This non-employee director option agreement grants the optionee (the non-employee director) a non-qualified stock option under the company's non-employee director stock option plan. The option allows optionee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Idaho Non Employee Director Stock Option Agreement

Description

How to fill out Non Employee Director Stock Option Agreement?

Choosing the best authorized record template might be a battle. Of course, there are a variety of templates available on the net, but how can you find the authorized form you require? Use the US Legal Forms site. The assistance delivers 1000s of templates, for example the Idaho Non Employee Director Stock Option Agreement, which you can use for enterprise and personal demands. Each of the types are examined by pros and satisfy federal and state demands.

When you are presently authorized, log in for your accounts and then click the Download option to have the Idaho Non Employee Director Stock Option Agreement. Make use of accounts to look with the authorized types you may have bought formerly. Visit the My Forms tab of your respective accounts and have another version in the record you require.

When you are a whole new user of US Legal Forms, listed below are simple recommendations that you can stick to:

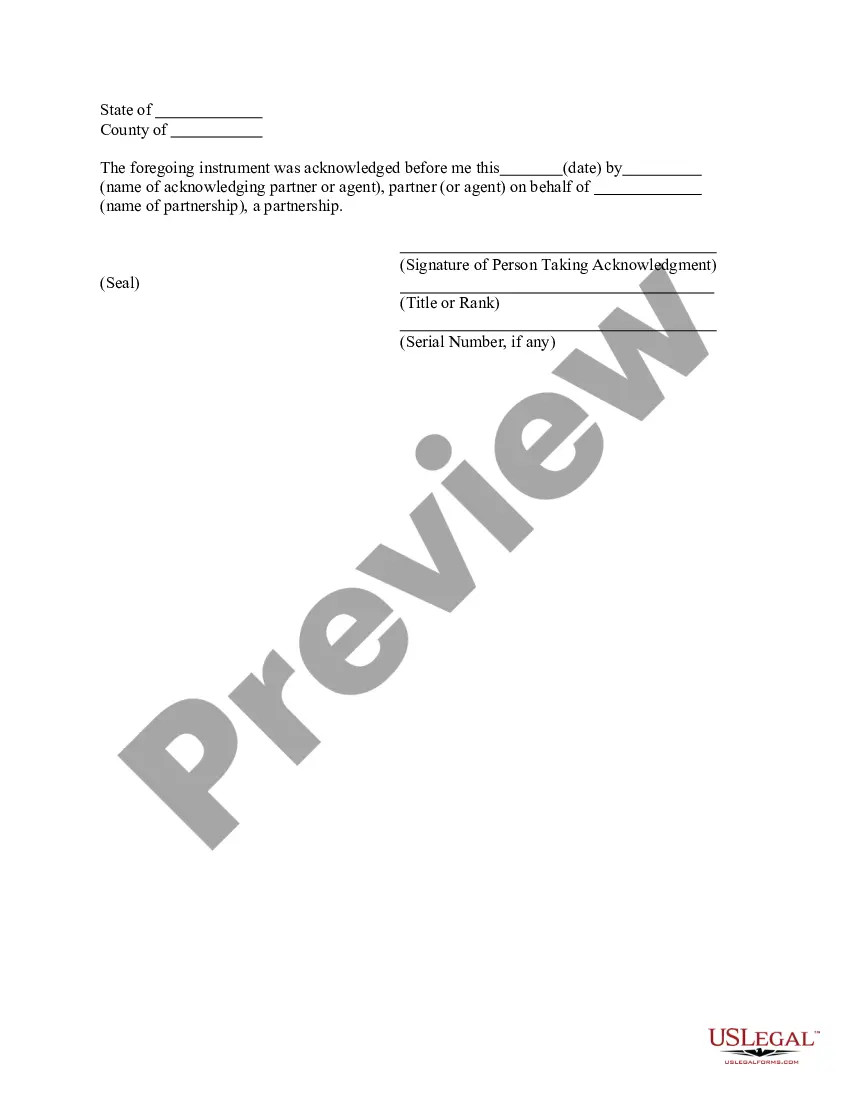

- Initially, ensure you have selected the appropriate form for your city/region. You are able to look over the form while using Review option and study the form outline to ensure this is the best for you.

- In the event the form will not satisfy your requirements, make use of the Seach industry to obtain the appropriate form.

- Once you are sure that the form is acceptable, go through the Get now option to have the form.

- Select the pricing prepare you need and enter in the essential details. Create your accounts and purchase the transaction utilizing your PayPal accounts or credit card.

- Pick the submit structure and obtain the authorized record template for your product.

- Complete, edit and print and sign the attained Idaho Non Employee Director Stock Option Agreement.

US Legal Forms may be the most significant local library of authorized types that you will find different record templates. Use the company to obtain skillfully-created documents that stick to status demands.

Form popularity

FAQ

Stock options are a financial investment where an employee can purchase shares in a company at a preset time and price. Instead of giving away shares directly, employers give their employees the option to acquire a certain number of shares at a discounted rate.

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

A share option is a contract issued to an employee (or another stakeholder) giving them the right to purchase shares in a company at a later date for a predetermined strike price.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

There are two main types of ESO: Incentive stock options (ISOs), also known as statutory or qualified options, are generally only offered to key employees and top management. ... Non-qualified stock options (NSOs) can be granted to employees at all levels of a company, as well as to board members and consultants.

NSOs. NSOs can be offered to anyone affiliated with your company, including independent contractors, investors and directors. If an employee disqualifies themselves from the terms of an ISO, their stock options are then treated as an NSO.