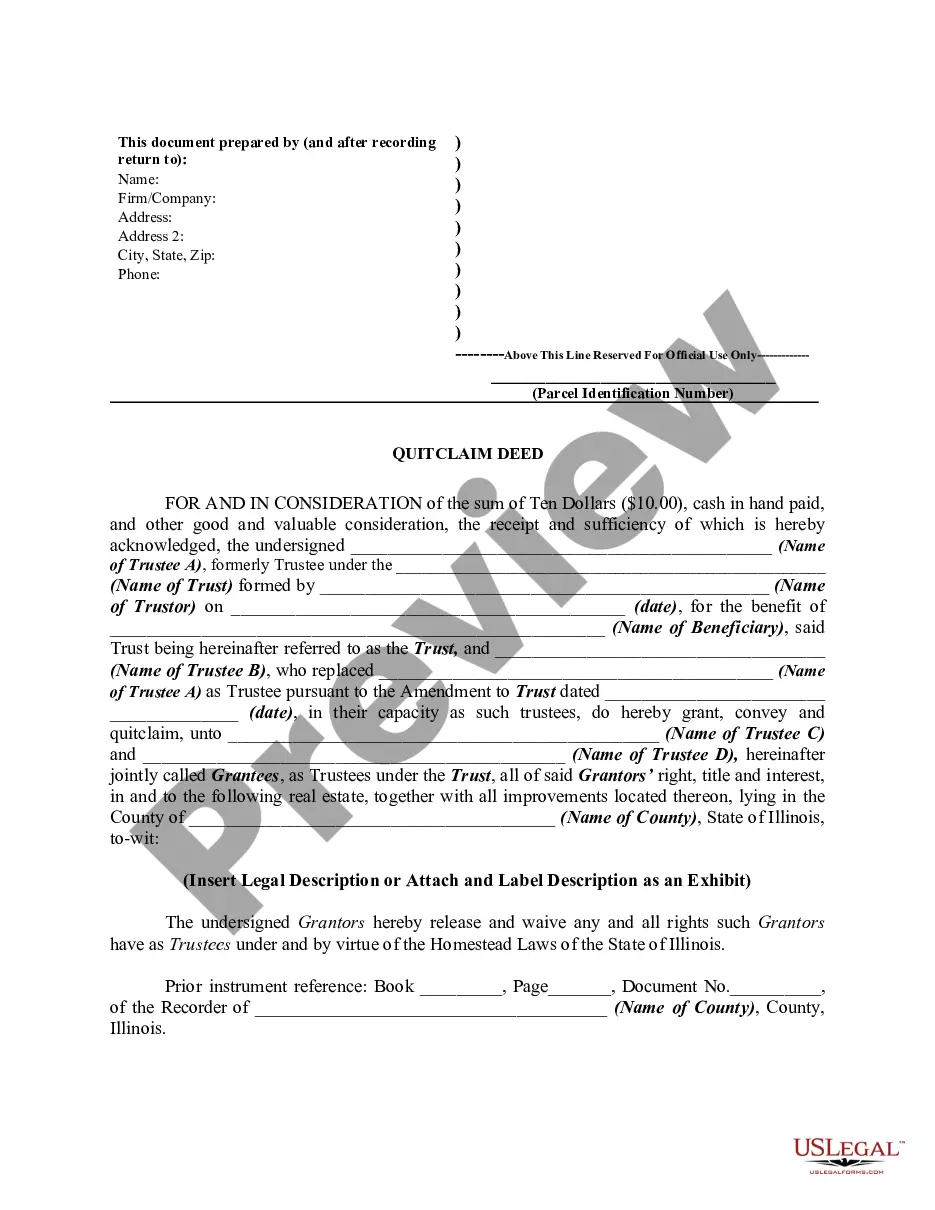

There are two basic types of deeds: a warranty deed, which guarantees that the grantor owns title, and the quitclaim deed, which transfers only that interest in the real property which the grantor actually has. The only type of deed that creates "liability by reason of covenants of warranty" as to matters of record is a general warranty deed. A quit claim deed contains no warranties and the grantor does not have liability to the grantee for other recorded claims on the property. The grantee takes the property subject to existing taxes, assessments, liens, encumbrances, covenants, conditions, restrictions, rights of way and easements of record.

Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees

Description

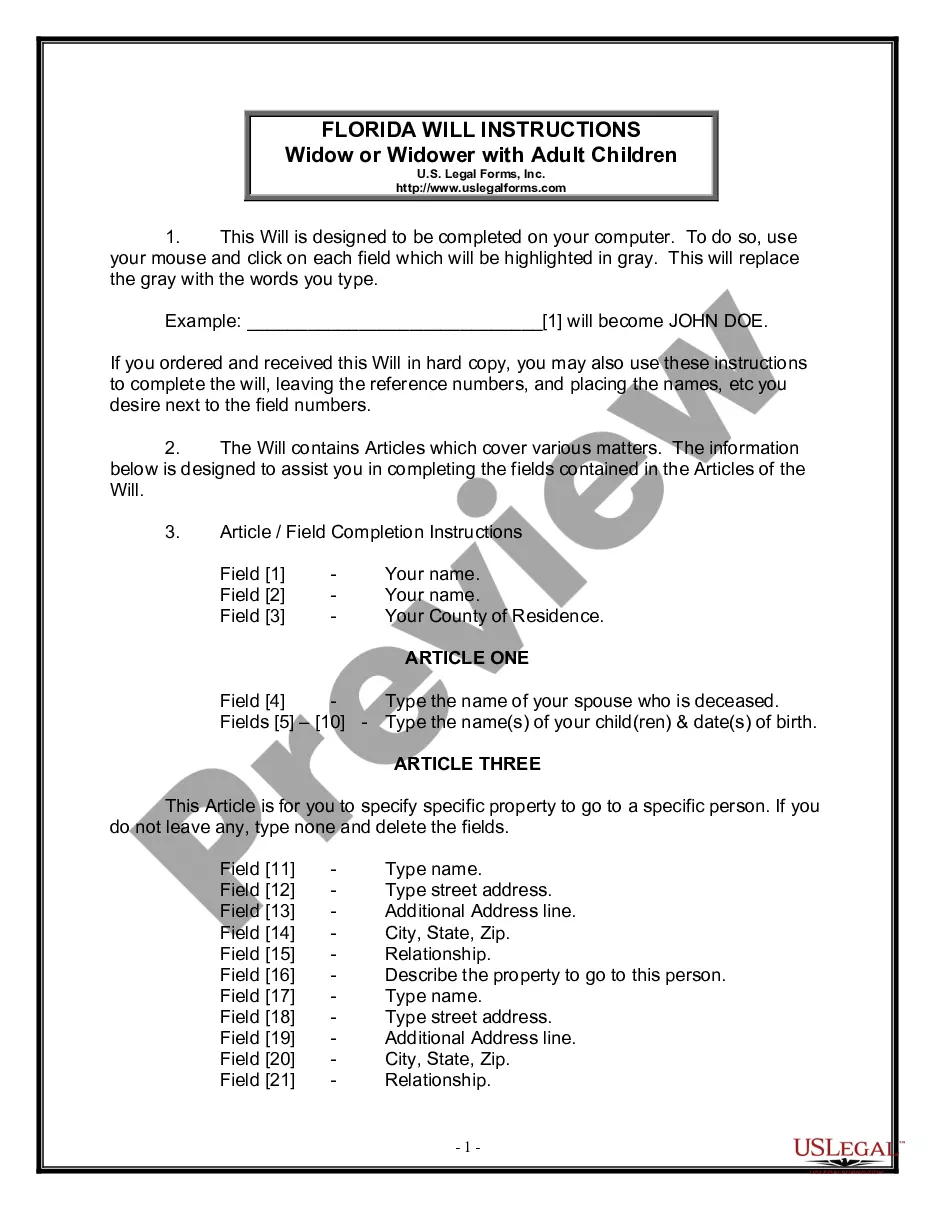

How to fill out Illinois Quitclaim Deed From Trustee And Former Trustee To New Trustees?

Locating Illinois Quitclaim Deed from Trustee and Prior Trustee to New Trustees templates and completing them can be quite difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate sample tailored for your state in just a few clicks.

Our attorneys draft each document, so you only need to complete them. It truly is that straightforward.

Select your plan on the pricing page and establish your account. Choose your payment method with a credit card or PayPal. Download the document in your preferred format. Now, you can either print the Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees form or complete it using any online editor. Don’t be concerned about making errors, as your form can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account using the provided link and revisit the form's page to download the sample.

- Your saved forms are stored in My documents and are always available for future use.

- If you haven’t subscribed yet, you need to create an account.

- Review our detailed guidelines on how to acquire the Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees template in a few moments.

- To obtain a valid example, verify its appropriateness for your state.

- Examine the example using the Preview feature (if accessible).

- If there is a description, read it to understand the key points.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

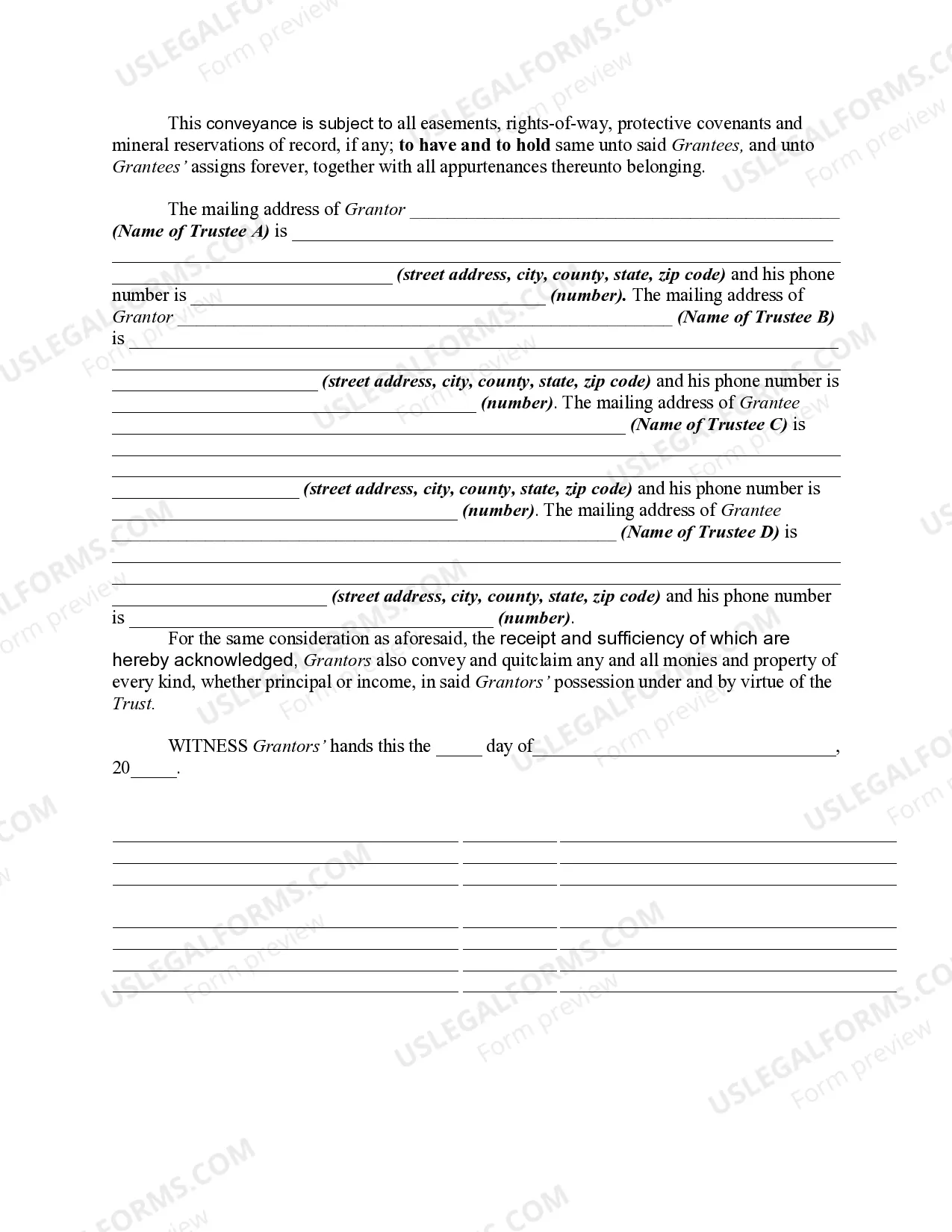

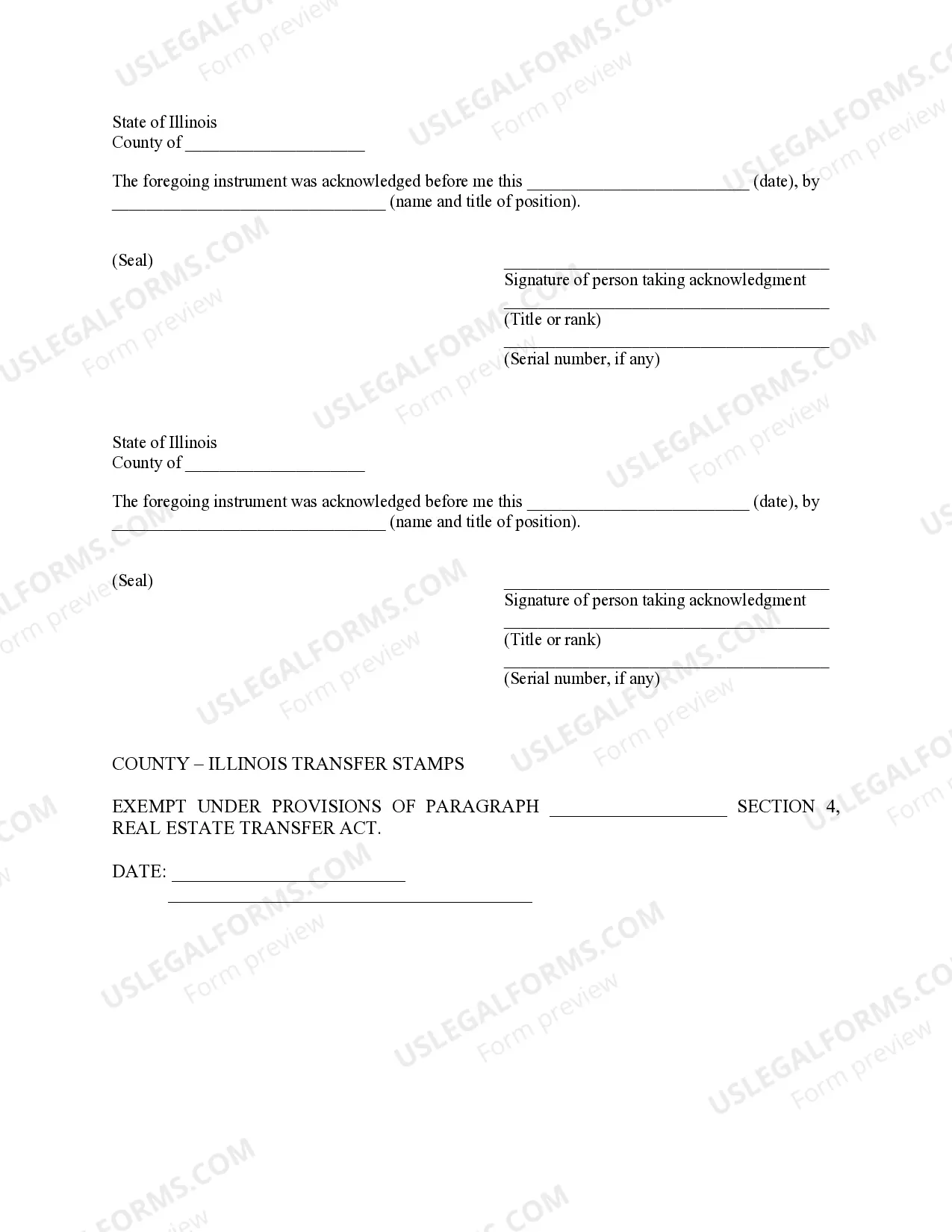

Filling out a quitclaim deed in Illinois involves several steps. First, obtain a blank Illinois Quitclaim Deed form, which you can find on various legal platforms, including uslegalforms. Next, clearly identify the property, the grantor, and the grantee. Finally, sign the deed in front of a notary public and file it with the county recorder for it to be legally effective.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

Yes, properties held in a living revocable trust can be refinanced. However, refinancing a mortgage held in a trust involves specific steps which may occur outside of the refinancing transaction. It's important to ensure it's done correctly so there's no lapse in your homeowner's title insurance coverage.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Transferring property out of a trust can be simple or nearly impossible, depending on which kind of trust you formed. Typically, you act as the trustee if you form a revocable trust. You retain control of the property you place into it. You can sell it or move it back out of the trust as you see fit.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.