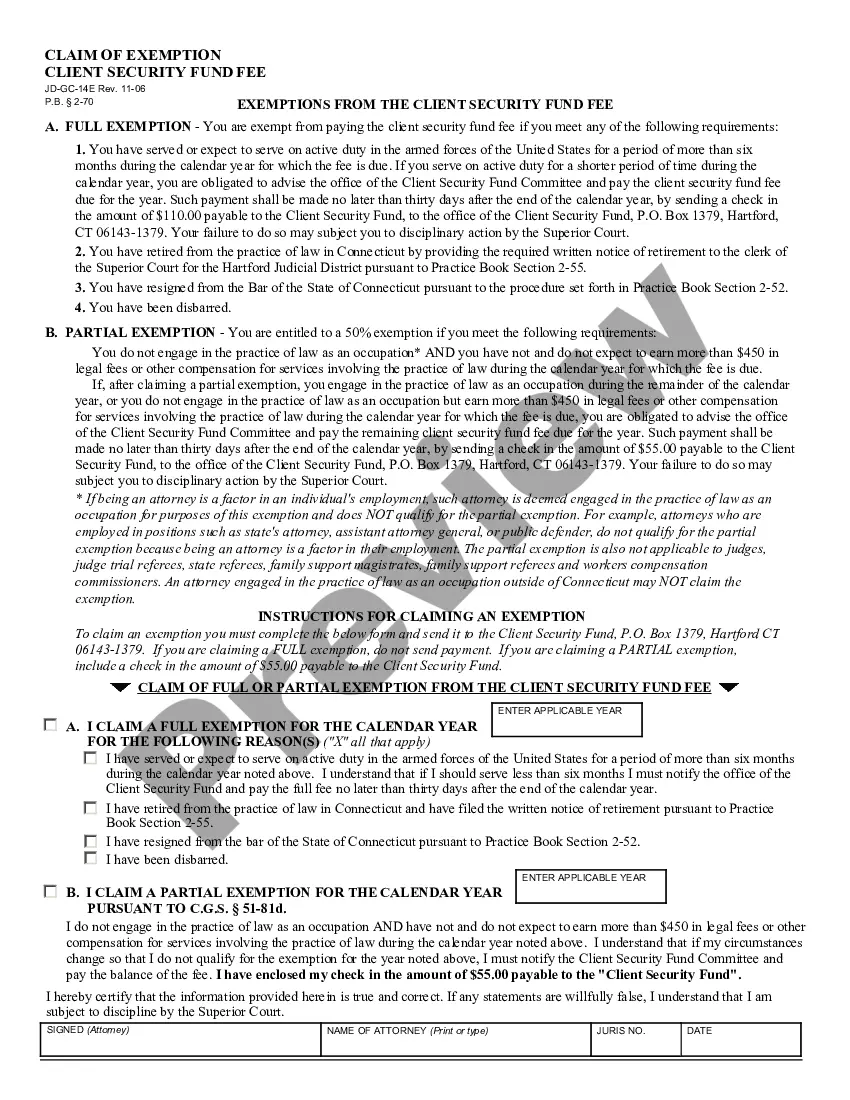

The Connecticut Claim of Exemption — Client Security Fund Fee (Use for Fees Owed for 2013 and After) is a document that can be used to claim an exemption from the Client Security Fund Fee in Connecticut. The fee is imposed on attorneys and law firms that are registered with the Connecticut State Bar Association. The fee is used to finance the Client Security Fund, which provides eligible claimants with compensation for losses sustained due to the dishonest conduct of attorneys. There are two types of Connecticut Claim of Exemption — Client Security Fund Fee (Use for Fees Owed for 2013 and After). The first is the Full Exemption, which is available to attorneys and law firms with gross annual receipts of $500 or less. The second is the Proportional Exemption, which is available to attorneys and law firms with gross annual receipts over $500. The Proportional Exemption is based on the ratio of the attorney’s or firm’s gross annual receipts to the statewide average gross annual receipts of attorneys and law firms registered with the Connecticut State Bar Association.

Connecticut Claim of Exemption -- Client Security Fund Fee (Use for Fees Owed for 2013 and After)

Description

How to fill out Connecticut Claim Of Exemption -- Client Security Fund Fee (Use For Fees Owed For 2013 And After)?

Engaging with legal documentation necessitates focus, accuracy, and utilizing well-crafted templates. US Legal Forms has been assisting individuals nationwide for 25 years, ensuring that when you select your Connecticut Claim of Exemption -- Client Security Fund Fee (Use for Fees Owed for 2013 and After) template from our platform, it complies with federal and state standards.

Interacting with our service is straightforward and swift. To access the required documentation, all you need is an account with an active subscription. Here’s a brief guide to obtain your Connecticut Claim of Exemption -- Client Security Fund Fee (Use for Fees Owed for 2013 and After) in a matter of minutes.

All documents are crafted for multiple uses, such as the Connecticut Claim of Exemption -- Client Security Fund Fee (Use for Fees Owed for 2013 and After) displayed on this page. If you require them in the future, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever needed. Experience US Legal Forms and efficiently prepare your business and personal paperwork while ensuring full legal adherence!

- Be sure to carefully review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for another official template if the one you previously accessed doesn’t align with your circumstances or state regulations (the tab for that can be found in the top page corner).

- Log in to your account and save the Connecticut Claim of Exemption -- Client Security Fund Fee (Use for Fees Owed for 2013 and After) in your preferred format. If this is your first time using our service, click Buy now to continue.

- Create an account, select your subscription option, and pay using your credit card or PayPal account.

- Select the format in which you wish to save your document and click Download. Print the blank or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

Attorneys who practice law in the State of CT are assessed an annual fee of $75 for the Client Security Fund.

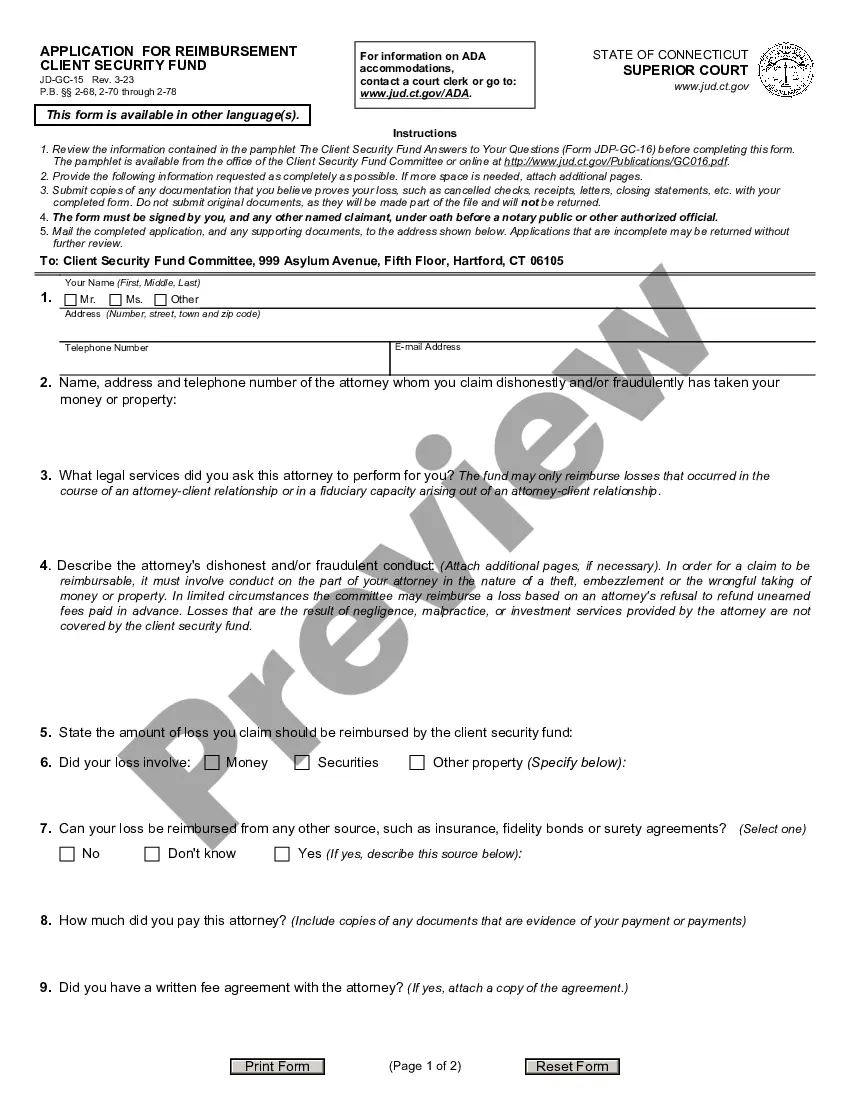

The purpose of the client security fund is to reimburse clients who have been the victims of the "dishonest conduct" of an attorney, as defined in Practice Book Section 2-69, and to provide crisis intervention and referral assistance pursuant to Practice Book Section 2-68A to attorneys admitted to the practice of law

You can file most family case types electronically (on-line), including dissolution of marriage (divorce); legal separation; annulment; and civil union - dissolution, legal separation or annulment, custody application, and visitation petition.

Attorneys who practice law in the State of CT are assessed an annual fee of $75 for the Client Security Fund.

To claim an exemption you must complete the below form and send it to the Client Security Fund, P.O. Box 1379, Hartford CT 06143-1379. If you are claiming a FULL exemption, do not send payment. If you are claiming a PARTIAL exemption, include a check in the amount of $37.50 payable to the Client Security Fund.

FULL EXEMPTION - You are exempt from paying the client security fund fee if you meet any of the following requirements: 1. You have served or expect to serve on active duty in the armed forces of the United States for a period of more than six months during the calendar year for which the fee is due.