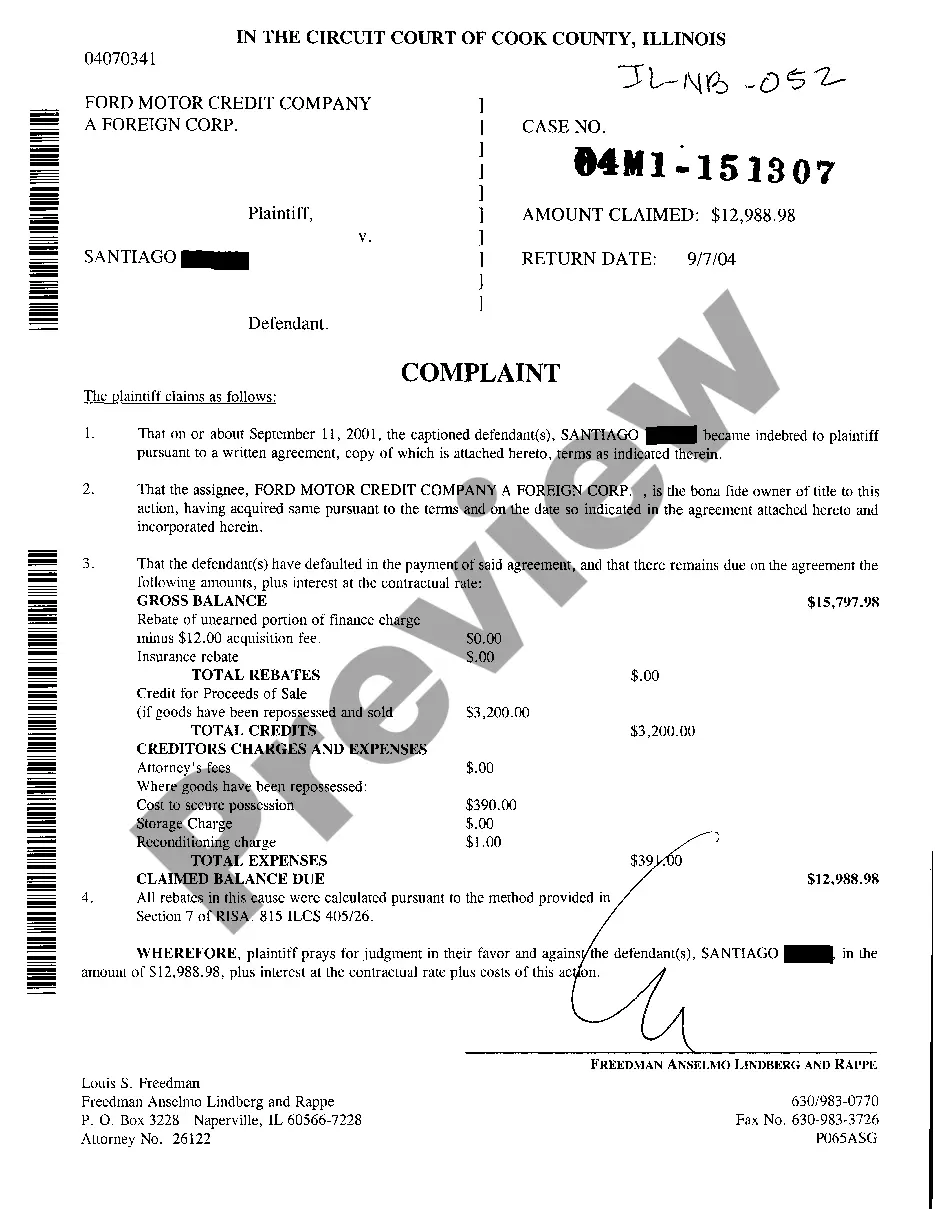

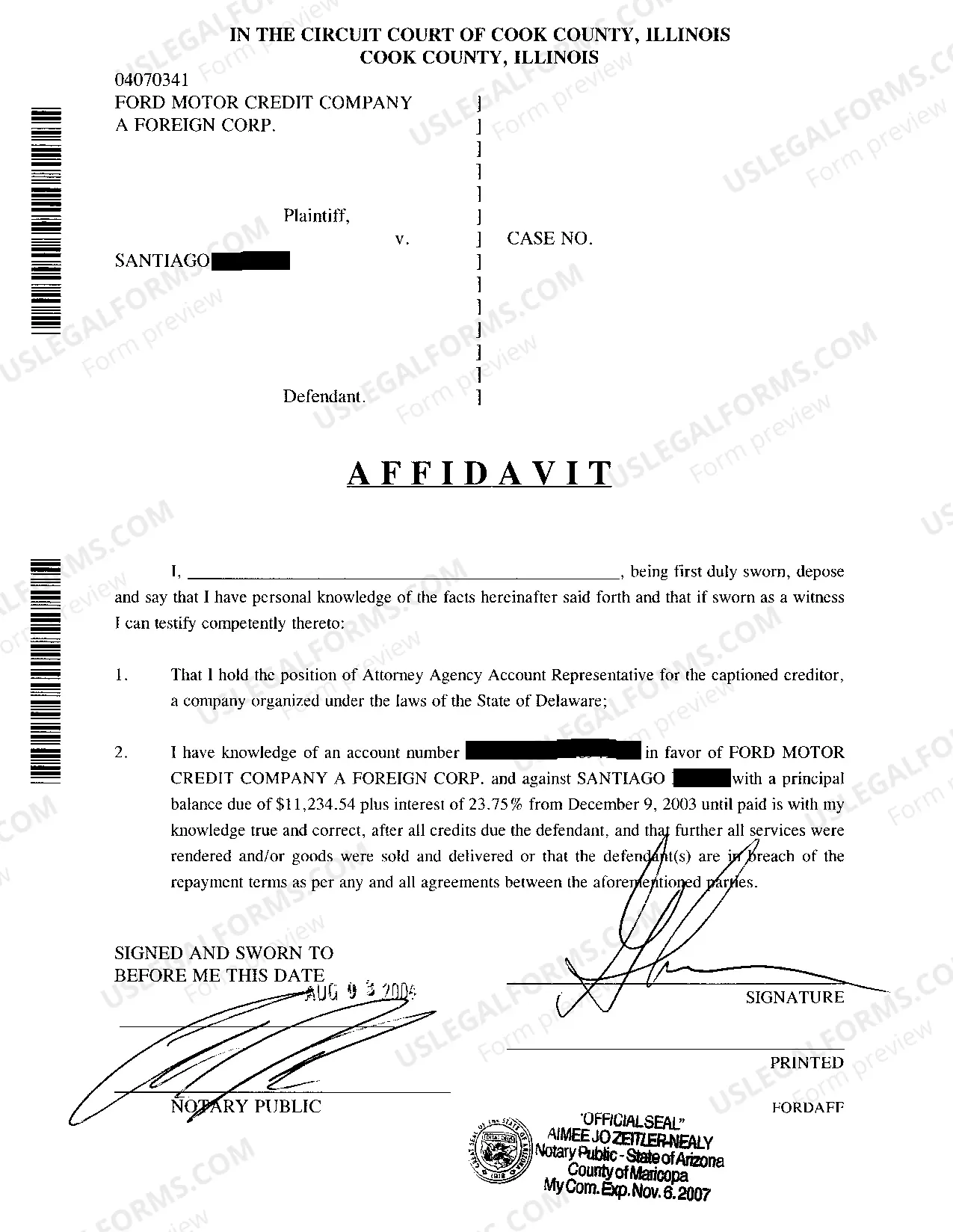

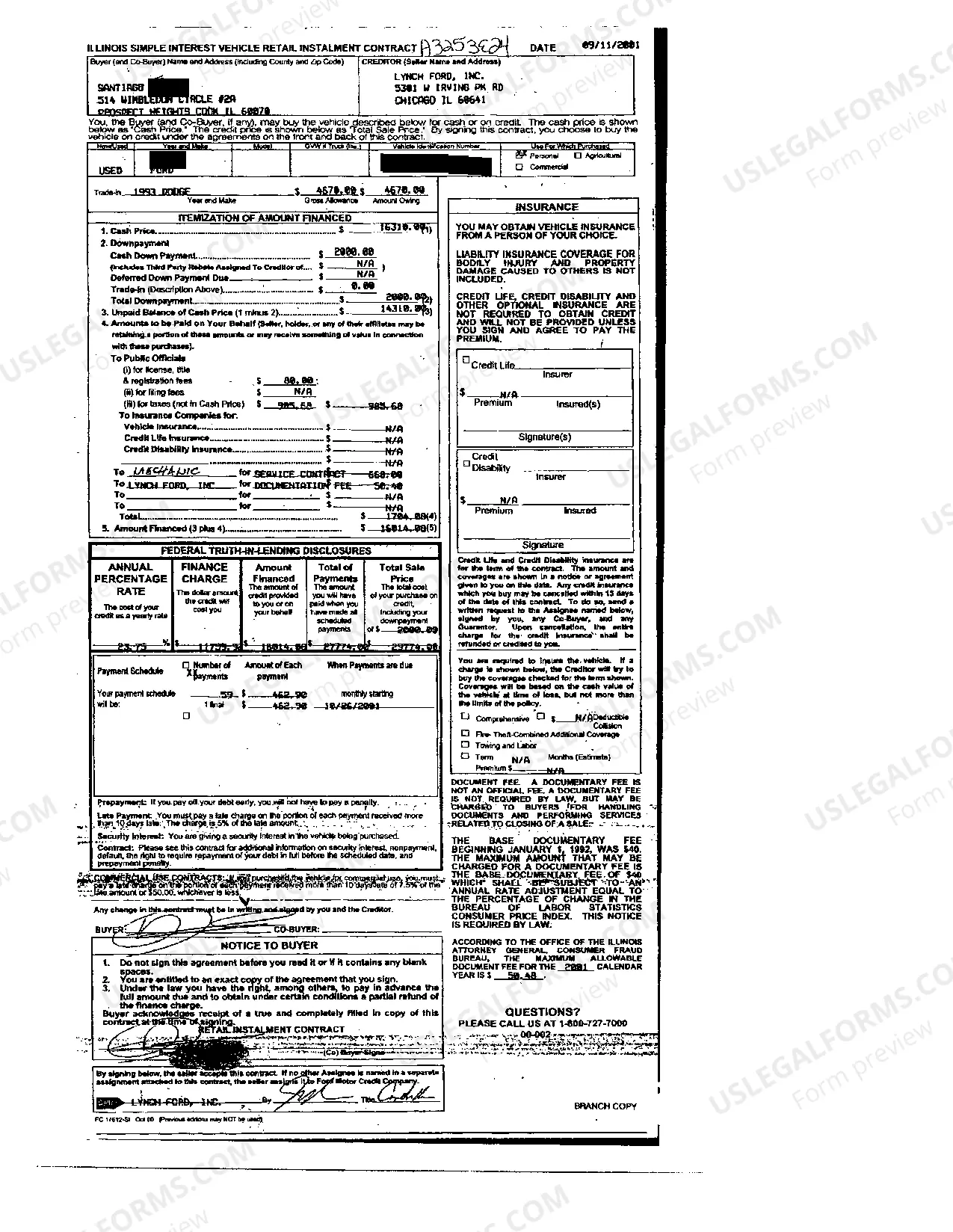

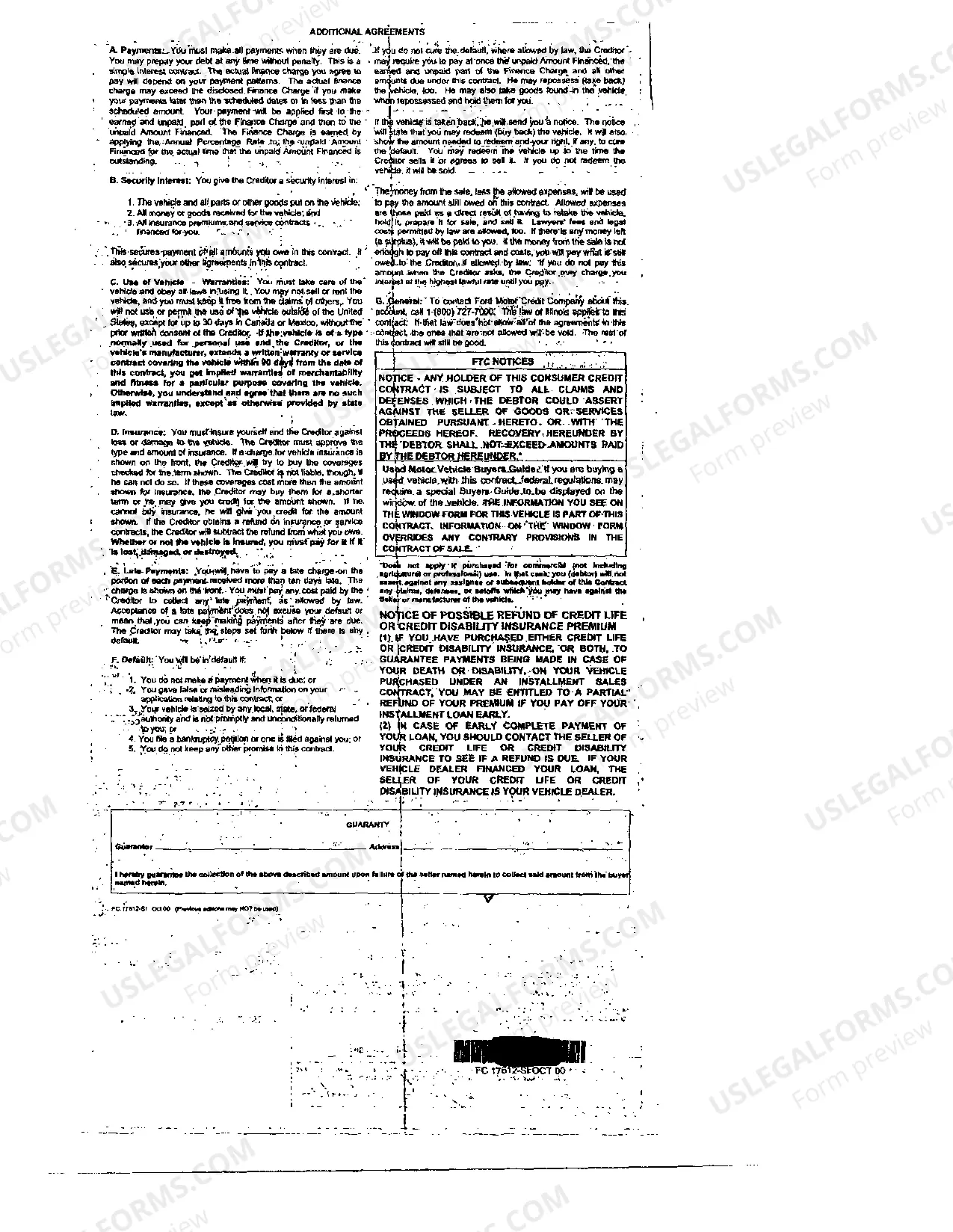

Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile

Description

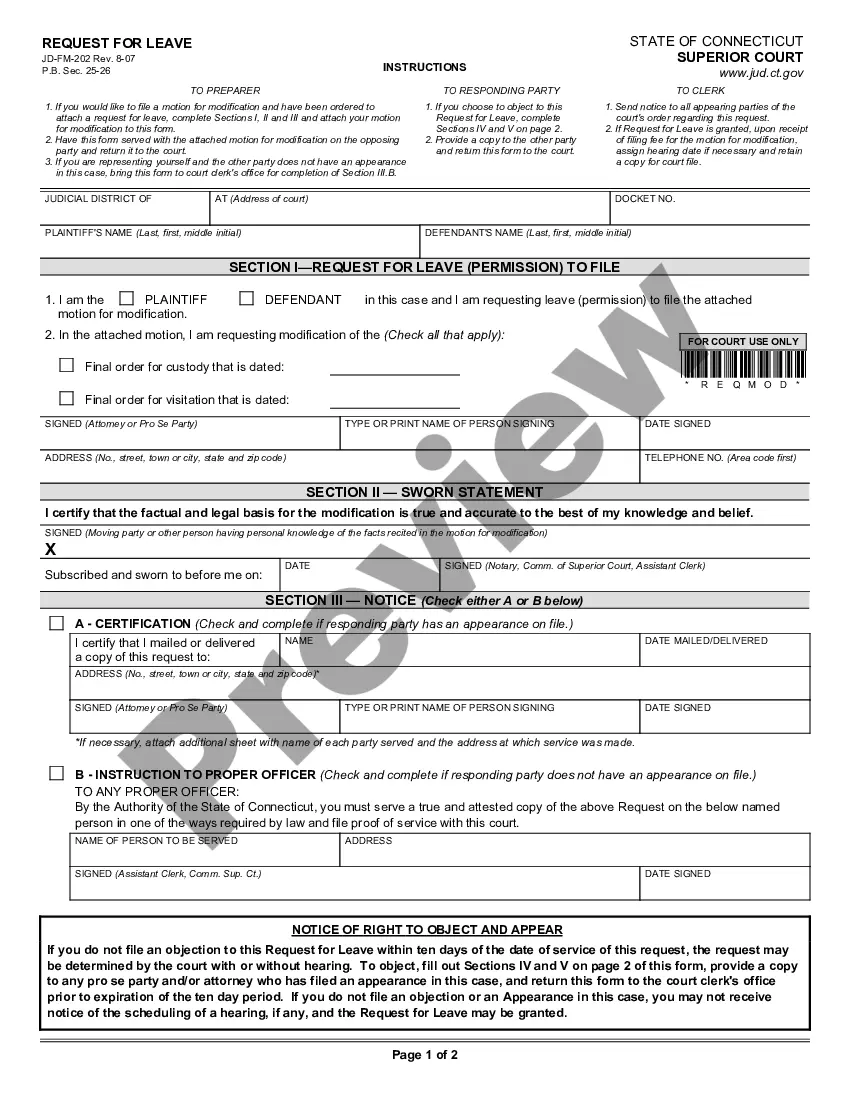

How to fill out Illinois Complaint To Collect Deficiency Balance After Repossession Sale Of Automobile?

Looking for Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile documents and completing them might be challenging.

To conserve significant time, expenses, and effort, utilize US Legal Forms to locate the appropriate sample tailored for your state in just a few clicks.

Our lawyers prepare each document, so you merely need to complete them. It's really that easy.

Select your plan on the pricing page and establish your account. Choose whether you want to pay with a credit card or via PayPal. Download the document in your preferred format. You can print the Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile template or fill it out using any online editor. There’s no need to worry about making mistakes as your template can be utilized and submitted, and published as many times as you desire. Try out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the sample.

- Your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t signed up yet, you need to register.

- Review our thorough instructions on how to acquire your Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile template in minutes.

- To obtain a qualified sample, verify its validity for your state.

- Examine the example using the Preview feature (if available).

- If there is a description, read it to grasp the particulars.

- Click Buy Now if you find what you need.

Form popularity

FAQ

Also, it's possible to negotiate a reduced deficiency or pay a lump-sum settlement regarding any remaining debt associated with the transaction. Be aware that you might have tax consequences if the lender forgives all or some of the deficiency. You might also consider filing for bankruptcy.

Even after a deficiency judgment is entered, your lender still may work out an agreeable payment plan with you. You can try to negotiate a payment by calling the lender or the lender's attorney. Almost every lender's attorney will take your call, and at least listen to payment offers that you make.

Declaring Bankruptcy. Negotiating a Waiver of the Lender's Right to Seek a Deficiency Judgment. Making a Settlement Offer. Taking the Chance that Your Lender Won't Actually Sue You for the Deficiency.

During the act of repossession, you should ask the agent to return your goods. If he refuses or wants convenience money, call the cops. If you find that your vehicle is towed away with things inside, contact the lender immediately. Go to where the car is garaged, and ask them to return your belongings.

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

A deficiency balance is the amount owed to a creditor when collateral is sold for an amount that is less than what the borrower owes on a secured loan.

If your car is repossessed, you have a right to get back your personal belongings that were in the car.When a car loan lender repossesses your car, it doesn't have a right to any personal property you have inside the car. That means you have a right to get your personal belongings back.

If you refuse to pay, the debt will most likely be sold to collections. But either the lender or the collector can choose to file a lawsuit against you, which could result in a wage garnishment, a levy against your bank account or a lien against your other property.

Even if you voluntarily turn over your property, you may have to pay a deficiency balance. If you refuse to pay, the debt will most likely be sold to collections.You may even be able to get your lender to waive the balance as a part of your agreement to let go of your house.