Idaho Share Appreciation Rights Plan with amendment

Description

How to fill out Share Appreciation Rights Plan With Amendment?

You may commit time on the Internet looking for the legal document design which fits the state and federal specifications you need. US Legal Forms gives 1000s of legal kinds which are examined by pros. It is simple to acquire or print the Idaho Share Appreciation Rights Plan with amendment from your assistance.

If you have a US Legal Forms bank account, you can log in and click on the Obtain button. Next, you can full, revise, print, or indication the Idaho Share Appreciation Rights Plan with amendment. Every single legal document design you purchase is yours for a long time. To have one more backup of the obtained type, proceed to the My Forms tab and click on the related button.

If you work with the US Legal Forms website initially, stick to the easy guidelines under:

- Initially, ensure that you have selected the proper document design for your area/town of your choice. Browse the type explanation to make sure you have selected the appropriate type. If offered, make use of the Preview button to check from the document design also.

- If you want to get one more model from the type, make use of the Search discipline to get the design that meets your requirements and specifications.

- Once you have discovered the design you would like, click Get now to continue.

- Choose the prices strategy you would like, type your credentials, and sign up for a free account on US Legal Forms.

- Complete the deal. You can use your Visa or Mastercard or PayPal bank account to fund the legal type.

- Choose the format from the document and acquire it to your product.

- Make alterations to your document if possible. You may full, revise and indication and print Idaho Share Appreciation Rights Plan with amendment.

Obtain and print 1000s of document themes using the US Legal Forms web site, that provides the largest variety of legal kinds. Use expert and condition-particular themes to tackle your organization or specific requirements.

Form popularity

FAQ

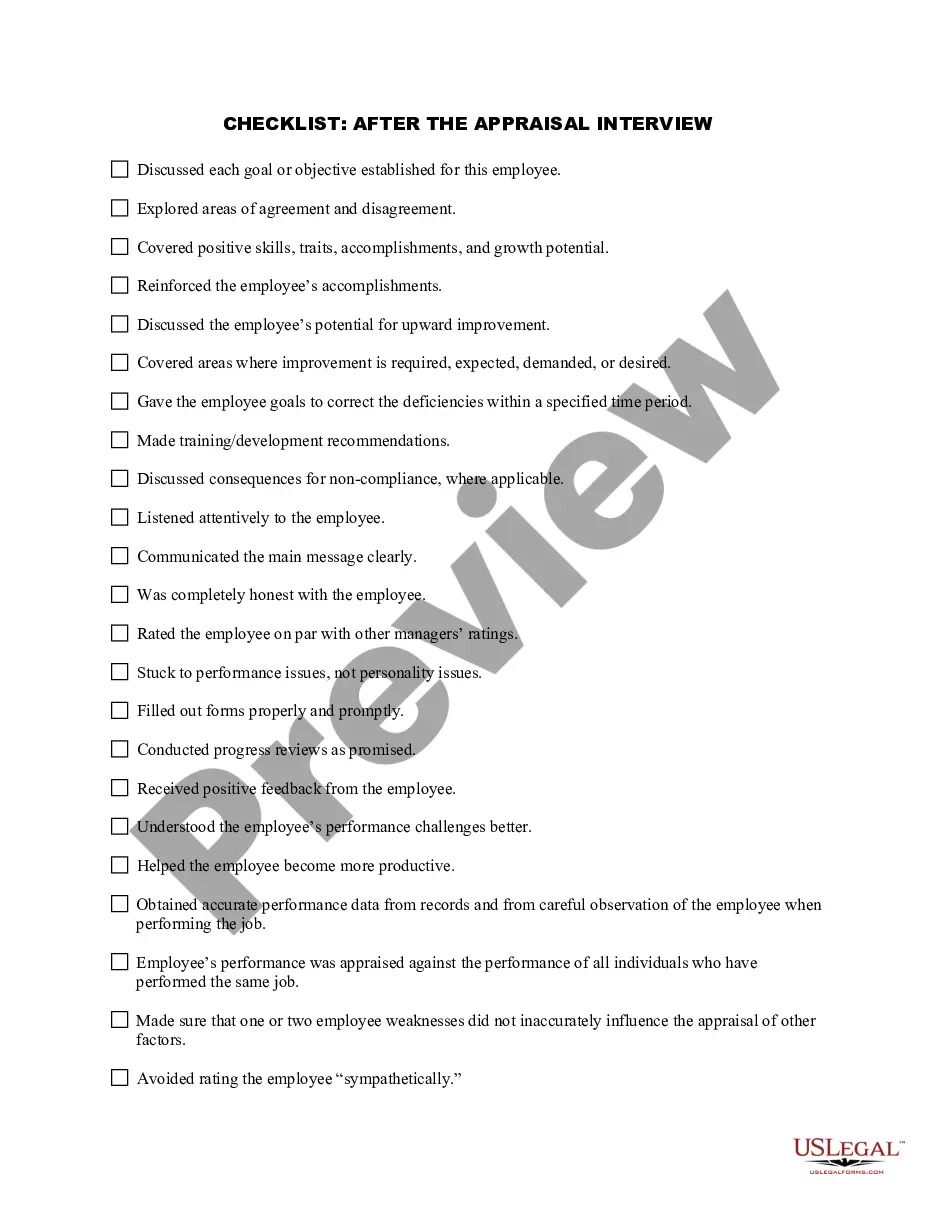

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

Stock appreciation rights are similar to stock options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

SARs may be settled in cash or shares. However, it is more common for SARs to be settled in cash. A SAR is similar to a stock option except that the recipient is not required to pay an exercise price to exercise the SAR.

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a preset period. Unlike stock options, SARs are often paid in cash and do not require the employee to own any asset or contract.

Intrinsic value is the difference between the fair value of the shares and the price that is to be paid for the shares by the counterparty.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.