage and distribute the property according to the terms of the trust document. This makes the Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries an essential tool for ensuring your wishes are honored.

The Schedule K-1 T is another important form in the Illinois tax system, specifically designed for reporting income from trusts. It is similar to the corporate version, detailing income, deductions, and credits that beneficiaries must report. Proper completion of this form helps to ensure compliance with tax regulations for trusts, underscoring the significance of using the Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries in managing such affairs.

Schedule K-1 T is a specific tax form used in Illinois to report income from trusts and estates. This form is essential for beneficiaries to report their share of income, deductions, and credits on their own tax returns. Executors and trustees must complete this schedule accurately to ensure compliance with tax laws. Using the Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries helps facilitate the proper management of these tasks.

The executor of a will has a fiduciary duty to act in the best interest of the estate. This means that the law prevents you from acting in your own interest to the detriment of the estate. As an extension of this duty, executors also have several responsibilities to the beneficiaries of the will.

Fiduciary - An individual or bank or trust company that acts for the benefit of another. Trustees, executors, and personal representatives are all fiduciaries.

Yes, an executor can override a beneficiary's wishes as long as they are following the will or, alternative, any court orders. Executors have a fiduciary duty to the estate beneficiaries requiring them to distribute estate assets as stated in the will.

The executor has a fiduciary duty to an estate, and to its beneficiaries, when settling an estate plan. A fiduciary is someone in a position of trust and power, and the law recognizes this and so places an added burden on that person or institution to act with honesty, integrity, good faith, fairness and loyalty.

Fiduciary - An individual or trust company that acts for the benefit of another.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

The defendant was acting as a fiduciary of the plaintiff; The defendant breached a fiduciary duty to the plaintiff; The plaintiff suffered damages as a result of the breach; and. The defendant's breach of fiduciary duty caused the plaintiff's damages.

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.