Illinois Satisfaction of Judgment

What is this form?

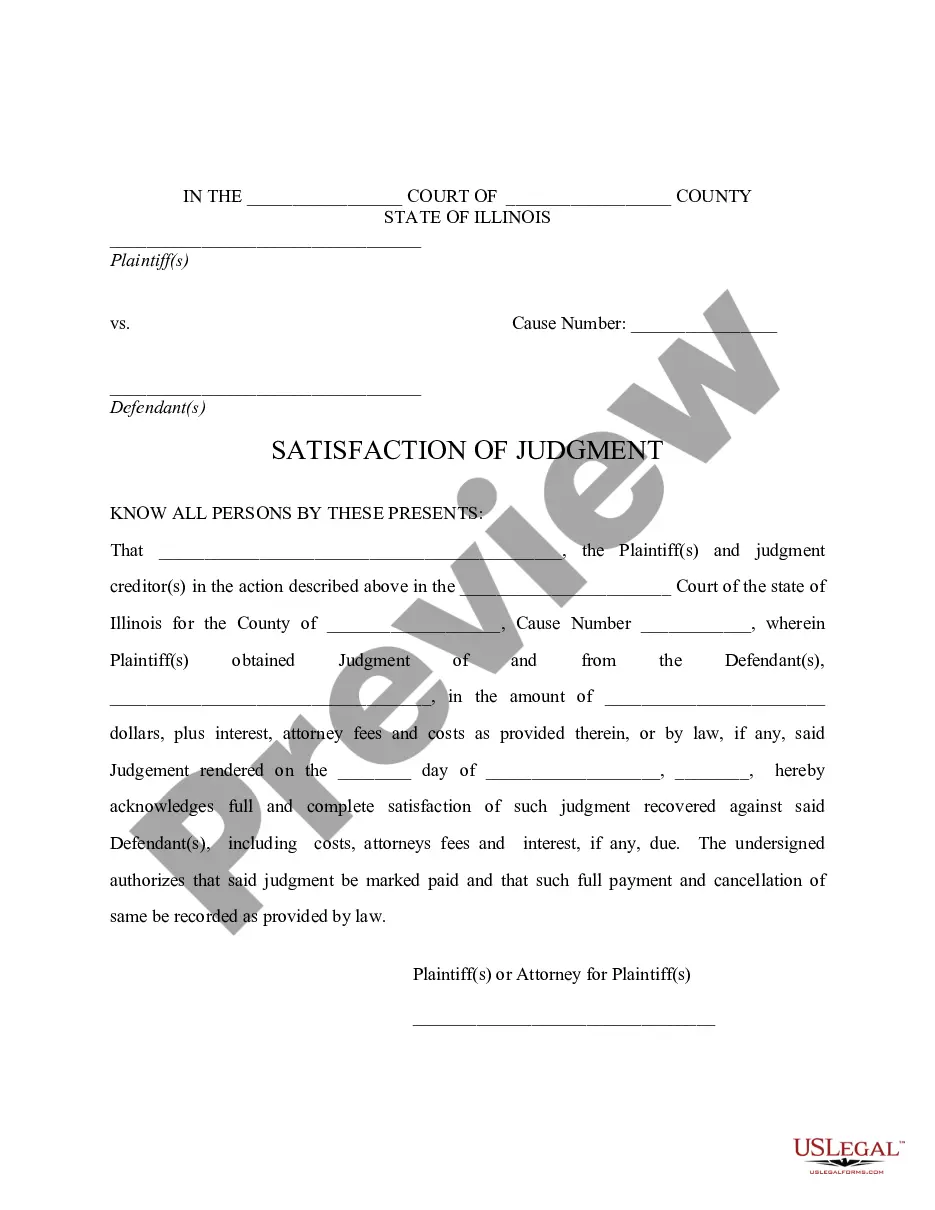

The Illinois Satisfaction of Judgment form is a legal document used to officially acknowledge that a judgment has been paid in full by the debtor. This form serves as proof that all related fees, costs, and interests have been settled, allowing the creditor to instruct the court to mark the judgment as paid. Unlike similar forms, this document is specifically designed for use in the state of Illinois, ensuring compliance with local legal requirements.

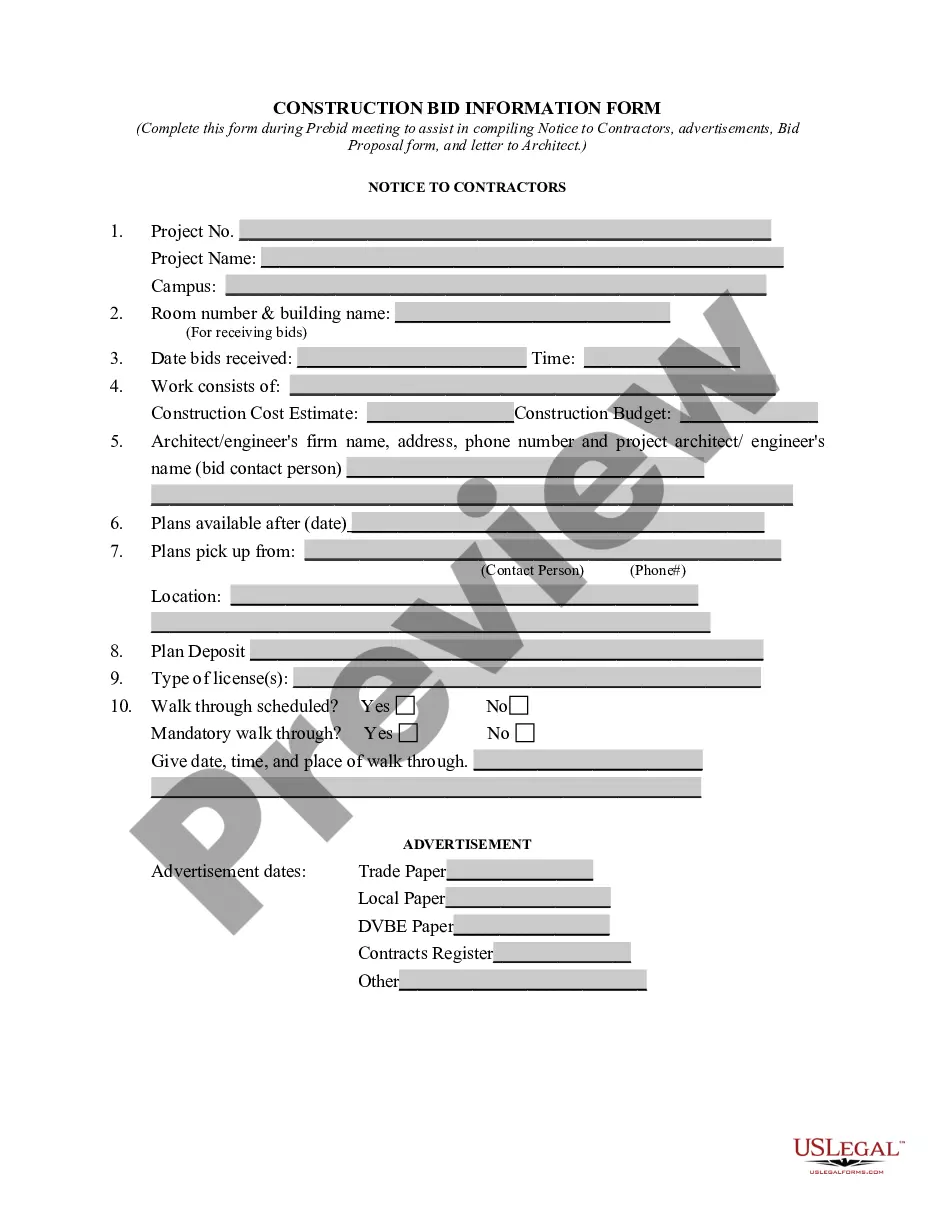

What’s included in this form

- Court details: Identifies the court and county where the judgment was issued.

- Parties involved: Names the plaintiff(s) and defendant(s) associated with the judgment.

- Cause number: A unique identifier for the legal case.

- Amount of judgment: Specifies the total amount of the judgment, including interest and costs.

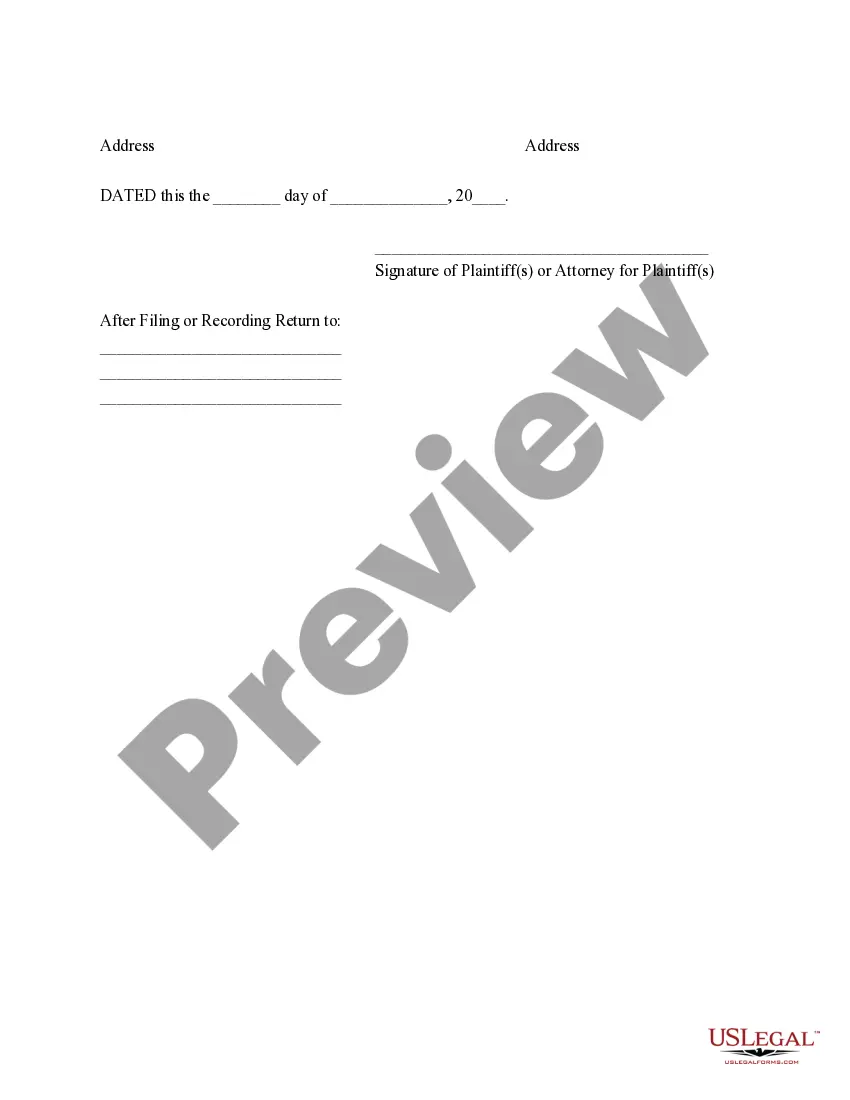

- Signature: Requires the signature of the plaintiff(s) or their attorney to validate the document.

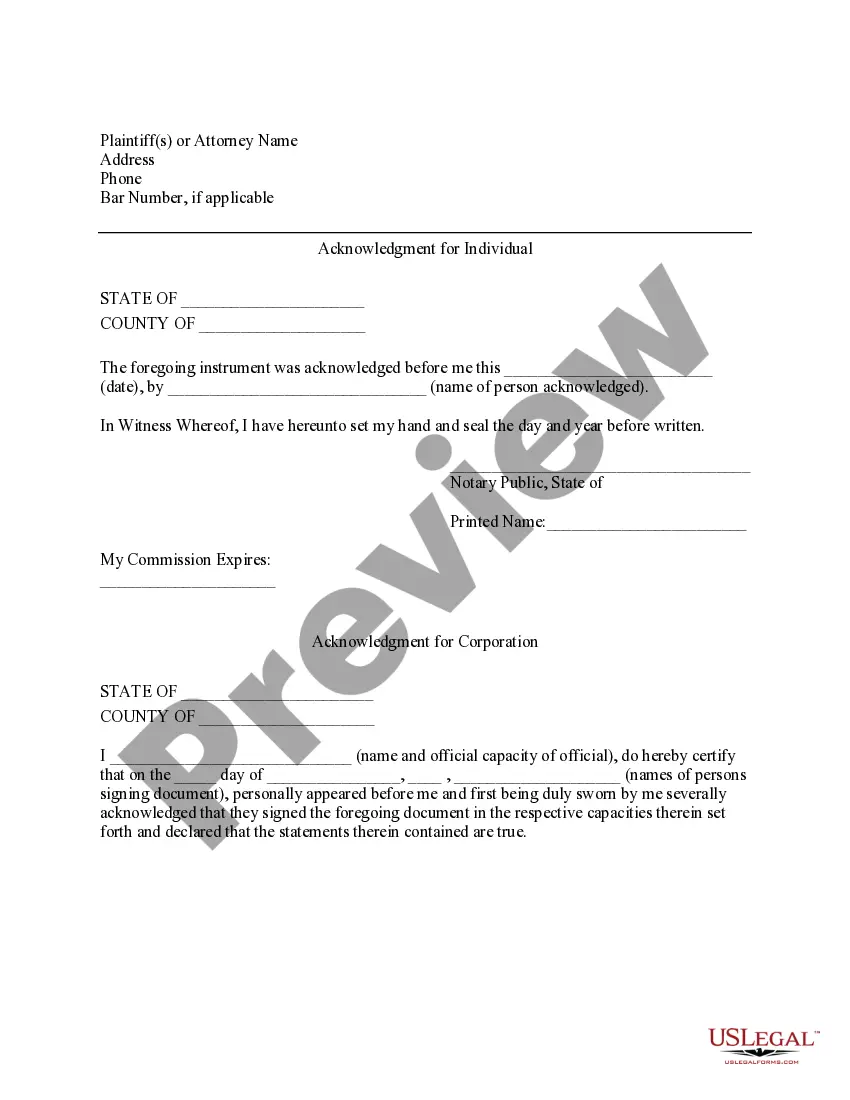

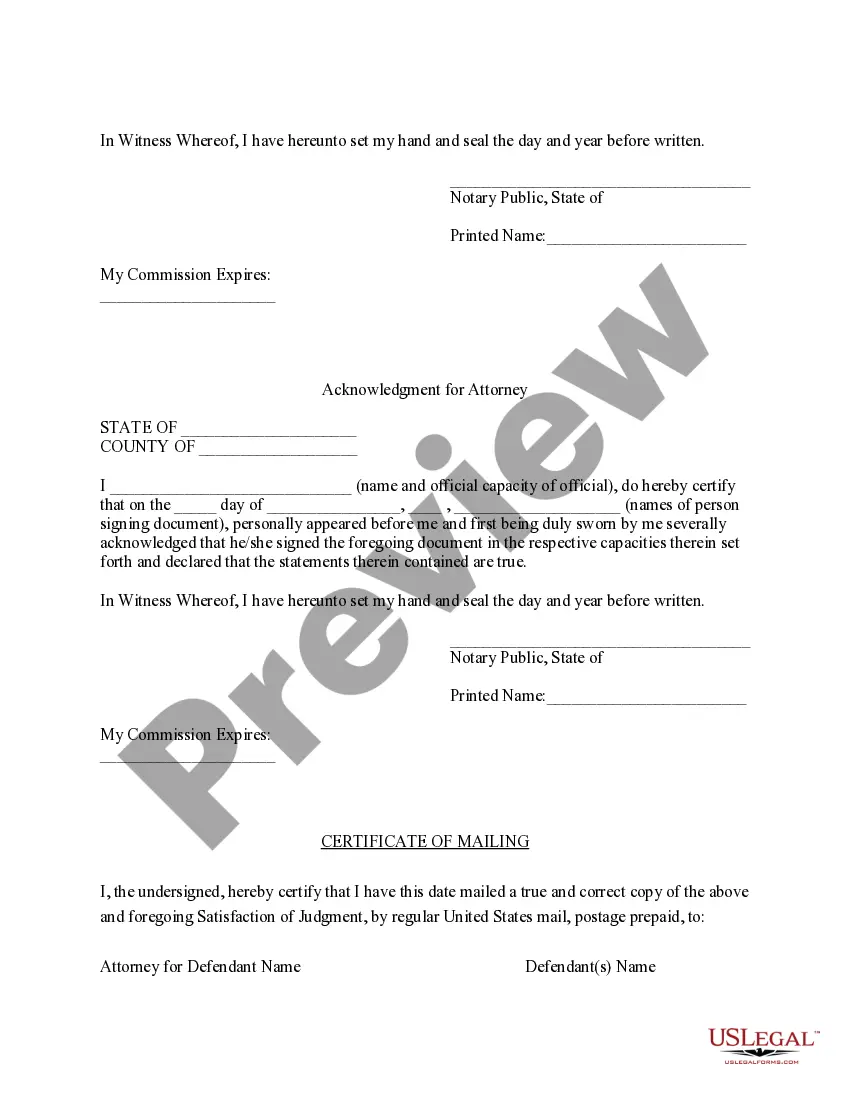

- Notarization section: Includes sections for necessary acknowledgments by a notary public.

State-specific requirements

This form is tailored for use in Illinois, incorporating specific legal language and acknowledgments required by the state's laws. Ensure to fill out all sections accurately, as failure to do so may affect its validity in court.

When this form is needed

You should use the Illinois Satisfaction of Judgment form when a judgment against a debtor has been fully paid. This could occur after a settlement agreement, after a payment plan, or when a debt has been cleared through other means. Filing this form with the court helps protect the creditor's rights and clears the debtor's name from the recorded judgment.

Who can use this document

- Plaintiffs or judgment creditors seeking to confirm that a judgment has been resolved.

- Attorneys representing plaintiffs in a completed case.

- Debtors who wish to ensure that their records reflect the satisfaction of a judgment.

How to prepare this document

- Identify the court and county where the judgment was filed.

- Enter the names of the plaintiff(s) and defendant(s) accurately.

- Provide the cause number associated with the original judgment.

- Specify the total amount of the judgment, including any additional fees or interest.

- Ensure the document is signed by the plaintiff(s) or their attorney.

- Have the completed form notarized, if required, to ensure legal compliance.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to sign the document, which can render it invalid.

- Neglecting to include the correct cause number, leading to potential confusion.

- Forgetting to notarize the form if required under local law.

- Providing inaccurate details about the judgment amount or parties involved.

Why complete this form online

- Convenience: Download and fill out the form from anywhere at any time.

- Editability: Easily modify the document to fit your specific situation.

- Reliability: Access professionally drafted templates ensuring compliance with legal standards.

Form popularity

FAQ

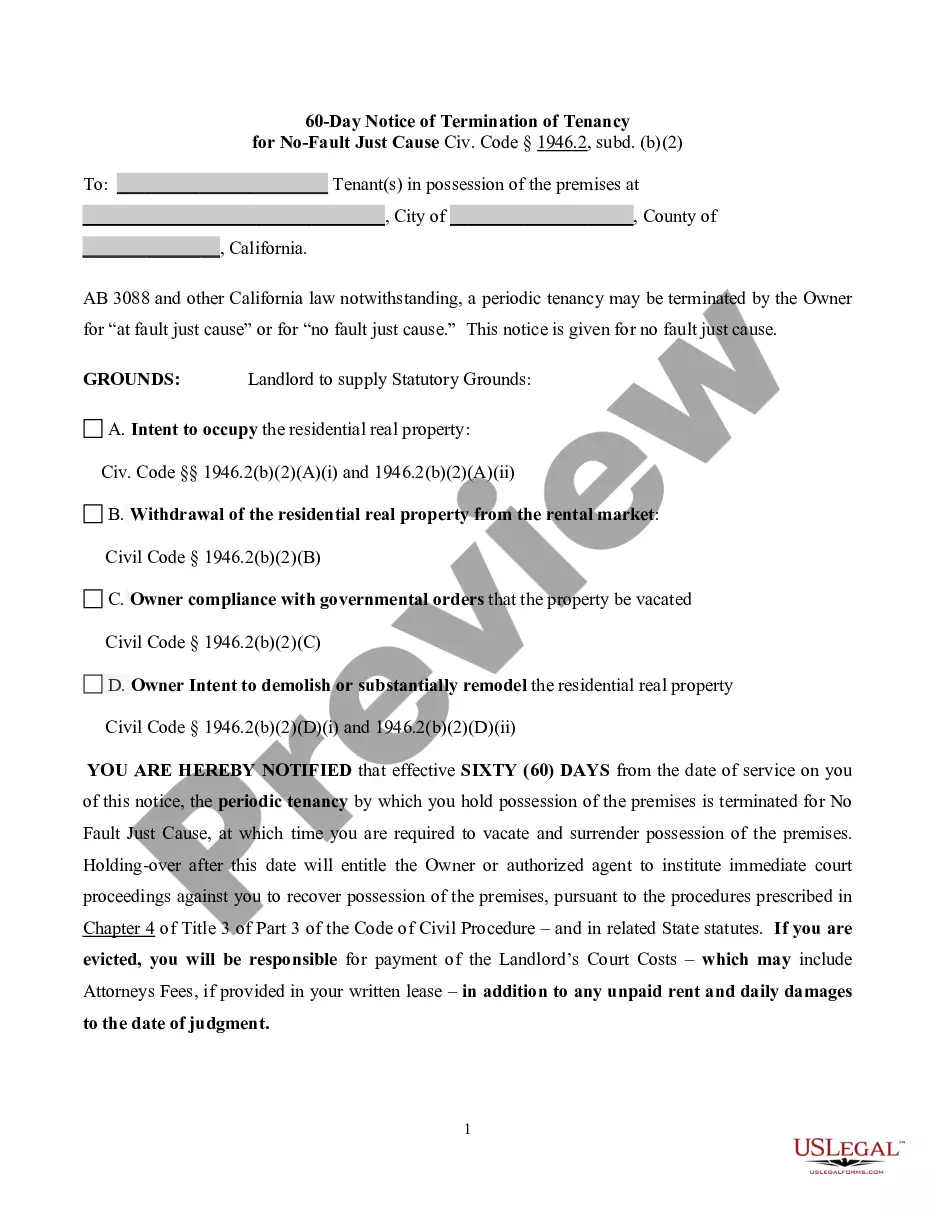

Filing a satisfaction of judgment in Illinois involves submitting the appropriate forms to the court where the original judgment was issued. This action officially records that you have satisfied the judgment, clearing your record. You can simplify this process by using platforms like US Legal Forms, which guides you through the necessary steps and provides the required paperwork, making your experience easier and more efficient.

After a judgment is entered against you in Illinois, the court typically grants the winning party certain rights to collect what is owed. This may include garnishing wages or placing liens on your property. Understanding these ramifications is vital for finding your path to an Illinois Satisfaction of Judgment.

Enforcing a judgment in Illinois typically involves filing court documents to collect what is owed. You may initiate proceedings such as wage garnishment or bank levies to recover the owed amount. Proper execution of these steps will support your claim for an Illinois Satisfaction of Judgment, helping you close the chapter on your financial obligations.

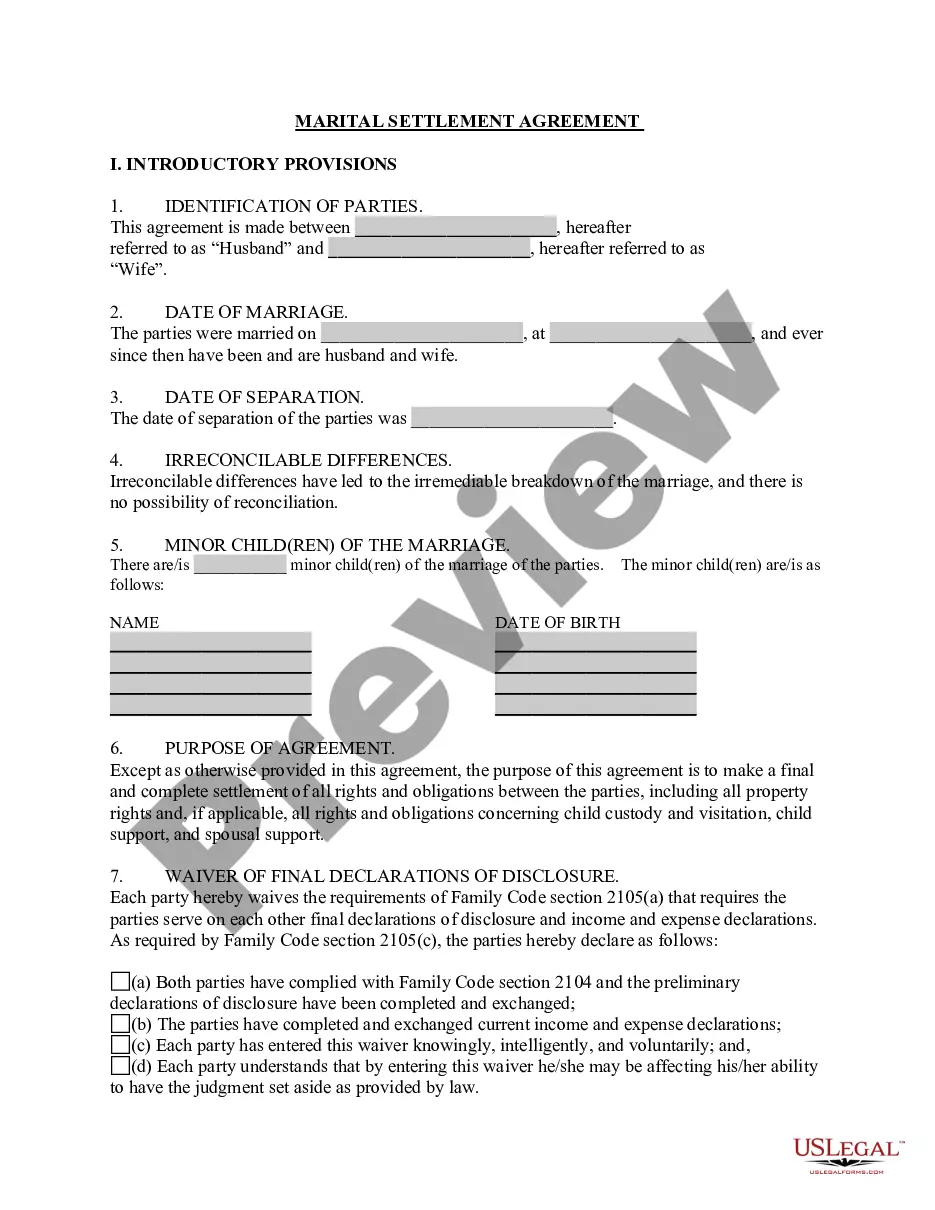

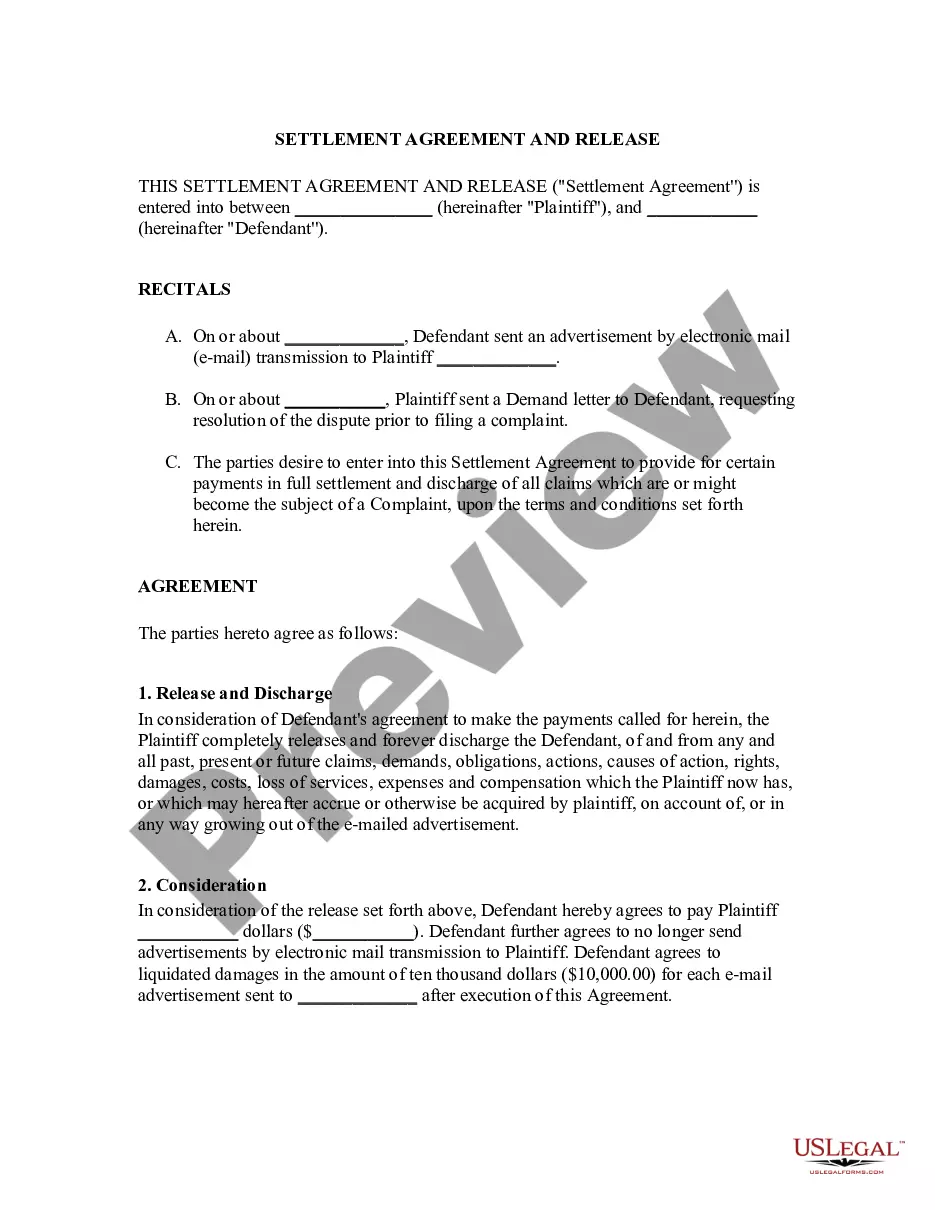

Release and satisfaction of judgment refer to the terms that signify both the payment of the judgment amount and the subsequent removal of the judgment from public record. The release allows the debtor to move forward without the burden of the previous debt showing on their report. In Illinois, this process is essential for individuals wishing to restore their creditworthiness and financial reputation. US Legal Forms can help you understand and streamline this process.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

Satisfaction by Levy A judgment creditor's obligation to give or file an acknowledgement of satisfaction arises only when the judgment creditor received the full amount required to satisfy the judgment from the levying officer.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.If a civil judgment is still on your credit report, file a dispute with the appropriate credit reporting agencies to have it removed.

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.