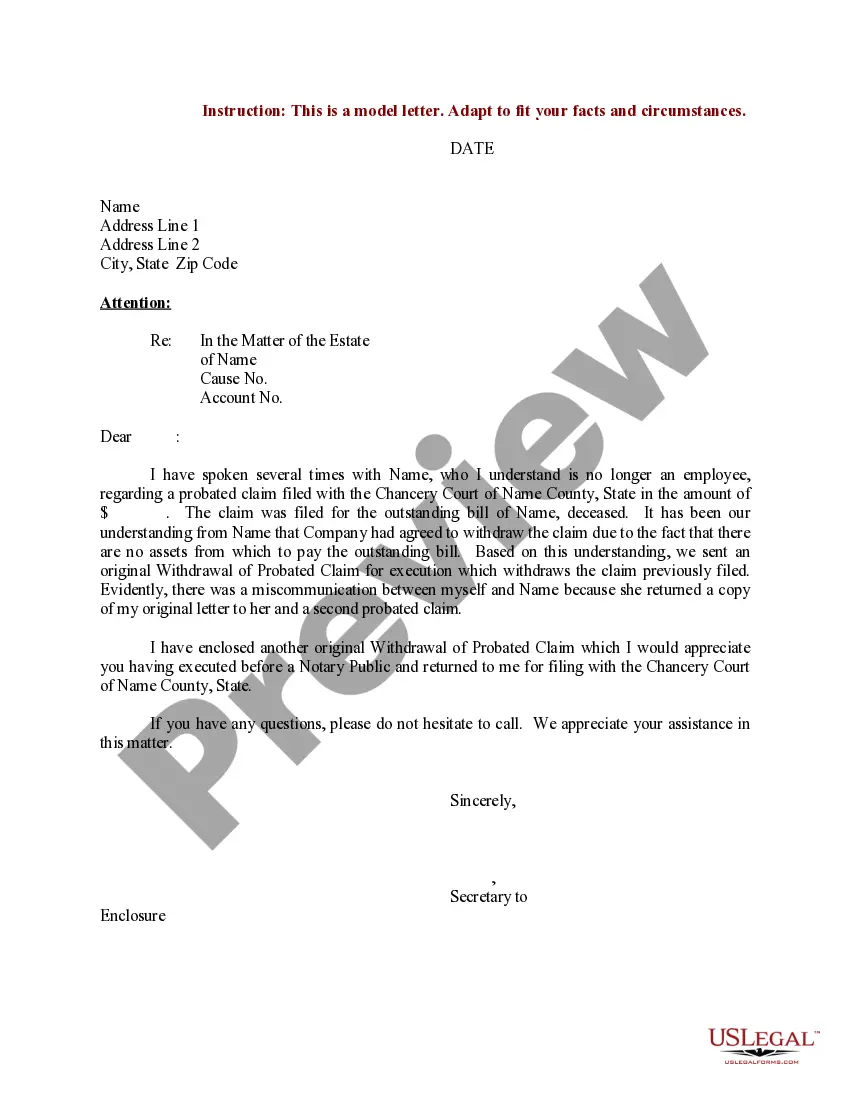

Idaho Sample Letter for Claim Settlement Against Decedent's Estate

Description

How to fill out Sample Letter For Claim Settlement Against Decedent's Estate?

US Legal Forms - among the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Idaho Sample Letter for Claim Settlement Against Decedent's Estate in just moments.

If you have an account, Log In and download the Idaho Sample Letter for Claim Settlement Against Decedent's Estate from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents tab of your profile.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finish the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Idaho Sample Letter for Claim Settlement Against Decedent's Estate. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Idaho Sample Letter for Claim Settlement Against Decedent's Estate with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If this is your first time using US Legal Forms, here are simple steps to help you get started.

- Make sure you have selected the correct form for your city/state.

- Click the Preview button to view the content of the form.

- Read the form description to ensure you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

Idaho probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

The Seven Steps in Idaho's Informal Probate Process Initiate the Probate Proceeding. ... Acceptance of the Application and Issuance of Letters. ... Notice to Heirs and Devisees. ... Notice to Creditors. ... Inventory of Estate. ... Distribution of Estate assets. ... Informal Verification Statement of Personal Representative Closing Estate.

I.C. § 15-3-1205. Letters Testamentary: The instrument by which a probate court approves the appointment of an executor under a will and authorizes the executor to administer the estate.

The first and the best way is when a person has a written last will and testament where they nominate who they want to appoint as their executor. This person could be a spouse, or a child, or other family member, or it could be a close family friend.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.

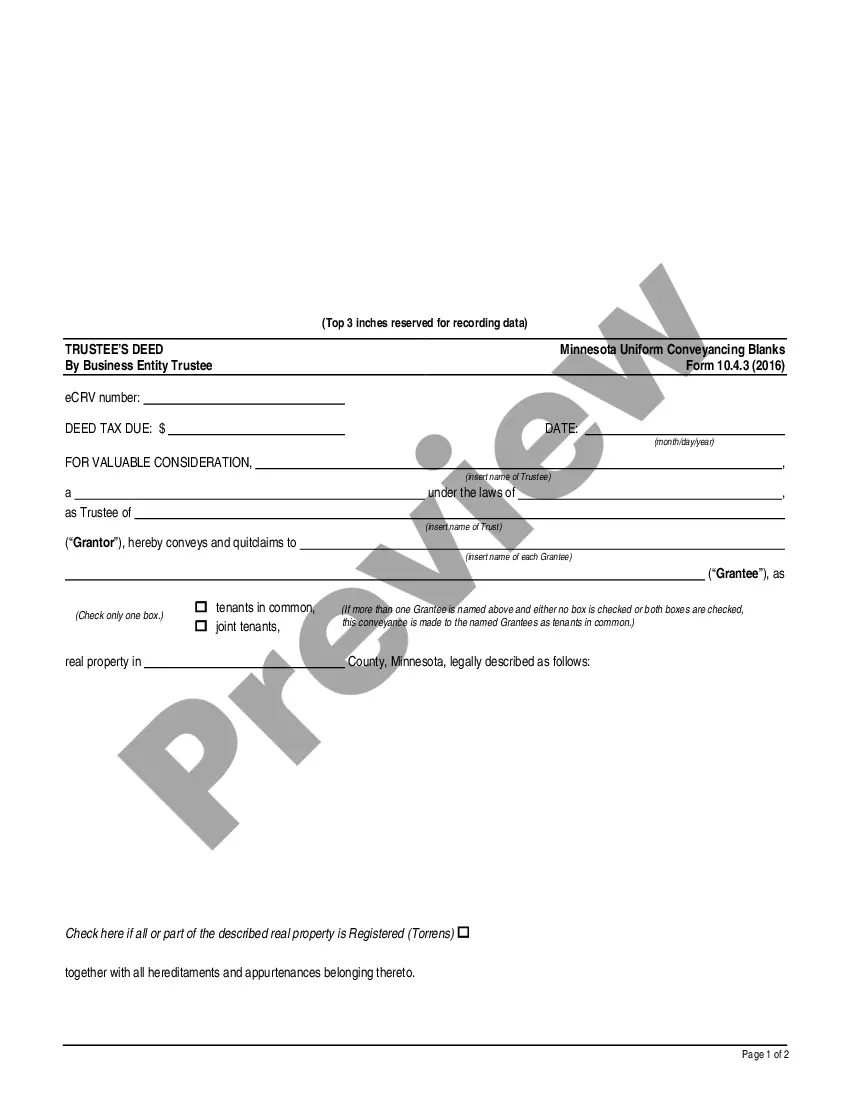

Trusts Can Avoid Probate A trust is an effective tool to avoid probate in Idaho. A trust can hold virtually any asset, including real property, bank accounts, and vehicles. A valid trust will transfer ownership of your property to yourself as the trustee.

As part of the probate process, letters testamentary are issued by your state's probate court. To obtain the document, you need a copy of the will and the death certificate, which are then filed with the probate court along with whatever letters testamentary forms the court requires as part of your application.