Idaho Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

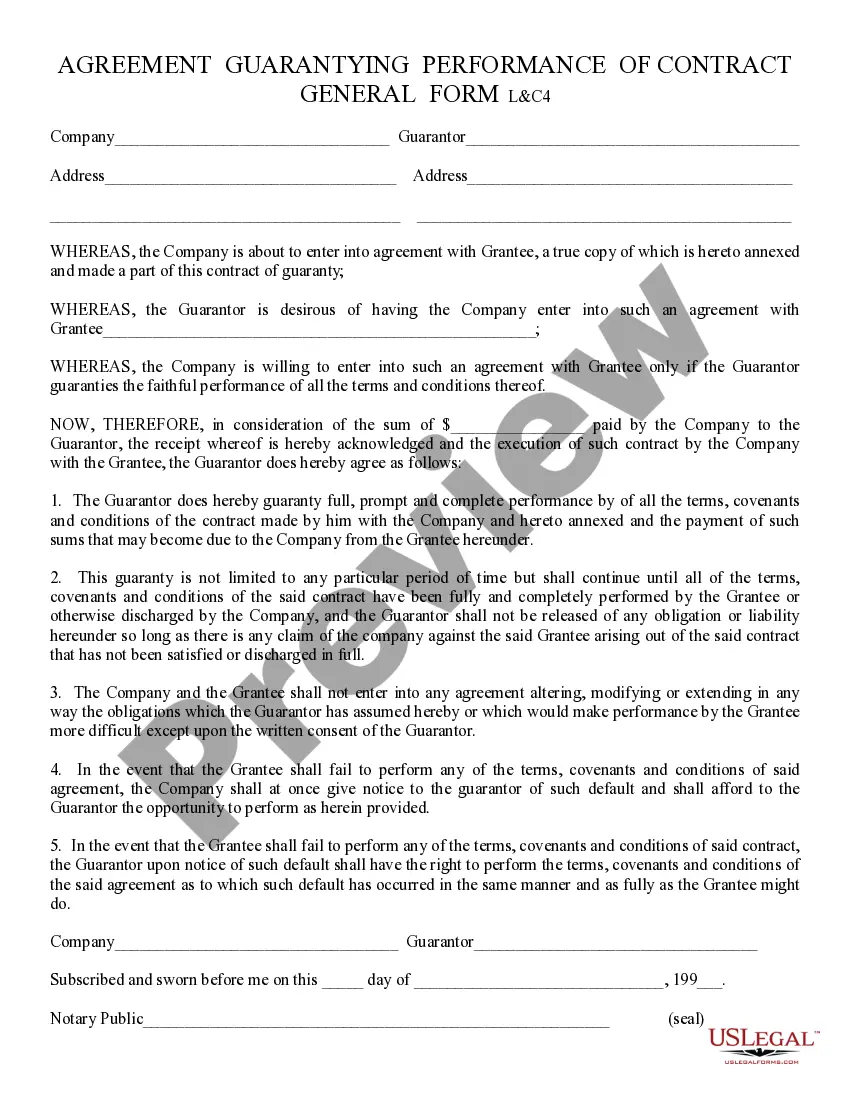

How to fill out Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

Are you presently in a position in which you require papers for either enterprise or personal reasons just about every day time? There are a lot of legitimate document themes accessible on the Internet, but locating kinds you can trust isn`t easy. US Legal Forms gives 1000s of kind themes, just like the Idaho Receipt and Release Personal Representative of Estate Regarding Legacy of a Will, which are created to meet state and federal requirements.

If you are presently informed about US Legal Forms website and possess a free account, basically log in. After that, it is possible to down load the Idaho Receipt and Release Personal Representative of Estate Regarding Legacy of a Will web template.

Unless you offer an bank account and want to start using US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is to the appropriate metropolis/region.

- Utilize the Preview switch to examine the shape.

- Browse the outline to ensure that you have selected the appropriate kind.

- In case the kind isn`t what you`re searching for, utilize the Search discipline to get the kind that meets your needs and requirements.

- When you get the appropriate kind, simply click Acquire now.

- Choose the prices prepare you want, fill in the specified information and facts to make your account, and buy your order making use of your PayPal or credit card.

- Select a convenient data file file format and down load your duplicate.

Locate each of the document themes you have bought in the My Forms menus. You can get a more duplicate of Idaho Receipt and Release Personal Representative of Estate Regarding Legacy of a Will any time, if possible. Just click the necessary kind to down load or print out the document web template.

Use US Legal Forms, probably the most comprehensive selection of legitimate varieties, to save efforts and avoid blunders. The support gives professionally produced legitimate document themes that can be used for an array of reasons. Make a free account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Who to Choose as Your Personal Representative Spouse. For a married couple, the first person that naturally comes to mind who should be considered to be appointed as a personal representative is the surviving spouse. ... Children. ... Close Friend. ... Professional. ... Enlist an Idaho Estate Planning Attorney to Help You.

If you die without a will (intestate), your property passes ing to the laws of Idaho. In general, a surviving spouse receives all of the community property and the spouse and children share the decedent's separate property.

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

Beneficiaries are entitled to financial records (such as bank statements, real estate closing statements, etc.) upon reasonable request.

§ 15-3-108) a regular probate must be completed within 3 years of a person's death.

Every estate is different and can take a different length of time to administer depending on its complexity. There is a general expectation that an executor or administrator should try to complete the estate administration within a year of the death, and this is referred to as the executor's year.

(22) "Heirs" means those persons, including the surviving spouse, who are entitled under the statutes of intestate succession to the property of a decedent.

Creditors have a certain time frame, typically four months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.

An executor (which in Idaho is called a ?personal representative? even though these two different names means the same thing) is the person who is given legal authority to deal with the money, property, and other assets of a person's estate after they die.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.