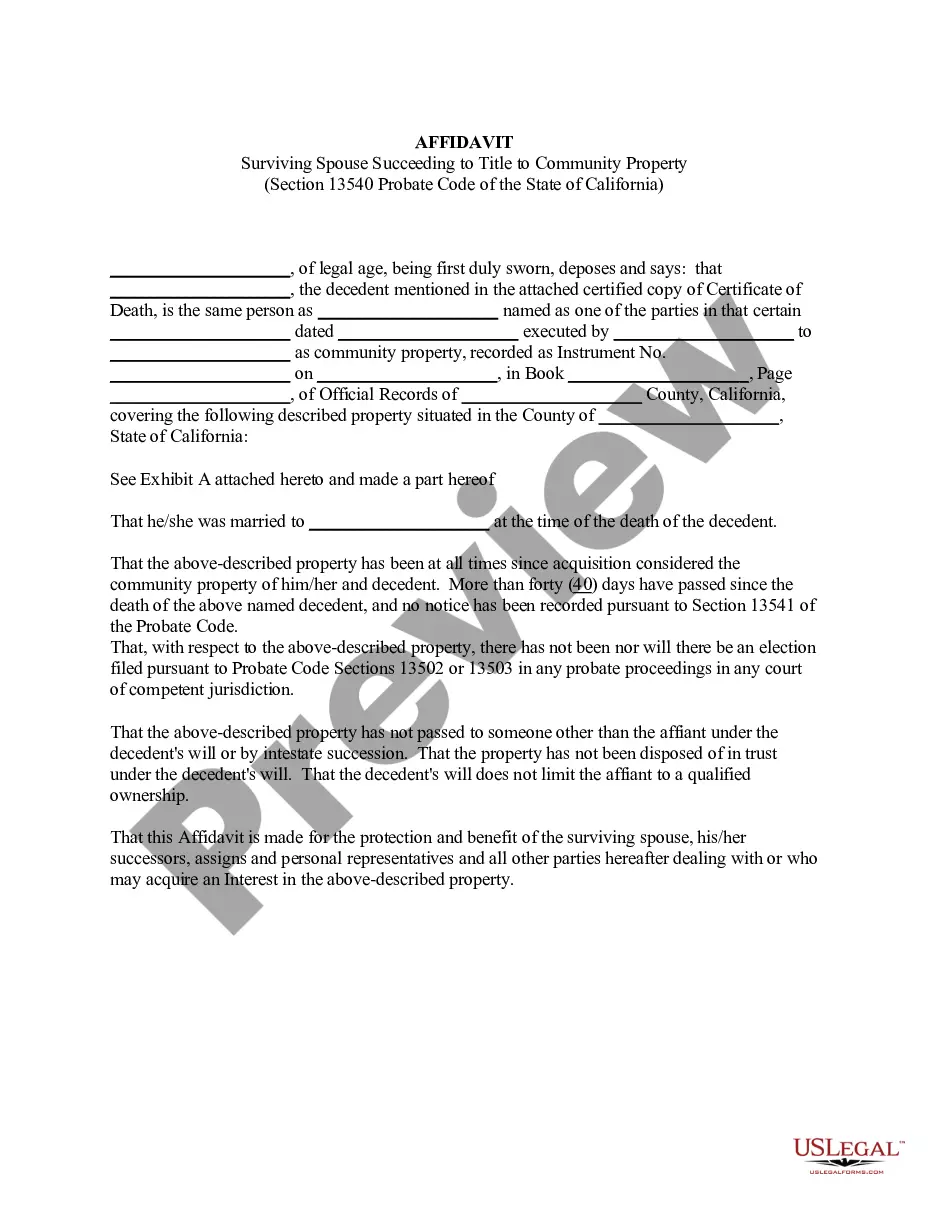

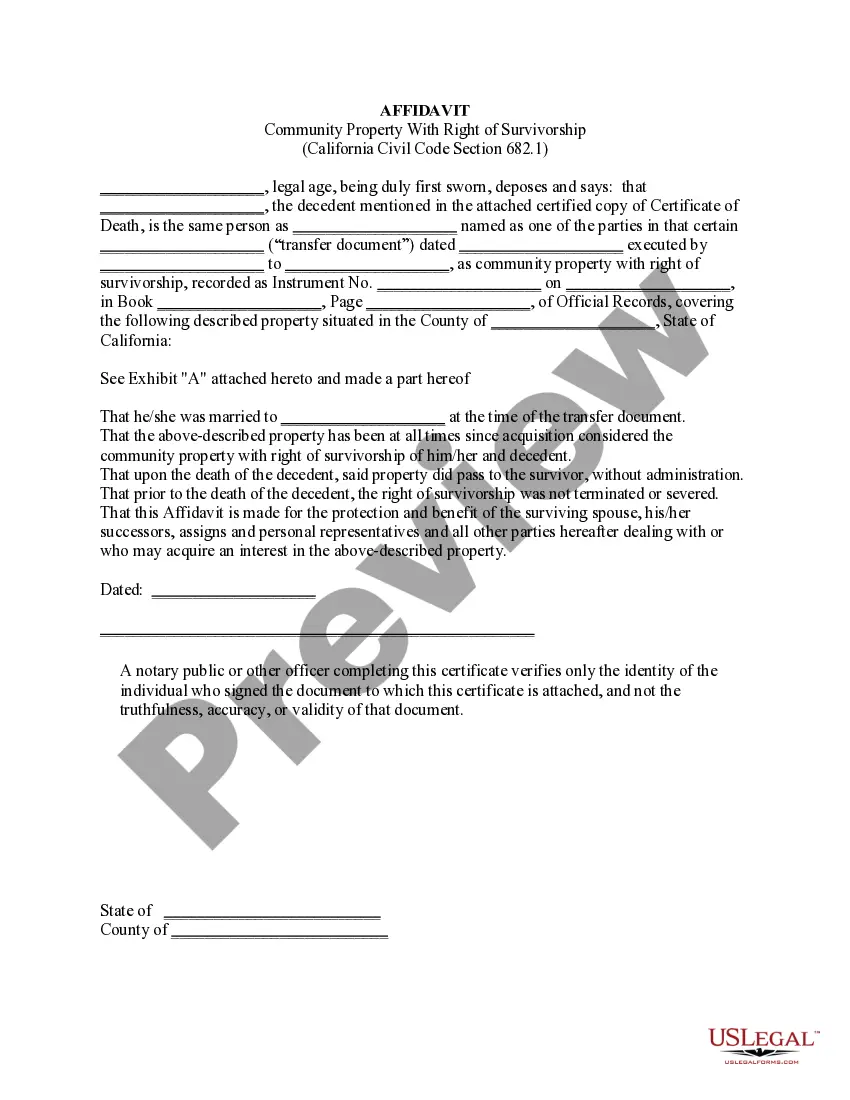

Illinois Acceptance By Corporate Fiduciary is a service offered by corporate fiduciaries in Illinois to provide legal acceptance of fiduciary responsibility. This service allows the fiduciary to accept and acknowledge legal responsibility for the management of trust assets, such as investment accounts, real estate, and other investments, on behalf of a beneficiary or group of beneficiaries. The fiduciary must be registered with the Illinois Secretary of State before providing the service and must provide proof of their qualifications and expertise in the field. There are two types of Illinois Acceptance By Corporate Fiduciary: General Acceptance and Specific Acceptance. General Acceptance involves accepting fiduciary responsibility for all assets that are held in trust by the fiduciary, while Specific Acceptance involves accepting fiduciary responsibility for a specific asset or group of assets.

Illinois acceptance By Corporate Fuduciary

Description

How to fill out Illinois Acceptance By Corporate Fuduciary?

Creating legal documents can be quite a hassle unless you have pre-prepared fillable templates. With the US Legal Forms online collection of formal paperwork, you can trust the templates you receive, as all of them adhere to federal and state statutes and have been reviewed by our experts.

So if you require to complete the Illinois acceptance By Corporate Fiduciary, our service is the ideal platform to download it.

You haven't tried US Legal Forms yet? Sign up for our service today to quickly and easily obtain any formal document you need, keeping your paperwork organized!

- Acquiring your Illinois acceptance By Corporate Fiduciary from our platform is as straightforward as possible. Previously registered users with a valid subscription just need to Log In and click the Download button upon finding the correct template.

- Afterward, if needed, users can access the same document via the My documents tab in their account.

- However, even if you are new to our service, registering with a valid subscription will only take a few minutes.

- Here’s a brief guideline for you.

Form popularity

FAQ

Section 2-8 of the Corporate Fiduciary Act outlines the powers and duties of corporate fiduciaries in Illinois. It specifies their obligations regarding investment management, record keeping, and reporting to beneficiaries. Familiarizing yourself with this section is crucial for anyone seeking Illinois acceptance by Corporate Fiduciary, as it establishes essential compliance guidelines.

A ?corporate fiduciary? is a business entity, such as ours, that has been granted permission by the state to act in a fiduciary capacity. We can serve as trustee, and we can settle estates. In this capacity, we are subject to a wide range of audit controls and government regulatory supervision.

The most common fiduciary relationships involve legal or financial professionals who agree to act on behalf of their clients. For example, a lawyer and a client have a fiduciary relationship. So do a trustee and a beneficiary, a corporate board and its shareholders, and an agent acting for a principal.

Both the board of directors and the CEO of a small business have a fiduciary responsibility to the business's shareholders. The fiduciary duties are legal concepts that form the basis of a CEO's legal relationship with his company's owners.

The Illinois Trust Code (ITC) now governs the obligations of trust fiduciaries and rights of beneficiaries, and its modifications to prior law have significant implications for trust preparation and administration.

Directors' duties As persons in control of the property of others, directors are fiduciaries. As such, they must act in the best interests of those they serve. Directors owe a duty of care to their corporation. This duty requires directors to stay informed about corporate developments and to make informed decisions.

Contracts, wills, trusts, and corporate settings can bind fiduciary relationships. For example, a board of directors has a fiduciary duty to act in the best interest of each other and the company's shareholders. Whereas a doctor has a fiduciary duty to always act in the best interest of their patients.

Statutory Grounds For Removal of a Trustee Under the Illinois Trust Code, a qualified beneficiary, settlor, or co-trustee can request that a court remove a trustee and replace them with a successor. A court also has the power to remove a trustee on its own initiative if it finds grounds for doing so.