Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the premier collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By utilizing the platform, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the latest versions of forms, such as the Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor, within moments.

Examine the form description to confirm that you have chosen the appropriate form.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you have a subscription, sign in and download the Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog.

- The Download button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some straightforward tips to get started.

- Ensure you have selected the correct form for your area/region.

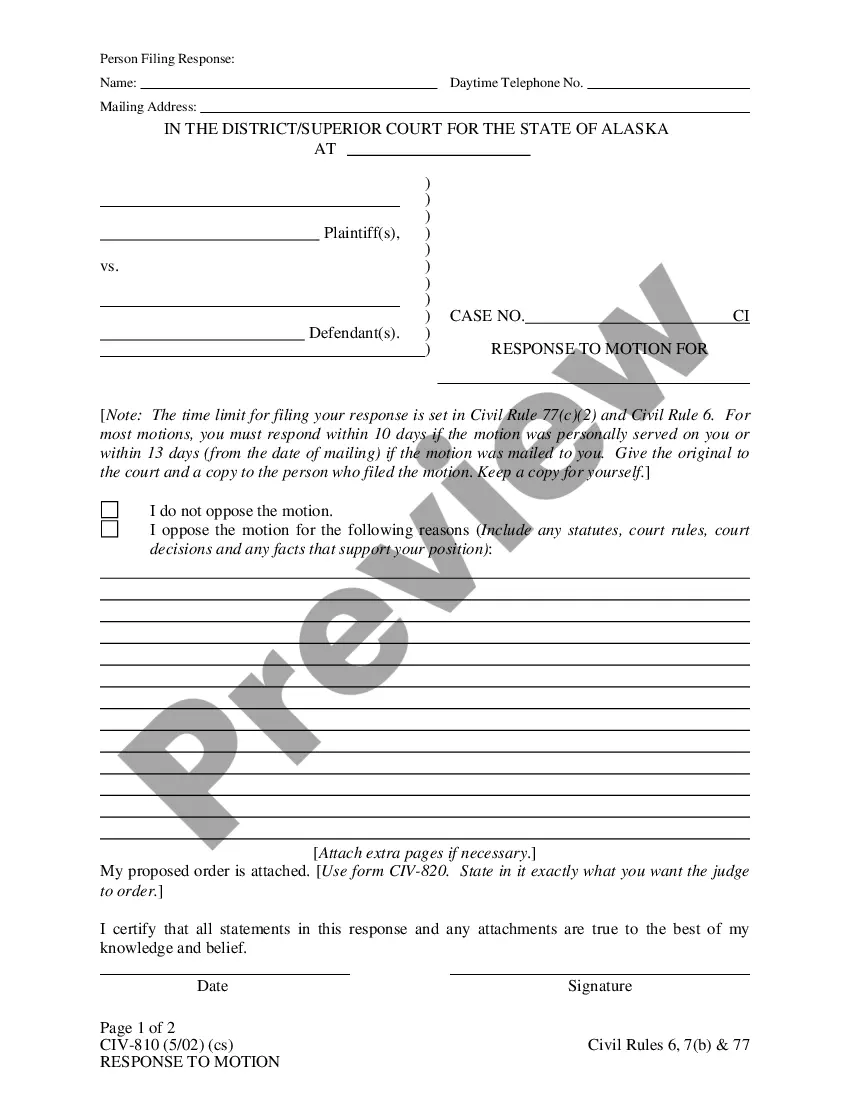

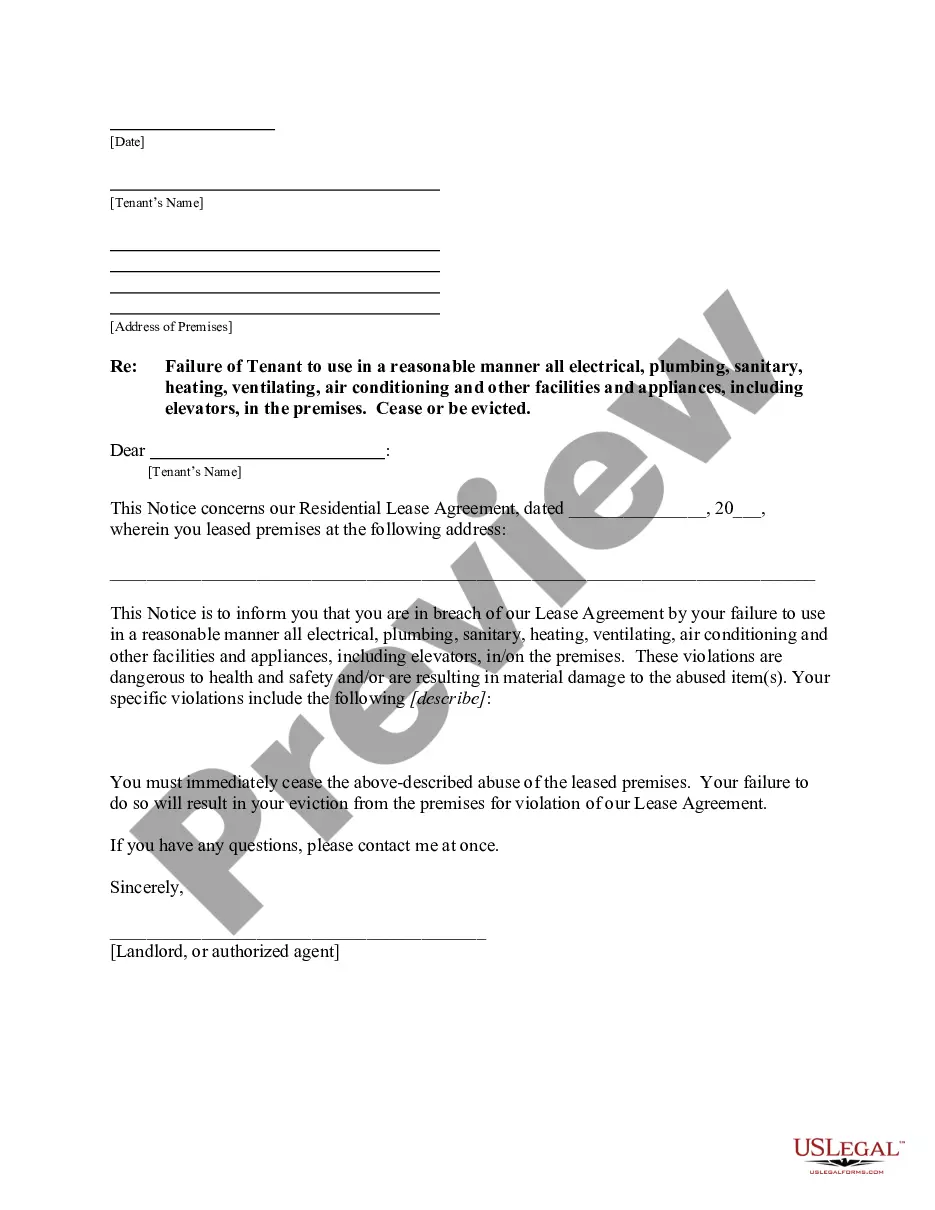

- Click on the Preview button to review the form's content.

Form popularity

FAQ

Writing an independent contractor agreement begins with clearly defining the project scope and deliverables. Include essential elements like payment terms, duration of the agreement, and any provisions for confidentiality and termination. Incorporating the Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor ensures you cover all necessary legal bases. For assistance, US Legal Forms offers a range of templates that can help you create a comprehensive and effective agreement.

Filling out an independent contractor agreement involves several key steps. Start by providing the basic information about both parties, including names and contact details. Then, specify the terms of the Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor, such as payment terms, project scope, and deadlines. Lastly, review the agreement thoroughly and consider using US Legal Forms for additional guidance and templates that simplify this process.

As a self-employed independent contractor, you typically need to complete a W-9 form to provide your taxpayer identification information. Additionally, you may require an Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor to clarify your work terms and conditions. This agreement helps protect your rights and outlines responsibilities, ensuring both parties understand their commitments. Using platforms like US Legal Forms can streamline this process by providing ready-to-use templates.

In Idaho, independent contractors may need a business license depending on their work type or business structure. Consulting with local authorities or reviewing your Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor can clarify licensing requirements. This step ensures you operate legally and avoid potential penalties.

The new federal rule on independent contractors emphasizes a more stringent classification process. This affects how work relationships are defined under the law, particularly for those working under an Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor. Staying updated on these regulations can help ensure compliance.

Yes, NDAs do apply to independent contractors. It's wise to include confidentiality clauses in your Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor. This helps safeguard your client's projects and sensitive information from being disclosed to third parties.

When employing an independent contractor, it's crucial to have a well-drafted Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor. In addition to the agreement, you may need to collect tax forms such as the W-9. This documentation keeps your project organized and compliant with tax regulations.

If you get hurt while working as an independent contractor, your options for compensation may vary. Unlike employees, independent contractors usually do not have access to workers' compensation. Check the terms of your Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor and consider personal insurance to cover potential injuries.

If you break an independent contractor agreement, you may face legal consequences outlined in your Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor. Typically, the other party may seek damages or request specific performance. It's vital to understand your obligations to avoid these issues.

To protect yourself as an independent contractor, ensure you have a clear Idaho Outside Project Manager Agreement - Self-Employed Independent Contractor. This agreement should outline the project scope, payment terms, and timelines. Additionally, consider obtaining insurance and seeking legal advice to cover potential risks.