Idaho Seller's Affidavit of Nonforeign Status

Description

How to fill out Seller's Affidavit Of Nonforeign Status?

Discovering the right legitimate document design can be a struggle. Naturally, there are a lot of web templates accessible on the Internet, but how will you obtain the legitimate type you need? Utilize the US Legal Forms website. The services offers 1000s of web templates, including the Idaho Seller's Affidavit of Nonforeign Status, that can be used for company and private requires. Each of the varieties are checked out by specialists and satisfy state and federal requirements.

If you are currently signed up, log in to your accounts and then click the Down load button to have the Idaho Seller's Affidavit of Nonforeign Status. Utilize your accounts to check with the legitimate varieties you have ordered formerly. Go to the My Forms tab of your accounts and have one more copy in the document you need.

If you are a fresh user of US Legal Forms, listed below are basic recommendations for you to stick to:

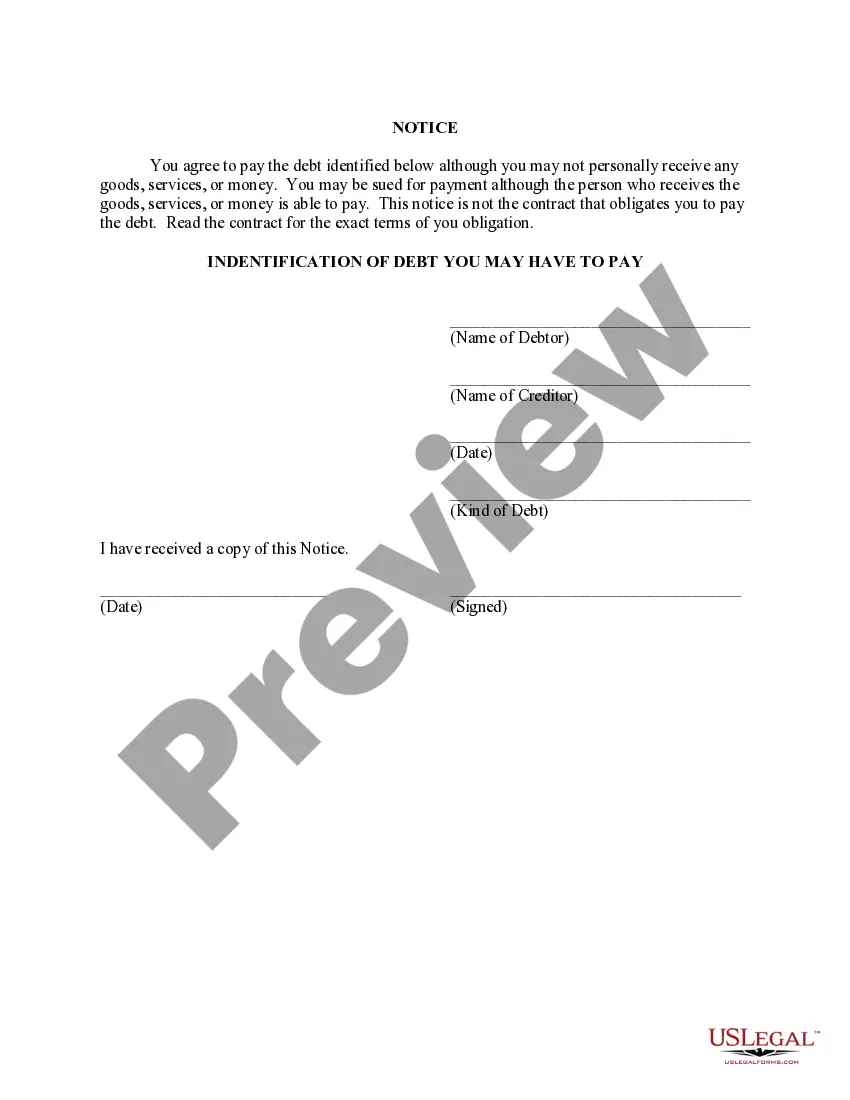

- Initial, ensure you have chosen the right type for the area/area. You may look over the form using the Review button and read the form description to make sure it is the right one for you.

- When the type does not satisfy your expectations, make use of the Seach area to get the proper type.

- When you are certain that the form would work, click on the Acquire now button to have the type.

- Select the rates strategy you need and enter the essential information. Create your accounts and pay money for the order using your PayPal accounts or Visa or Mastercard.

- Select the document structure and down load the legitimate document design to your system.

- Total, revise and produce and indicator the acquired Idaho Seller's Affidavit of Nonforeign Status.

US Legal Forms is definitely the biggest local library of legitimate varieties where you can see various document web templates. Utilize the service to down load appropriately-produced paperwork that stick to status requirements.

Form popularity

FAQ

The seller (transferor) gives the transferee a certification stating, under penalties of perjury, that the transferor is not a foreign person. The certification should contain the transferor's name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

Certification of Non-Foreign Status FIRPTA is the Foreign Investment in Real Property Act. If you are selling real estate in the United States, the IRS requires certain disclosures to avoid non-U.S. Persons from escape U.S. Tax on the sale of U.S. Real Estate.

The Seller's Affidavit of Non-Foreign Status ( AS-14) is used to document the exemption if the Seller is not a NRA. This can be signed by a: US citizen; US green card holder; or. Non-citizen who meets the substantial presence test (based on the number of days actually present in the US).

BASIC RULES UNDER FIRPTA If the seller is a foreign entity or person, the buyer must withhold the 10% and remit the tax to the IRS within 20 days of the date of closing. If the buyer fails to do so, the buyer is liable to the IRS for the tax that should have been withheld plus penalties and interest.

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.

With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.