Illinois Garnishment Summons Non Wage is a court-ordered summons used to collect a debt from a debtor. It requires the debtor to appear in court to answer questions about their assets and income. The summons is issued by the court to the garnishee, who may be an employer, bank, or other financial institution. The garnishee is then required to turn over the debtor's assets to the court to satisfy the debt. There are two types of Illinois Garnishment Summons Non Wage: (1) Regular Non-Wage Garnishment Summons and (2) Supplemental Non-Wage Garnishment Summons. The Regular Non-Wage Garnishment Summons is used to collect a debt from a debtor who has no wages or other income to be collected, while the Supplemental Non-Wage Garnishment Summons is used to collect a debt from a debtor who has wages or other income that is not subject to garnishment.

Illinois Garnishment Summons Non Wage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Garnishment Summons Non Wage?

How much duration and resources do you typically allocate for drafting official documentation.

There’s a better alternative to obtaining such forms than employing legal professionals or spending hours navigating the internet for a suitable blank.

Another benefit of our service is that you can retrieve previously acquired documents that you safely store in your profile in the My documents section. Access them anytime and re-fill your documentation as often as needed.

Conserve time and effort assembling official documentation with US Legal Forms, one of the most reliable online solutions. Sign up with us today!

- Browse through the form details to confirm it meets your state regulations. To do this, review the form description or use the Preview option.

- If your legal template does not fulfill your requirements, search for another one using the search bar at the top of the page.

- If you are already registered with our platform, Log In and download the Illinois Garnishment Summons Non Wage. If not, proceed to the following steps.

- Click Buy now once you discover the right document. Select the subscription plan that best fits your needs to access our library’s complete service.

- Create an account and process your subscription payment. You can pay with your credit card or via PayPal - our service is completely secure for that.

- Download your Illinois Garnishment Summons Non Wage onto your device and complete it on a printed copy or electronically.

Form popularity

FAQ

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

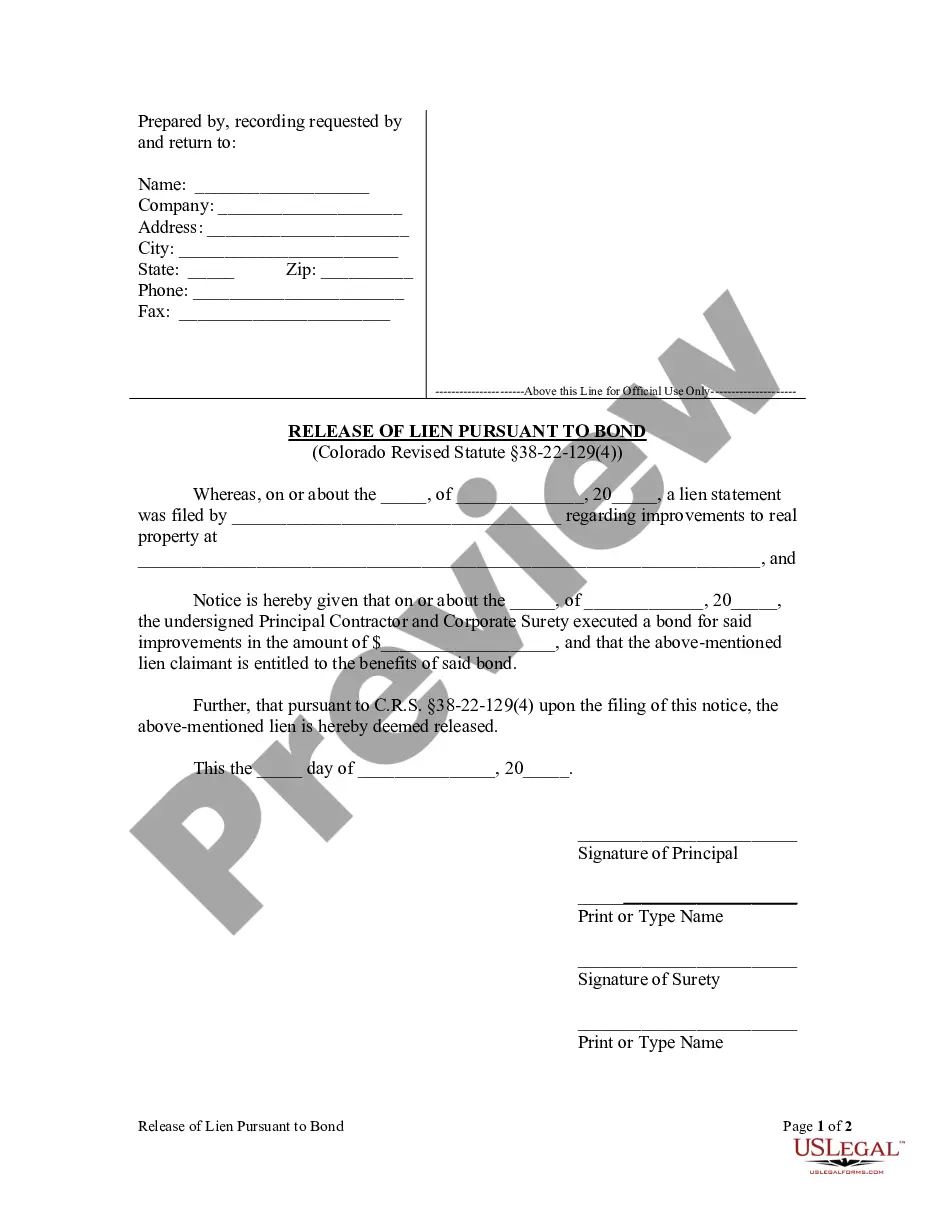

Non-wage garnishment is the judgment creditor's attachment, after judgment, of the judgment debtor's property, other than wages, which is in the possession, custody or control of third parties. Example: A creditor files a non-wage garnishment to attach funds your client has deposited in the local bank.