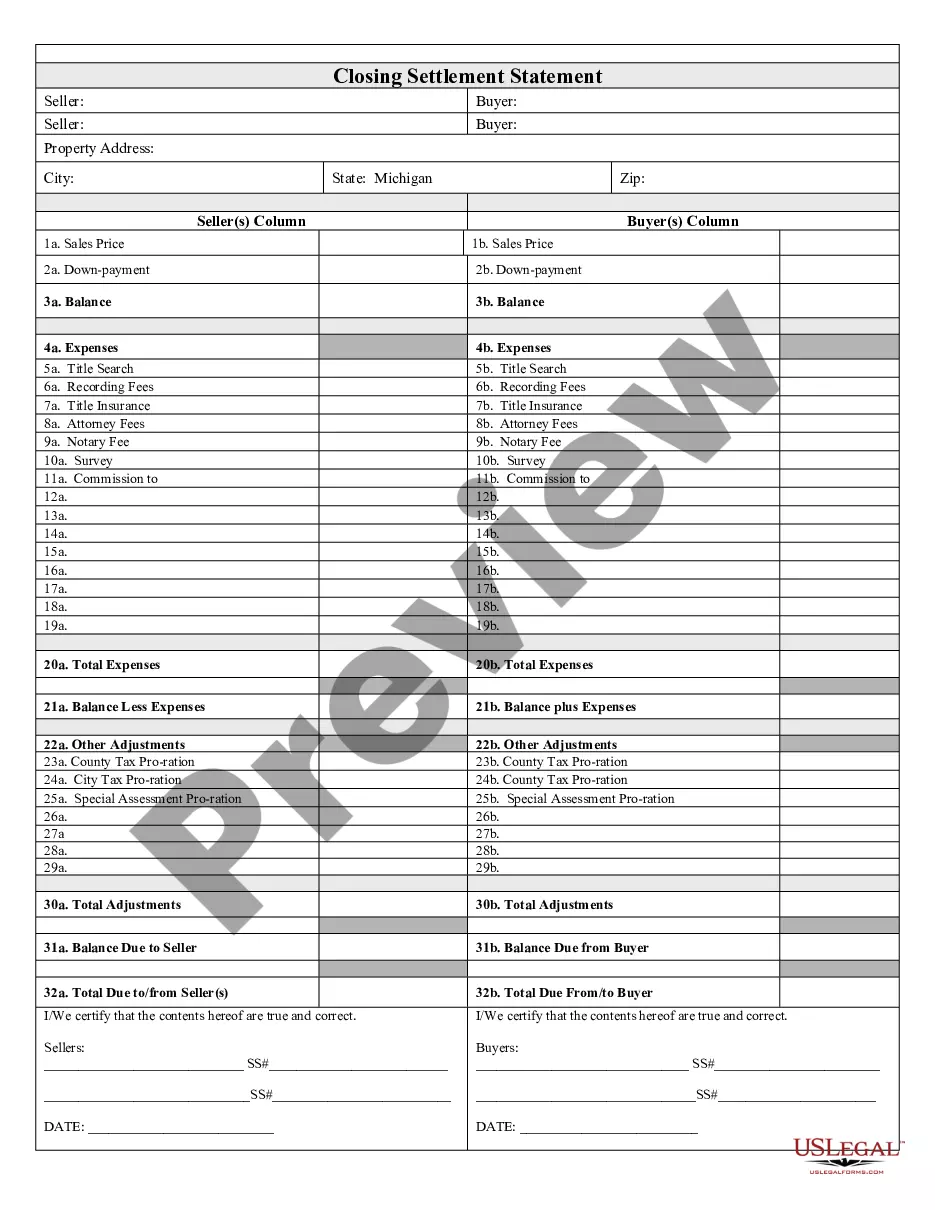

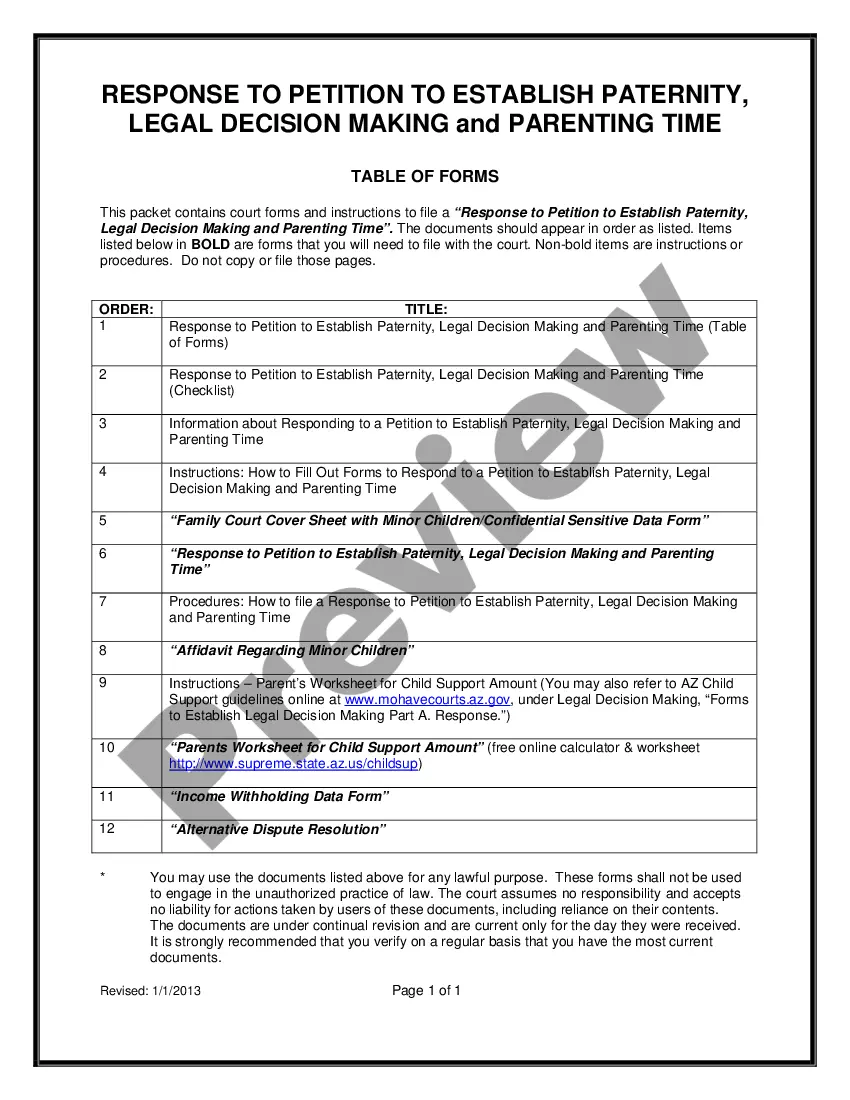

Idaho Summary of Payments Non-Fatal Cases is a form used by the Idaho Department of Labor to document compensation awarded to claimants for work-related injuries. This form is used to document and track payments for non-fatal accidents that occur in Idaho workplaces. It includes information like the claimant's name, date of injury, the type of injury, and the amount of compensation awarded. It also records any medical expenses or other costs associated with the injury. There are two types of Idaho Summary of Payments Non-Fatal Cases: one for those claiming a lump sum payment and one for those claiming a weekly payment. Both forms require the claimant to provide documentation of the injury, such as medical records and wage statements.

Idaho Summary of Payments Non Fatal Cases

Description

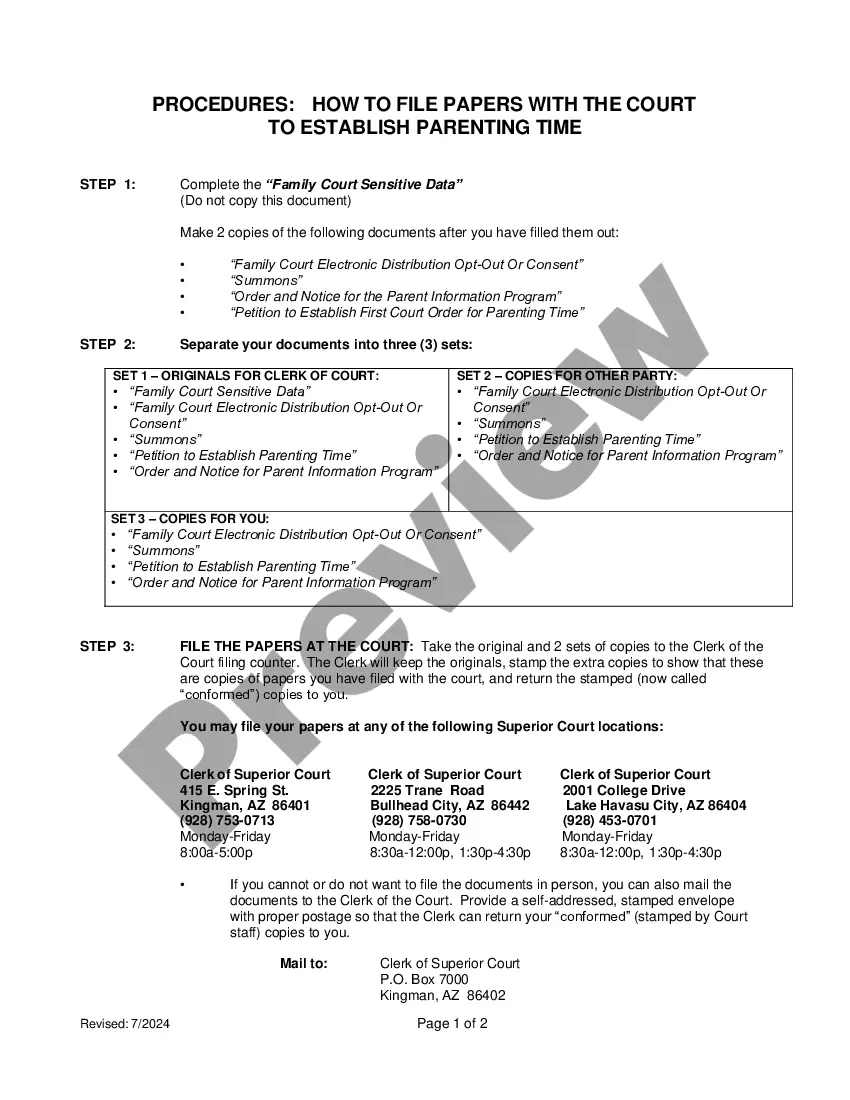

How to fill out Idaho Summary Of Payments Non Fatal Cases?

How much time and resources do you generally allocate for drafting official documents.

There’s a better alternative to obtaining such forms than engaging legal professionals or spending hours searching online for a suitable template. US Legal Forms is the leading online repository that provides expertly crafted and verified state-specific legal documents for any need, such as the Idaho Summary of Payments Non Fatal Cases.

Another benefit of our service is that you can access previously acquired documents that you safely store in your profile in the My documents tab. Retrieve them at any time and re-complete your documents as often as you require.

Conserve time and energy while completing legal paperwork with US Legal Forms, one of the most dependable online solutions. Join us today!

- Review the form content to ensure it complies with your state laws. To achieve this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your criteria, find another one using the search tab at the top of the page.

- If you are already a member of our service, Log In and download the Idaho Summary of Payments Non Fatal Cases. If not, proceed to the ensuing steps.

- Click Buy now once you locate the appropriate blank. Choose the subscription plan that best fits your needs to access the complete offerings of our library.

- Register for an account and pay for your subscription. You can complete your transaction using a credit card or through PayPal - our service is completely secure for that.

- Download your Idaho Summary of Payments Non Fatal Cases onto your device and finalize it on a printed copy or electronically.

Form popularity

FAQ

In Idaho, every employer with one or more employees needs workers' compensation insurance. This includes full-time and part-time employees, as well as seasonal and occasional workers. For employees who have a work-related injury or illness, workers' comp helps provide: Medical benefits.

Workers Compensation Insurance: Employers having one or more full-time, part-time, seasonal or occasional employees must provide workers compensation insurance unless specifically exempt under Idaho law.

Inclusions in payroll for Workers Compensation insurance: Wages or salaries, including retroactive wages.Commissions and draws against commissions. Bonuses including stock bonus plans. Extra pay for overtime work, with exception. Pay for holidays, vacations, or periods of sickness.

Ask your employer or the Idaho Industrial Commission for a First Report of Injury or Illness form. Fill out the form to the best of your ability. Return your completed form to the Idaho Industrial Commission's main office in Boise.

Idaho worker's comp provides payments for medical treatment, lost wages, and permanent disability. Workers' compensation in Idaho is a mandatory insurance program designed to compensate injured workers for medical care and lost wages.

Exemptions from workers' compensation requirements in Idaho include: Sole proprietors and independent contractors. Family members employed by a sole proprietor and living in the same household. Some family members of sole proprietors who don't live in the same household may file for an exemption.