Idaho Expense Reimbursement Form for an Employee

Description

How to fill out Expense Reimbursement Form For An Employee?

Locating the appropriate sanctioned document template can be quite challenging. Of course, there are numerous templates accessible online, but how will you acquire the official form you need.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Idaho Expense Reimbursement Form for an Employee, which can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to locate the Idaho Expense Reimbursement Form for an Employee. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and get another copy of the document you need.

Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Idaho Expense Reimbursement Form for an Employee. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted documents that adhere to state regulations.

- First, ensure you have chosen the correct form for your state/region.

- You can view the form using the Preview button and review the form details to confirm it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

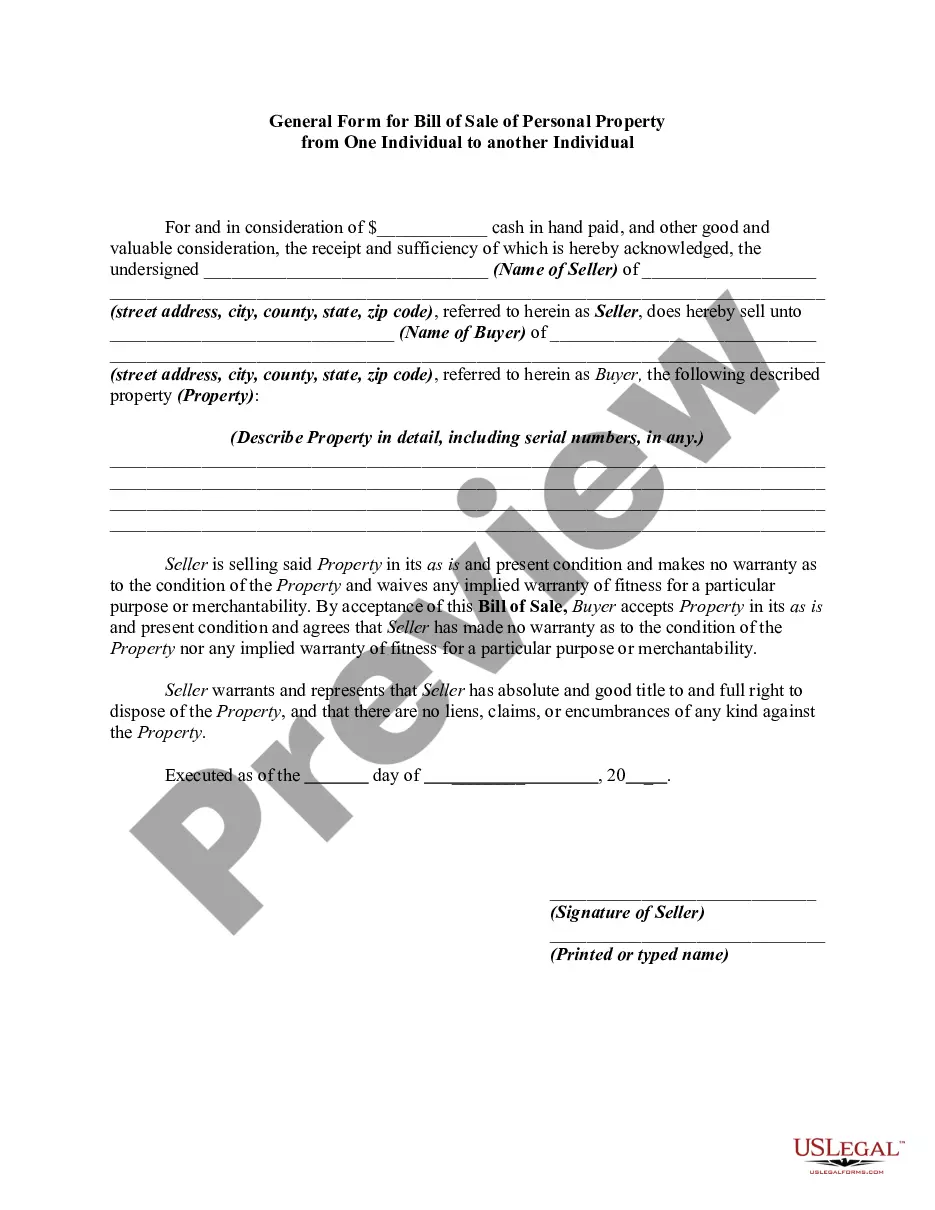

An employee reimbursement form is a document that employees use to request repayment for costs incurred while performing job-related duties. The Idaho Expense Reimbursement Form for an Employee simplifies this process by providing a standardized format for detailing expenses. Using these forms helps ensure that all necessary information is submitted for timely reimbursement.

The State Board of Examiners has established State Moving Policy and Procedures. This policy allows reimbursement of moving expenses for a current or newly hired employee.

An expense reimbursement claim report should be filed and completed by the employee and submitted to their HR department for approval after the costs have been incurred. As per your company's policy guidelines, communicate what information is needed when submitting expense claims and reports.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

An employee reimbursement form is a standardized template an employee may use to report expenses paid on behalf of the company to receive reimbursement. The exact reimbursable items will be strictly up to the agreement between the employer and employee.

Expense reimbursements aren't employee income, so they don't need to be reported as such. Although the check or deposit is made out to your employee, it doesn't count as a paycheck or payroll deposit.

Business expense reimbursements are not considered wages, and therefore are not taxable income (if your employer uses an accountable plan). An accountable plan is a plan that follows the Internal Revenue Service regulations for reimbursing workers for business expenses in which reimbursement is not counted as income.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.