The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Illinois Annual Minutes

Description

How to fill out Illinois Annual Minutes?

Searching for Yearly Minutes - Illinois paperwork and completing them can be an issue.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare every document, allowing you to simply complete them. It's truly that simple.

Select your payment method, either by credit card or through PayPal. Save the document in your preferred format. You can print out the Yearly Minutes - Illinois form or complete it using any online editor. Don’t worry about typos since your template can be used, sent, and printed as often as needed. Visit US Legal Forms and gain access to more than 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the template.

- All your saved documents can be found in My documents and are accessible at any time for future use.

- If you haven't subscribed yet, you ought to register.

- Review our detailed instructions on how to obtain your Yearly Minutes - Illinois form in a few minutes.

- To get a valid template, verify its appropriateness for your state.

- Examine the template using the Preview option (if available).

- If there's a description, read it to grasp the details.

- Click Buy Now if you found what you seek.

Form popularity

FAQ

Failing to file your annual report can lead to significant consequences for your LLC. Your business may face late fees, and eventually, the state may dissolve your LLC if you do not comply. It is crucial to keep your Illinois Annual Minutes up to date to avoid these issues and ensure your company's continued existence. You can rely on USLegalForms to guide you through the filing process and keep you informed.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

Enter the name of your LLC. Enter Illinois on the first line and then enter the date your LLC was formed. Enter your LLC's Principal Place of Business address (PO boxes are not allowed). Enter the name and address of your LLC's Managers or Members.

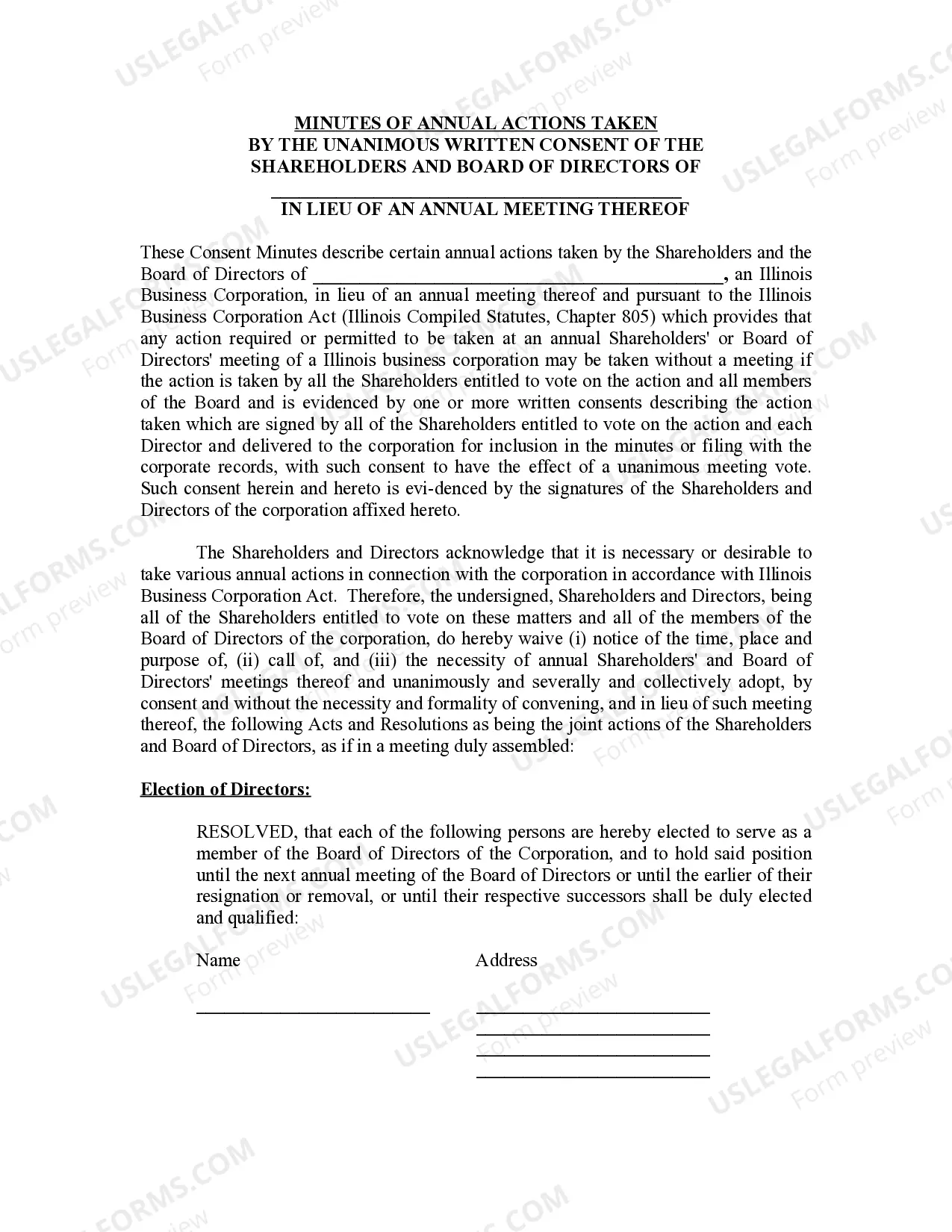

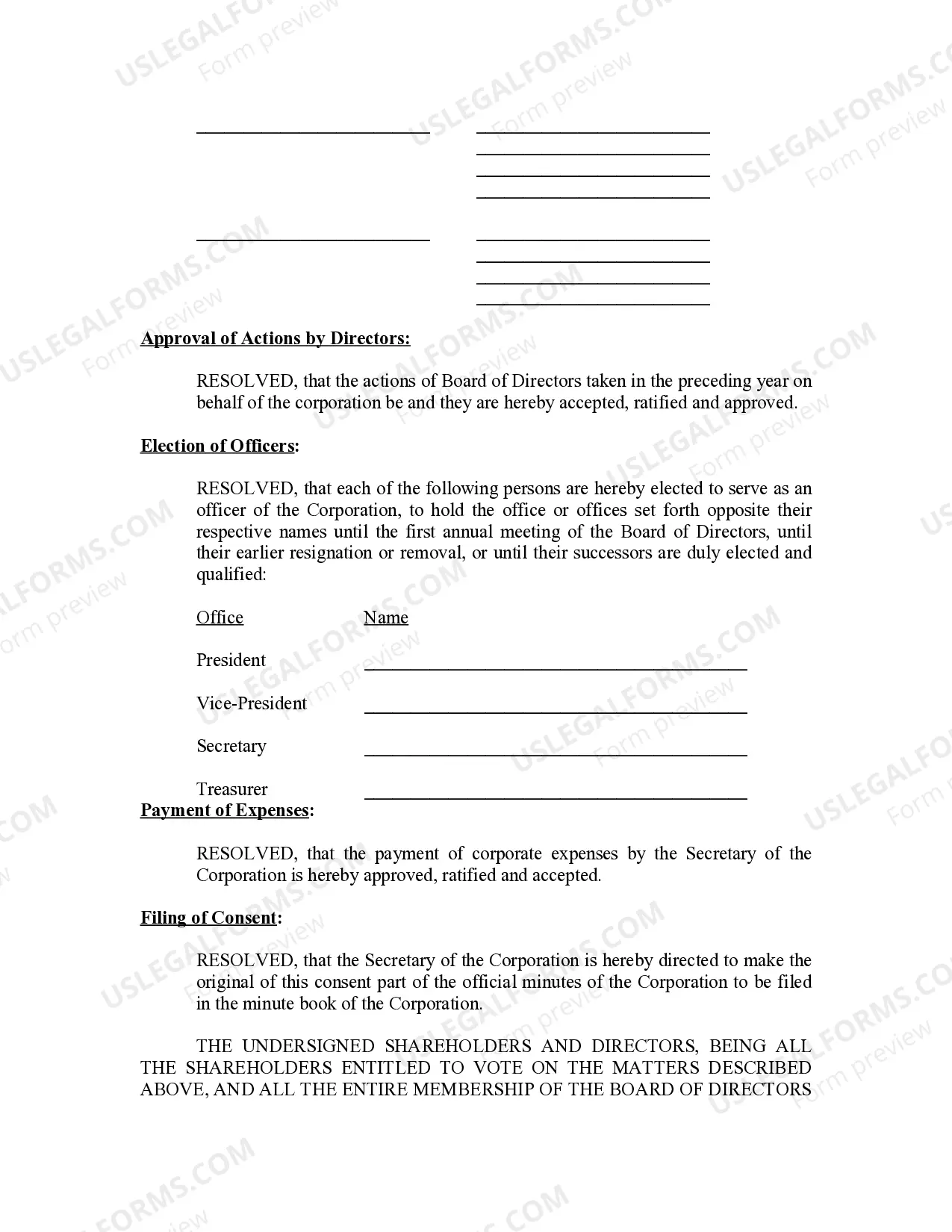

The purpose of filing an annual or biennial report is to provide the jurisdiction with current information on the company's structure (officers, directors, members, registered agent, etc.) and finances (authorized shares, issued shares, stated capital, paid in capital, etc.)

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.

An annual report typically includes a business's name and address, the state in which the company was formed, a list of officers and directors, all business activities conducted within the state during the fiscal year, name and contact information for the registered agent, and other required information, which varies

Illinois requires LLCs to file an annual report during the 60-day period before the first day of the anniversary month of the incorporation date. The annual report fee is $250. Taxes. For complete details on state taxes for Illinois LLCs, visit Business Owner's Toolkit or the State of Illinois .

An Annual report is a filing that details a company's activities throughout the prior year. Annual reports are intended to give state governing authorities information regarding the names and addresses of directors or managing members of a corporation or LLC as well as the company and registered agent address.

LLC Taxes in CaliforniaCalifornia LLCs must pay an annual $800 LLC tax. California LLC taxes are due by April 15th, just like federal taxes, and should be paid to the California Franchise Tax Board. You must pay this tax even if your LLC doesn't earn any income.

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.