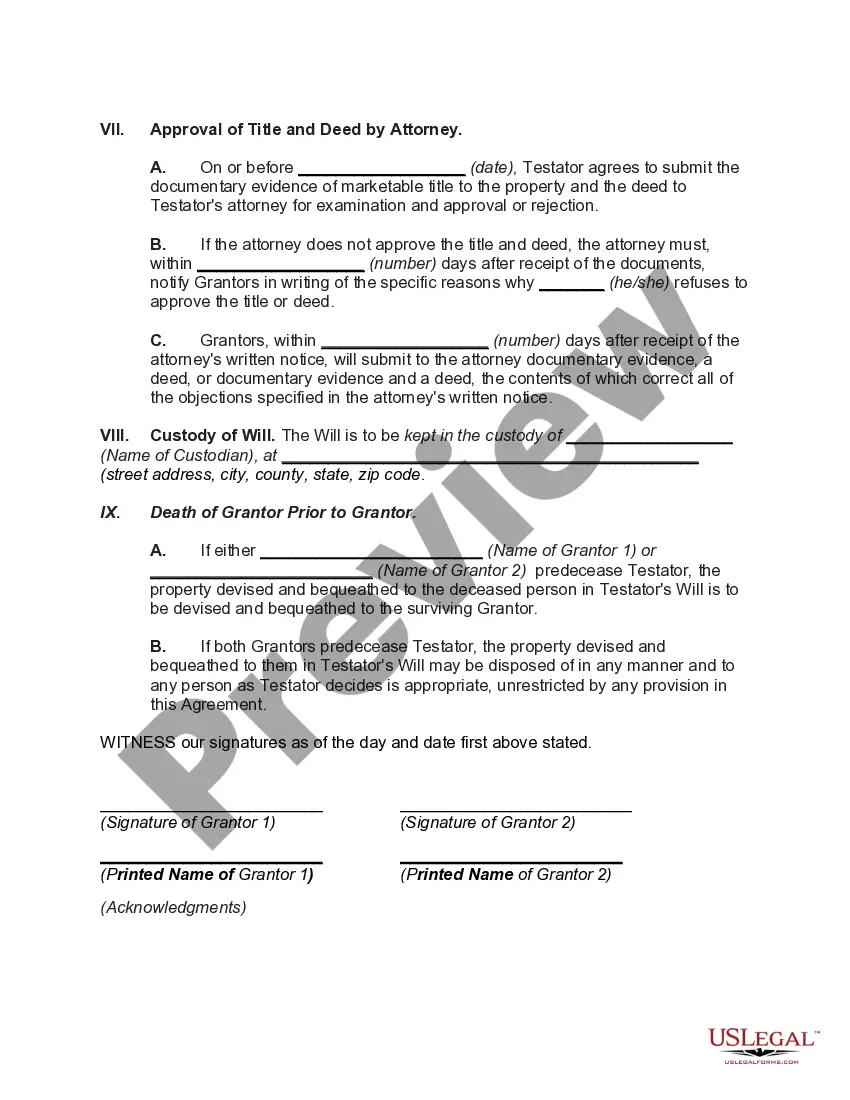

Idaho Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

Selecting the correct sanctioned document format can be challenging.

Clearly, there are numerous templates accessible online, but how can you locate the sanctioned form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Idaho Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, that you can leverage for business and personal needs.

If the form does not satisfy your requirements, utilize the Search box to find the correct form. Once you are confident the form is appropriate, select the Purchase now button to obtain the form. Choose your preferred pricing plan and input the necessary information. Create your account and finalize the transaction using your PayPal account or credit card. Select the file format and download the sanctioned document format to your device. Complete, edit, print, and sign the acquired Idaho Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator. US Legal Forms is the largest repository of sanctioned forms where you can access a variety of document templates. Use the service to download professionally-crafted papers that adhere to state requirements.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to download the Idaho Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

- Use your account to browse the authorized forms you have obtained before.

- Visit the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the appropriate form for the city/state. You can preview the form using the Preview button and view the form summary to confirm it is suitable for you.

Form popularity

FAQ

A Will can be hand-written or typed. It is to be written clearly specifying one's personal details, family details, property details, bequeath details, and details of both witnesses. One must make sure that his/her Will is created when one is mentally sound, without any fear, force, coercion, or undue influence.

Spend Your Estate on Yourself The single best way to avoid probate in Idaho is to spend all of your money, property, and assets, on yourself during your lifetime, so that there are no assets left that need to be probated when you die.

The short answer is that TOD deeds are not allowed in Idaho. The reason for this is because Idaho is a community property state.

Once they finalise the distribution, heirs can draw a family settlement deed where each member signs, which can then be registered for official records. To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.

The short answer is that TOD deeds are not allowed in Idaho. The reason for this is because Idaho is a community property state.

Making a Will helps ensure one's property devolves as wished and the right heirs receive their fair shares. Under the Indian Succession Act 1925, a Will is a legal declaration of the intention of the testator, with respect to his property which he desires to be carried into effect after his death.

Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

Idaho statutes dealing with intestate succession state that a surviving spouse receives all of the community property and they receive one half of any separate property owned by the decedent. The remaining 1/2 of the separate property will go to the decedent's children or parent or other heirs if there are any.

When is Probate Required in Idaho? In Idaho, probate is required if you own any real estate or if you own possessions with a total value of $100,000. The only situation where probate is not required is if you die without any real estate and you leave total assets of less than $100,000.

Make sure you enter all the essential personal details, including name, address, place and date, correctly; put in the full name and relationship of beneficiaries; mention the assets precisely; have it done in the presence of two witnesses; and sign it along with the witnesses and their details.