Idaho Demand for Collateral by Creditor

Description

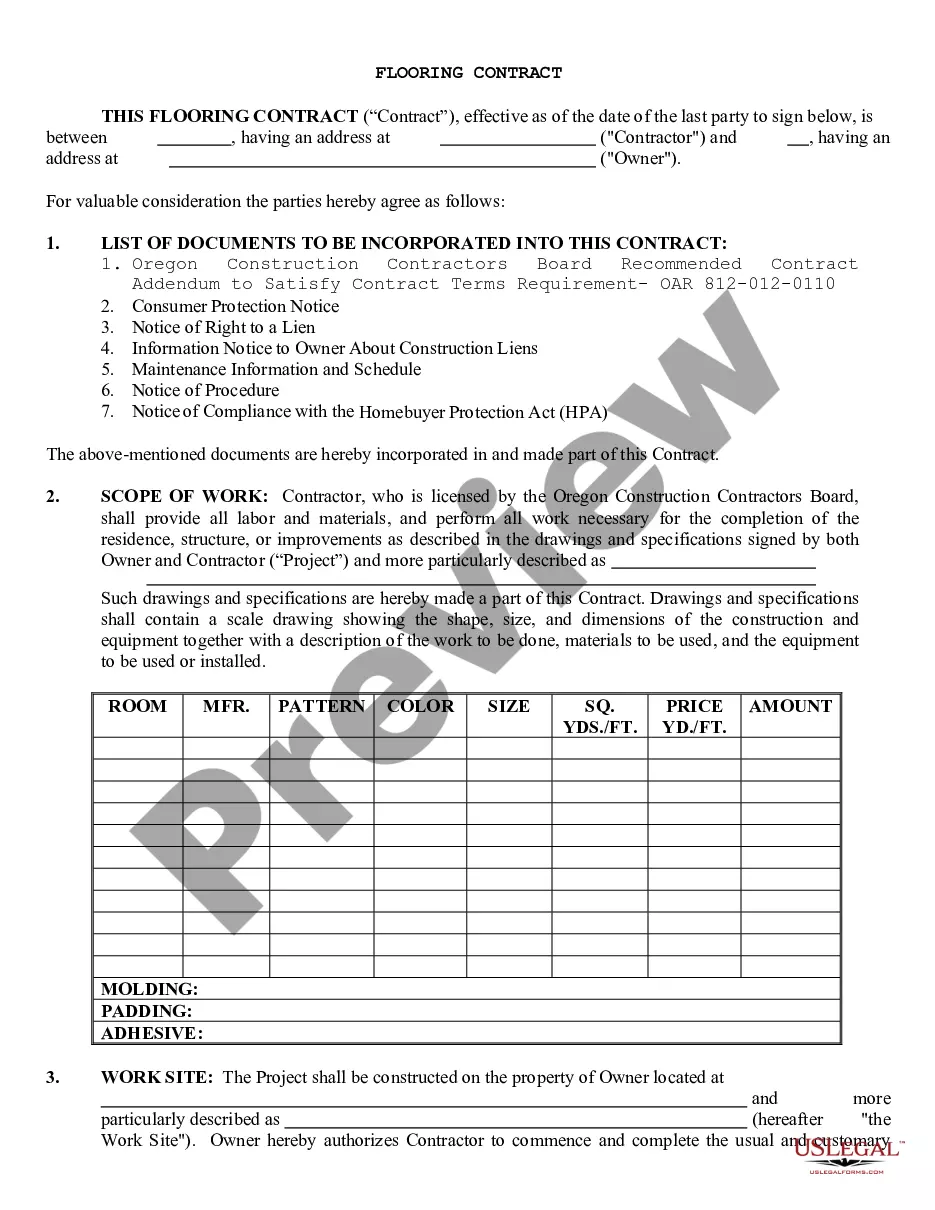

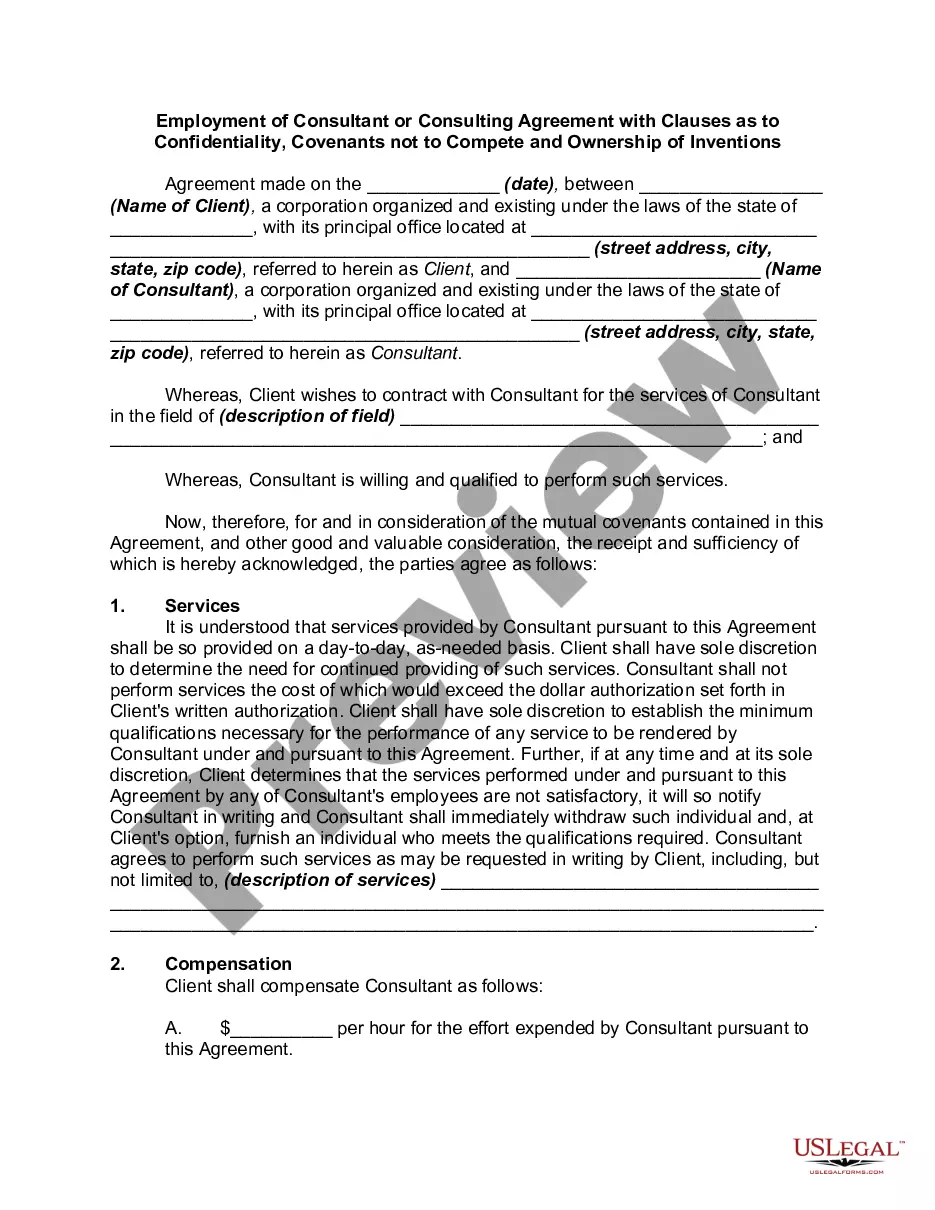

How to fill out Demand For Collateral By Creditor?

You can dedicate hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast selection of legal forms that are reviewed by experts.

You can obtain or print the Idaho Demand for Collateral by Creditor from my service.

If available, use the Preview button to examine the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, edit, print, or sign the Idaho Demand for Collateral by Creditor.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of a purchased form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow these simple instructions below.

- First, ensure you have selected the correct document template for the county/area of your choice.

- Review the form details to confirm you have chosen the right one.

Form popularity

FAQ

A collateral support program aims to assist borrowers in meeting their collateral requirements for loans. This program provides additional security options for creditors to reduce their risk while facilitating financing for borrowers. By enabling easier access to loans, the collateral support program strengthens the financial relationship between creditors and borrowers, especially within the framework of Idaho Demand for Collateral by Creditor.

The process by which a creditor takes possession of collateral is known as repossession. This process occurs after the creditor has issued an Idaho Demand for Collateral by Creditor, indicating that the borrower has defaulted on their obligations. Through repossession, the creditor can recover the owed amount by selling the secured asset, thereby alleviating some financial losses.

First-time misdemeanors in Idaho may result in jail time, but it is not guaranteed. The sentence often considers the nature of the offense, your criminal history, and other circumstances. If your situation relates to an Idaho Demand for Collateral by Creditor, understanding the potential legal outcomes can help you prepare for the next steps in your case.

Idaho Code 28-9-203 addresses the rights and obligations of parties in secured transactions. This includes the specifics of how collateral can be claimed and the rights of creditors. If you are confronting an Idaho Demand for Collateral by Creditor, knowing this code can help you navigate your rights and responsibilities effectively.

Idaho Code 9-203 discusses the rules of evidence relating to the admissibility of documents in legal proceedings. This code is crucial for ensuring that only relevant and credible evidence is presented during a trial. When faced with an Idaho Demand for Collateral by Creditor, understanding how evidence is evaluated can significantly impact your case.

Idaho Statute 49-2417 pertains to the rules regarding commercial driver's licenses (CDL) and the penalties for violations. This law outlines the consequences for different driving offenses that relate to CDL holders. If you're involved in legal matters touching on this statute, it may connect to broader discussions about financial responsibilities, such as an Idaho Demand for Collateral by Creditor.

Idaho Code Title 9 covers laws related to civil procedure and actions in the state. This includes guidelines for filing lawsuits, conducting trials, and appealing decisions. Understanding Title 9 can be vital when dealing with an Idaho Demand for Collateral by Creditor, as these procedures affect how claims are handled in court.

Attempted strangulation in Idaho is classified as a felony, punishable by a substantial prison sentence. The specific penalties depend on various factors, including prior convictions and the circumstances of the crime. Knowing the implications of such charges is crucial, especially in cases where an Idaho Demand for Collateral by Creditor may arise from related incidents.

In Idaho, debt collectors generally have five years to collect unsecured debts. This time limit may vary depending on the nature of the debt, so it's essential to know the specific type involved. If you're facing an Idaho Demand for Collateral by Creditor, being aware of these timelines can help you respond effectively.

The collateral source rule in Idaho states that a plaintiff may receive compensation for damages from both their insurance and the defendant who caused those damages. It means that compensation from other sources does not reduce the recovery amount from the defendant. Understanding this rule is vital for those involved in legal disputes, especially regarding an Idaho Demand for Collateral by Creditor.