Idaho Production Assistant Contract - Self-Employed Independent Contractor

Description

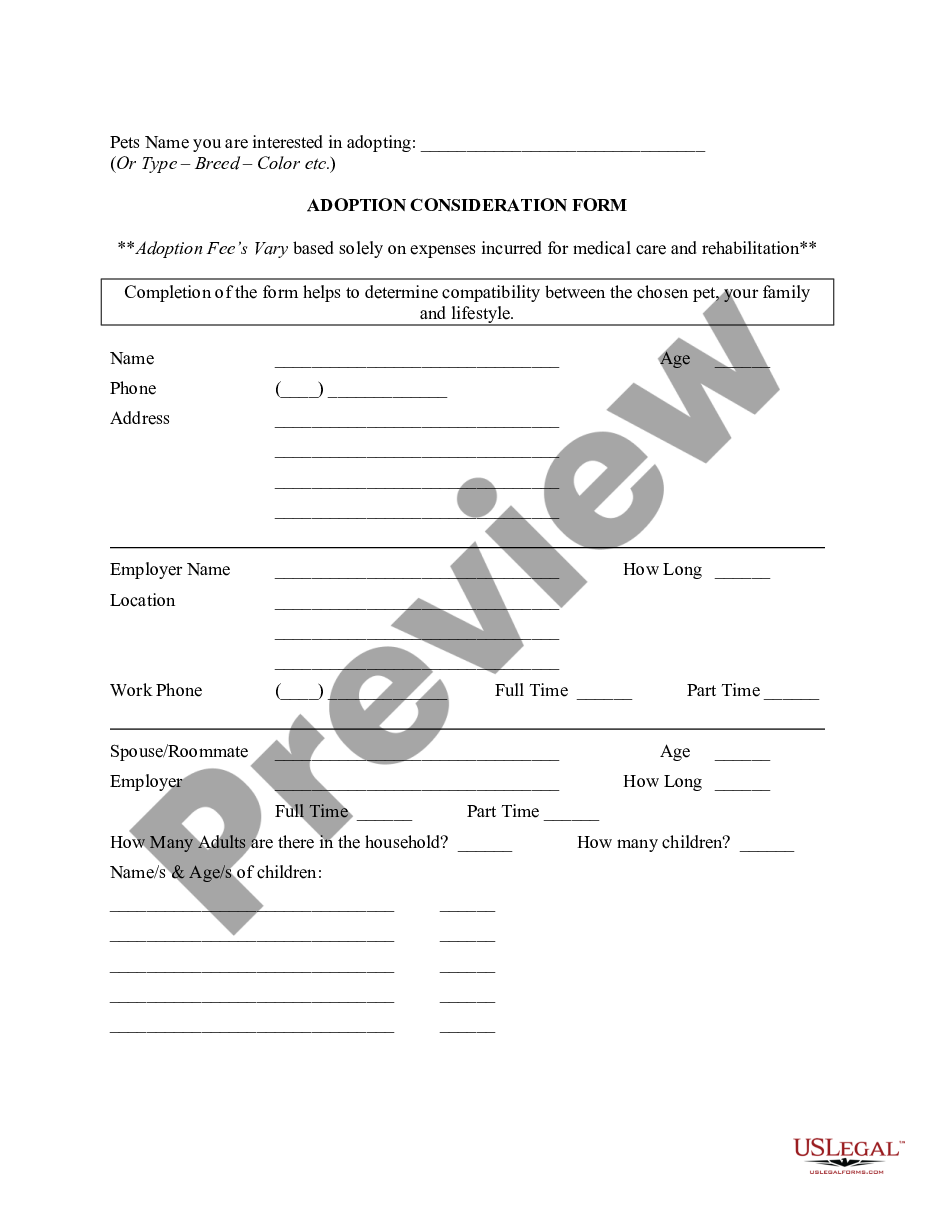

How to fill out Production Assistant Contract - Self-Employed Independent Contractor?

Locating the appropriate sanctioned document format can be challenging. Clearly, there are numerous templates accessible online, but how can you find the official type you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Idaho Production Assistant Contract - Self-Employed Independent Contractor, which can be utilized for both business and personal purposes. All documents are verified by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to locate the Idaho Production Assistant Contract - Self-Employed Independent Contractor. Use your account to review the official forms you have previously acquired. Visit the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, make sure you have selected the correct type for your city/region. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search field to find the correct form. Once you are confident that the form is appropriate, click the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the official document format to your device. Complete, modify, print, and sign the acquired Idaho Production Assistant Contract - Self-Employed Independent Contractor.

Overall, US Legal Forms is an essential resource for obtaining legally sound documents that meet your specific requirements.

- US Legal Forms is the largest repository of official documents available.

- You can find a variety of document templates.

- Utilize the service to download professionally crafted papers.

- Ensure compliance with state regulations.

- Access thousands of templates for various needs.

- Easily navigate through the platform to find the forms you require.

Form popularity

FAQ

In Idaho, you can perform a limited amount of work as a self-employed independent contractor without a contractor license. If your project costs under $2,000, you generally do not need a license. However, larger projects require a license, ensuring that both parties understand their rights and responsibilities. To better navigate these requirements, consider using an Idaho Production Assistant Contract - Self-Employed Independent Contractor from US Legal Forms, which clearly outlines terms and protects your interests.

An assistant can certainly work as an independent contractor. This arrangement offers flexibility and the freedom to choose projects based on personal interests and availability. By utilizing an Idaho Production Assistant Contract - Self-Employed Independent Contractor, assistants can define their services, compensation, and legal obligations clearly. This clarity helps foster a productive working environment and protects the interests of both the assistant and the employer.

Yes, a Production Assistant (PCA) can operate as an independent contractor. This setup allows the PCA to manage their work schedule and take on multiple projects with different clients. An Idaho Production Assistant Contract - Self-Employed Independent Contractor outlines roles, responsibilities, and payment terms, ensuring clarity for both parties. Utilizing such a contract can protect your legal rights and establish a professional relationship.

In Idaho, whether an independent contractor needs a business license can depend on their specific location and the nature of their work. Generally, having an Idaho Production Assistant Contract - Self-Employed Independent Contractor does not automatically require a business license, but it is recommended to check local regulations. Contacting local government offices is an excellent way to ensure compliance. Staying informed can save Contractors from potential issues later.

Yes, a production assistant can be classified as an independent contractor. When working under an Idaho Production Assistant Contract - Self-Employed Independent Contractor, they typically manage their business operations independently. This status means they are not entitled to employee benefits, but they enjoy flexibility and the chance to work on varied projects. Proper contracts help define their roles and responsibilities clearly in this relationship.

Yes, assistants, like production assistants, can operate as self-employed individuals. When working under an Idaho Production Assistant Contract - Self-Employed Independent Contractor, they have flexibility in how they manage their work and finances. This self-employment status allows for greater control over work hours and project selection. To thrive as a self-employed assistant, clear contracts and good client relationships are essential.

Yes, independent contractors, including those under an Idaho Production Assistant Contract - Self-Employed Independent Contractor, file taxes as self-employed individuals. This means they report their income on Schedule C of their tax returns. By doing this, they can also deduct certain business expenses. Overall, understanding this process is crucial for independent contractors to manage their taxes effectively.

Filling out an Idaho Production Assistant Contract - Self-Employed Independent Contractor requires careful attention to detail. Start by clearly identifying the parties involved, including the contractor's name and the hiring party's name. Next, outline the scope of work and specific responsibilities, ensuring you include payment terms and deadlines. Finally, review the contract thoroughly to confirm that it accurately reflects your agreement and consult with a legal professional if needed.