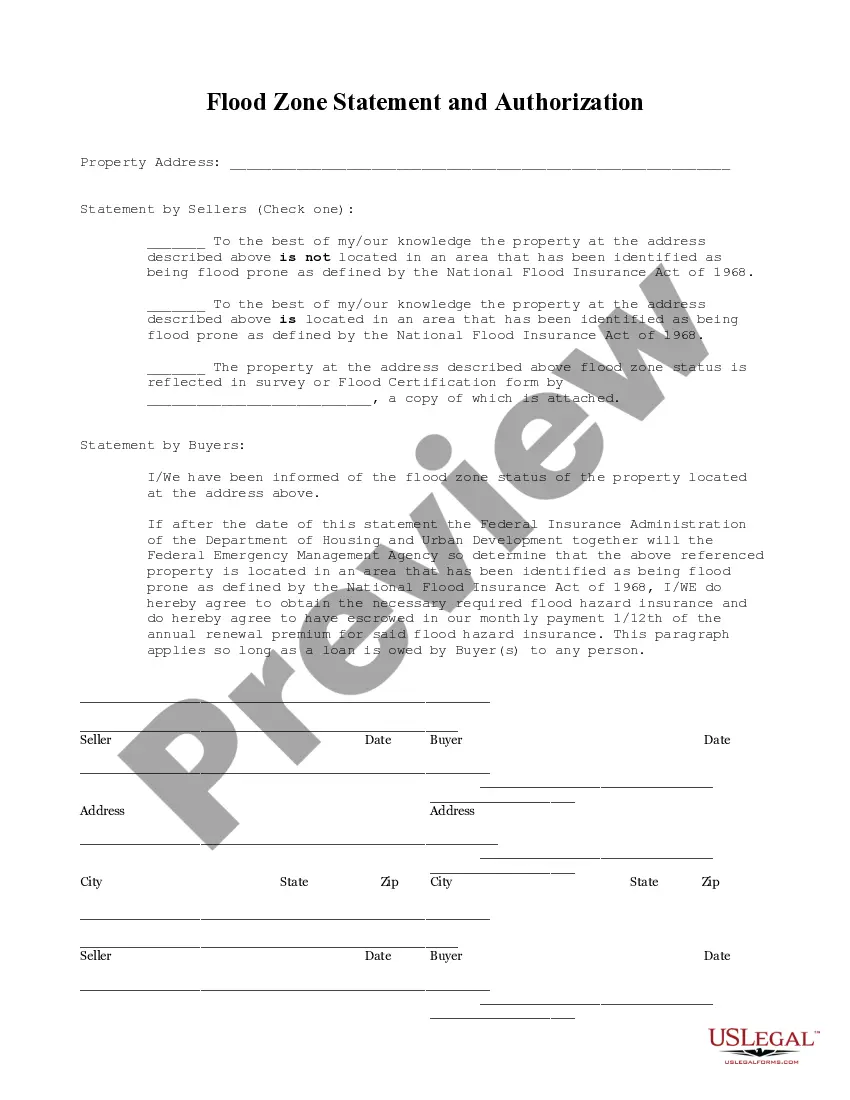

Illinois Flood Zone Statement and Authorization

About this form

The Flood Zone Statement and Authorization is a crucial document for real estate transactions. It enables sellers to disclose the flood zone status of a property and requires buyers to acknowledge this information. This form helps protect both parties by ensuring that buyers are aware of potential flood insurance requirements should the property be determined to be in a flood zone in the future. It is distinct from other property disclosure forms by specifically addressing flood risk and insurance obligations.

Key components of this form

- Property address section to specify the location.

- Statement by sellers to indicate their knowledge of the flood zone status.

- Buyers' acknowledgment of flood zone status and their agreement to obtain flood insurance if necessary.

- Signature lines for both sellers and buyers to affirm the statements made.

When to use this form

This form is typically used during the sale of a property that may be located in a flood-prone area. It is essential when buyers seek to understand their potential liabilities concerning flood insurance and when sellers wish to ensure compliance with federal disclosure requirements. Use this form in transactions where flood risk is a consideration.

Who should use this form

This form is intended for:

- Sellers of residential or commercial properties who need to disclose flood zone information.

- Buyers looking to understand potential flood risks associated with their property purchase.

- Real estate professionals assisting in property transactions where flood risk is a consideration.

Completing this form step by step

- Identify and enter the property address at the top of the form.

- Sellers check the appropriate statement regarding the flood zone status.

- If applicable, provide details of any attached flood certification or survey.

- Buyers acknowledge understanding of the flood information provided by the sellers.

- All parties sign and date the form, including their contact information.

Notarization requirements for this form

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to properly check the flood zone status option by sellers.

- Leaving sections incomplete, particularly regarding contact information.

- Not attaching required flood certification documents when applicable.

Benefits of completing this form online

- Convenient access to downloadable templates for easy use.

- Editability allows for customization based on specific property details.

- Reliable legal wording drafted by licensed attorneys helps ensure adherence to legal standards.

Legal use & context

- The form mitigates risk by ensuring clear communication regarding flood zone status.

- It provides legal protection for sellers against future claims of non-disclosure.

- Buyers are legally bound to obtain flood insurance if the property is later identified as being in a flood zone.

Quick recap

- The Flood Zone Statement and Authorization is essential for property transactions involving potential flood risk.

- Both sellers and buyers have defined responsibilities regarding flood zone disclosure and insurance.

- Completing this form helps ensure compliance with legal requirements, protecting both parties in a transaction.

Glossary of terms

- Flood zone: An area identified by the federal government as being at risk for flooding.

- Flood insurance: Insurance coverage that protects property owners from losses due to flooding.

- National Flood Insurance Act of 1968: A federal law that established a program for flood insurance and floodplain management.

Looking for another form?

Form popularity

FAQ

Summary: Proximity to a flood zone lowers property values. By law, a property is considered in a flood zone if any part of the structure falls within a floodplain, an area that is adjacent to a stream or river that experiences periodic flooding.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

Areas in flood zone A have a 1 percent chance of flooding per year and a 25 percent chance of flooding at least once during a 30-year mortgage. Since there haven't been detailed hydraulic analysis in these areas, the base flood elevation and depths have not been determined.

Use the Comments area of Section D, on the back of the certificate, to provide datum, elevation, or other relevant information not specified on the front. Complete Section E if the building is located in Zone AO or Zone A (without BFE). Otherwise, complete Section C instead.

If you live in a high-risk area for flooding and are purchasing flood insurance through the National Flood Insurance Program (NFIP), you will almost certainly be required to provide an elevation certificate to complete your purchase.

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

The BFE is the elevation that floodwaters are estimated to have a 1% chance of reaching or exceeding in any given year. The higher your lowest floor is above the BFE, the lower the risk of flooding. Lower risk typically means lower flood insurance premiums.

If you live in a high-risk area for flooding and are purchasing flood insurance through the National Flood Insurance Program (NFIP), you will almost certainly be required to provide an elevation certificate to complete your purchase.

The best way to find flood insurance without a Flood Elevation Certificate is to consult a licensed flood insurance agent to see if they work with any companies that don't rely on a certificate to price out flood risk.