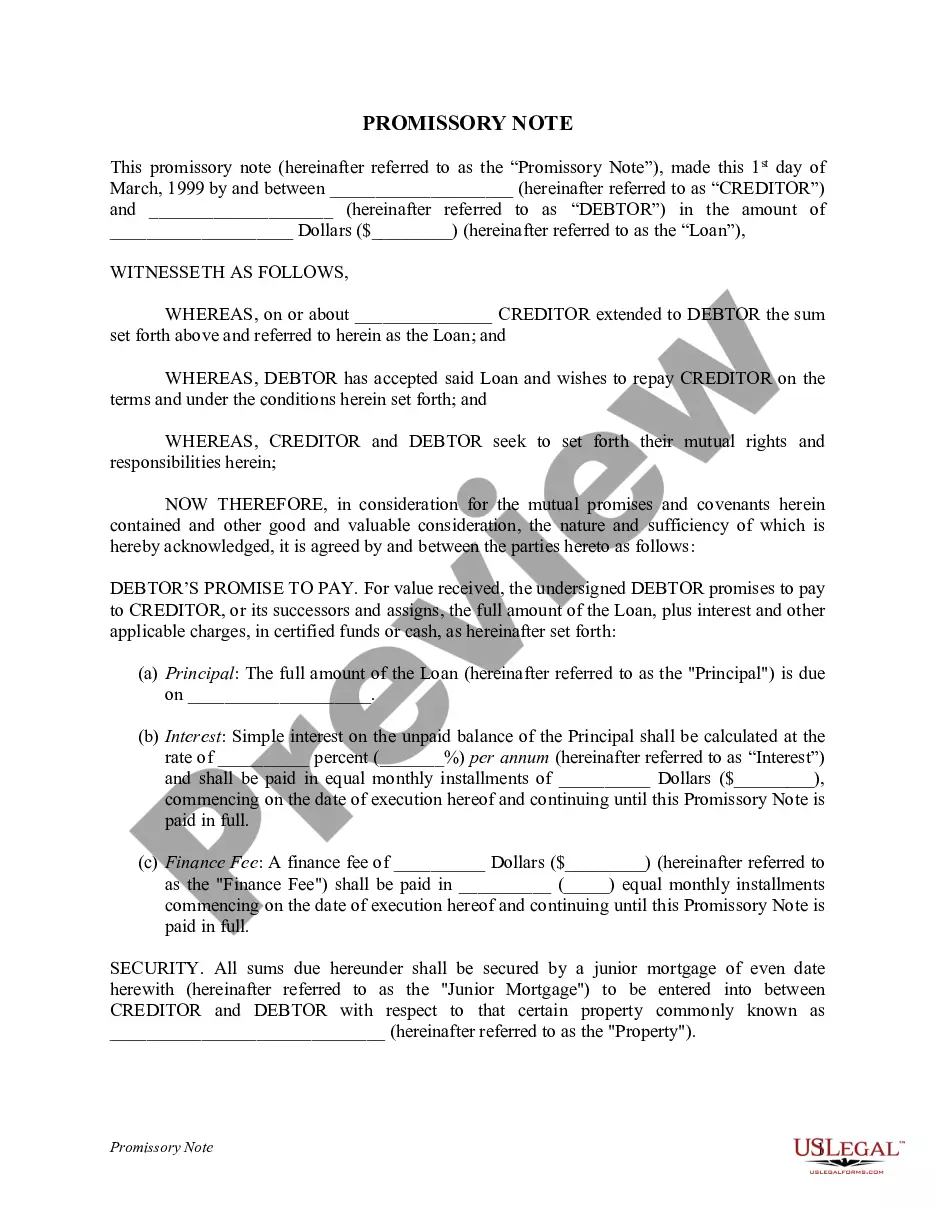

Illinois Promissory Note

Description

What Is a Promissory Note?

A promissory note is a financial instrument that involves a written promise by one party (the maker or issuer) to pay another party (the payee) a definite sum of money, either on demand or at a specified future date. Promissory notes are used in various financial transactions and are considered a negotiable instrument.

History of the Promissory Note

The origins of promissory notes can be traced back to ancient civilizations, including the code of Hammurabi. In the United States, promissory notes have been used since the country's founding to manage and exchange debts, and their formal characteristics and legal implications have evolved over time.

Key Elements of a Promissory Note

- Principal Amount: The amount of money that is being borrowed and promised to be paid back.

- Interest Rate: This may be expressed as a percentage of the principal, payable at a regular interval.

- Maturity Date: The specific date by which the borrowed amount is to be repaid.

- Issuer and Payee: Names and details of the borrower and the lender.

- Repayment Terms: Details about the repayment structure, which may include installment payments or a lump sum.

Step-by-Step Guide to Drafting a Promissory Note

- Label the document as a 'Promissory Note' at the top.

- Clearly state the principal amount being borrowed.

- Specify the interest rate and the method of its application.

- Define a clear maturity date, and terms of repayment.

- Include the legal names and addresses of all parties involved.

- Ensure both parties sign and date the document, and consider witnessing or notarization if required by state law.

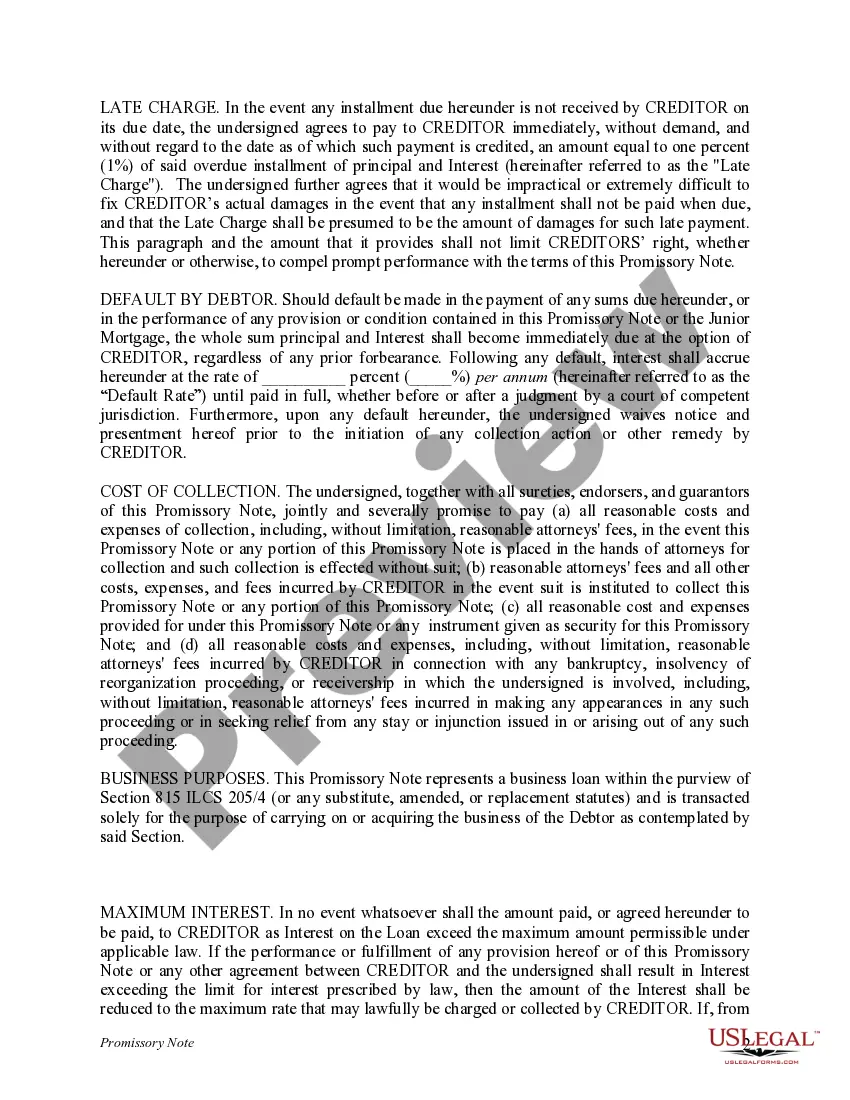

Risk Analysis of Using Promissory Notes

- Default Risk: The borrower may fail to meet the obligations outlined in the note.

- Legal Risk: Improper documentation can lead to legal ambiguities during dispute resolution.

- Interest Rate Risk: Fixed-rate promissory notes can result in losses if interest rates increase significantly.

Best Practices in Managing Promissory Notes

- Verify the creditworthiness of the borrower before issuing a promissory note.

- Keep a secured backup, an archived original, for legal and record-keeping purposes.

- Specify all terms clearly to avoid future disputes and ensure legal enforceability.

- Consider the involvement of legal counsel in drafting the note to comply with local regulations and protect all parties' interests.

Common Mistakes & How to Avoid Them

- Lack of Specificity: Always define all terms and conditions explicitly to avoid misunderstandings.

- Failing to Secure the Note: For loans involving substantial amounts, securing the note against collateral can mitigate default risks.

- Neglecting Legal Formalities: Each state may have specific requirements for promissory notes to be legally binding; neglecting these can invalidate the note.

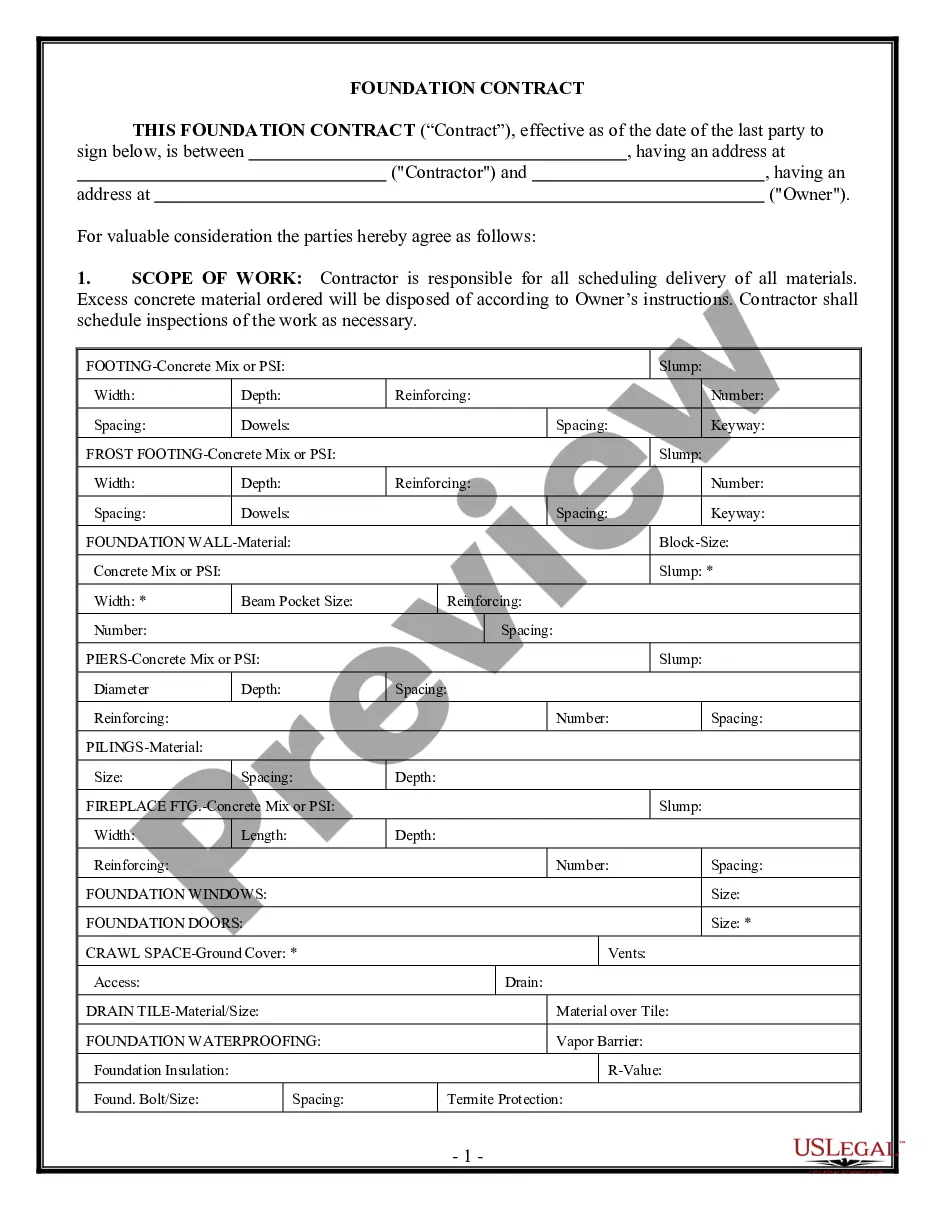

How to fill out Illinois Promissory Note?

Locating Illinois Promissory Note templates and completing them can be a struggle.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state with just a few clicks.

Our attorneys create every document, so you merely have to complete them. It’s truly that straightforward.

Select your payment option on the pricing page and create your account. Choose whether to pay with a credit card or via PayPal. Save the form in your preferred format. Now you can print the Illinois Promissory Note form or fill it out using any online editor. Don't worry about typos, as your form can be used and submitted, and printed as many times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to download the sample.

- All your downloaded templates are kept in My documents and can be accessed anytime for future use.

- If you haven’t subscribed yet, you will need to register.

- Review our detailed guidelines on how to obtain the Illinois Promissory Note sample in just a few moments.

- To get a valid template, verify its suitability for your state.

- Examine the template using the Preview feature (if available).

- If a description is provided, read it to understand the details.

- Click on the Buy Now button if you've located what you're looking for.

Form popularity

FAQ

A valid Illinois promissory note must contain specific elements, including the principal amount, interest rate, due date, and the names of the parties involved. Additionally, it should be in writing and signed by the maker of the note. These essentials ensure clarity and enforceability.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.