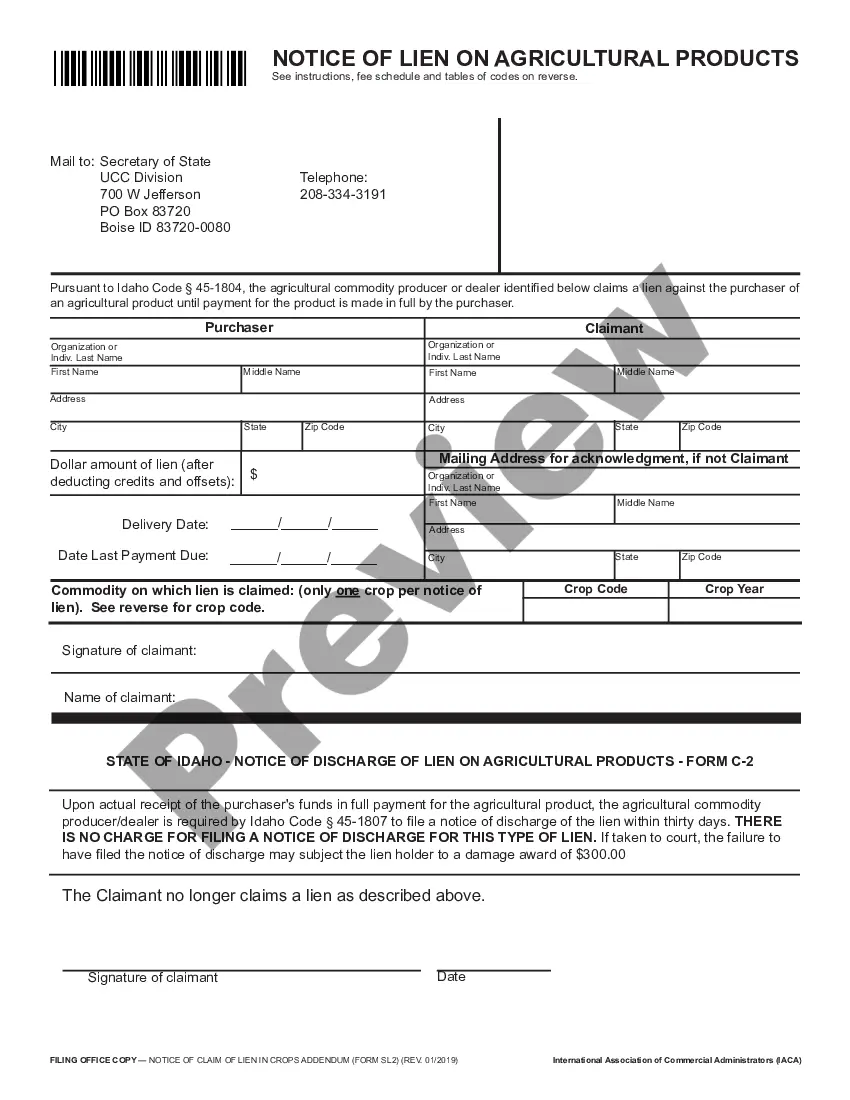

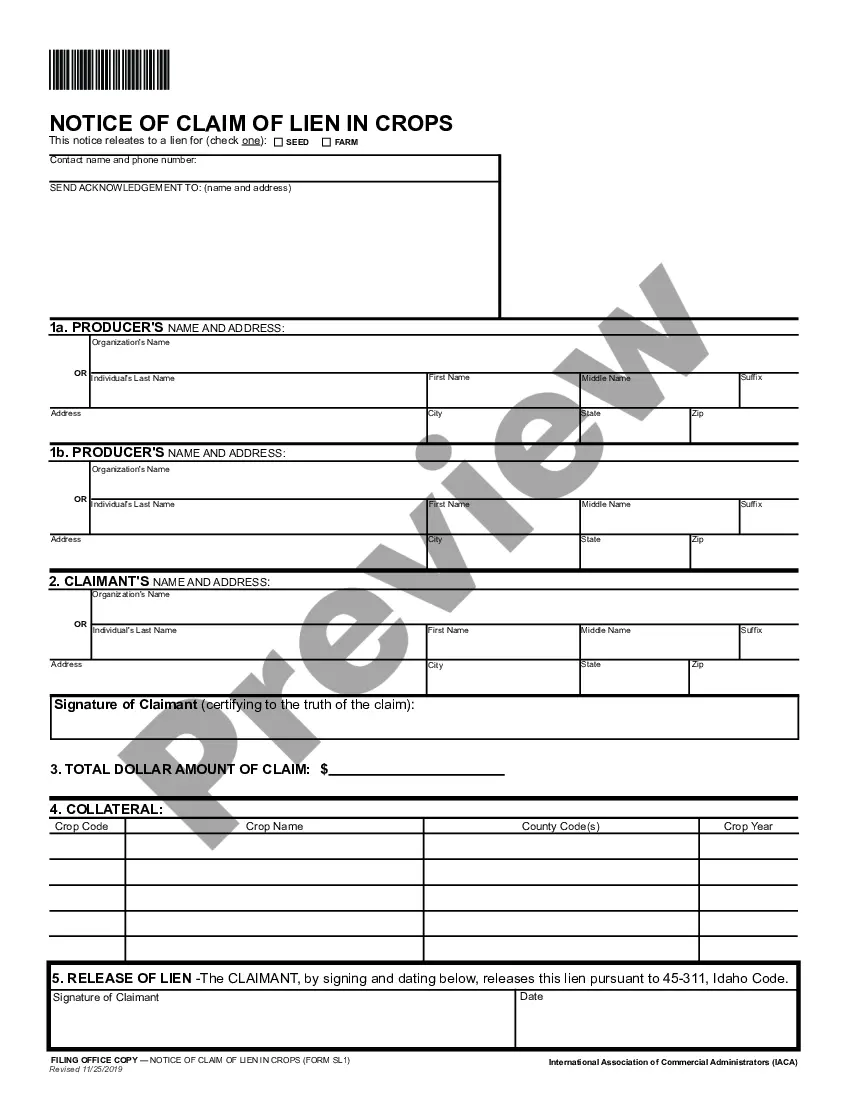

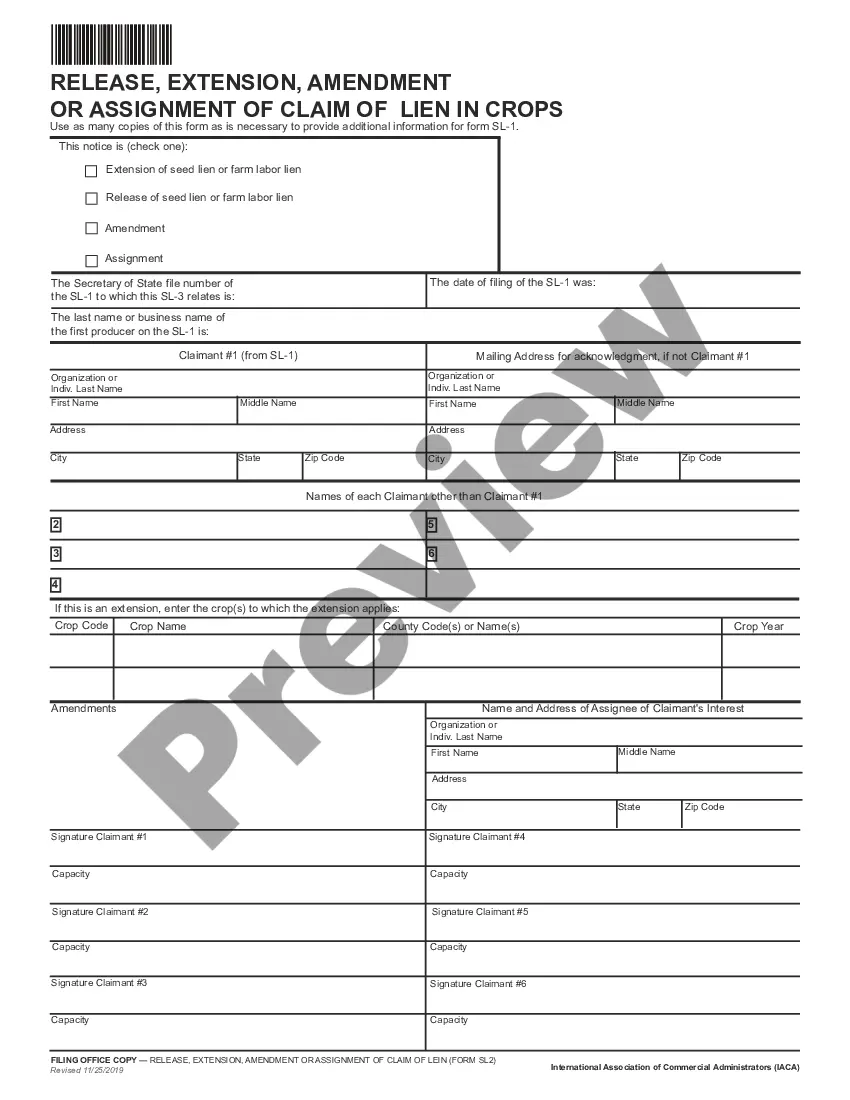

Supplement To Notice Of Claim Of Lien In Crops form used to supplement information found in the initial Notice of Claim Of Lien In Crops filed with the Idaho filing office.

Idaho UCC Supplement To Notice Of Claim Of Lien In Crops

Description

How to fill out Idaho UCC Supplement To Notice Of Claim Of Lien In Crops?

Locating an Idaho UCC Supplement To Notice Of Claim Of Lien In Crops example and completing it can be quite daunting.

To conserve time, expenses, and effort, utilize US Legal Forms to find the suitable template specifically for your state in just a few clicks.

Our attorneys prepare every document, so you merely need to complete them.

Select how you would like to pay via credit card or PayPal. Download the form in your desired format. You can print the Idaho UCC Supplement To Notice Of Claim Of Lien In Crops form or complete it using any online editor. Don't worry about errors, as your form can be utilized, submitted, and printed as many times as you wish. Experience US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the example.

- All your saved templates are stored in My documents and are accessible at all times for future use.

- If you haven't subscribed yet, you must register.

- Review our detailed guidelines on how to obtain the Idaho UCC Supplement To Notice Of Claim Of Lien In Crops form in just a few minutes.

- To acquire a legitimate example, verify its validity for your state.

- Examine the form using the Preview feature (if it's available).

- If there's a description, read it to understand the essential details.

- Click on the Buy Now button if you found what you're seeking.

Form popularity

FAQ

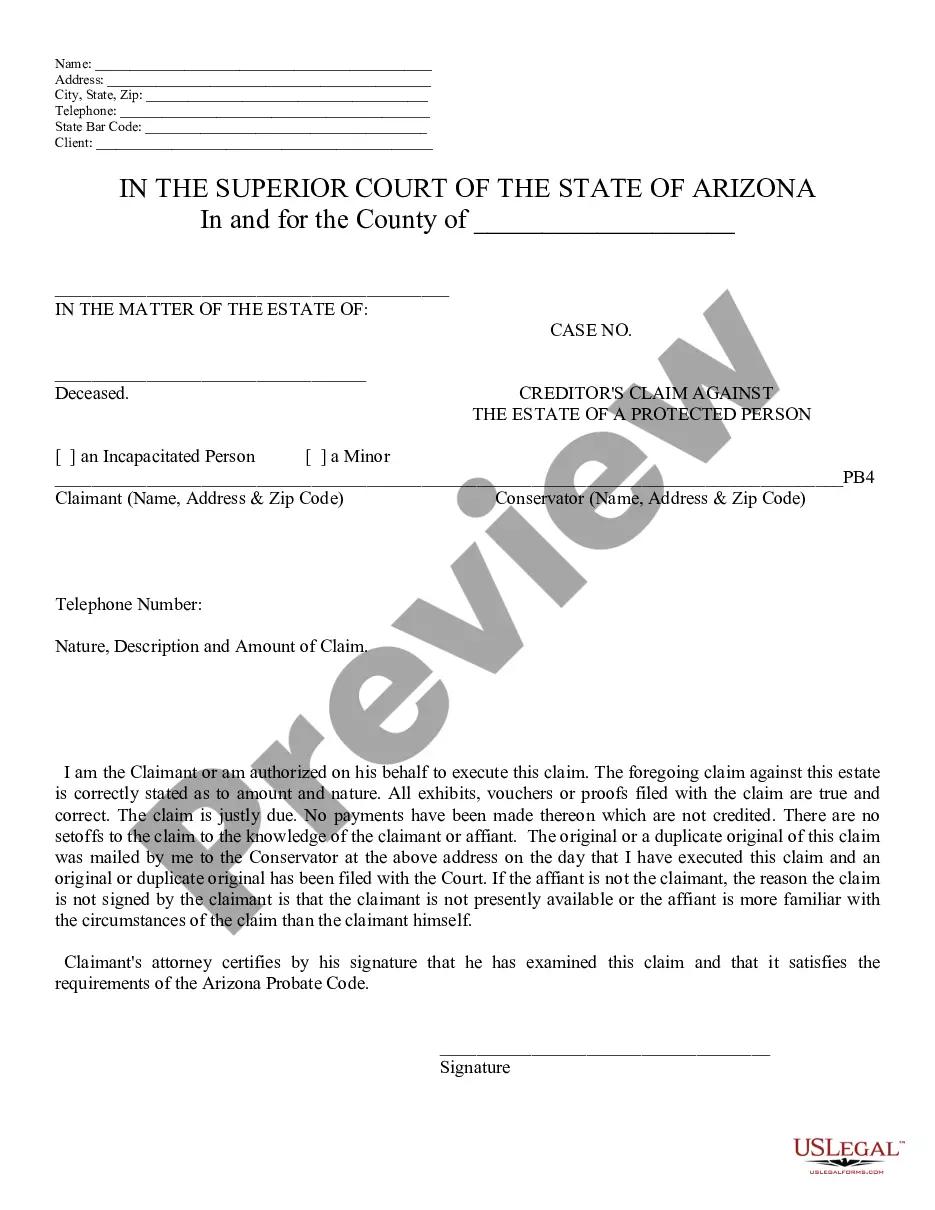

The purpose of a UCC lien is to secure a lender's interest in personal property, including crops. This lien provides legal protection to creditors by allowing them to claim the collateral if the borrower fails to repay their debt. In the context of Idaho, understanding the Idaho UCC Supplement To Notice Of Claim Of Lien In Crops can help ensure that your rights are properly documented and defended.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing.

A UCC filing ensures you are a secured creditor and therefore in the best possible position to get paid. In addition, a Purchase Money Security Interest filing provides the priority right of repossession of your inventory or equipment at default or bankruptcy. You define default in your security agreement.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

A UCC-1 financing statementalso sometimes referred to as a 'UCC-1 filing,' a 'UCC lien,' or simply a 'UCC-1'is a form that creditors use to create a lien against a debtor's property.

UCC-1 Filings Explained If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan.

UCC filings or liens are legal forms that a creditor files to give notice that it has an interest in the personal or business property of a debtor. Essentially, UCC lien filings allow a lender to formally lay claim to collateral that a debtor pledges to secure their financing.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.