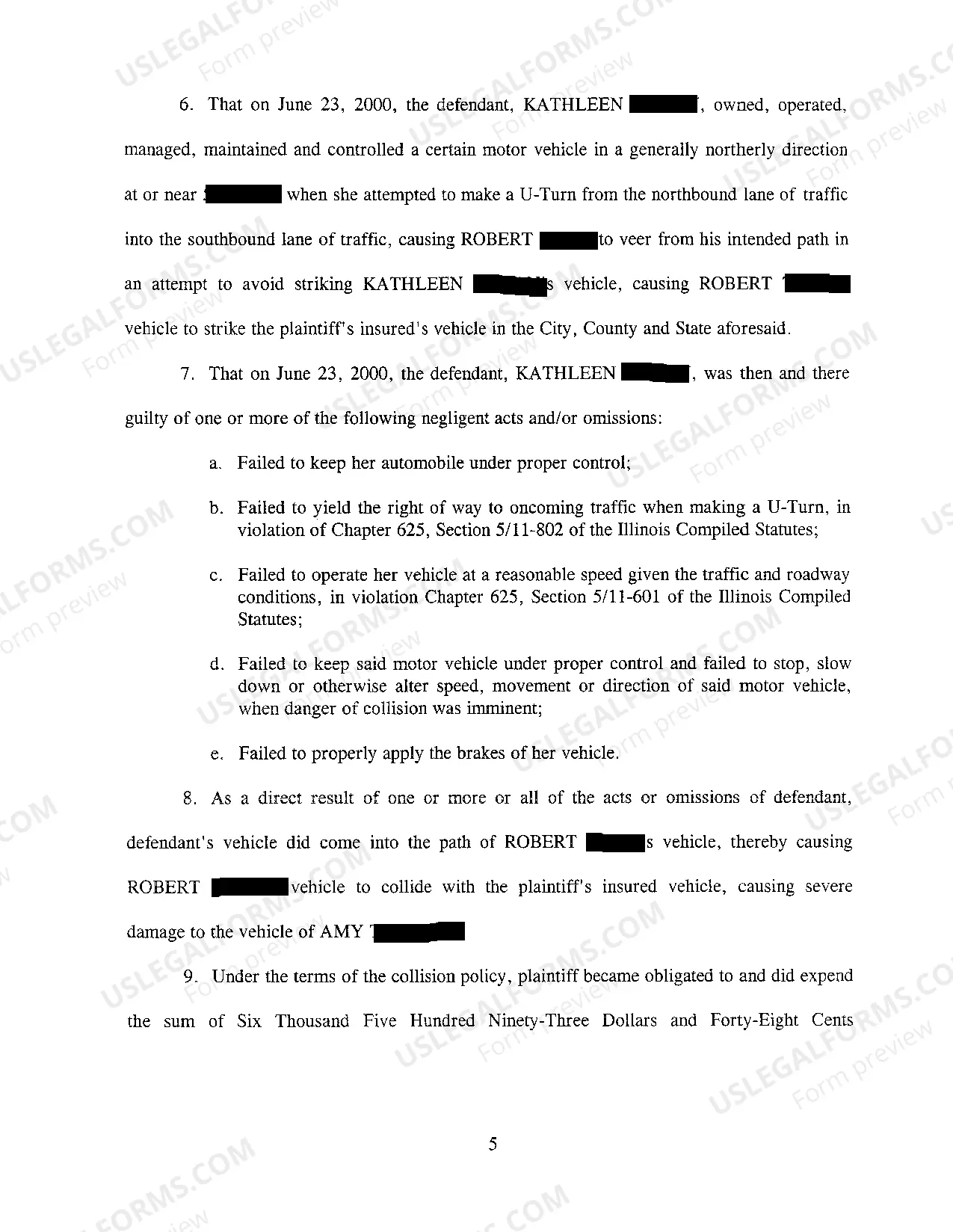

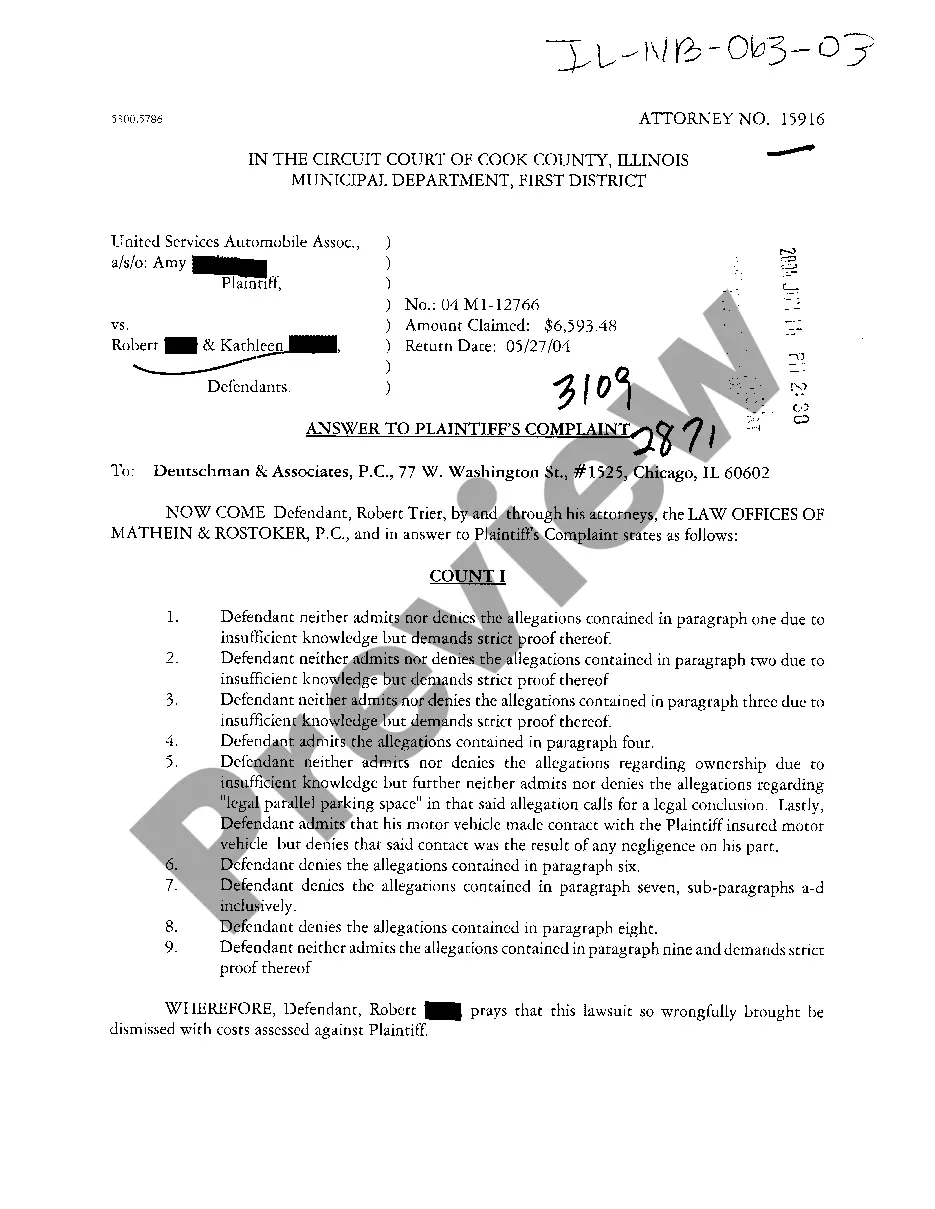

Illinois Complaint At Law in Subrogation Against Negligent Driver

Description

How to fill out Illinois Complaint At Law In Subrogation Against Negligent Driver?

Searching for Illinois Complaint At Law in Subrogation Against Negligent Driver templates and completing them can be a task. To streamline your efforts, save time and reduce costs, utilize US Legal Forms to discover the appropriate sample tailored for your state in just a few clicks. Our lawyers prepare every document, so you only need to fill them in. It’s truly that simple.

Sign in to your account and return to the form's web page to download the sample. All your downloaded templates are stored in My documents and remain accessible at all times for future use. If you haven’t registered yet, you need to sign up.

Review our detailed instructions on how to obtain your Illinois Complaint At Law in Subrogation Against Negligent Driver form in just a few minutes.

You can now print the Illinois Complaint At Law in Subrogation Against Negligent Driver template or edit it using any online tool. No need to stress about errors, as your form can be utilized, submitted, and printed multiple times as required. Experience US Legal Forms and access over 85,000 state-specific legal and tax documents.

- To acquire a legitimate sample, ensure its compliance with your state.

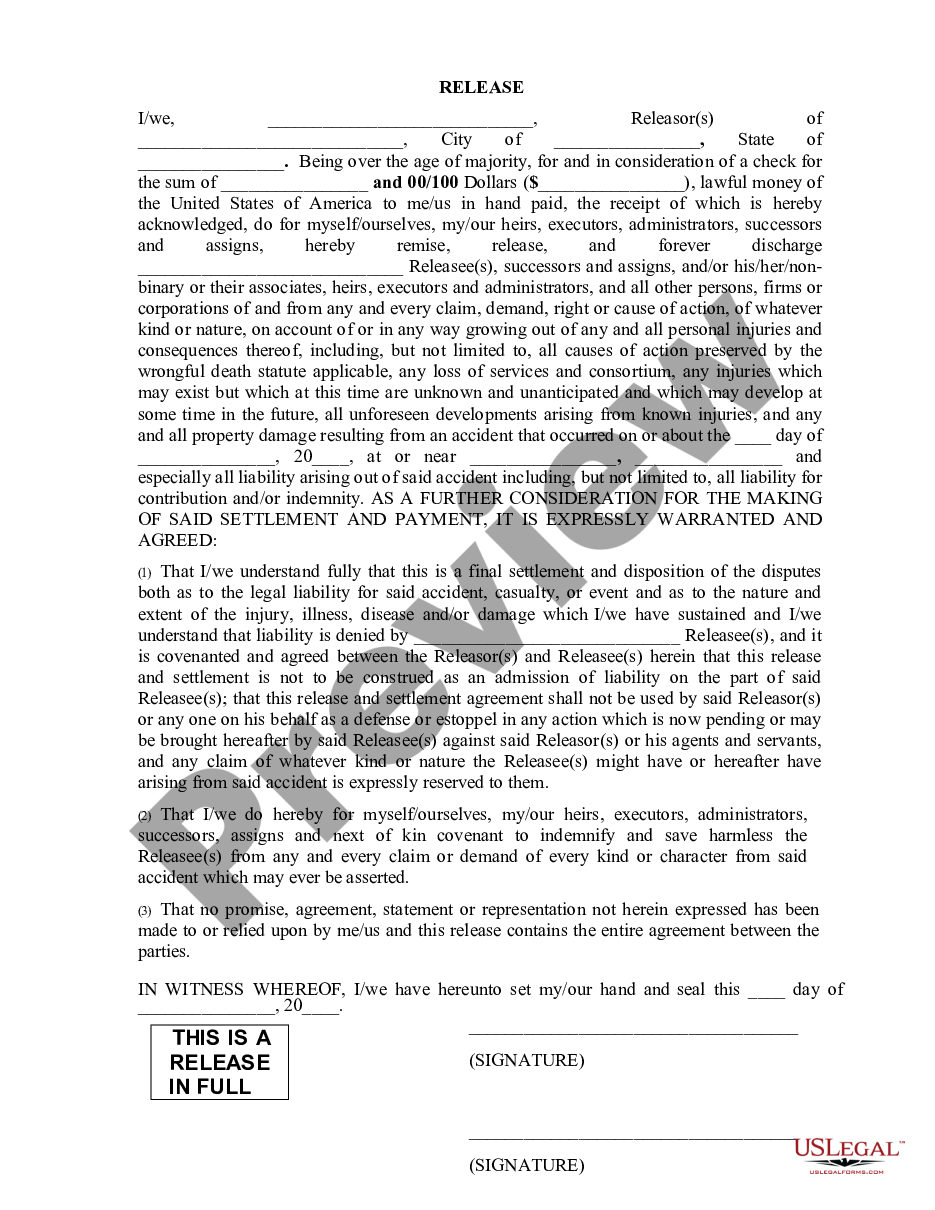

- Examine the form using the Preview feature (if available).

- If there’s a description, read it for additional specifics.

- Click Buy Now if you found what you need.

- Select your pricing plan and create an account on the payment page.

- Choose to pay through a card or PayPal.

- Download the form in your preferred file format.

Form popularity

FAQ

New laws set to take effect on January 1, 2025, may introduce changes to various aspects of subrogation and consumer protections. It's vital to stay informed about these changes, especially regarding liability and claims processes. For navigating these updates in the context of an Illinois Complaint At Law in Subrogation Against Negligent Driver, consulting legal professionals can be beneficial.

A subrogation letter is written by a third party, who in addition to the plaintiff in a case, aims to pursue the defendant for compensation. For example, if someone was injured in a car accident and received care at a hospital, the hospital might end up sending them a subrogation letter.

One example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

You or your personal injury attorney may be able to negotiate with your health insurance provider to reduce the amount being claimed by subrogation. Because attorneys are more experienced in dealing with these situations, they often get better results than attempting to negotiate the subrogation claim yourself.

What happens if you don't pay a subrogation claim? If you choose to not pay a subrogation, the insurer will continue to mail requests for reimbursement. Again, they may file a lawsuit against you. One way to avoid an effort to subrogate from the victim's insurance company is if there is a subrogation waiver.

One example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

Subrogation adjusters send letters to those who appear to be responsible for reimbursing the insurance company.If the recipient ignores the letter, the insurer may continue to mail requests for reimbursement or may choose to file a lawsuit against the responsible party.

The doctrine of subrogation confers upon the insurer the right to receive the benefit of such rights and remedies as the assured has against third parties in regard to the loss to the extent that the insurer has indemnified the loss and made it good.

A health insurance company or benefits plan with subrogation rights relative to an injury settlement is not required to negotiate their subrogation interest in the claim.While the insurer may refuse to negotiate, the insurer's ability to actually collect the settlement proceeds from the insured may be very limited.

Letter creation date. The name of the insured and the name of the at-fault party. The sum paid to the insured. Summary of the damages. Request for the policy number of the recipient. Request to contact the insurance company and contact details.