Idaho Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

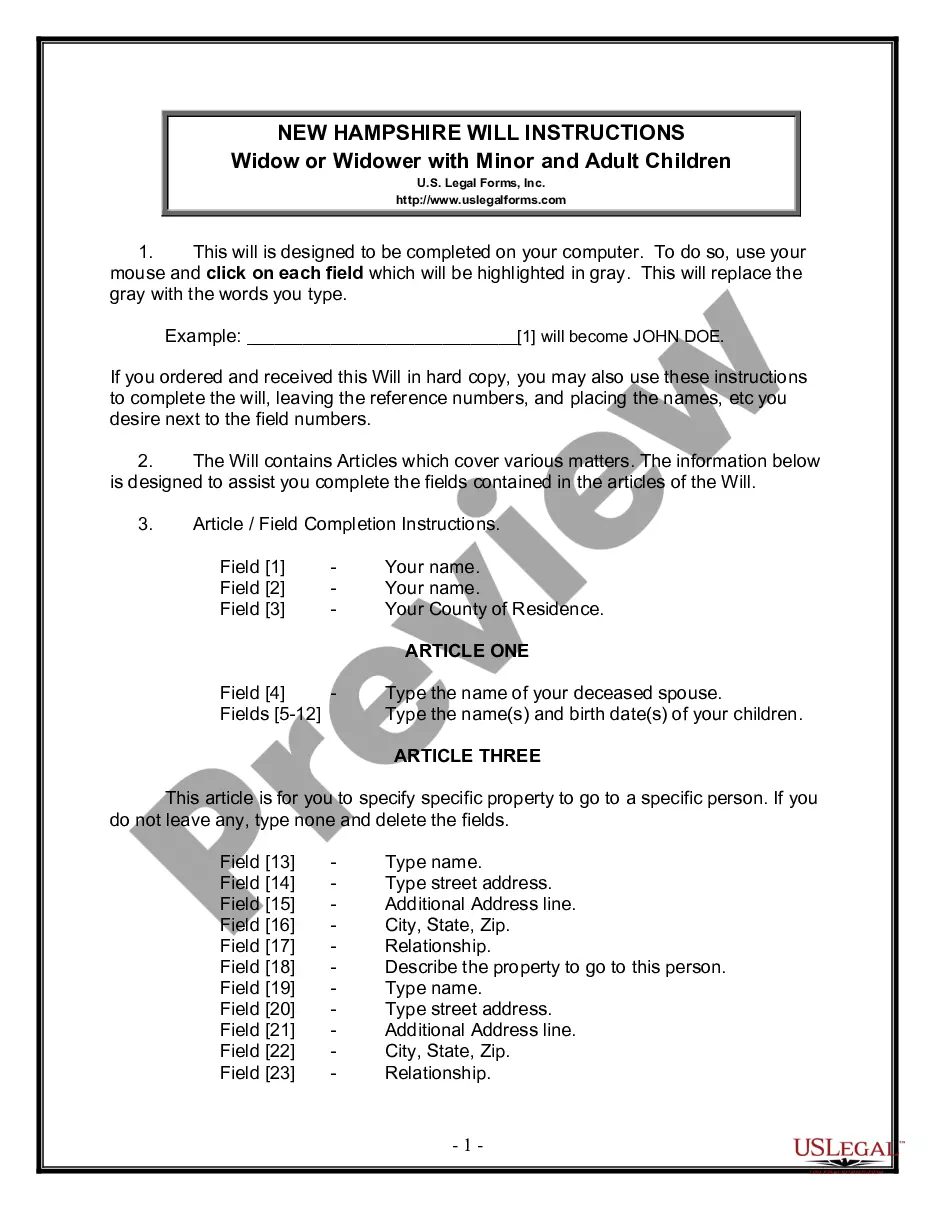

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

If you need to finish, download, or create approved document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site's simple and convenient search feature to locate the files you require. Various templates for professional and personal purposes are organized by categories and claims or keywords.

Utilize US Legal Forms to quickly find the Idaho Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions with just a few clicks.

Every legal document template you acquire is permanently yours. You have access to each form you downloaded in your account. Visit the My documents section and choose a form to print or download again.

Compete and download, and print the Idaho Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions with US Legal Forms. There are millions of professional and state-specific forms available for your commercial or personal requirements.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Download button to acquire the Idaho Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have chosen the form for the appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to check the outline.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After locating the desired form, click the Buy now button. Choose the pricing plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account for the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Idaho Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

Form popularity

FAQ

While a buy-sell agreement provides many benefits, it can have drawbacks. For instance, it may require ongoing maintenance and updates to reflect changes in business valuations. Additionally, not having the proper structure in an Idaho Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions may lead to disputes among shareholders if terms are unclear. It’s essential to draft this agreement carefully to address all potential challenges.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

The creation of buy-sell agreements involves a certain amount of future-thinking. The parties must think about what could, might, or will happen and write an agreement that will work for all sides in the event an agreement is triggered at some unknown time in the future.

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

Some of the common triggers include death, disability, retirement or other termination of employment, the desire to sell an interest to a non-owner, dissolution of marriage or domestic partnership, bankruptcy or insolvency, disputes among owners, and the decision by some owners to expel another owner.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.