Idaho Disclaimer of All Rights Under Operating Agreement by Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Party To Agreement?

If you wish to comprehensive, down load, or printing legal papers templates, use US Legal Forms, the greatest assortment of legal varieties, which can be found on the Internet. Take advantage of the site`s basic and handy lookup to find the documents you need. Different templates for company and specific purposes are categorized by classes and suggests, or keywords. Use US Legal Forms to find the Idaho Disclaimer of All Rights Under Operating Agreement by Party to Agreement with a few click throughs.

If you are presently a US Legal Forms client, log in to your bank account and then click the Download option to get the Idaho Disclaimer of All Rights Under Operating Agreement by Party to Agreement. You can even access varieties you formerly delivered electronically inside the My Forms tab of your respective bank account.

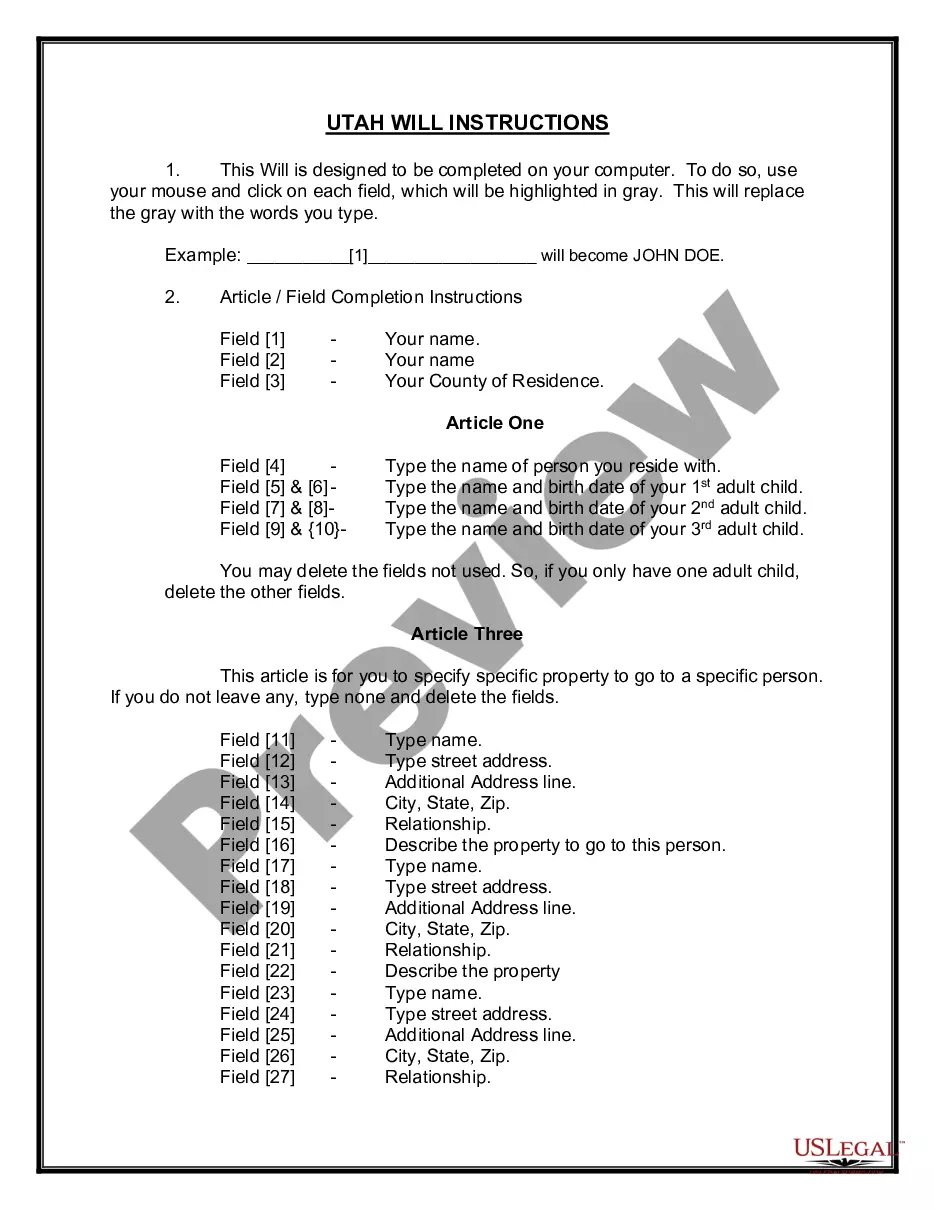

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the correct area/nation.

- Step 2. Use the Preview solution to look through the form`s content material. Don`t overlook to learn the information.

- Step 3. If you are unsatisfied with all the develop, utilize the Research area at the top of the display to locate other variations from the legal develop web template.

- Step 4. Upon having located the shape you need, select the Purchase now option. Opt for the pricing plan you choose and include your accreditations to sign up for the bank account.

- Step 5. Procedure the deal. You may use your credit card or PayPal bank account to complete the deal.

- Step 6. Pick the formatting from the legal develop and down load it on your system.

- Step 7. Total, edit and printing or indication the Idaho Disclaimer of All Rights Under Operating Agreement by Party to Agreement.

Every single legal papers web template you acquire is yours eternally. You have acces to each develop you delivered electronically inside your acccount. Go through the My Forms segment and pick a develop to printing or down load once more.

Be competitive and down load, and printing the Idaho Disclaimer of All Rights Under Operating Agreement by Party to Agreement with US Legal Forms. There are thousands of specialist and state-specific varieties you can use for your company or specific requirements.

Form popularity

FAQ

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, which means someone could sue you without there being any shield to protect your personal assets.

30-25-304. LIABILITY OF MEMBERS AND MANAGERS. (a) A debt, obligation, or other liability of a limited liability company is solely the debt, obligation, or other liability of the company.

While a written operating agreement isn't required (per Idaho Statute § 30-25-102), your operating agreement is an essential document for many important aspects of your business, from opening a bank account to handling major events (like fighting lawsuits).

(1) An action for breach of any contract for sale must be commenced within four (4) years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one (1) year but may not extend it.

While most states don't require LLCs to have operating agreements, it's always a good idea to create one to ensure your business is well administered and protected from risk.

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Idaho Statutes (d) A limited liability company's indebtedness to a member or transferee incurred by reason of a distribution made in ance with this section is at parity with the company's indebtedness to its general, unsecured creditors, except to the extent subordinated by agreement.

Oregon does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.