Idaho Computer Software Lease with License Agreement

Description

How to fill out Computer Software Lease With License Agreement?

If you seek to aggregate, download, or print authorized document templates, utilize US Legal Forms, the foremost collection of legal forms, which is accessible online.

Employ the website's straightforward and convenient search to find the documents you require. Various templates for business and individual purposes are categorized by types and categories, or by keywords.

Use US Legal Forms to find the Idaho Computer Software Lease with License Agreement with just a couple of clicks.

Every legal document template you obtain is yours permanently. You will have access to each form you saved within your account. Visit the My documents section and select a form to print or download again.

Complete and download, and print the Idaho Computer Software Lease with License Agreement with US Legal Forms. There are numerous professional and state-specific templates you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click the Download option to access the Idaho Computer Software Lease with License Agreement.

- You can also retrieve forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form relevant to the appropriate city/region.

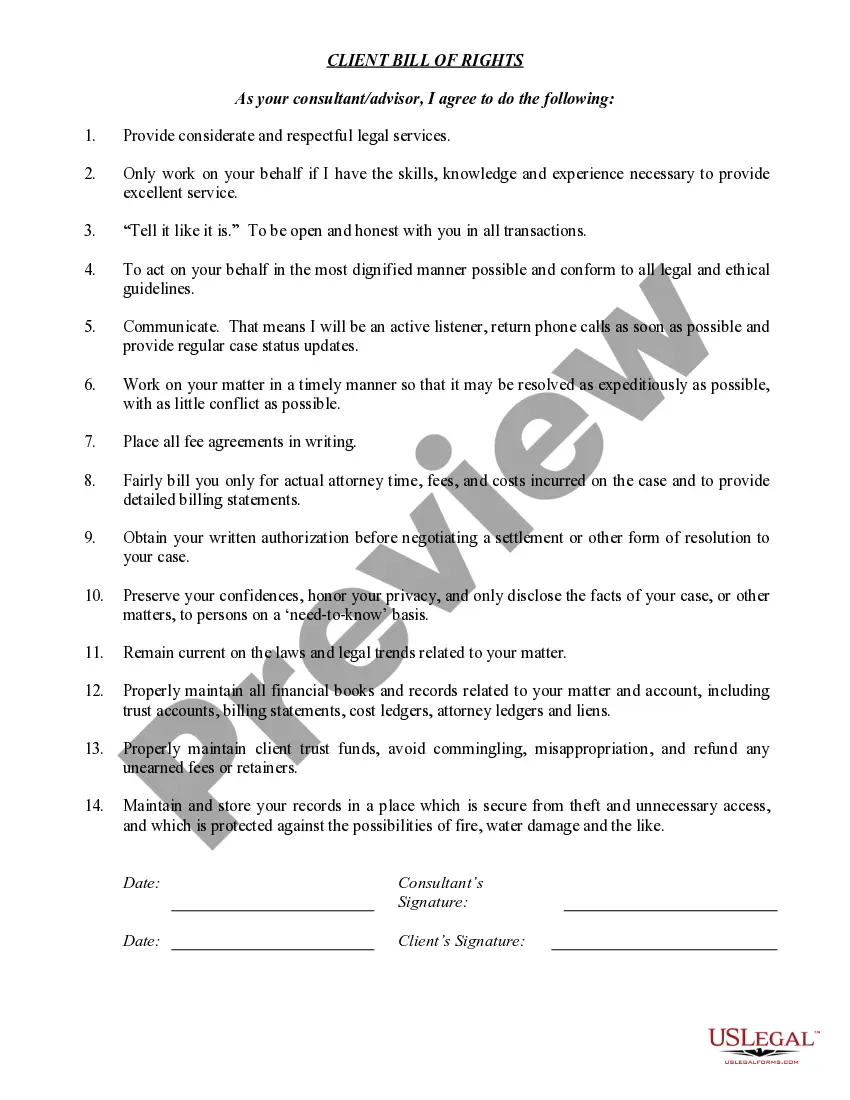

- Step 2. Use the Preview option to view the form's content. Do not forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other templates in the legal form format.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Idaho Computer Software Lease with License Agreement.

Form popularity

FAQ

In Idaho, the sales tax for software as a service (SaaS) is currently under consideration and can be somewhat complex. Generally, SaaS may not be subject to sales tax unless certain conditions apply, such as being part of an Idaho Computer Software Lease with License Agreement. Staying informed about changes in tax legislation can help you navigate this matter effectively.

Yes, software can be subject to sales tax in Idaho, particularly when it is sold with a license agreement as part of an Idaho Computer Software Lease with License Agreement. However, if you are using software as a service (SaaS), the sales tax implications may vary. It's crucial to review the specific terms of your license agreement and consult relevant state tax laws to ensure compliance.

Software is generally taxable in Idaho, especially if it is sold as a tangible good. However, the taxation may differ based on whether the software is delivered physically or electronically. Understanding your Idaho Computer Software Lease with License Agreement can help clarify whether your software obligations fall under taxable categories. For accurate information, consult with legal or tax professionals.

In Idaho, many services are subject to sales tax, including those related to certain repairs and maintenance. However, not all services are taxable, and the specifics can vary based on the type of service provided. If your services are bundled with an Idaho Computer Software Lease with License Agreement, it's crucial to determine the tax implications. A thorough review of these details can help ensure compliance.

Idaho does not impose sales tax on specific categories of items and services. Notably, certain food items, prescription drugs, and some services such as educational or medical services are exempt from taxation. As you explore your Idaho Computer Software Lease with License Agreement, ensure to identify what components may qualify for these exemptions. This knowledge can save you costs in the long run.

Rentals in Idaho can be taxable depending on the nature of the rental agreement. For instance, rentals involving tangible goods typically incur sales tax. If your rental includes a software component, consulting the Idaho Computer Software Lease with License Agreement can clarify tax responsibilities. Proper understanding can help you navigate the intricacies of Idaho's tax law.

In Idaho, leases are generally considered taxable under certain circumstances. It is vital to determine if the lease falls under the category of tangible personal property. If your Idaho Computer Software Lease with License Agreement qualifies, it may be subject to sales tax. Always consult a tax professional for specific guidance on your situation.

The income tax rate in Idaho varies based on individual earnings, with rates structured in brackets. The state has progressive tax rates that apply depending on the amount earned. If you're planning to sign an Idaho Computer Software Lease with License Agreement, understanding the income tax implications can contribute to more informed financial decisions.

Idaho generally taxes income sourced within the state, while worldwide income is not subjected to state tax. This means that if you earn income outside of Idaho, it typically would not be included in your state tax calculations. However, if you're involved in an Idaho Computer Software Lease with License Agreement, understanding your tax obligations can help clarify any complex income scenarios.

Idaho imposes an income tax rate on pass-through entities (PTE) that can vary depending on the entity's earnings. This structure allows the income to pass through to the owners, where it is taxed at their individual rates. If you are engaging in an Idaho Computer Software Lease with License Agreement as a PTE, being aware of tax implications aids in effective financial management.