Idaho Stock Appreciation Right Plan of Helene Curtis Industries, Inc.

Description

How to fill out Stock Appreciation Right Plan Of Helene Curtis Industries, Inc.?

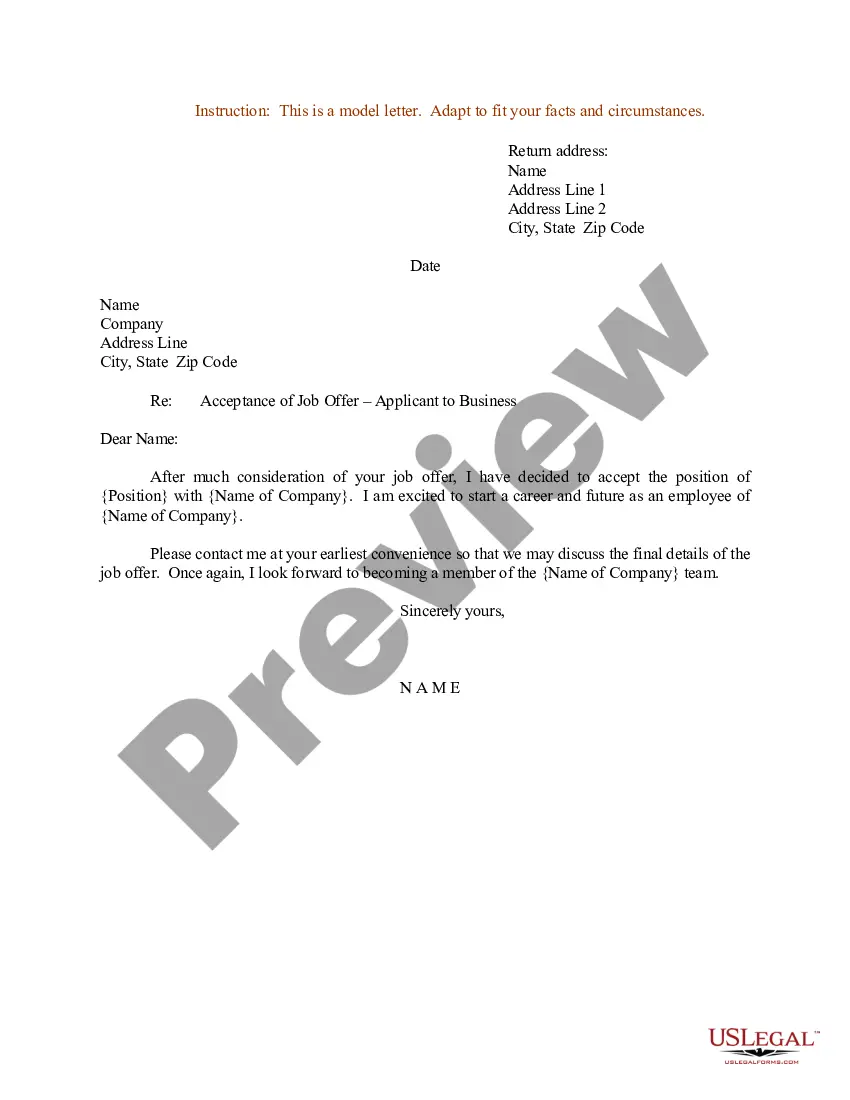

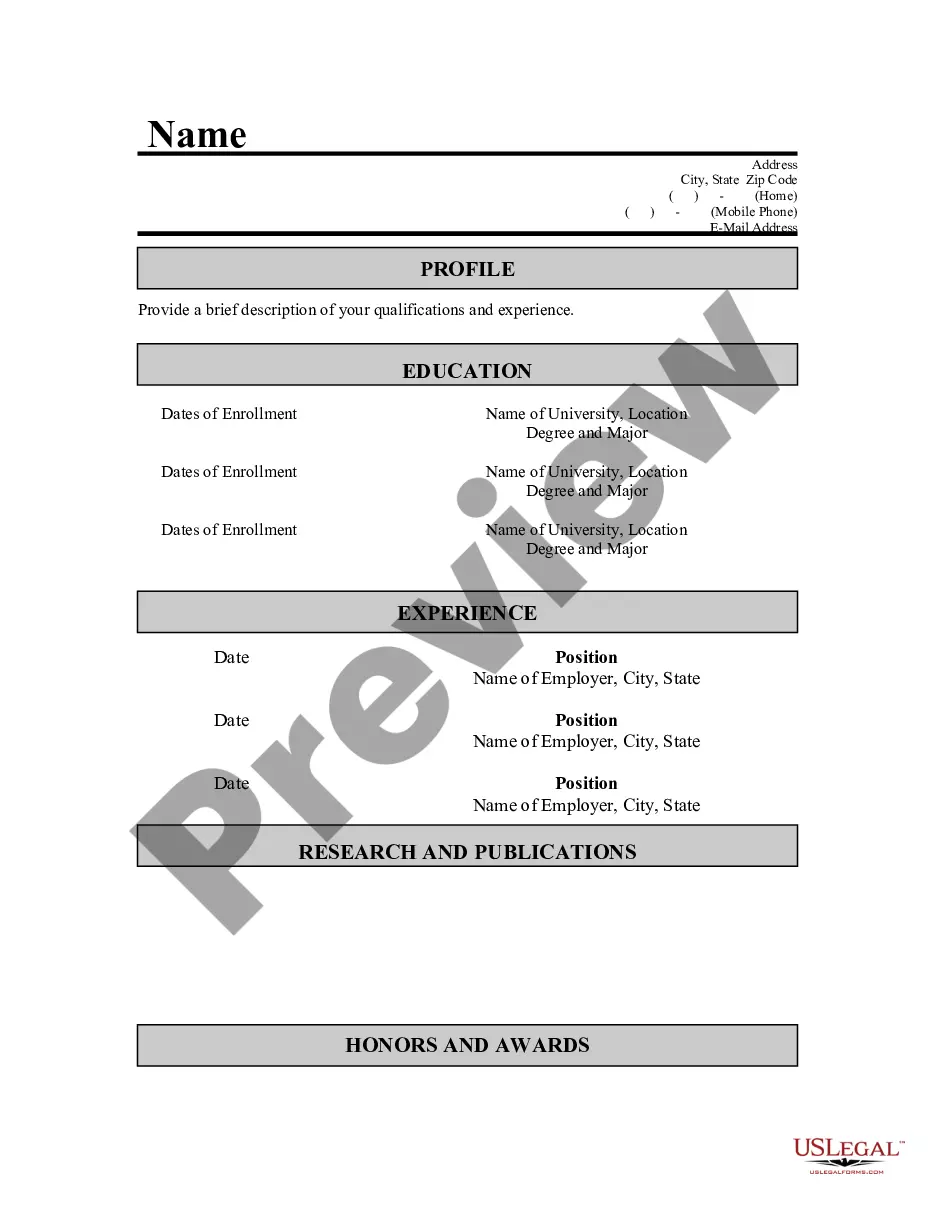

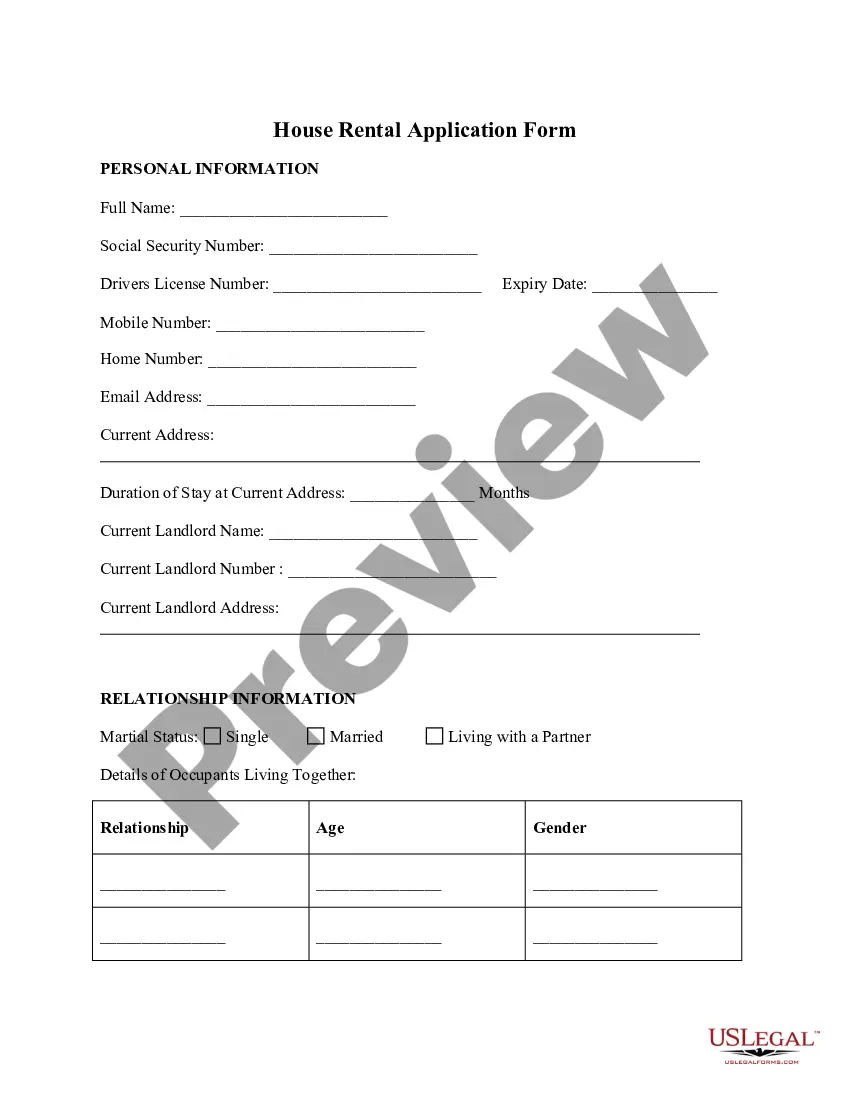

You are able to commit time on the web searching for the authorized document format that suits the federal and state needs you require. US Legal Forms offers a large number of authorized varieties that happen to be examined by experts. You can easily acquire or print out the Idaho Stock Appreciation Right Plan of Helene Curtis Industries, Inc. from the service.

If you already have a US Legal Forms profile, you may log in and click on the Acquire option. Following that, you may comprehensive, edit, print out, or indication the Idaho Stock Appreciation Right Plan of Helene Curtis Industries, Inc.. Each authorized document format you purchase is the one you have permanently. To obtain an additional copy of the obtained type, check out the My Forms tab and click on the related option.

If you use the US Legal Forms site initially, follow the basic directions listed below:

- Initial, make certain you have chosen the right document format to the region/city of your liking. Look at the type description to ensure you have chosen the appropriate type. If readily available, utilize the Preview option to search through the document format too.

- If you wish to locate an additional version in the type, utilize the Search industry to obtain the format that meets your needs and needs.

- Once you have found the format you want, just click Acquire now to proceed.

- Find the pricing strategy you want, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal profile to pay for the authorized type.

- Find the structure in the document and acquire it in your gadget.

- Make changes in your document if needed. You are able to comprehensive, edit and indication and print out Idaho Stock Appreciation Right Plan of Helene Curtis Industries, Inc..

Acquire and print out a large number of document templates while using US Legal Forms web site, that offers the greatest assortment of authorized varieties. Use skilled and state-particular templates to tackle your organization or specific demands.

Form popularity

FAQ

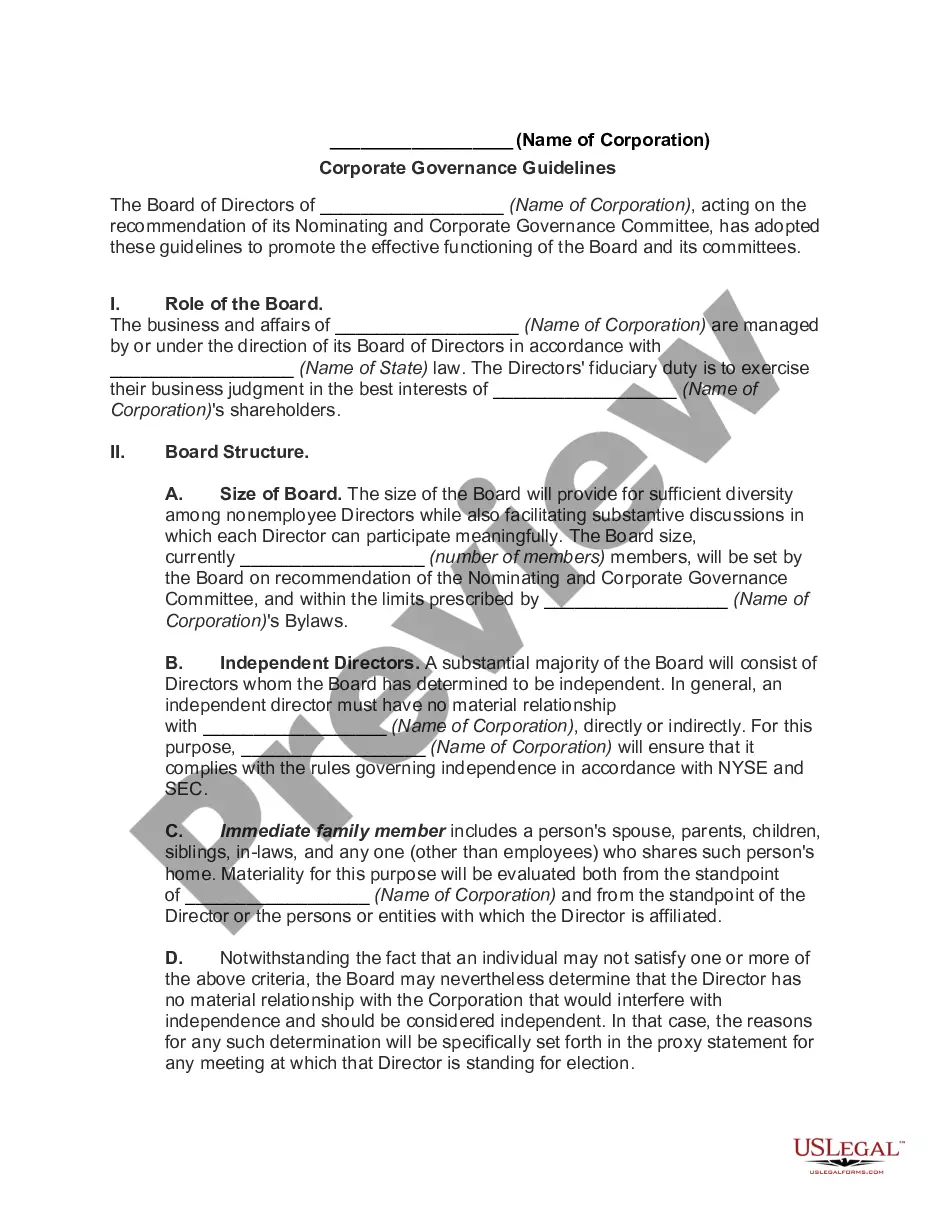

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

SARs are taxed the same way as non-qualified stock options (NSOs). There are no tax consequences of any kind on either the grant date or when they are vested. However, participants must recognize ordinary income on the spread at the time of exercise.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

The company continued to grow, manufacturing products as varied as deodorant to skin creams, until 1996 when Helene Curtis was acquired by Unilever for $770 million.

Helene Curtis, which was controlled by the Gidwitz family until it was sold to Unilever for $910 million in 1996, has been manufacturing at the 92-year-old facility since the late 1940s, ing to a Unilever spokesman.

In February 1996, Helene Curtis agreed to be acquired by Unilever for about $770 million. In contract law, the company is known for the 1963 case Helene Curtis Industries, Inc. v.