Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

If you need to finalize, acquire, or create sanctioned record formats, utilize US Legal Forms, the largest selection of authorized documents, which are available online.

Employ the site's straightforward and user-friendly search to find the documentation you require.

Different formats for business and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your pricing plan and enter your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to locate the Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping in just a few clicks.

- If you are currently a US Legal Forms subscriber, Log In to your account and click the Download button to obtain the Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

- You can also find documents you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

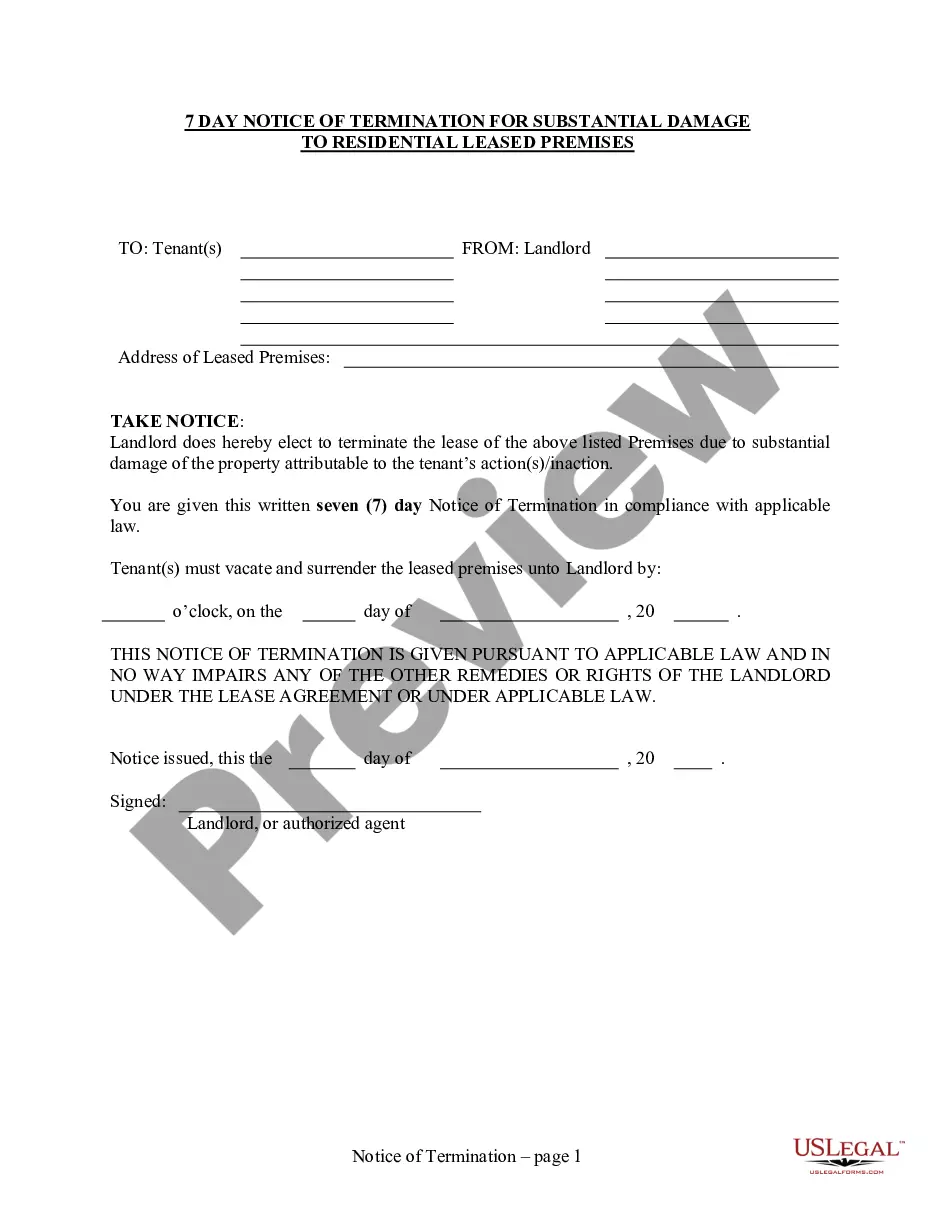

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find additional versions of your legal document template.

Form popularity

FAQ

Politely terminating a client involves clear and respectful communication. Reference your Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping to adhere to legal obligations. Start the conversation positively, then present your decision, followed by an explanation to help them understand. Providing resources or recommendations can also ease the transition and leave a positive impression.

To inform a customer that you will no longer service them, consider creating a polite message based on your Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. Start with a friendly greeting and express your gratitude for their business. Clearly state your decision and the reason behind it, offering assistance in their transition if appropriate. This thoughtful approach helps maintain goodwill and professionalism.

To fire your bookkeeper, start by consulting your Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. Contact your bookkeeper and express your decision respectfully, providing specific reasons to maintain transparency. Offering a clear path forward can make the transition easier for both parties. Additionally, consider issuing a formal termination letter to document the end of the professional relationship.

When you need to fire a bookkeeping client, it's important to act professionally. First, review your Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping to ensure compliance with any termination clauses. Then, clearly communicate your decision in writing, explaining the reasons without being confrontational. Finally, ensure the client receives all necessary documents and information they need to transition smoothly.

To fire an accounting client, approach the situation with professionalism. Clearly outline your reasons for ending the relationship during a private meeting. You might also offer guidance on the next steps they can take for their accounting needs. Implementing an Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can streamline this process and safeguard both parties' interests.

Ending a relationship with an accountant should be handled tactfully. Choose a suitable time for discussion to express your decision and the reasons behind it. Core to this process is clear communication, and it helps to provide closure for both parties. Referring to an Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can ensure that all contractual obligations are addressed.

Starting a CPA tax firm begins with thorough planning and understanding the regulations. You’ll need to establish a clear business model that aligns with your strengths and target market. Utilizing an Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can be advantageous for creating an organized framework for advising clients as your firm grows.

Respectfully firing a client means being direct yet considerate. Arrange a private discussion to address the issues that prompted your decision. Offer to assist them in finding a suitable replacement if applicable. An Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can guide this conversation and ensure all necessary steps are taken.

Firing your tax accountant requires a delicate approach. Start by expressing your concerns and clarifying your decision. It’s crucial to keep the communication straightforward and respectful, as professionalism is key. To facilitate the process, the Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping provides a framework for ending professional relationships smoothly.

Dropping a bookkeeping client involves a professional and transparent conversation. Relay your reasons, focusing on the need for a better client fit. You might also suggest alternative options they can explore, which shows your commitment to their success. An Idaho General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can ease this transition.