Illinois Exhibit A Adjustable Rate Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Exhibit A Adjustable Rate Note?

Searching for Illinois Exhibit A Adjustable Rate Note documents and filling them out could be a challenge.

To save time, money, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare every document, so you merely need to complete them. It is truly that simple.

Select Buy Now if you found what you're looking for. Choose your plan on the pricing page and register an account. Decide how you prefer to pay, either by card or via PayPal. Save the form in your preferred format. You can print the Illinois Exhibit A Adjustable Rate Note form or fill it out using any online editor. No need to fret about errors, as your template can be used and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the document.

- Your downloaded samples are stored in My documents and are available at all times for future use.

- If you haven't signed up yet, you need to create an account.

- Examine our detailed instructions on how to obtain the Illinois Exhibit A Adjustable Rate Note template in a matter of minutes.

- To obtain a qualified template, verify its relevance for your state.

- Use the Preview feature to view the form (if available).

- Read the description to understand the specifics.

Form popularity

FAQ

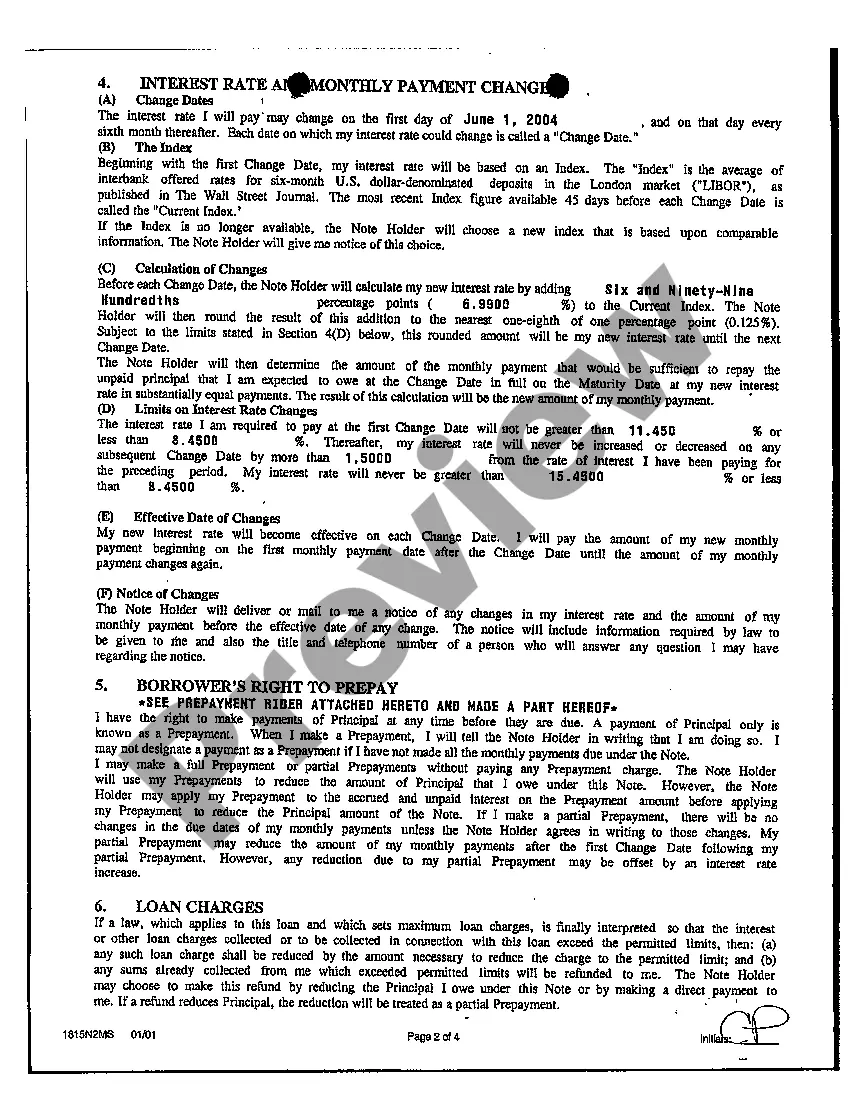

An ARM has four components: (1) an index, (2) a margin, (3) an interest rate cap structure, and (4) an initial interest rate period. When the initial interest rate period has expired, the new interest rate is calculated by adding a margin to the index.

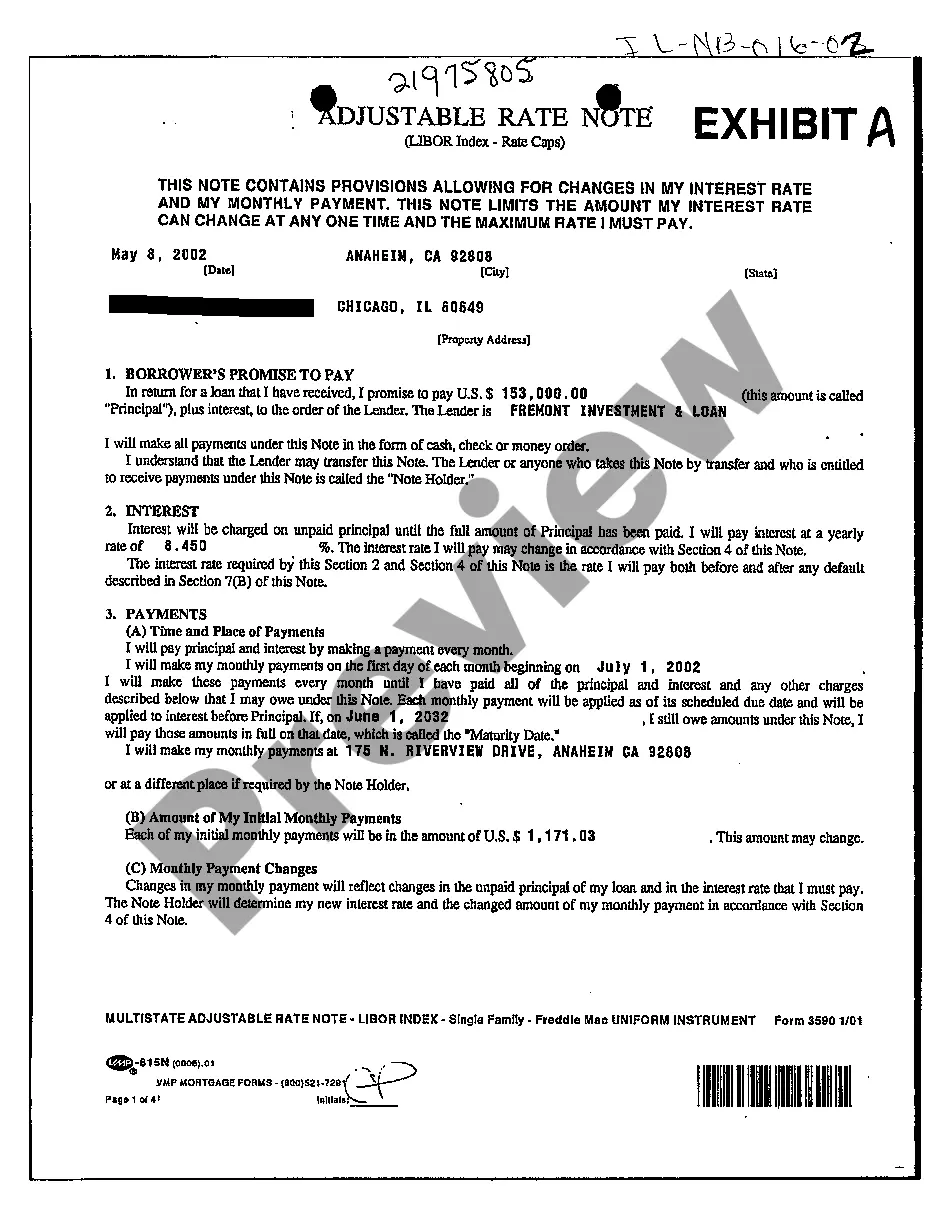

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY.

THIS NOTE PROVIDES FOR A CHANGE IN MY FIXED INTEREST RATE TO AN ADJUSTABLE INTEREST RATE. THIS NOTE LIMITS THE AMOUNT MY ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES I MUST PAY. THIS NOTE ALSO CONTAINS THE OPTION TO CONVERT MY ADJUSTABLE INTEREST RATE TO A NEW FIXED RATE.

Divide your interest rate by the number of payments you'll make in the year (interest rates are expressed annually). So, for example, if you're making monthly payments, divide by 12. 2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

Initial cap: Your interest rate can only change by up to 2% the first time it adjusts. Periodic cap: Each change after that is limited to 1% every 6 months. Lifetime cap: Throughout the rest of the loan term, the most the interest rate can increase or decrease is 5% from the fixed rate.

Payment shock. What is the term used to describe a rate adjustment resulting in a new payment amount? recast.

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

Index + Margin = Your Interest Rate The index is a benchmark interest rate that reflects general market conditions. The index changes based on the market. Changes in the index, along with your loan's margin, determine the changes to the interest rate for an adjustable-rate mortgage loan.