Idaho Approval of option grant

Description

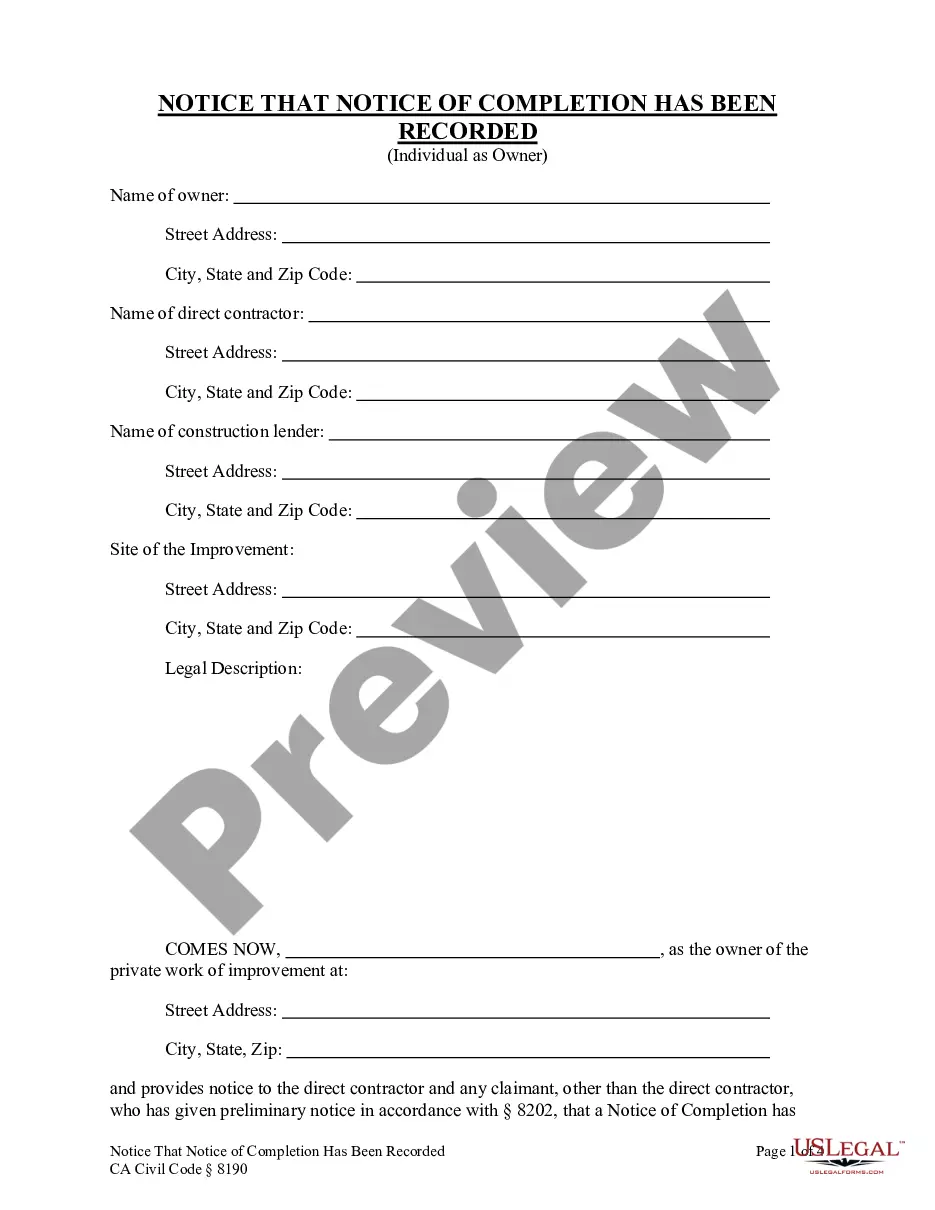

How to fill out Approval Of Option Grant?

Are you presently within a position the place you need to have paperwork for possibly company or person reasons nearly every working day? There are a lot of legitimate file templates accessible on the Internet, but finding versions you can trust isn`t effortless. US Legal Forms offers a large number of form templates, such as the Idaho Approval of option grant, that are published in order to meet federal and state needs.

If you are presently knowledgeable about US Legal Forms internet site and get an account, just log in. Following that, you may down load the Idaho Approval of option grant template.

If you do not come with an account and want to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is to the proper city/state.

- Use the Preview key to examine the shape.

- See the outline to actually have selected the appropriate form.

- When the form isn`t what you are searching for, utilize the Lookup discipline to obtain the form that suits you and needs.

- If you discover the proper form, click Purchase now.

- Choose the pricing prepare you want, fill in the required info to make your money, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Select a convenient data file file format and down load your version.

Locate all of the file templates you possess bought in the My Forms food selection. You may get a further version of Idaho Approval of option grant anytime, if necessary. Just select the required form to down load or print out the file template.

Use US Legal Forms, the most extensive assortment of legitimate varieties, to save lots of time as well as stay away from faults. The support offers professionally made legitimate file templates that can be used for a variety of reasons. Create an account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

Grant Awards Grants will be prioritized and awarded first to households with an Adjusted Gross Income (AGI) at or below $60,000 per year. Once the first phase is awarded, the AGI limit will be expanded to households earning up to $75,000 per year.

Average State of Idaho hourly pay ranges from approximately $14.50 per hour for Peer Coach to $40.81 per hour for IT Auditor. The average State of Idaho salary ranges from approximately $37,455 per year for Instructor to $94,311 per year for Chief Financial Officer.

State executive salaries Office and current officialSalaryGovernor of Idaho Brad Little$138,302Lieutenant Governor of Idaho Scott Bedke$48,406Attorney General of Idaho Raul Labrador$134,000Idaho Secretary of State Phil McGrane$117,5574 more rows

To qualify, students must: Be a graduate (class of 2024) from an Idaho High School, home school, or GED. Be an Idaho resident. Be enrolled in or have applied to an eligible Idaho institution. Begin enrollment by Fall Semester after graduation.

During FY 2024, the Legislature approved the following: ?DHR shall shift the salary structure upward by an average of eight and one-half percent (8.5%) beginning on July 1, 2023, with the exception of the minimum wage of $7.25 per hour at pay grade D, and shall add an additional pay structure for public safety.

First, let's set a baseline for raise sizing: Small raise: 1% Normal raise: 2-3% Good raise: 4-7%

Senate Bill 1125 allows parents to send their child to any public school in Idaho regardless of where they live. The current law restricts parents' ability to choose the public school that is best for their child, and Senate Bill 1125 modernizes the law to give parents more choice in public education.

Boise State football head coach Andy Avalos, the state's highest-paid employee, earns about $1.6 million annually.