Idaho Release and Indemnification of Personal Representative by Heirs and Devisees

Description

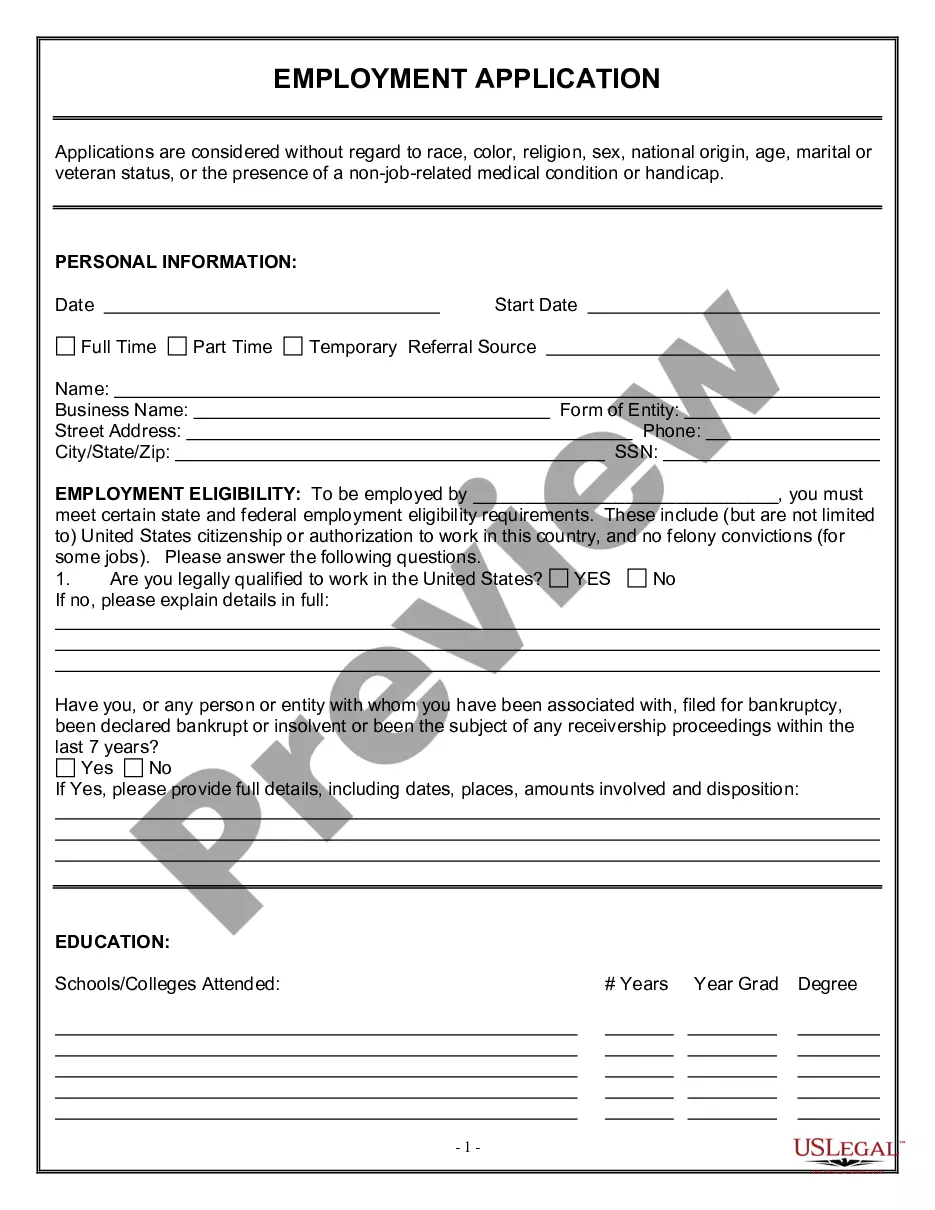

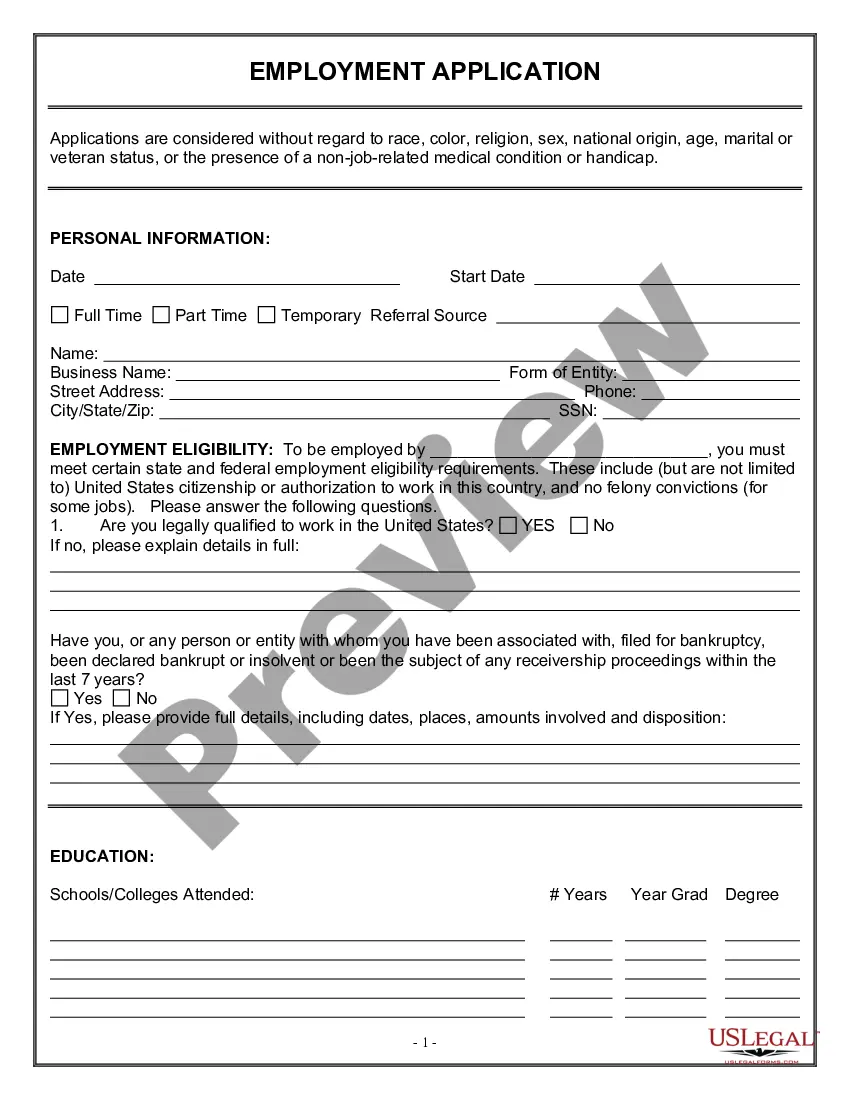

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

If you require to compile, retrieve, or create approved document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search feature to locate the forms you need.

Various templates for business and personal use are organized by categories and states or keywords. Use US Legal Forms to find the Idaho Release and Indemnification of Personal Representative by Heirs and Devisees in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to obtain the Idaho Release and Indemnification of Personal Representative by Heirs and Devisees. You can also access forms you previously downloaded in the My documents section of your account.

Every legal document template you acquire is yours forever. You can access every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and download, then print the Idaho Release and Indemnification of Personal Representative by Heirs and Devisees using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other options in the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

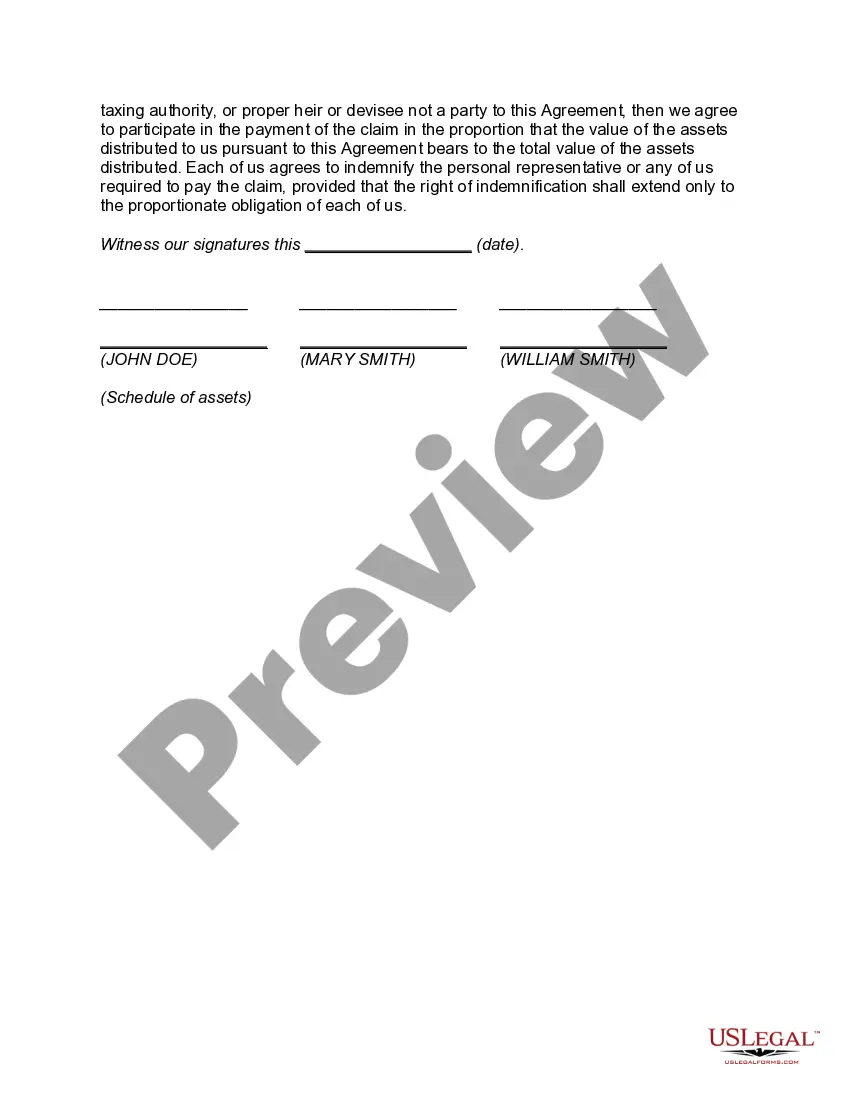

- Step 7. Complete, edit, and print or sign the Idaho Release and Indemnification of Personal Representative by Heirs and Devisees.

Form popularity

FAQ

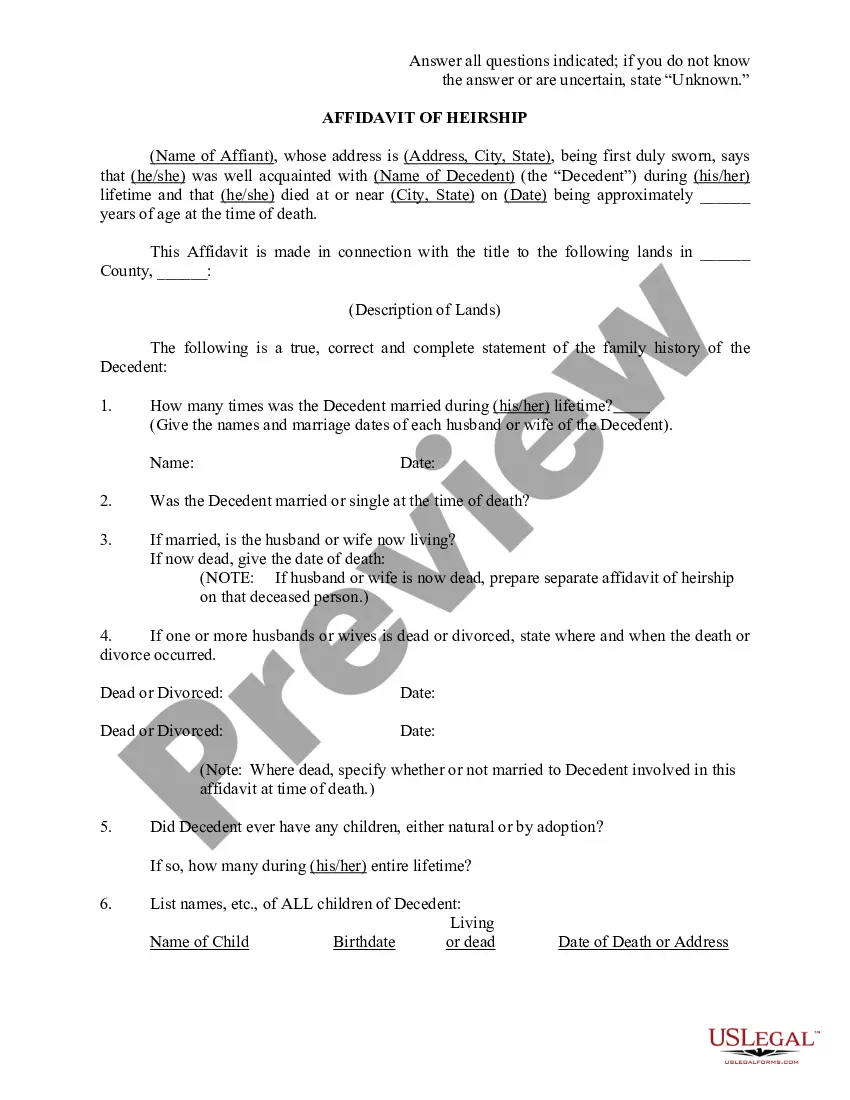

Step 1 Wait Thirty (30) Days. State law says a small estate affidavit cannot be used until thirty (30) days have passed since the death of a decedent.Step 2 Prepare Affidavit.Step 3 Get It Notarized.Step 4 Collect the Assets.Statement 1.Statement 5.Idaho Notarized Signing.

Idaho Statutes Any estate in personal property held by a husband and wife as community property with right of survivorship shall, upon the death of one (1) spouse, transfer and belong solely to the surviving spouse as a nontestamentary disposition at death.

The short answer is that TOD deeds are not allowed in Idaho. The reason for this is because Idaho is a community property state.

When is Probate Required in Idaho? In Idaho, probate is required if you own any real estate or if you own possessions with a total value of $100,000. The only situation where probate is not required is if you die without any real estate and you leave total assets of less than $100,000.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

Typically the process takes at least 6 months. This is because Idaho statutes require the estate to remain open for at least six months after the appointment of the personal representative. Sometimes however it takes longer to deal with the property in an estate.

Because Idaho is a community property state, it does allow a right of survivorship in real property to be given to a surviving spouse. But that is it. Even if a person is not married, they cannot use a TOD to transfer their ownership interest in the real estate to someone else when they die.

According to Idaho Code § 15-3-1201 et seq., after a family member or loved one passes away, an individual can use a small estate affidavit that specifically identifies them as the recipient of personal property owned by the decedent. The small estate affidavit has to have some specific language in it.

Community Property with Right of Survivorship. Nine U.S. states treat a husband and wife as a single economic unit under a system of community property law. In these stateswhich include Texas, California, Washington, and Arizonaspouses can hold title as community property with right of survivorship.

In Idaho, this form of joint ownership is available: Joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary.