Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

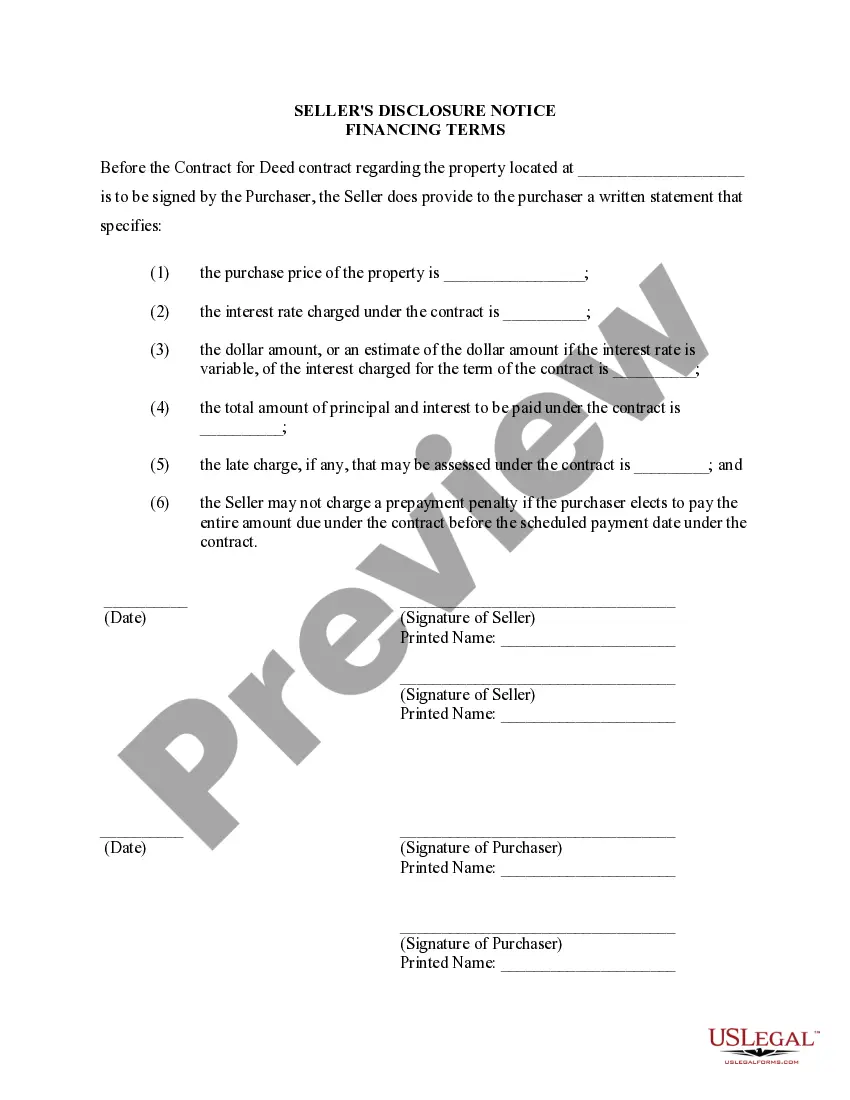

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

Are you in a location where you require documents for both business and personal purposes nearly every day.

There is a multitude of legitimate document templates available online, yet finding forms you can rely on is challenging.

US Legal Forms offers a vast number of form templates, including the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor, designed to meet federal and state requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, provide the necessary details to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you want and ensure it is for the correct city/region.

- Utilize the Review button to evaluate the form.

- Check the summary to confirm you have selected the right document.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

To write an independent contractor agreement, start by clearly outlining the terms of the relationship between the contractor and the client. Include essential details such as the scope of work, payment terms, and confidentiality clauses. Utilizing the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process, as it provides proven frameworks tailored to your needs. This ensures that both parties have a clear understanding of their rights and responsibilities, minimizing potential disputes.

In Idaho, the primary difference between an independent contractor and an employee lies in the degree of control the employer exerts over the worker. Employees typically receive benefits and can be directed in their work, while independent contractors enjoy greater independence and flexibility. Understanding these differences is crucial, particularly when drafting your Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor. This clarity ensures compliance with state laws and protects your rights and interests in the working relationship.

Choosing between being on payroll or receiving a 1099 form depends on your personal and financial situation. Being on payroll provides benefits like consistent wages and employer contributions to insurance and retirement plans. Conversely, working as a 1099 independent contractor offers more flexibility and potential tax deductions. Your Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor can guide you in understanding these options and help you make the best choice.

The basic independent contractor agreement outlines the working relationship between a business and an independent contractor. This document typically includes details on the scope of work, payment terms, and deadlines. By utilizing an Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor, you can clearly define responsibilities and protect both parties. A well-structured agreement helps in avoiding misunderstandings in your business dealings.

Payroll for independent contractors works differently than for traditional employees. Contractors often receive payment based on specific projects or deliverables, rather than hourly wages. To ensure compliance, utilize the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor, which outlines the payment terms and protects both parties.

Filling out an independent contractor agreement requires clarity on the scope of work and payment terms. Make sure to include key details such as duration, expectations, and any necessary legal language. Using a template from US Legal Forms can guide you through the compliance aspects of the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor.

Setting up payroll for 1099 employees involves gathering necessary documentation from your contractors, including W-9 forms. You will also need to track the payment details to ensure they meet IRS guidelines. This process is simplified through platforms like US Legal Forms, which can help you create the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor.

To handle payroll for independent contractors, it starts with identifying the hours worked or the payment terms agreed upon. Next, ensure you have the correct information, such as their Tax Identification Number. Finally, document each payment, ensuring compliance with the IRS regulations regarding the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor.

An independent contractor should complete a W-9 form for tax purposes, providing their taxpayer identification information. Additionally, they should review any specific provisions outlined in the Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor. This ensures that all legal requirements are met and that both parties understand their obligations.

Legal requirements for independent contractors vary by state but generally include proper classification to avoid misclassification issues. Your Idaho Payroll Specialist Agreement - Self-Employed Independent Contractor should address business responsibilities, payment terms, and deliverables. Following these guidelines helps both parties maintain compliance with tax laws and labor regulations.