Idaho Requisition Slip

Description

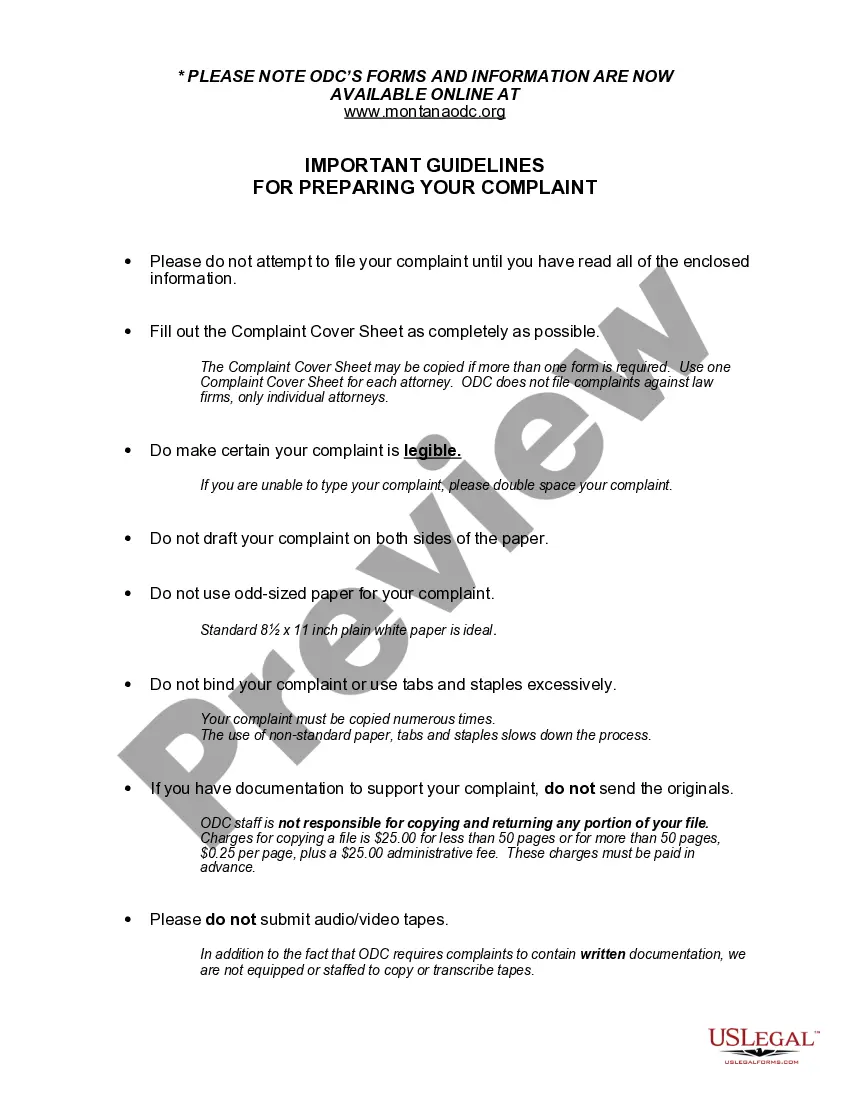

How to fill out Requisition Slip?

You are capable of spending time online searching for the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal templates that are assessed by experts.

You can download or print the Idaho Requisition Slip from my service.

If available, utilize the Review option to examine the document template as well. If you wish to find another version of the form, make use of the Search field to locate the template that suits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can fill out, modify, print, or sign the Idaho Requisition Slip.

- Each legal document template you purchase is yours indefinitely.

- To acquire another copy of a purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your county/region of preference.

- Review the form description to confirm you have selected the appropriate one.

Form popularity

FAQ

Neglecting to file state taxes in Idaho can lead to penalties, interest charges, and potentially legal consequences. It is essential to fulfill your tax obligations to avoid any issues. If you haven’t filed yet, consider utilizing the Idaho Requisition Slip to ensure you complete your filing correctly and on time.

Yes, you are typically required to file a tax return in Idaho if your income exceeds the state’s established limits. Even if you work outside of Idaho but have income sourced from Idaho, you may still need to file. The Idaho Requisition Slip can help you gather the necessary information for your filing.

Whether you are required to file an Idaho tax return depends on your income levels, residency status, and other factors. If you meet the local income thresholds, then yes, filing is necessary. To simplify the filing process, consider using the Idaho Requisition Slip found on uslegalforms.

You can mail Idaho state tax forms and documents to the address specified on the form itself. Typically, the Idaho Requisition Slip includes specific instructions on where to send your completed forms. If you're unsure, the Idaho State Tax Commission's website provides clear guidance on mailing addresses.

Filing a tax return is mandatory for most individuals in Idaho, especially if you meet certain income thresholds. If you have income from a job, self-employment, or other sources, you likely need to file. Using the Idaho Requisition Slip can streamline this process and help you navigate your obligations effectively.

To file Idaho 967, you will need to complete the appropriate form and attach any required documentation. You can obtain the Idaho Requisition Slip from the Idaho State Tax Commission's website or through a tax preparation service. After completing the form, submit it electronically or by mail to the designated address provided on the form.

Form 910 Idaho is a form used for various legal and administrative purposes, including requests for records or information within state government. It is crucial to provide accurate details for proper processing. To enhance your submission and increase the chances of prompt response, consider using an Idaho Requisition Slip.

To request a vehicle record in Idaho, you must complete the appropriate form and submit it to the Department of Motor Vehicles. Provide relevant details such as your vehicle's VIN and your identification. Utilizing an Idaho Requisition Slip can facilitate the process, making it easier to obtain your vehicle records.

Idaho 910 refers to a specific form used in various administrative processes within the state, including applications for certain benefits or services. This form requires clarity in the information provided to avoid delays. If you need to submit the Idaho 910 form, have an Idaho Requisition Slip ready to ensure all required documents accompany your application.

To quickly secure proof of residency in Idaho, gather the necessary documentation, such as a utility bill or bank statement, showing your address. Submitting these documents online or in person can expedite the verification process. Also, utilizing an Idaho Requisition Slip might speed up requests for official residency proof.