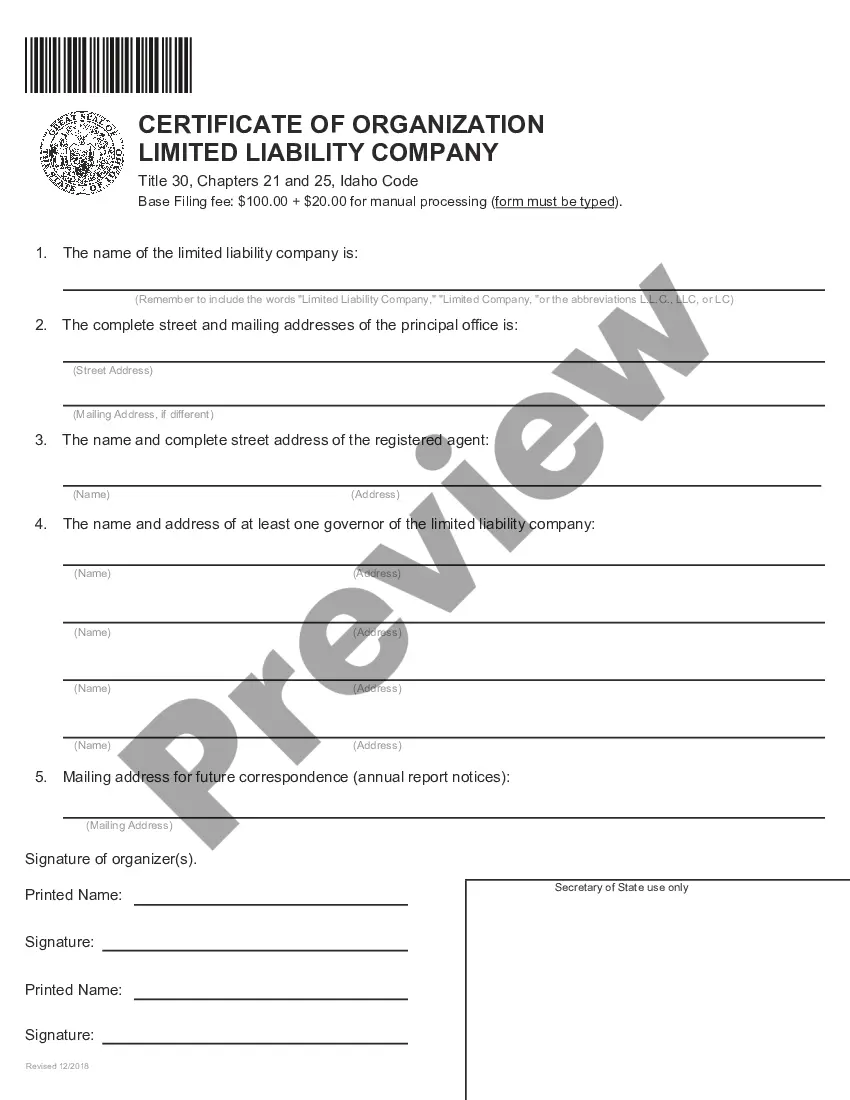

Articles of Organization contain the defining information for the PLLC. File the Articles with the Secretary of State to form the PLLC for the practice of a state-licensed profession.

Articles of Organization for an Idaho Professional Limited Liability Company PLLC

Description

How to fill out Articles Of Organization For An Idaho Professional Limited Liability Company PLLC?

Attempting to locate Articles of Organization for an Idaho Professional Limited Liability Company PLLC example and completing them may pose a difficulty.

To conserve significant time, expenses, and effort, utilize US Legal Forms to find the suitable template specifically for your region in just a few clicks.

Our lawyers create all documents, so you merely have to complete them. It is truly that straightforward.

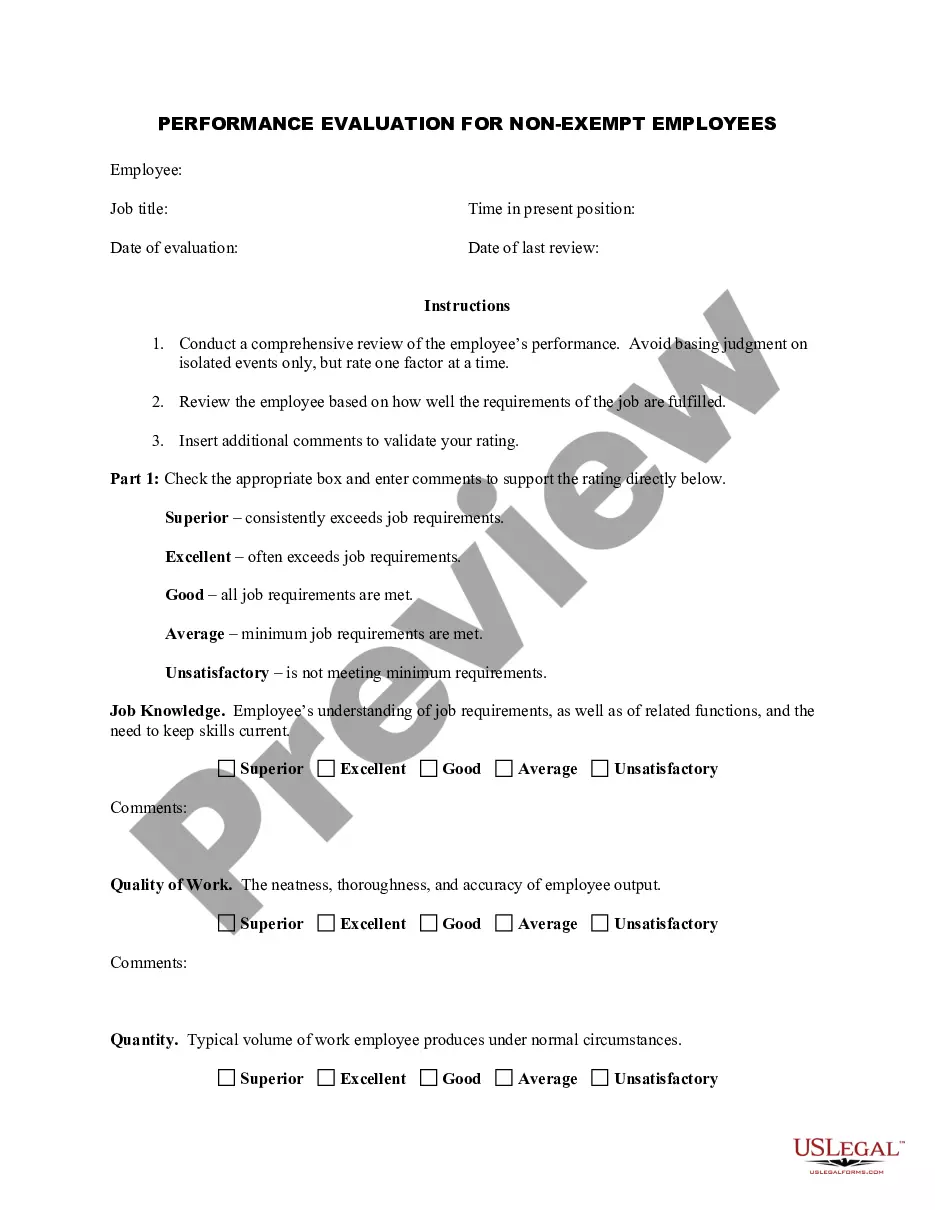

Choose your plan on the pricing page and set up your account. Select your payment method with a card or through PayPal. Save the form in the desired file format. You can print the Articles of Organization for an Idaho Professional Limited Liability Company PLLC form or complete it using any online editor. Don't worry about making mistakes, as your template can be used and submitted, and printed as many times as you wish. Visit US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your downloaded samples are stored in My documents and are available at all times for future use.

- If you haven’t registered yet, you should sign up.

- Review our detailed instructions on how to obtain your Articles of Organization for an Idaho Professional Limited Liability Company PLLC form in a matter of minutes.

- To acquire a valid template, verify its relevance for your state.

- Examine the form using the Preview feature (if accessible).

- If there is a description, read it to grasp the specifics.

- Click Buy Now if you discovered what you are looking for.

Form popularity

FAQ

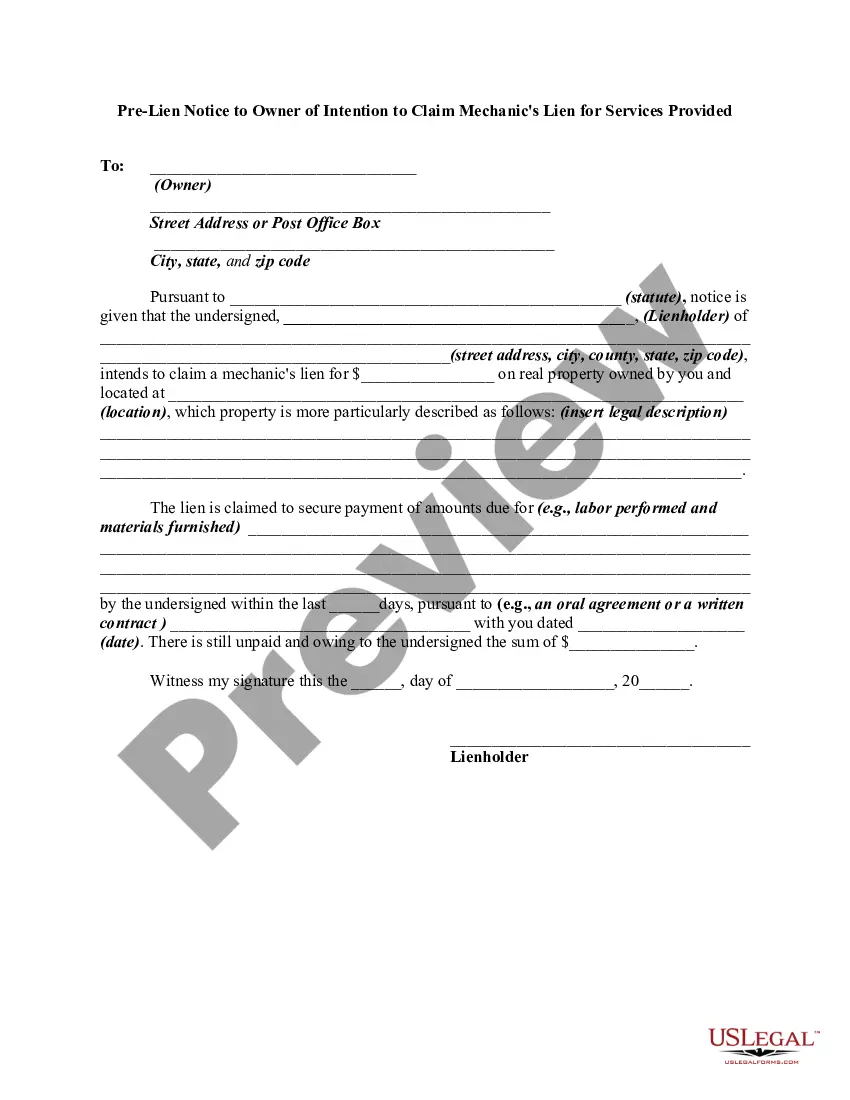

The articles of organization document typically includes the name of the LLC, the type of legal structure (e.g. limited liability company, professional limited liability company, series LLC), the registered agent, whether the LLC is managed by members or managers, the effective date, the duration (perpetual by default

The owners of a PLLC are called members, and they have an operating agreement that governs how they work together and divide profits and losses. Many professionals start a PLLC because they want to separate their individual liability from their liability as a member of the business or practice.

The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs. The articles of organization are similar to those for a standard LLC, but extra steps are necessary to file.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.