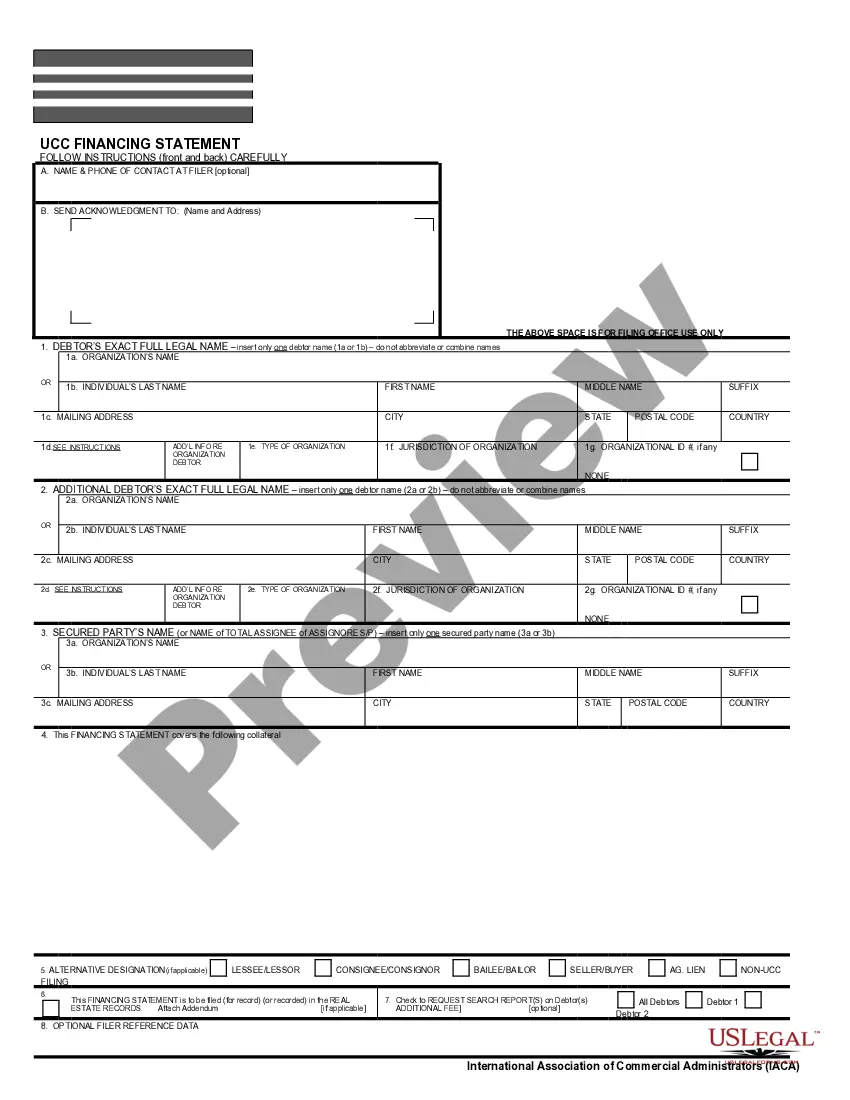

Idaho B22C-1 — (12/14) is a type of cold-hardy, winter-hardy, early-ripening apple tree. It is a cross between Honey crisp and Liberty apples. This variety is known for its excellent flavor and texture, and its ability to store well for long periods of time. It produces medium-sized, round apples with a light-red color and a sweet flavor. The tree is disease-resistant and has a high tolerance for cold temperatures. Other types of Idaho B22C-1 — (12/14) include thAltarsas variety, which is a cross between Honey crisp and Dorset apples; the Idaho Gold variety, which is a cross between Honey crisp and Golden Delicious; and the Idaho Sunrise variety, which is a cross between Honey crisp and Fuji apples.

Idaho B22C-1 - (12/14)

Description

How to fill out Idaho B22C-1 - (12/14)?

How much time and resources do you typically allocate to creating official documents.

There is a better chance to obtain such forms than employing legal professionals or spending hours searching the internet for a suitable template.

Download your Idaho B22C-1 - (12/14) onto your device and finish it on a printed hard copy or electronically.

Another advantage of our library is that you can access previously obtained documents that you securely store in your profile in the My documents tab. Retrieve them at any time and redo your paperwork as often as you require. Save time and energy completing official documents with US Legal Forms, one of the most reliable online solutions. Register with us today!

- To obtain and fill out a fitting Idaho B22C-1 - (12/14) template, follow these simple steps.

- Review the form's content to confirm it aligns with your state rules. To do so, refer to the form description or use the Preview option.

- If your legal template does not fulfill your requirements, search for an alternative using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Idaho B22C-1 - (12/14). If not, proceed to the next steps.

- Click Buy now once you locate the correct document. Choose the subscription plan that best fits your needs to access our library’s full services.

- Register for an account and settle your subscription fee. You can make a payment using your credit card or through PayPal - our service is completely secure for that.

Form popularity

FAQ

Alabama Attorneys Counseling Individuals on Bankruptcy To file for Chapter 13, you need to file Form 122C. Entering into a debt repayment plan is a serious commitment, and it is important to consult an Alabama bankruptcy lawyer about filing for Chapter 13 in this state.

Also do not not incur debt, use credit, credit cards, or enter into leases while in Chapter 13 without Bankruptcy Court approval, except in the case of an emergency for the protection and preservation of life, health or property. Contact your attorney if you need to sell property or incur debt.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Any bankruptcy filing could also negatively impact your credit for some time. A Chapter 13 bankruptcy can remain on your credit report for up to 10 years, and you will lose all your credit cards. Bankruptcy also makes it nearly impossible to get a mortgage if you don't already have one.

Chapter 13 can be useful for people with serious debts who worry about losing their homes to bankruptcy. If you adhere to your repayment plan, you'll have a new lease on financial life. Unsecured debts will be gone, but mortgages and car payments might linger.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.