Illinois Notification of Withdrawal of Partner for Cook County

Description

How to fill out Illinois Notification Of Withdrawal Of Partner For Cook County?

Searching for Illinois Notification of Withdrawal of Partner for Cook County documents and completing them may pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to locate the suitable template specifically for your state in just a few clicks.

Our attorneys prepare all paperwork, so you merely need to complete them. It's truly that straightforward.

Select your plan on the pricing page and establish your account. Choose your payment method via card or PayPal. Download the document in the desired file format. You can now print the Illinois Notification of Withdrawal of Partner for Cook County form or complete it using any online editor. There's no need to be concerned about typos because your template can be utilized and submitted, and printed out as often as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your profile and navigate back to the form's area to obtain the document.

- All of your saved forms are stored in My documents and are accessible at any time for future use.

- If you haven't subscribed yet, you must register.

- Review our extensive instructions on how to obtain your Illinois Notification of Withdrawal of Partner for Cook County form in mere minutes.

- To acquire a verified template, confirm its validity for your state.

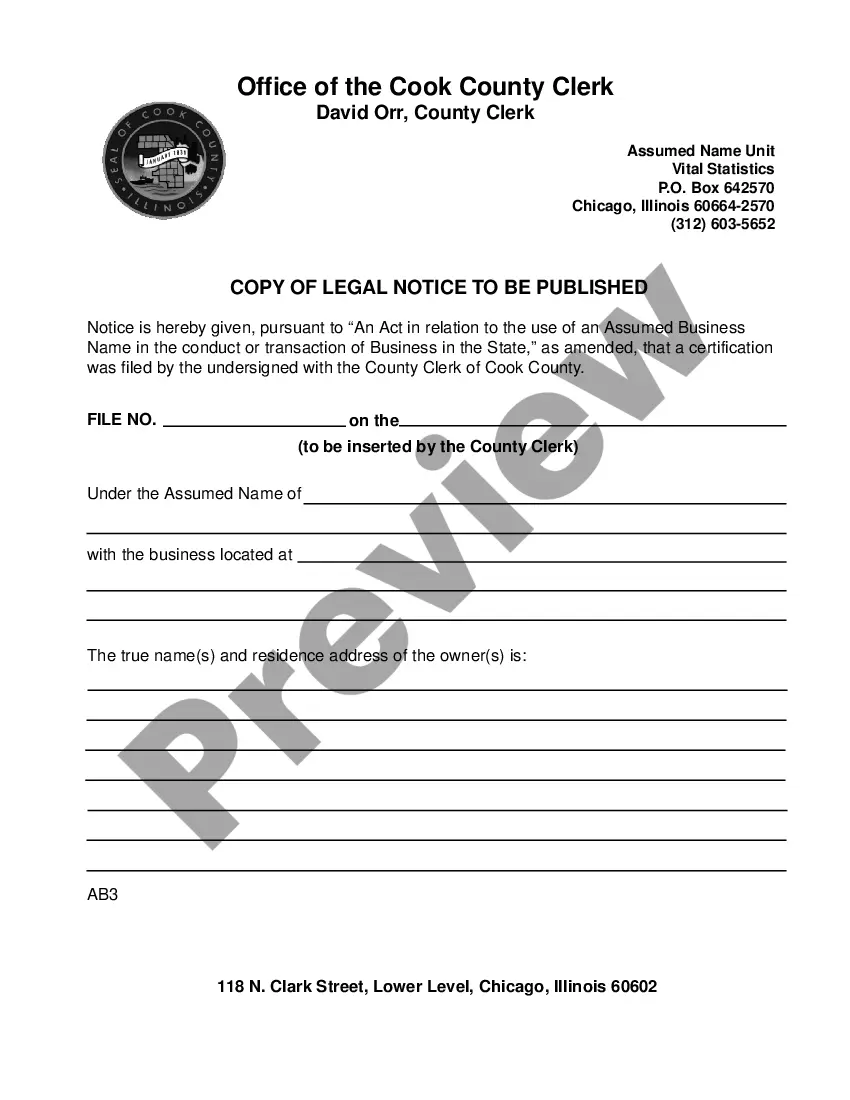

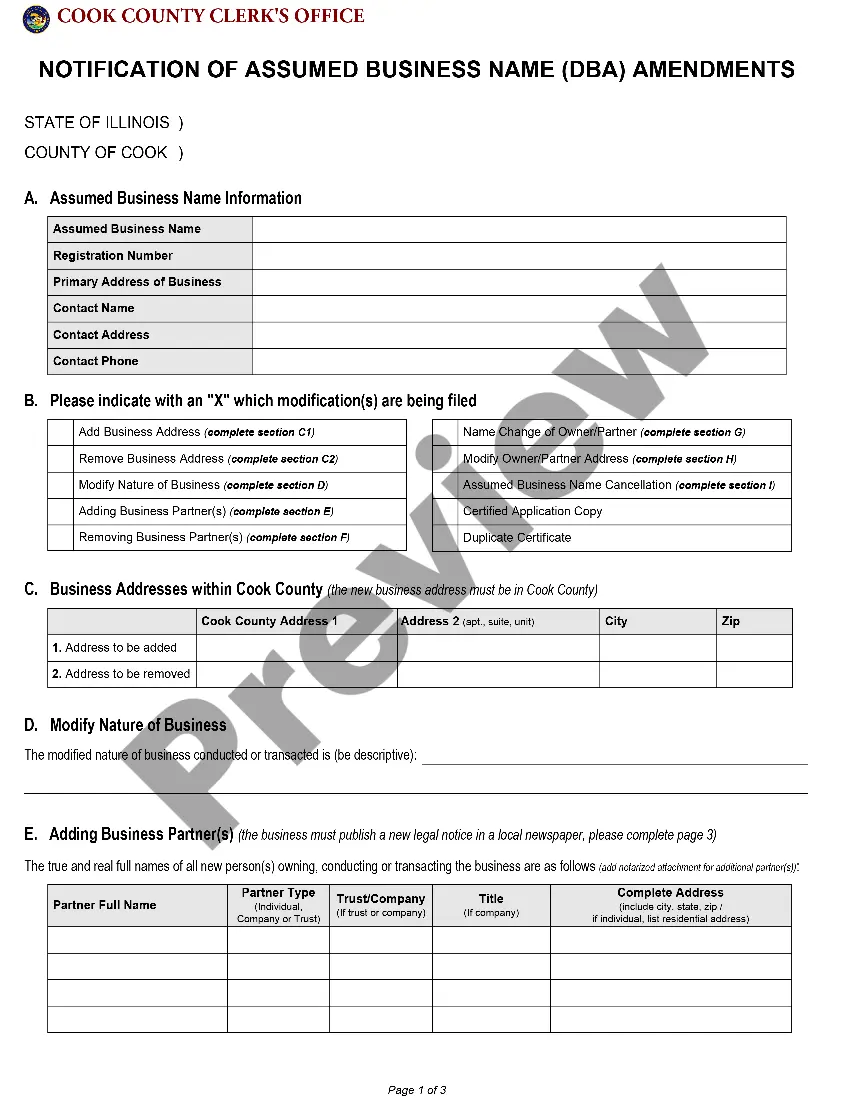

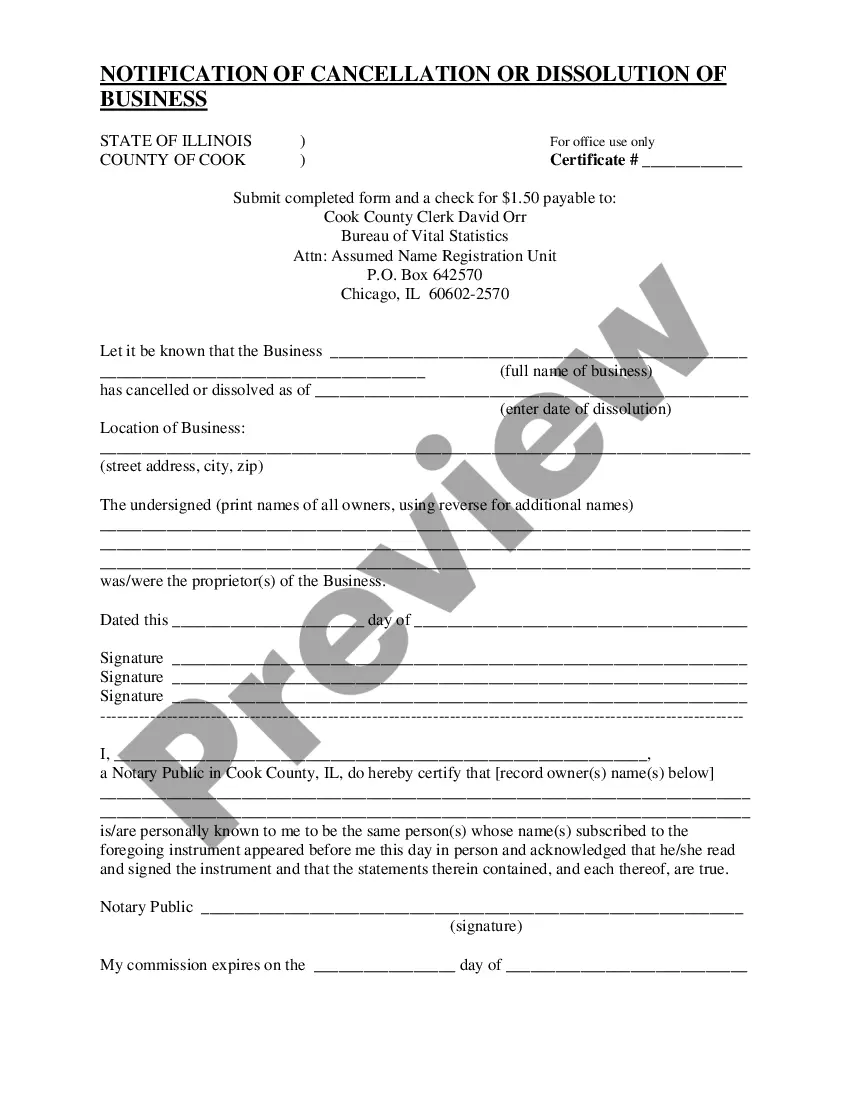

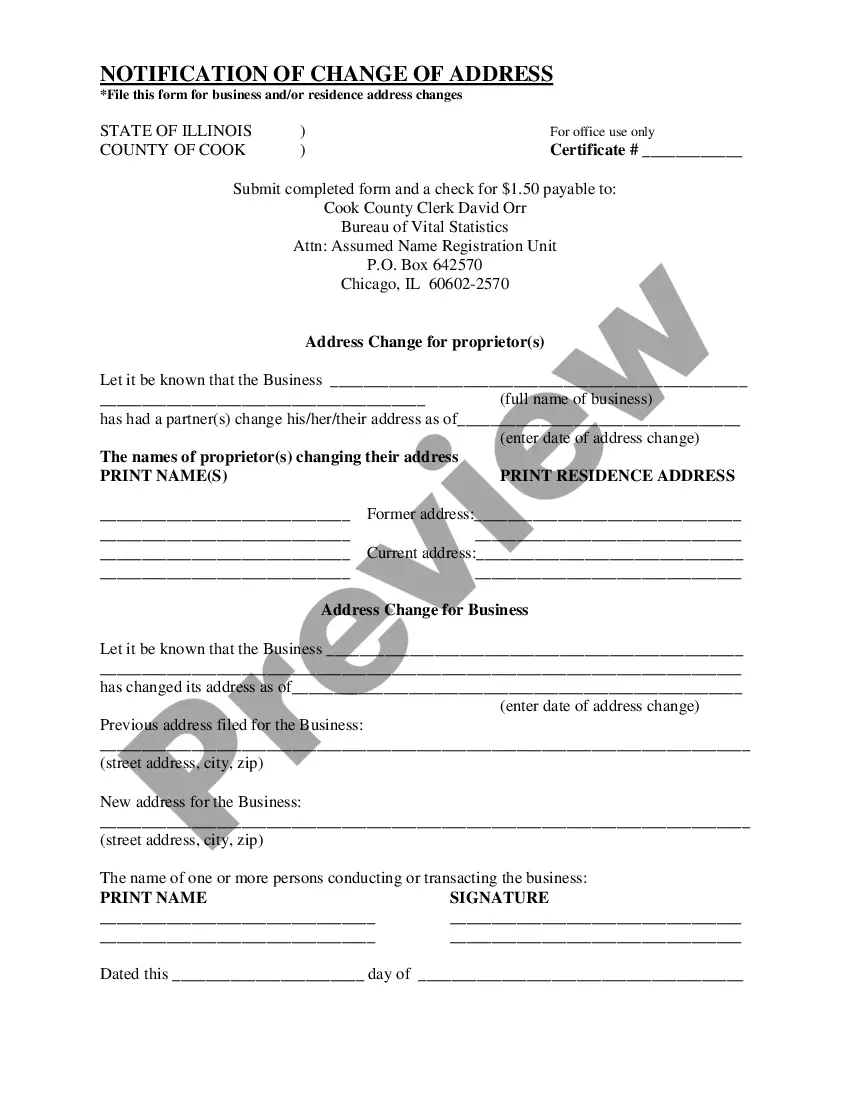

- Examine the example using the Preview option (if available).

- If there's a description, read it to grasp the details.

- Click Buy Now if you found what you're seeking.

Form popularity

FAQ

General partnership. A general partnership is a company owned by two or more individuals who agree to run the business as partners or co-owners. Limited partnership. Limited partnerships are more structured than general partnerships and have both general and limited partners. Limited liability partnership. LLC partnership.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

When one of the partners or all the partners is insolvent then dissolution can take place. Even the insolvency of one partner can dissolve the firm. Dissolution can also take place if any one of the partners resigns.

The partner who has left retains all their interest in the assets of the original partnership until they agree otherwise. They also remain jointly and severally liable for all the obligations of the original partnership. These principles apply to all partnership assets and liabilities.

The partners can agree (before the dissolution) that the partnership will effectively continue when someone leaves. However, so far as the legal rights and obligations of the partners is concerned, a partner's retirement still effectively ends the 'original partnership'.

A partner of a firm may not be dismissed from a partnership firm by a majority of the partner except in exercise, in good faith, of powers conferred by contract between the partners. An expulsion is not deemed to be in a proper interest of the business of the firm if the conditions below are not fulfilled.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

Dissolution. In a two person partnership, if one partner leaves, the operation becomes dissolved unless the remaining partner wishes to operate a sole proprietorship.Most often, a partner will sell his or her shares to the remaining partners if the business is not dissolved.

Voluntary and Non-Voluntary. A voluntary withdrawal means the partner merely wants to move on for personal reasons, such as they are retiring or they feel they can't remain dedicated to the partnership. Planning an Exit. Partnership Agreement. Dissolution. Peaceful Exit.

The individual partners pay, with their own cash and not the partnership cash, the leaving partner for a share of the leaving partner's capital account. The partnership pays the leaving partner for the value of his or her capital account + a cash bonus.