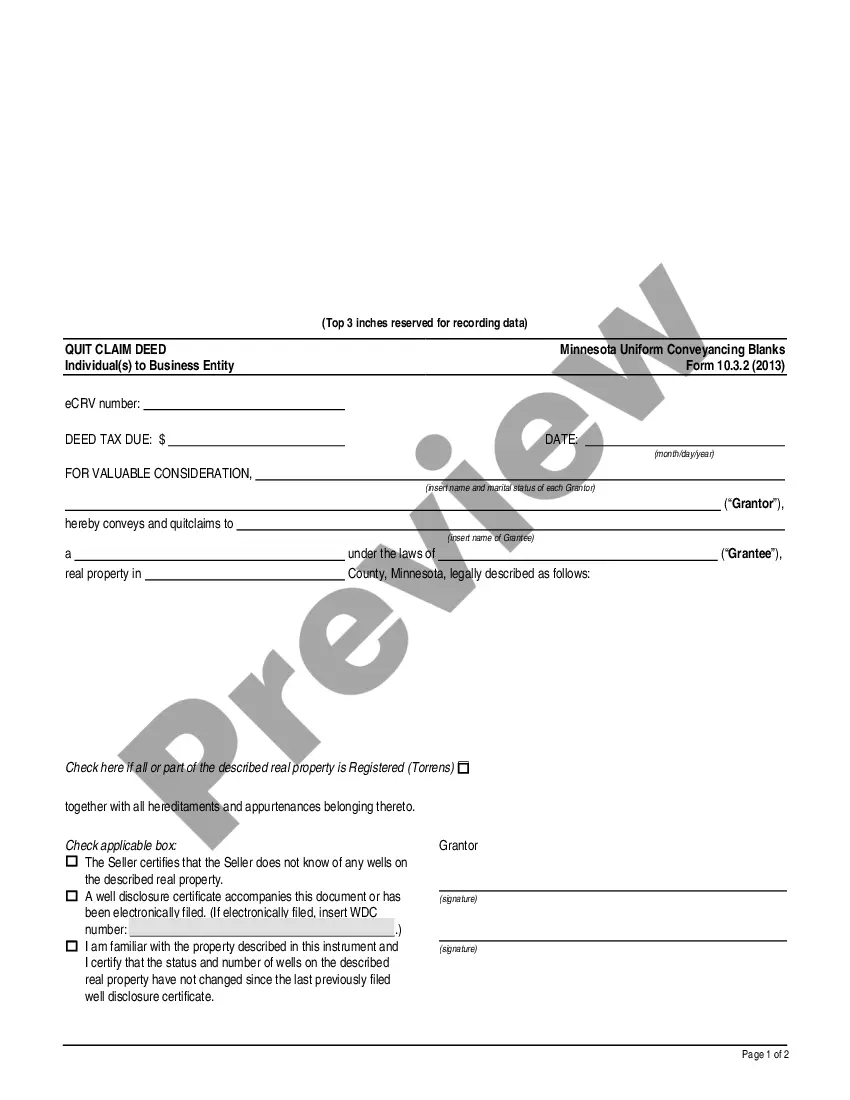

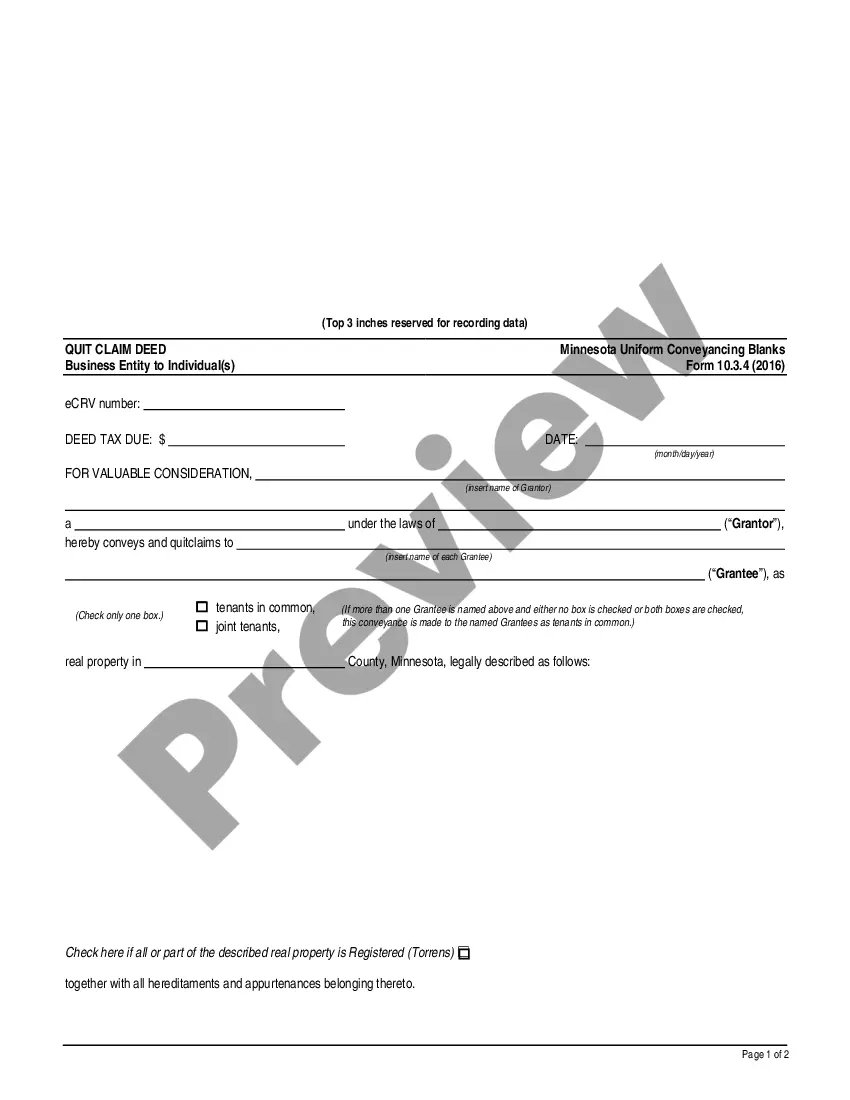

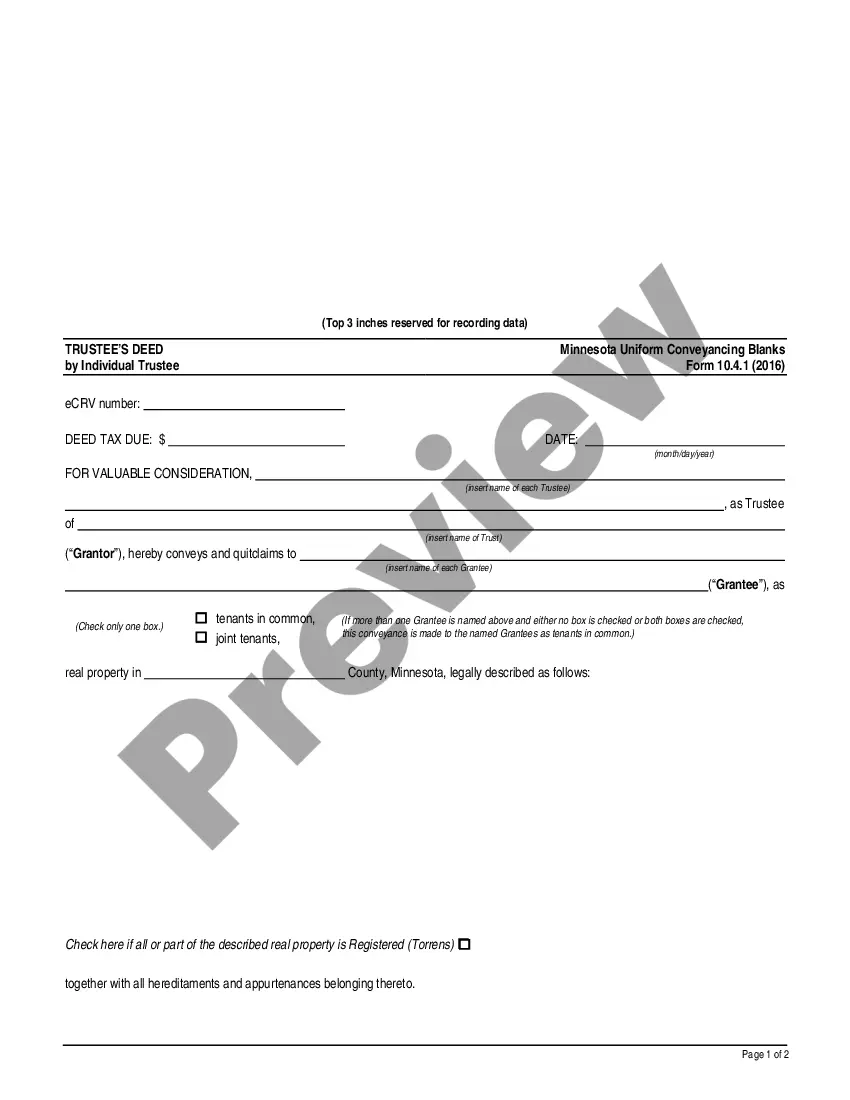

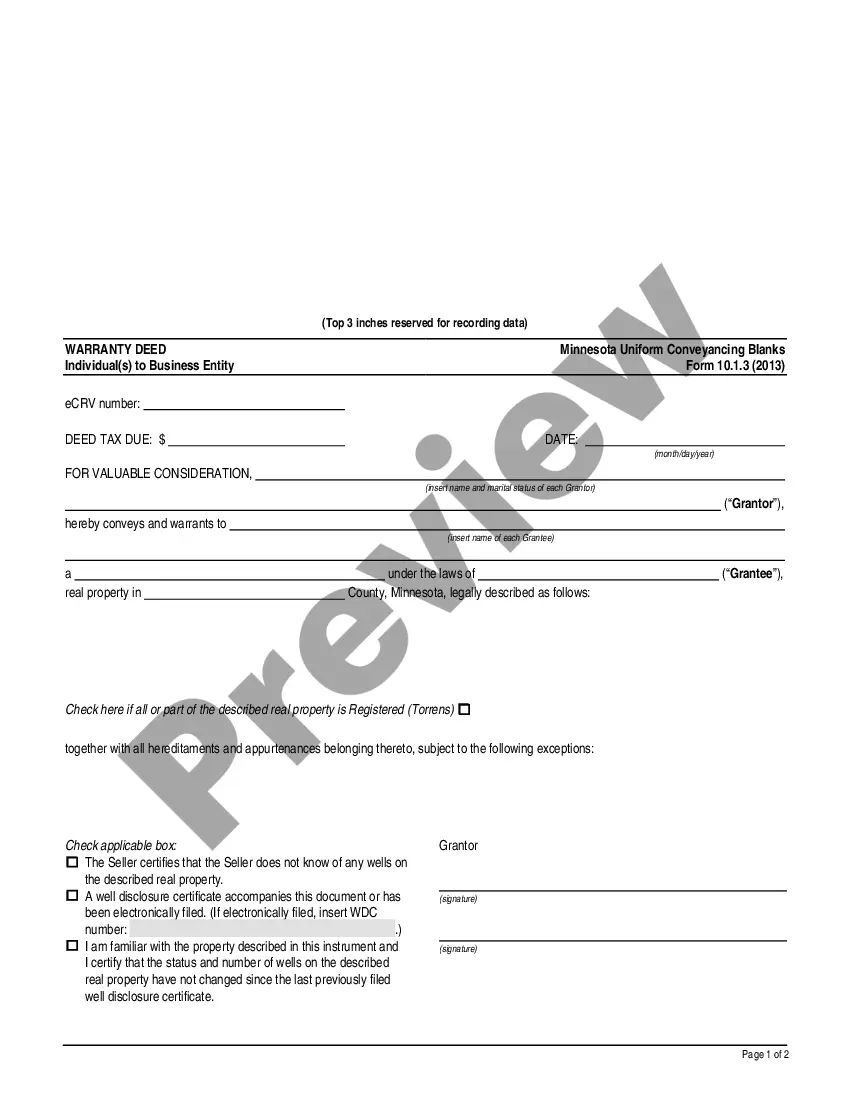

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3?

Obtain any template from 85,000 legal documents such as Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 online with US Legal Forms. Every template is crafted and refreshed by state-licensed attorneys.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the instructions below: Check the state-specific requirements for the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 you need to utilize. Review the description and preview the sample. Once you are assured that the template is what you require, click Buy Now. Select a subscription plan that fits your budget. Create a personal account. Make payment in one of two suitable methods: by card or via PayPal. Choose a format to download the file in; two options are available (PDF or Word). Download the document to the My documents tab. After your reusable template is downloaded, print it out or save it to your device.

- With US Legal Forms, you will consistently have prompt access to the appropriate downloadable sample.

- The service offers you access to documents and categorizes them to streamline your search.

- Utilize US Legal Forms to acquire your Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 quickly and effortlessly.

Form popularity

FAQ

To add a person to a deed in Minnesota, you will need to prepare a new deed that specifies both the current owner's name and the new person's name. After completing the deed, make sure it is signed, notarized, and filed with the county recorder’s office. The Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 can help you navigate this process efficiently, ensuring compliance with local laws.

Adding a name to a deed can create potential legal and financial complications. For example, it may expose the property to the new owner's creditors or impact tax liabilities. Thus, before proceeding, you should carefully consider the implications of transferring ownership and how the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 fits into your estate planning.

Adding a person to a house deed involves drafting a new deed that reflects both the current owner and the new individual. This deed should detail the property description, include both parties' names, and be properly executed and notarized. To facilitate this, consider using the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 to ensure a smooth transition in ownership.

To add a name to a deed in Minnesota, you need to prepare a new deed that includes the current owner's name and the name of the person you wish to add. This document must be signed, notarized, and recorded with the county recorder’s office. Utilizing the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 can simplify this process, ensuring all legal requirements are met.

A trustee deed and a trust deed serve different purposes in property transactions. A trustee deed is used to transfer property from a trustee to a beneficiary, while a trust deed creates a trust relationship for property management. Understanding the distinction is crucial when dealing with the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3, as it impacts how property rights are transferred and managed.

Yes, in Minnesota, all trustees typically need to sign a trust deed to ensure validity and enforceability. This requirement protects the interests of all parties involved and confirms the authority of the trustees. If you are using the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3, make sure each trustee adds their signature where indicated. This step is essential for maintaining clear ownership and trust management.

To properly fill out a quitclaim deed, begin with the accurate title and date at the top of the document. Clearly state the names of the parties involved and their roles, using the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 as a guide. Provide a complete legal description of the property being conveyed, and ensure the grantor signs the document in the presence of a notary. Afterward, file the deed with the local county office for proper record-keeping.

To complete a quit claim deed in Minnesota, start by obtaining the correct form, such as the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3. Fill in the details of the grantor and grantee, including their names and addresses. Specify the property being transferred, and ensure the document is signed by the grantor in front of a notary public. Finally, record the deed with the county recorder to make the transfer official.

Minnesota operates primarily as a deed of trust state, which means that property transactions often utilize deeds of trust rather than traditional mortgages. This system allows for a smoother foreclosure process, benefiting both lenders and borrowers. Understanding Minnesota's statutory framework, including the Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3, is crucial for anyone involved in real estate transactions. By using the correct forms and processes, you can navigate the legal landscape effectively.

In a trust arrangement, the property is technically owned by the trust, while the trustee manages it on behalf of the beneficiaries. The Minnesota Trustees Deed By Business Entity Trustee - UCBC Form 10.4.3 clarifies this structure, indicating that the trustee holds the title but acts in the best interests of the trust's beneficiaries. Therefore, the actual ownership resides with the trust, not the individual trustee. This distinction helps in understanding rights and responsibilities related to the property.