This office lease form is a standard default remedy clause, providing for the collection of the difference between the rent due and owing under the lease and the rents collected in the event of mitigation.

Idaho Default Remedy Clause

Description

How to fill out Default Remedy Clause?

Discovering the right legitimate papers format could be a battle. Of course, there are tons of web templates available online, but how do you discover the legitimate form you require? Take advantage of the US Legal Forms web site. The service provides a huge number of web templates, like the Idaho Default Remedy Clause, that you can use for enterprise and private requirements. All of the types are inspected by specialists and satisfy state and federal requirements.

When you are previously listed, log in for your account and then click the Acquire option to find the Idaho Default Remedy Clause. Utilize your account to look throughout the legitimate types you possess acquired in the past. Proceed to the My Forms tab of your own account and have yet another backup from the papers you require.

When you are a new consumer of US Legal Forms, here are straightforward recommendations that you should comply with:

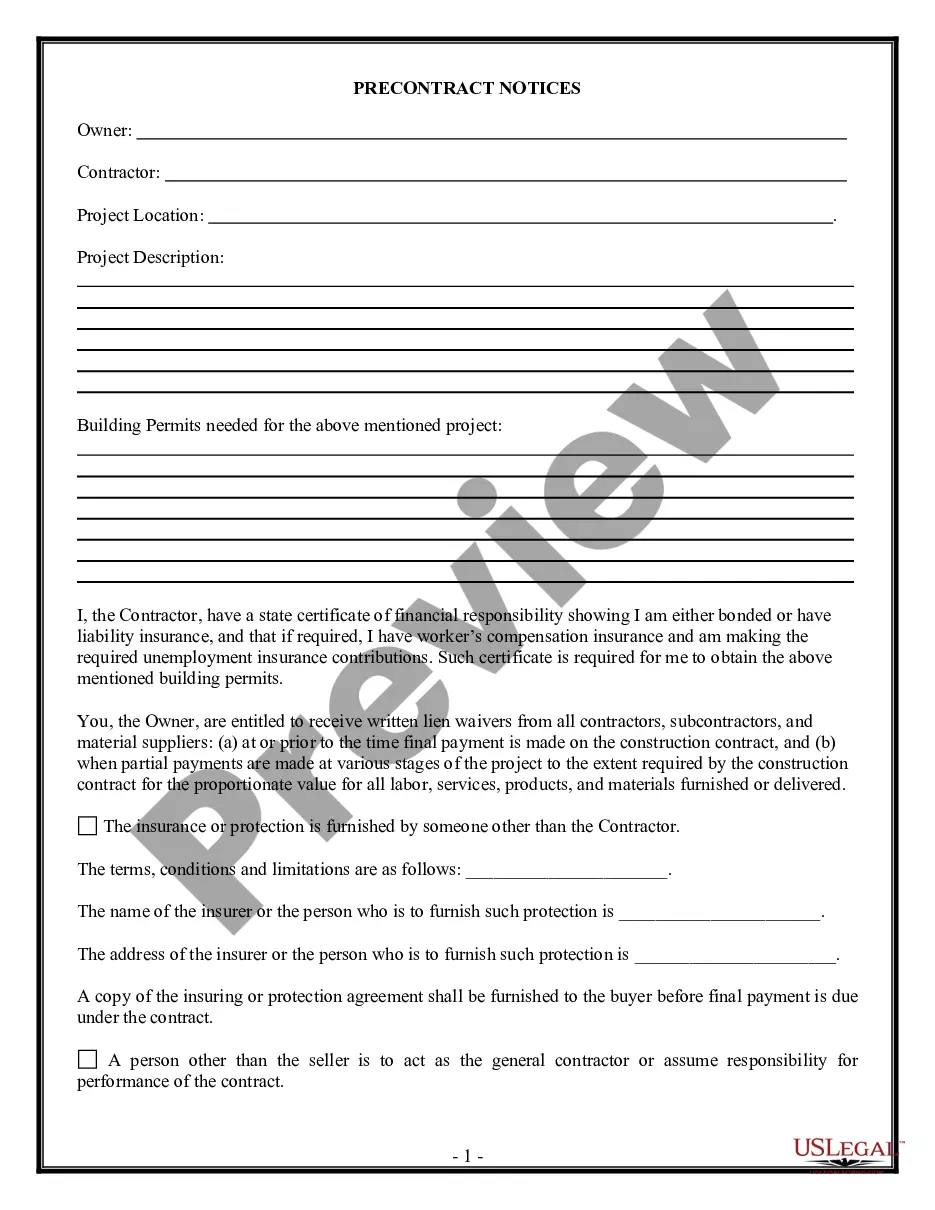

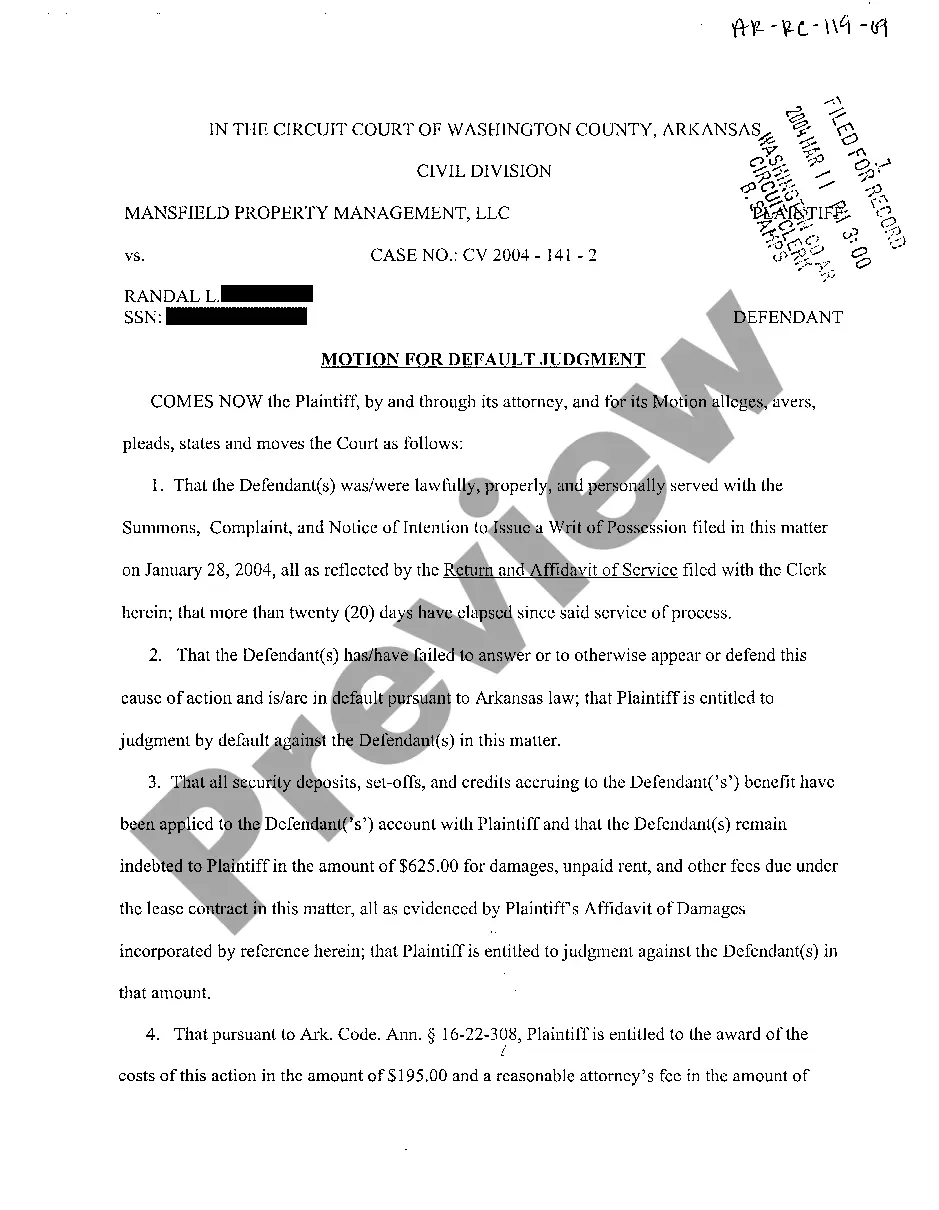

- First, ensure you have chosen the right form for the area/region. You are able to look over the shape while using Preview option and read the shape outline to ensure this is the best for you.

- In the event the form does not satisfy your requirements, take advantage of the Seach area to obtain the right form.

- When you are positive that the shape is proper, click on the Buy now option to find the form.

- Opt for the prices strategy you desire and type in the needed info. Create your account and pay for your order with your PayPal account or credit card.

- Pick the submit file format and download the legitimate papers format for your gadget.

- Full, change and produce and signal the attained Idaho Default Remedy Clause.

US Legal Forms will be the biggest catalogue of legitimate types in which you can discover different papers web templates. Take advantage of the service to download skillfully-produced documents that comply with status requirements.

Form popularity

FAQ

?Curing? or ?remedying? the default means correcting the failure or omission. A common example is a failure to pay the rent on time.

The court may not render judgment for more than the amount by which the entire amount of indebtedness due at the time of sale exceeds the fair market value at that time, with interest from date of sale, but in no event may the judgment exceed the difference between the amount for which such property was sold and the ...

45-1502. Definitions ? Trustee's charge. As used in this act: (1) "Beneficiary" means the person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or his successor in interest, and who shall not be the trustee.

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.

15-6-401. Community property with right of survivorship in real property. Any estate in real property held by a husband and wife as community property with right of survivorship shall, upon the death of one (1) spouse, transfer and belong to the surviving spouse.

(1) An action for breach of any contract for sale must be commenced within four (4) years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one (1) year but may not extend it.

The actions permitted by a contract and applicable law that a party may take to protect and recover its property interests in the event of default of another party to the contract are default rights and remedies .

Idaho law states that an agricultural commodity producer or dealer who sells or delivers agricultural products (such as hay, grain, corn, oats, straw, etc.) has a lien on those products and the proceeds from the subsequent sale of those products (Idaho Code § 45-1802).