Idaho Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

Are you in a situation where you require documentation for both business or personal purposes nearly every workday? There is a range of legal document templates accessible online, but finding reliable ones is not simple.

US Legal Forms offers a vast array of form templates, such as the Idaho Direct Deposit Form for IRS, that are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have a free account, simply Log In. Then, you can download the Idaho Direct Deposit Form for IRS template.

Choose a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Idaho Direct Deposit Form for IRS at any time, if necessary. Click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

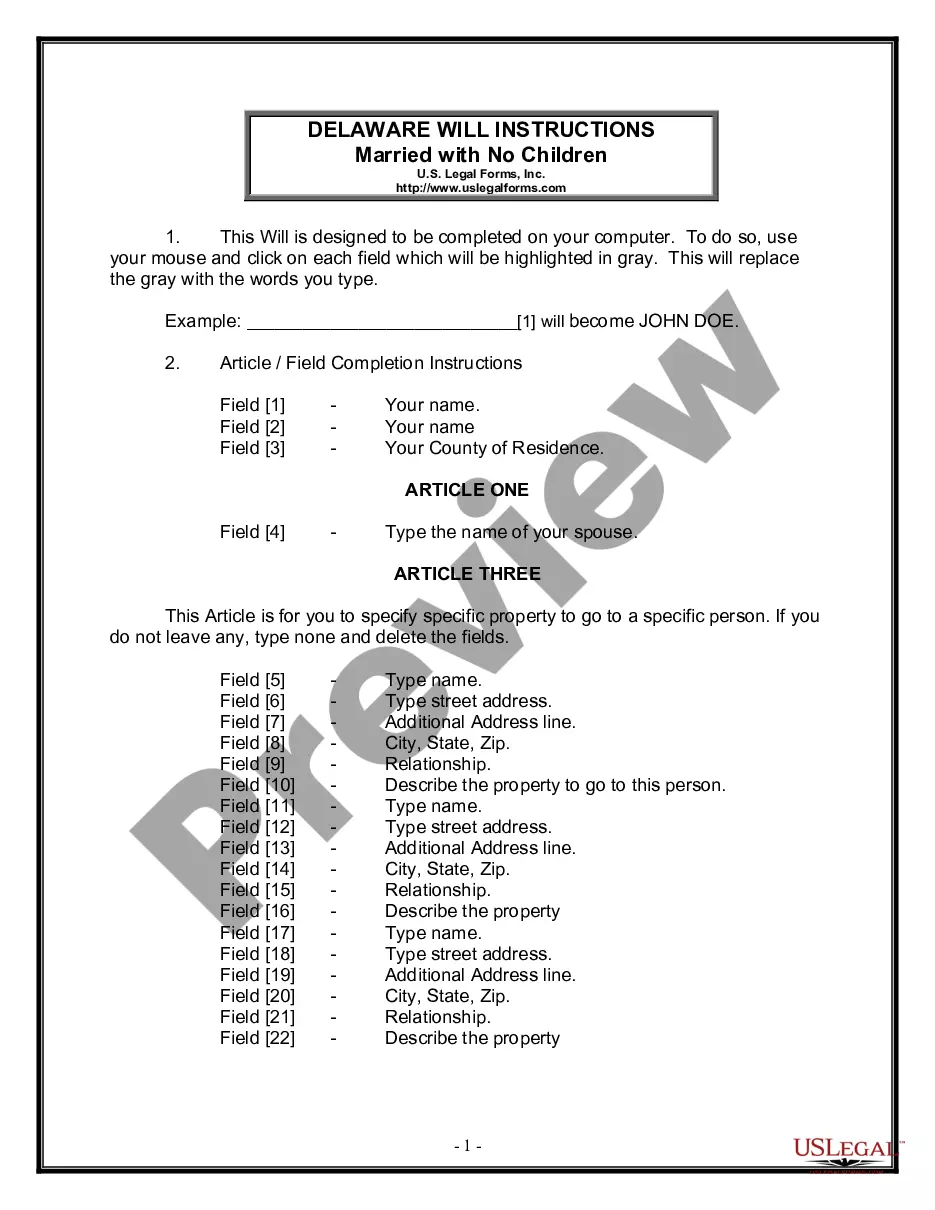

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

- Once you find the appropriate form, click Buy now.

- Select the pricing plan you want, fill in the required information to create your account, and complete your transaction using PayPal or a credit card.

Form popularity

FAQ

You should use IRS Form 8888 when you want to split your tax refund into multiple accounts. This form allows you to allocate your refund among different bank accounts, making it ideal for those who want to save for specific goals. Using the Idaho Direct Deposit Form for IRS in conjunction with Form 8888 can streamline your direct deposit process and enhance your financial planning.

Filling out a direct deposit form requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, provide your bank's routing number and your account number. Make sure to double-check these numbers to avoid delays, and consider using the Idaho Direct Deposit Form for IRS to ensure you have the correct format.

Setting up direct deposit with the IRS is straightforward. First, complete the Idaho Direct Deposit Form for IRS, providing your bank account information. You can submit this form with your tax return or use it to update your existing information. Direct deposit ensures that your tax refund is delivered quickly and securely to your bank account.

Yes, you can update your direct deposit information with the IRS. This can be done by submitting a new Idaho Direct Deposit Form for IRS, which allows you to change your bank account details. It is important to ensure that your new information is accurate to avoid any issues with your tax refund. You can also update your information through the IRS website or by calling their help line.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

Or, use IRS' Form 8888, Allocation of RefundPDF (including Savings Bond Purchases) if you file a paper return. Just follow the instructions on the form. If you want the IRS to deposit your refund into just one account, use the direct deposit line on your tax form.

If there are any delays in the processing of your return by the IRS, your entire refund will be deposited in the first account listed on Form 8888. Make sure the first account you list on Form 8888 is an account you would want the entire refund deposited in if this happens.

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

Your direct deposit information will be at the bottom of your Form 1040. To view your 1040 after filing, Sign into TurboTax > Taxes > Tax Timeline > Some other things you can do > Download/print (. pdf).

People who need to update their bank account information should go directly to the IRS.gov site and not click on links received by email, text or phone.