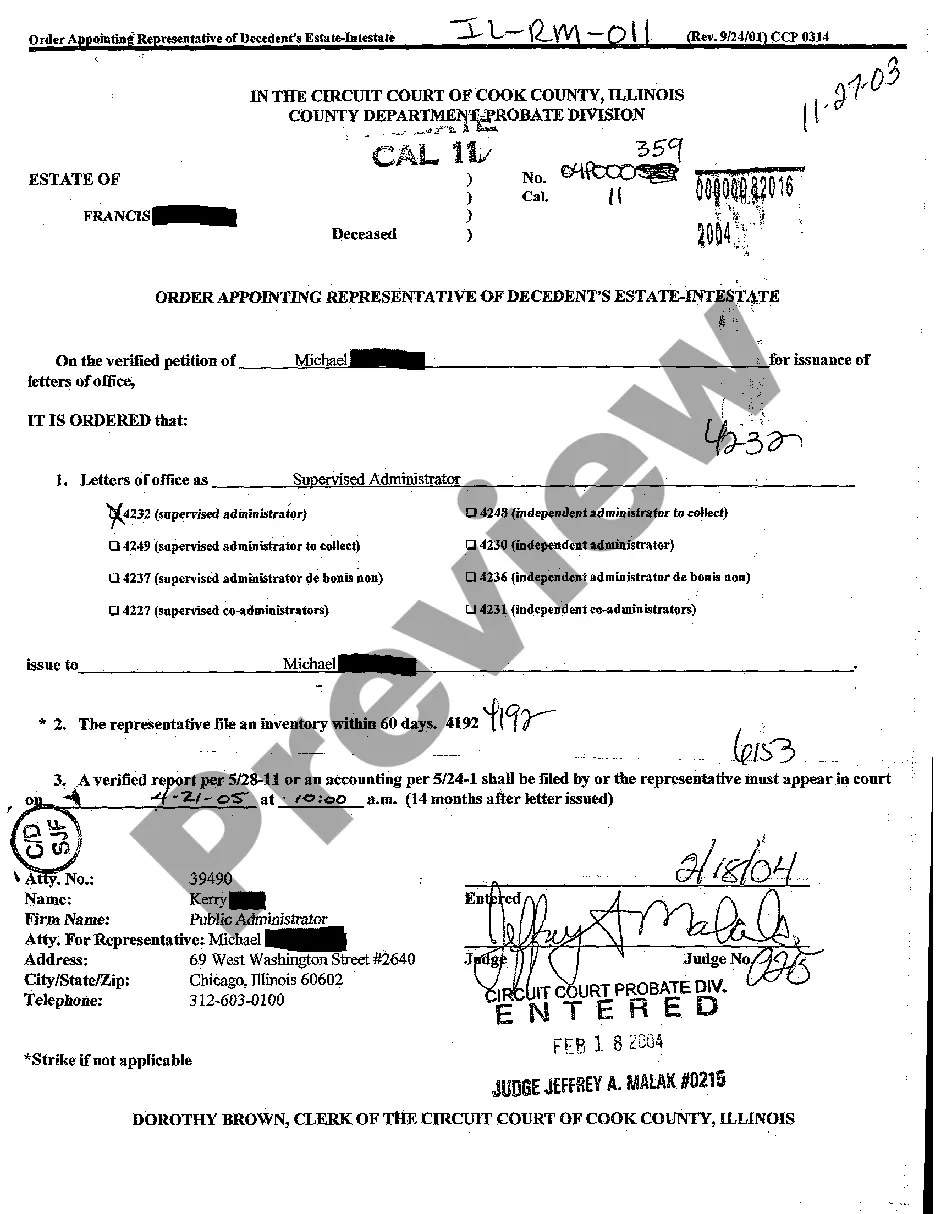

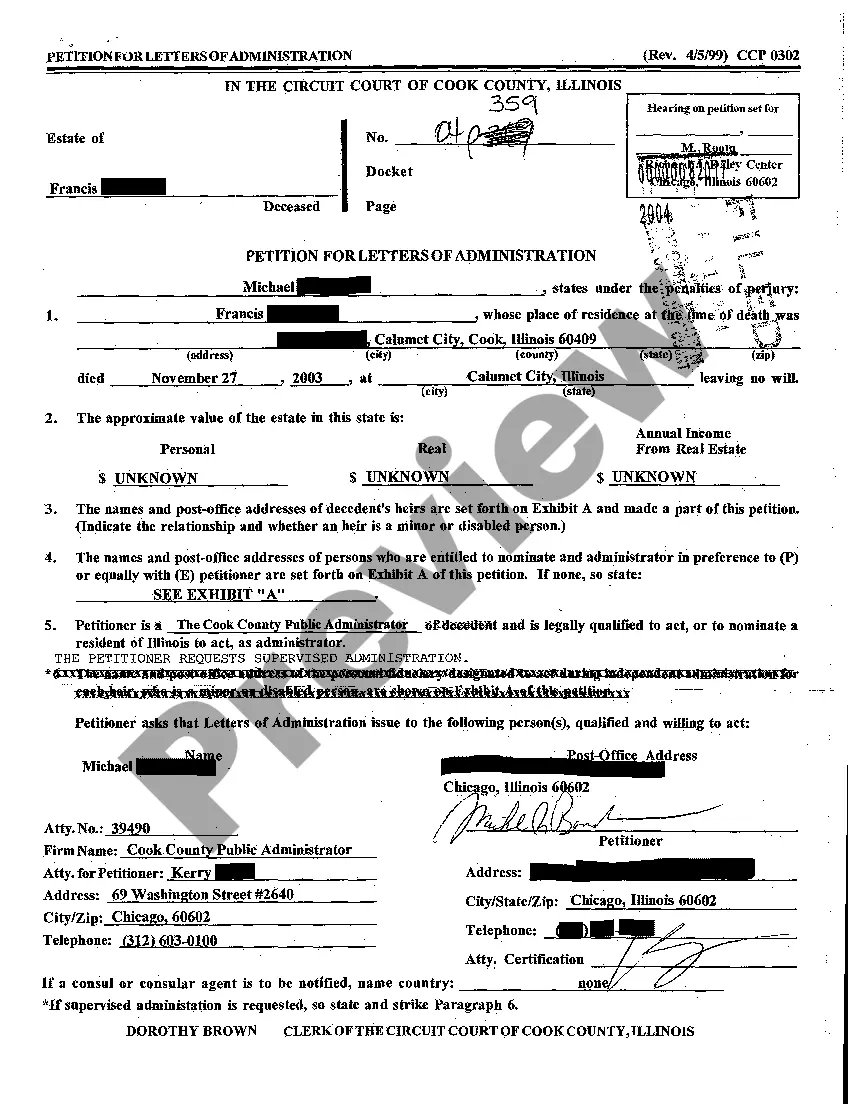

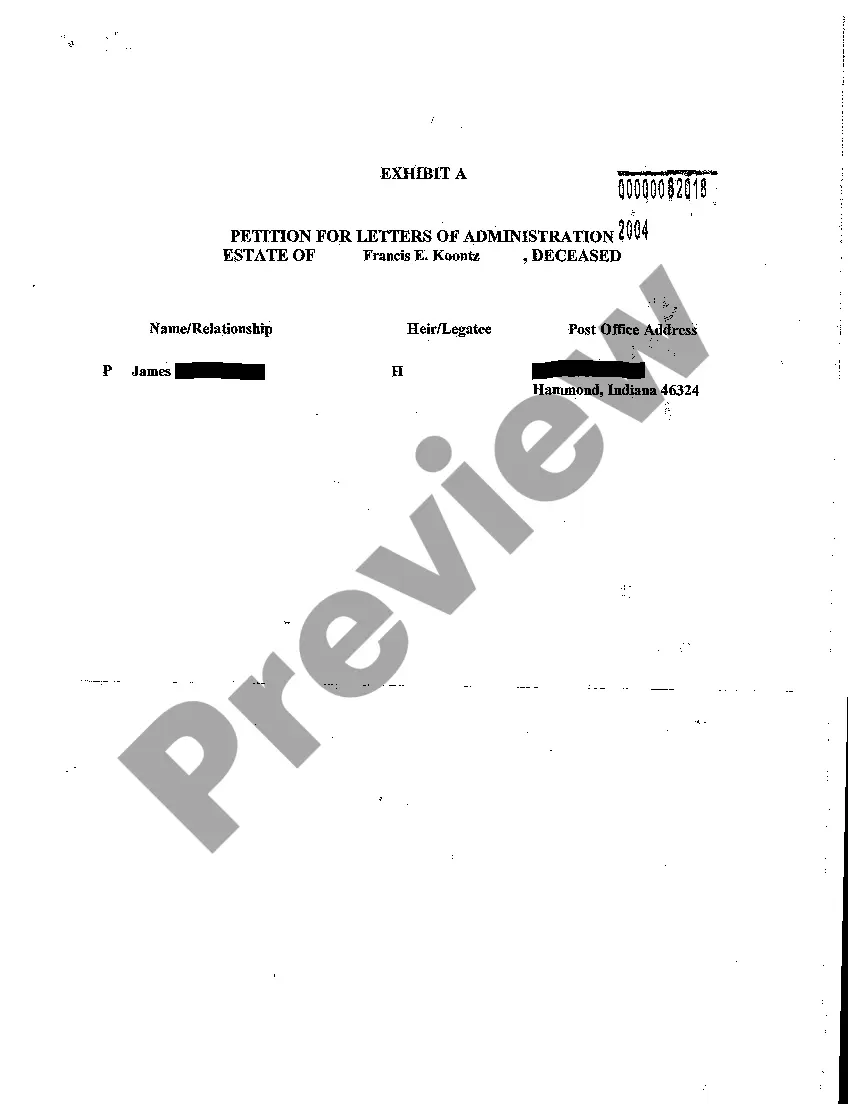

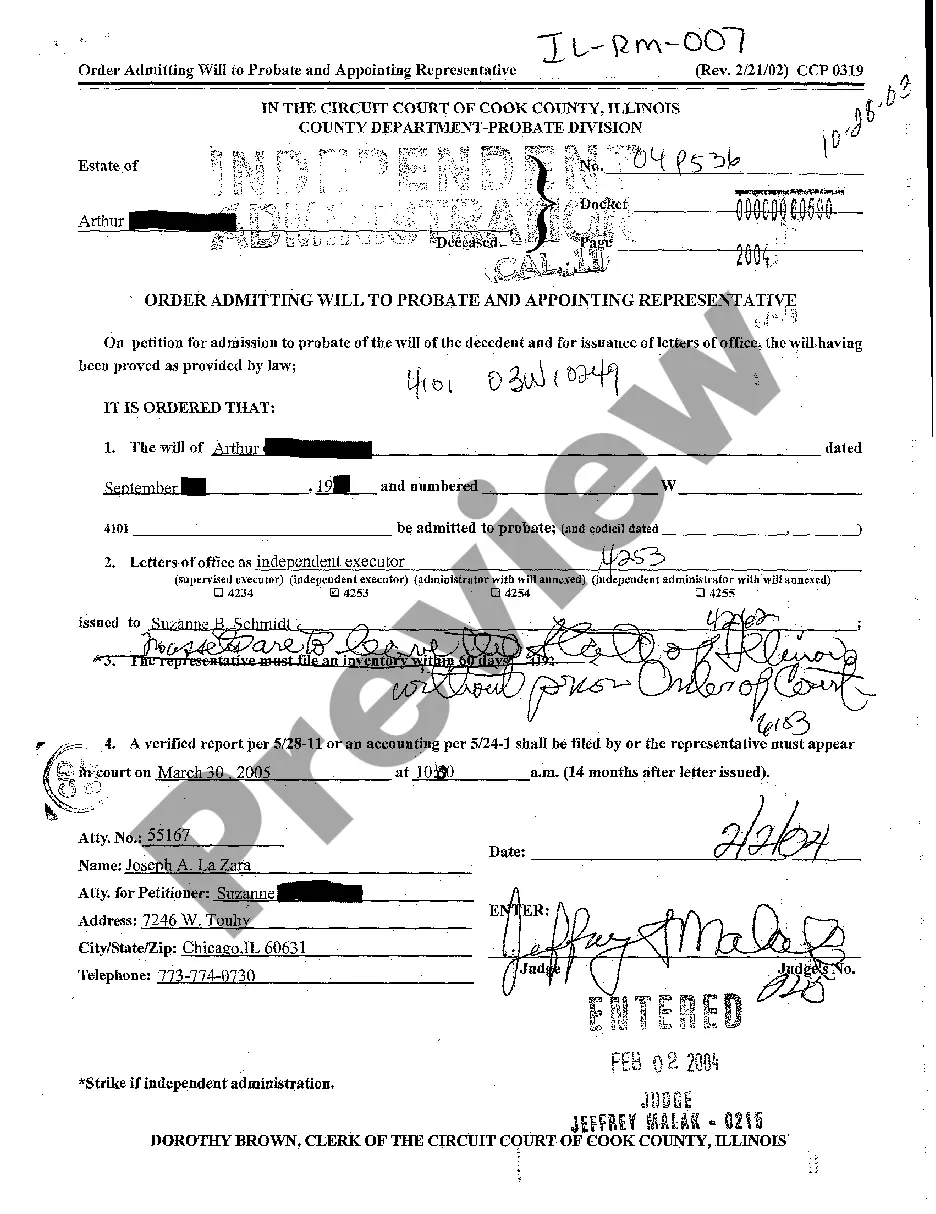

Illinois Order Appointing Representative Of Decedent's Estate - Intestate

Description

How to fill out Illinois Order Appointing Representative Of Decedent's Estate - Intestate?

Attempting to locate Illinois Order Appointing Representative of Decedent's Estate - Intestate documents and filling them out could pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate template tailored for your state in merely a few clicks.

Our legal experts draft each document, so you only need to complete them. It truly is that straightforward.

Choose your plan on the pricing page and create your account. Indicate whether you wish to pay via credit card or PayPal. Download the form in your preferred file format. You may print the Illinois Order Appointing Representative of Decedent's Estate - Intestate template or fill it out using any online editor. Don’t fret about making errors, as your sample can be used and submitted, and printed out as often as you desire. Try US Legal Forms and gain access to around 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the example.

- All of your downloaded samples are stored in My documents and are always available for later use.

- If you haven’t registered yet, you should sign up.

- Review our comprehensive instructions on how to obtain the Illinois Order Appointing Representative of Decedent's Estate - Intestate template in just a few moments.

- To acquire an eligible document, verify its relevance for your state.

- Examine the example using the Preview function (if available).

- If there's a description, read it to comprehend the details.

- Click on the Buy Now button if you've found what you're seeking.

Form popularity

FAQ

The next of kin is determined by the Illinois Probate Act, and under that statute, the next of kin depends on who survives the death: If there is a spouse and/or child surviving, then the spouse and/or children are the next of kin.

Although there is no 'challenge' to the intestacy rules in the same way that you can challenge a will, someone who feels that the deceased might have left them provision had they made a will can bring a claim under the Inheritance (Provision for Family and Dependants) Act 1975 for financial provision.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

What happens when a sole beneficiary dies?But if your primary beneficiary dies before you do, then the death benefit would be paid to any contingent beneficiaries that you named on your application. If there are no contingent beneficiaries, then the death benefit will most likely be paid directly into your estate.

The decedent's property is given to the decedent's heirs during a probate court case. Heirs are the beneficiaries of a person who dies without a will. A decedent's relatives also get part of the estate . For example, if there is a spouse and two children, the spouse gets half of the money from the estate.

Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

If you die without a valid will or any will, you will not have control over what you leave behind. Instead, a probate court gets control of all your assets. When your will goes to a probate court in intestacy, the court will distribute your assets according to the state law rather than your decedent's wishes.

Your mother's next of kin is her eldest child. The term "next of kin" is most commonly used following a death. Legally, it refers to those individuals eligible to inherit from a person who dies without a will. Surviving spouses are at the top of the list, followed by those related by blood.