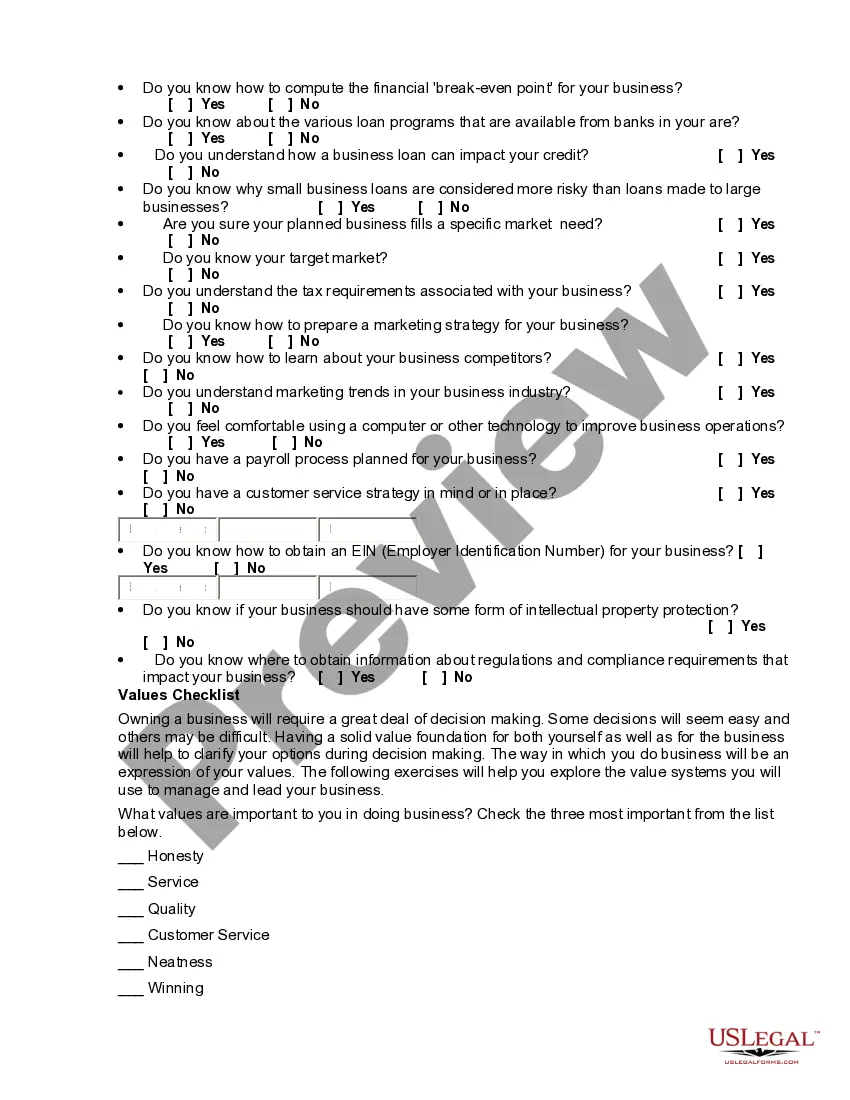

Are you ready to start a business? This assessment tool is designed to help you better understand your readiness for starting a small business. It will prompt you with questions and assist you in evaluating skills, characteristics and experience, as they relate to your being prepared for starting a business.

Idaho Personal Strengths and Weaknesses - Owning a Small Business

Description

How to fill out Personal Strengths And Weaknesses - Owning A Small Business?

Locating the appropriate legal document template may feel like a challenge. Certainly, there are numerous designs accessible online, but how do you obtain the legal format you need? Visit the US Legal Forms website. The service offers a wide range of templates, including the Idaho Personal Strengths and Weaknesses - Owning a Small Business, which you can utilize for both business and personal purposes.

All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already a member, Log In to your account and then click the Download button to retrieve the Idaho Personal Strengths and Weaknesses - Owning a Small Business. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents tab in your account and obtain another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Idaho Personal Strengths and Weaknesses - Owning a Small Business. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Utilize the service to download professionally-crafted documents that adhere to state regulations.

- First, ensure you have chosen the correct form for your city/county.

- You can review the form by clicking the Review button and read the form description to confirm it is the right fit for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Buy now button to purchase the form.

- Select the pricing plan you desire and fill in the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Incorporation requirements are set out in the Idaho Business Corporation Act and the Idaho Nonprofit Corporation Act, available from the Secretary of State. A one-time fee of $100 is required for business corporations ($120 if the application is handwritten) or $30 for nonprofit corporations.

Creating an Idaho business of your own can be challenging. You will need adequate funding, time, personal support, and professional support in order to move forward successfully with your entrepreneurial dreams.

Idaho. Like Mississippi, Idaho's per capita GDP damages this state's position as one of the best states to start a business. The education level and the availability of employees are both on the low end in Idaho, too.

Thumbtack's survey found Idaho to be the easiest place to start a business. You could have a legally operating business in a matter of a few hours here, claims a marketing consultant from Boise. Idaho offers straightforward and thorough online resources, top-level training and networking programs and scored the No.

How much does it cost to form an LLC in Idaho? The Idaho Secretary of State charges $100 to file the Certificate of Organization online and $120 to file by mail. You can reserve your LLC name with the Idaho Secretary of State for $20.

Incorporation requirements are set out in the Idaho Business Corporation Act and the Idaho Nonprofit Corporation Act, available from the Secretary of State. A one-time fee of $100 is required for business corporations ($120 if the application is handwritten) or $30 for nonprofit corporations.

5. Boise, Idaho. Boise ranks second for population growth and third for both job creation and net business creation, according to Inc. Local startups have seen a recent influx in funding, thanks in part to successful startups like Lovevery.

To Start a Business in Idaho, Follow These StepsChoose the Right Business Idea.Plan Your Idaho Business.Get Funding.Choose a Business Structure.Register Your Idaho Business.Set up Banking, Credit Cards, & Accounting.Get Insured.Obtain Permits & Licenses.More items...?

Idaho. Like Mississippi, Idaho's per capita GDP damages this state's position as one of the best states to start a business. The education level and the availability of employees are both on the low end in Idaho, too.