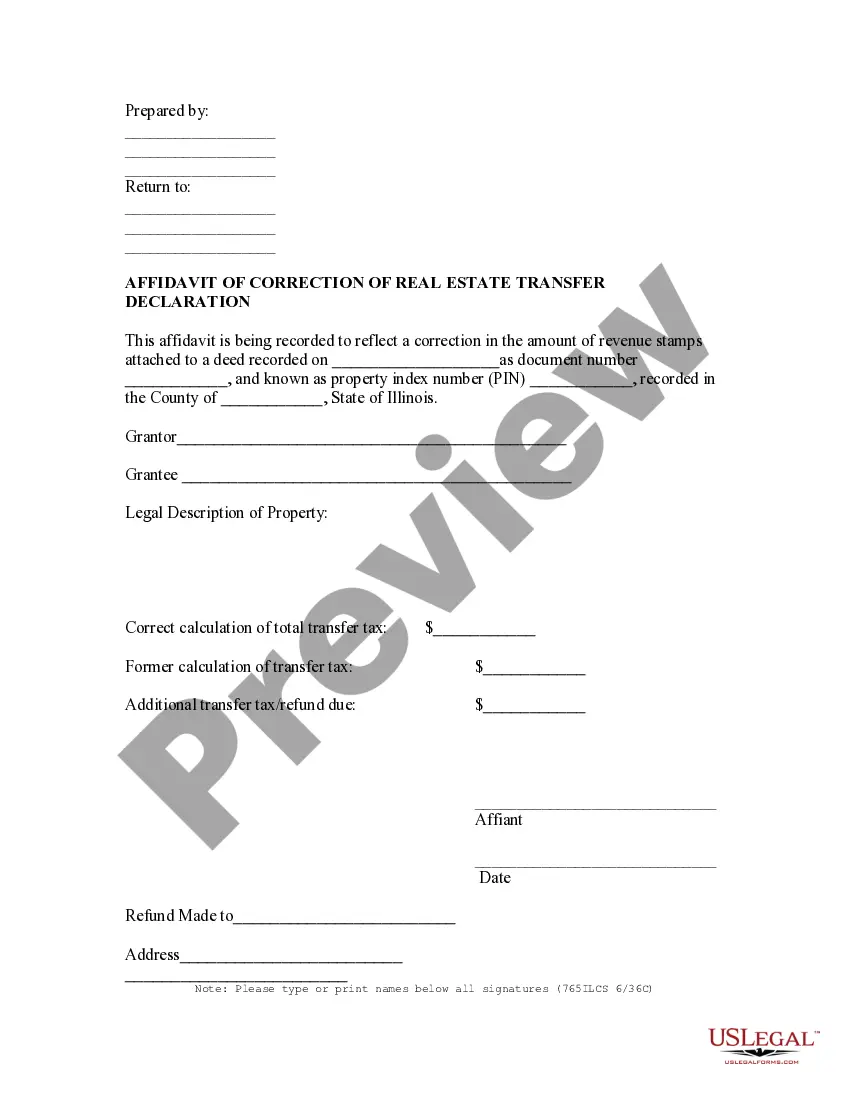

This affidavit is being recorded to reflect a correction in the amount of revenue stamps attached to a previously recorded deed.

The Illinois Affidavit of Correction of Real Estate Transfer Declaration is a legal document used to correct errors in the transfer or conveyance of real estate. This affidavit is used when an error is discovered after the deed or other real estate document has been recorded in the county recorder’s office. It is used to declare that the real estate is being transferred in accordance with the parties’ prior agreement, and corrects any errors that may have occurred in the initial transfer. This document is typically used when there is a discrepancy between the terms of the contract and the deed or other document used to effect the transfer. There are two types of Illinois Affidavit of Correction of Real Estate Transfer Declaration: the Owner's Affidavit and the Buyer's Affidavit. The Owner's Affidavit is typically signed by the seller of the property and states that the deed or other document accurately reflects the agreement between the parties. The Buyer's Affidavit is typically signed by the buyer and states that the deed or other document accurately reflects the agreement between the parties and that the seller has transferred the property as agreed. Both affidavits must be notarized and filed with the county recorder’s office in order to be valid.