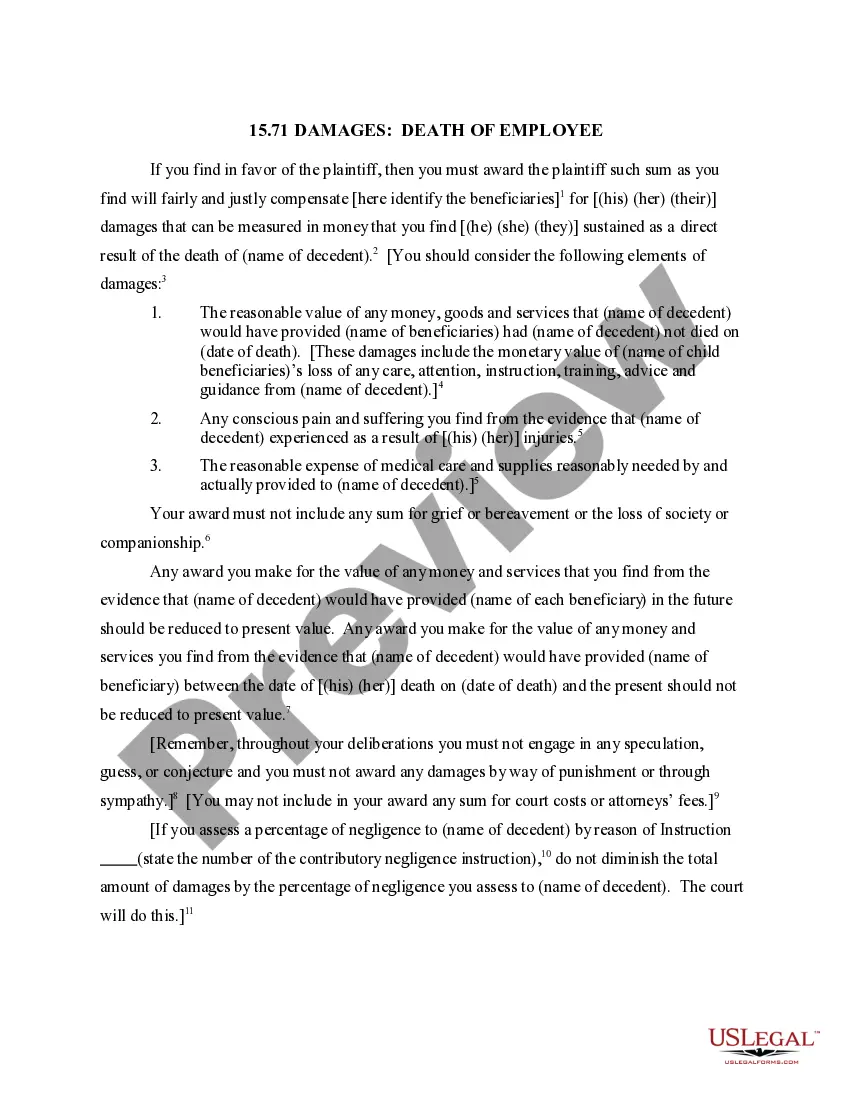

Idaho Summary of Payments Fatal Case is a system used to process claims for death benefits due to fatal workplace accidents. This system provides an overview of the payments and benefits available to eligible dependents of a worker who has died as a result of a workplace-related injury or illness. The Idaho Summary of Payments Fatal Case system is divided into two categories: Dependent Benefits and Survivor Benefits. Dependent Benefits include: 1. Lump-sum death benefits: This is a one-time payment to cover funeral expenses, burial costs, and other associated costs. 2. Health care benefits: This includes coverage for medical bills and other health-related expenses. 3. Education benefits: This includes an educational allowance for dependents to pursue higher education. 4. Dependent care benefits: This includes coverage for dependent care costs such as daycare and nanny services. Survivor Benefits include: 1. Survivor benefits: This is a monthly benefit paid to the surviving dependents of the deceased worker. 2. Death gratuity: This is a one-time payment to the surviving dependents of the deceased worker. 3. Survivor pension: This is a monthly pension paid to the surviving dependents of the deceased worker. 4. Survivor annuity: This is a monthly annuity paid to the surviving dependents of the deceased worker.

Idaho Summary of Payments Fatal Case

Description

How to fill out Idaho Summary Of Payments Fatal Case?

If you’re seeking a method to effectively prepare the Idaho Summary of Payments Fatal Case without enlisting a legal expert, then you’ve come to the perfect destination.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of formal templates for every personal and business circumstance. Each document you discover on our online platform is crafted in accordance with federal and state regulations, ensuring that your paperwork is in proper order.

Another excellent feature of US Legal Forms is that you will never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever you require them.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or utilizing the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the dropdown menu to find an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are assured that the paperwork meets all necessary criteria.

- Log in to your account and click Download. If you don’t have one yet, create an account with the service and choose a subscription plan.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be ready for download immediately thereafter.

- Choose the format you wish to save your Idaho Summary of Payments Fatal Case in and download it by clicking the designated button.

- Import your template into an online editor for quick completion and signing, or print it out to prepare your physical copy manually.

Form popularity

FAQ

To qualify for workers' compensation benefits, you must report your job-related injury or disease to your employer IMMEDIATELY. You could lose all benefits if you wait longer than 60 days to report your injury. Tell your employer about your injury or disease.

Permanent partial impairment is a medical determination of the percentage of loss that you have suffered as a result of your industrial injury.

Job status does not affect medical benefits. If you have already left your job and your employer has stopped paying your workers' comp medical benefits ? or has threatened to ? you need to speak to an experienced workers' compensation attorney right away.

To qualify for workers' compensation benefits, you must report your job-related injury or disease to your employer IMMEDIATELY. You could lose all benefits if you wait longer than 60 days to report your injury. Tell your employer about your injury or disease.

Workers' compensation is no-fault insurance. It provides compensation for missed work, permanent injuries, and rehabilitation in the event an employee is injured on the job. Employers are protected from paying costly medical bills and defending against lawsuits no matter who is at fault in an accident.

Idaho's Workers' Compensation Law does not require your employer to hold your job open or rehire you after you recover from your job-related injury or disease. However, Rehabilitation Consultants with the Industrial Commission can provide return-to-work assistance.

The basic benefit is sixty-seven percent (67%) of your average weekly wage, subject to the minimums and maximum of 90% of the average state wage provided in Idaho Code (I.C.) 72-408 and 72-409. After 52 weeks, the basic benefit is 67% of the average state wage subject to maximums and minimums in I.C. 72-409.

Exemptions from workers' compensation requirements in Idaho include: Sole proprietors and independent contractors. Family members employed by a sole proprietor and living in the same household. Some family members of sole proprietors who don't live in the same household may file for an exemption.