Idaho Direct Deposit Form for IRS

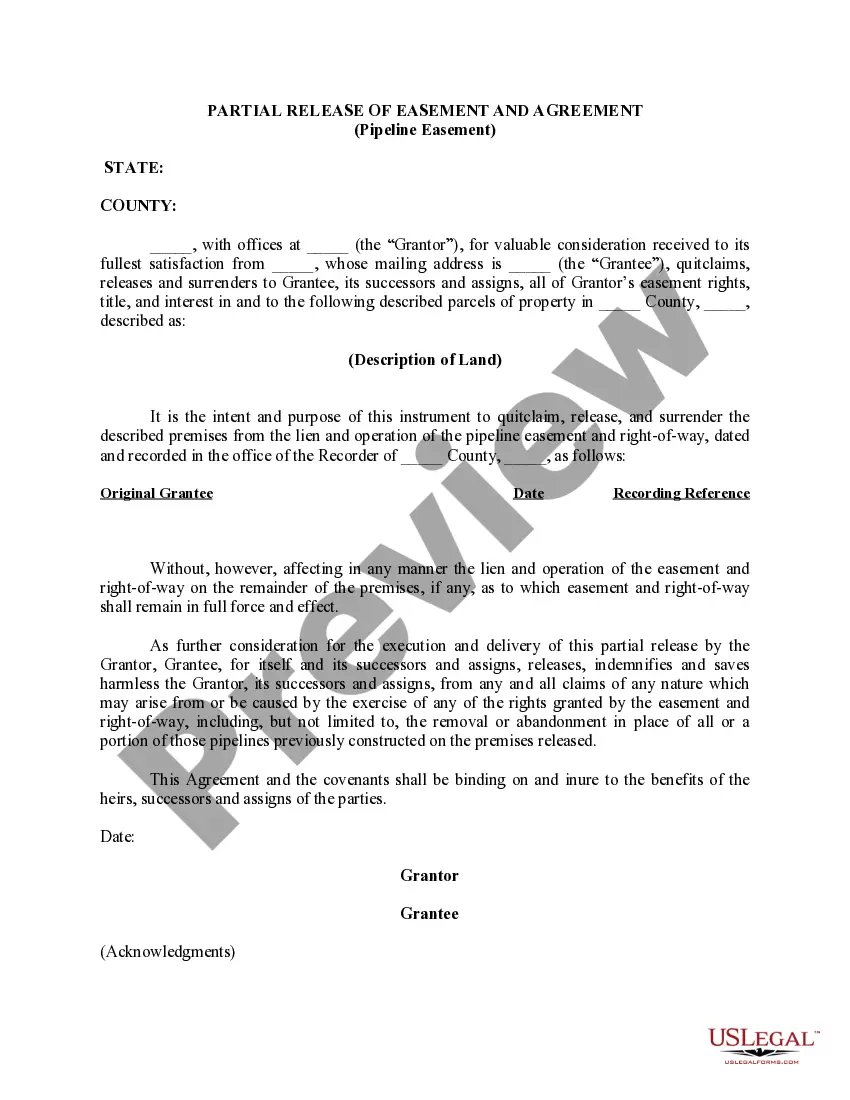

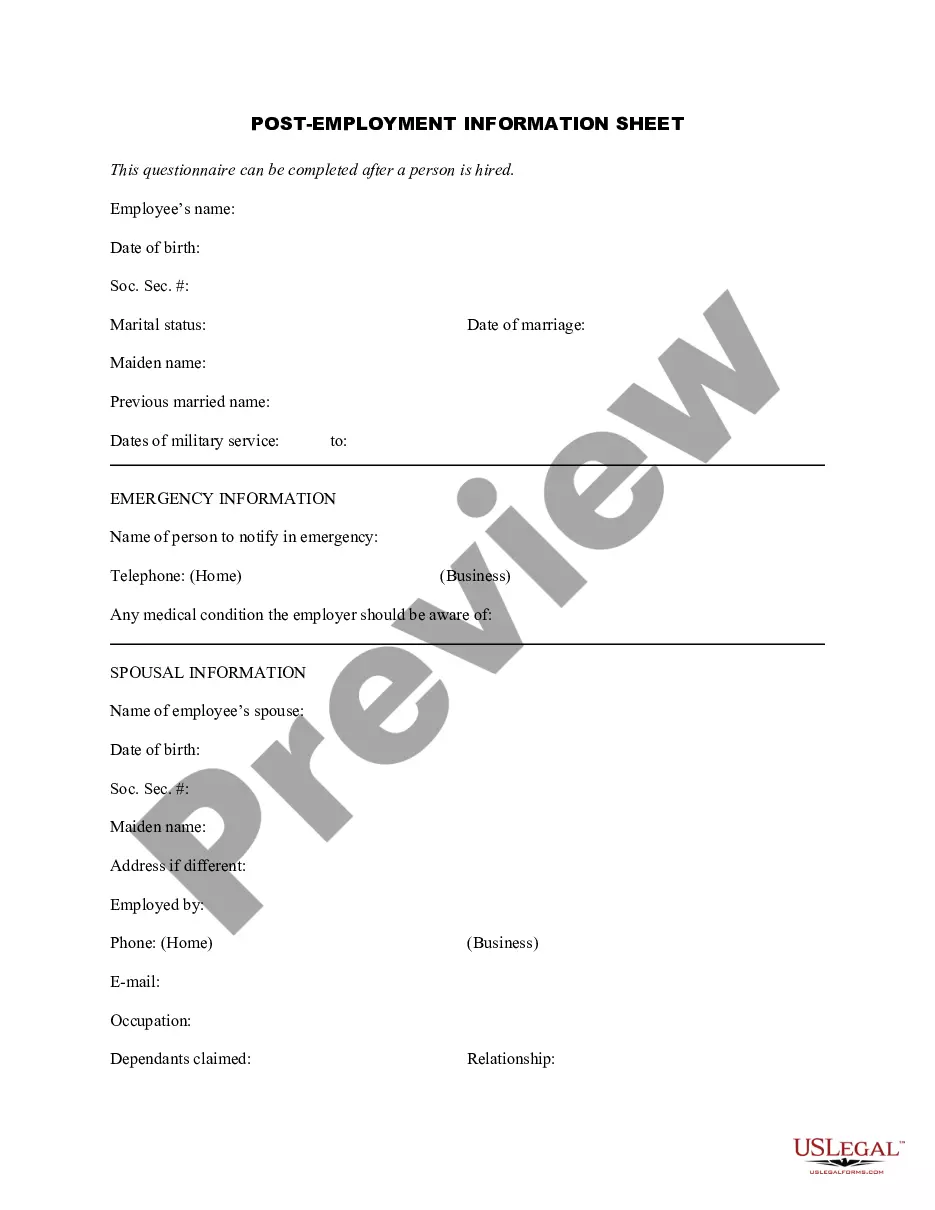

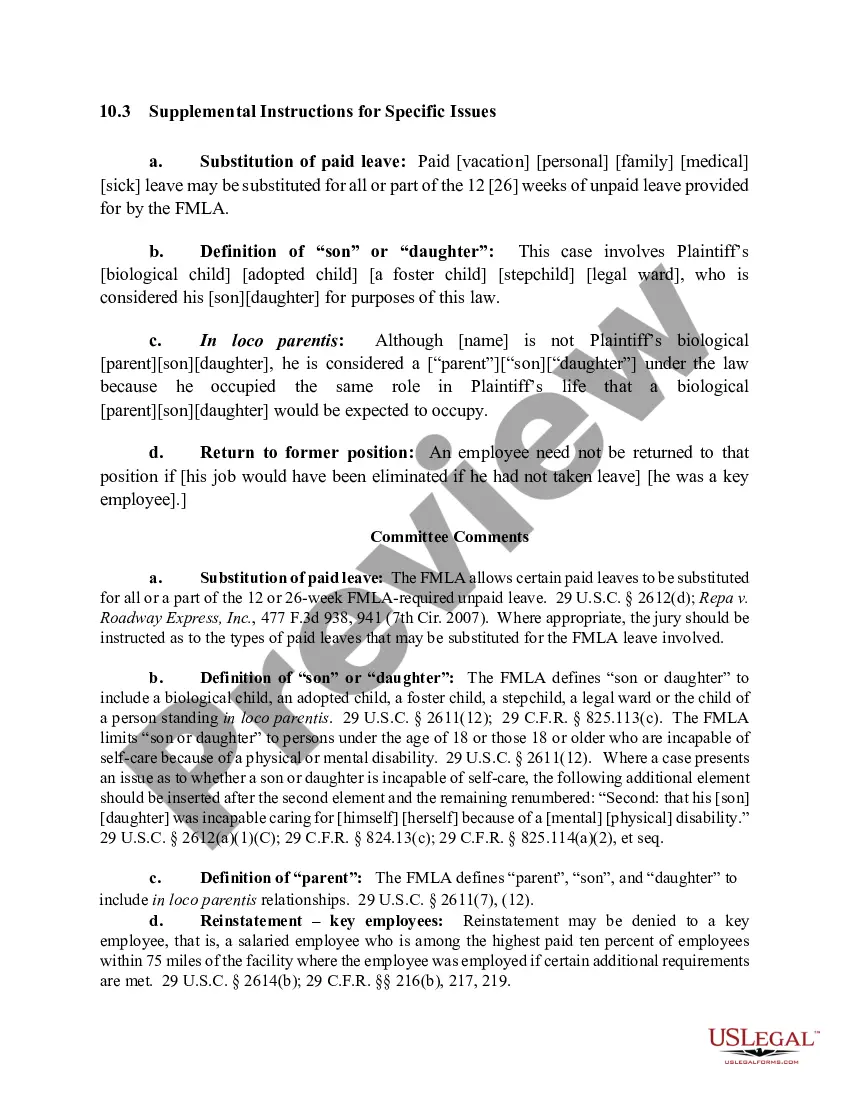

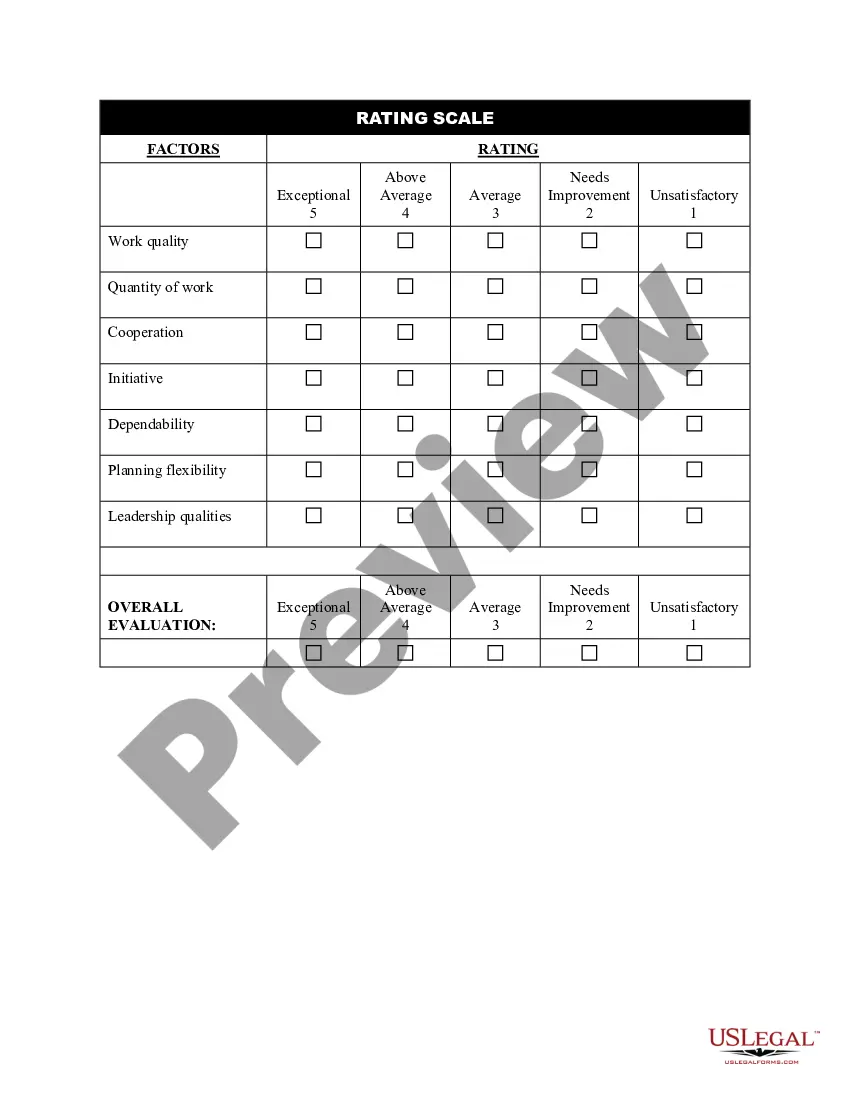

Description

How to fill out Direct Deposit Form For IRS?

Are you currently in a situation where you require documents for either business or personal reasons frequently.

There are many legal document templates available online, but finding reliable versions is not simple.

US Legal Forms offers a vast selection of form templates, including the Idaho Direct Deposit Form for IRS, which is crafted to comply with federal and state regulations.

Once you have the correct form, click Purchase now.

Choose your desired payment plan, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Idaho Direct Deposit Form for IRS template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Preview feature to examine the document.

- Review the details to assure you have selected the right form.

- If the document does not meet your expectations, utilize the Search area to find the form that suits your requirements.

Form popularity

FAQ

If you haven't adjusted your state withholding to account for new tax laws enacted in 2018, you might owe more taxes when you filed your 2019 return this year, Idaho State Tax Commission spokeswoman Renee Eymann told EastIdahoNews.com.

You will have to wait for a mailed paper check if the IRS does not have bank information for you, or if the bank account you had on file with the agency has been closed or the account information supplied is incorrect, among other reasons.

Idaho is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

The Update Portal is available only on IRS.gov. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the rest of 2021. Families will receive their July 15 payment by direct deposit in the bank account currently on file with the IRS.

Form 43 is the Idaho income tax return for nonresidents with income from Idaho sources. Instructions are in a separate file.

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056 INCLUDE A COMPLETE COPY OF YOUR FEDERAL RETURN.

Form 39-R is an Idaho Supplemental Schedule For Form 40, Resident Returns Only. It is simply a worksheet for posting your Form 40. View the IDAHO SUPPLEMENTAL SCHEDULE Form 39R. Form-39R is a supplemental form to Idaho's Form-40.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.