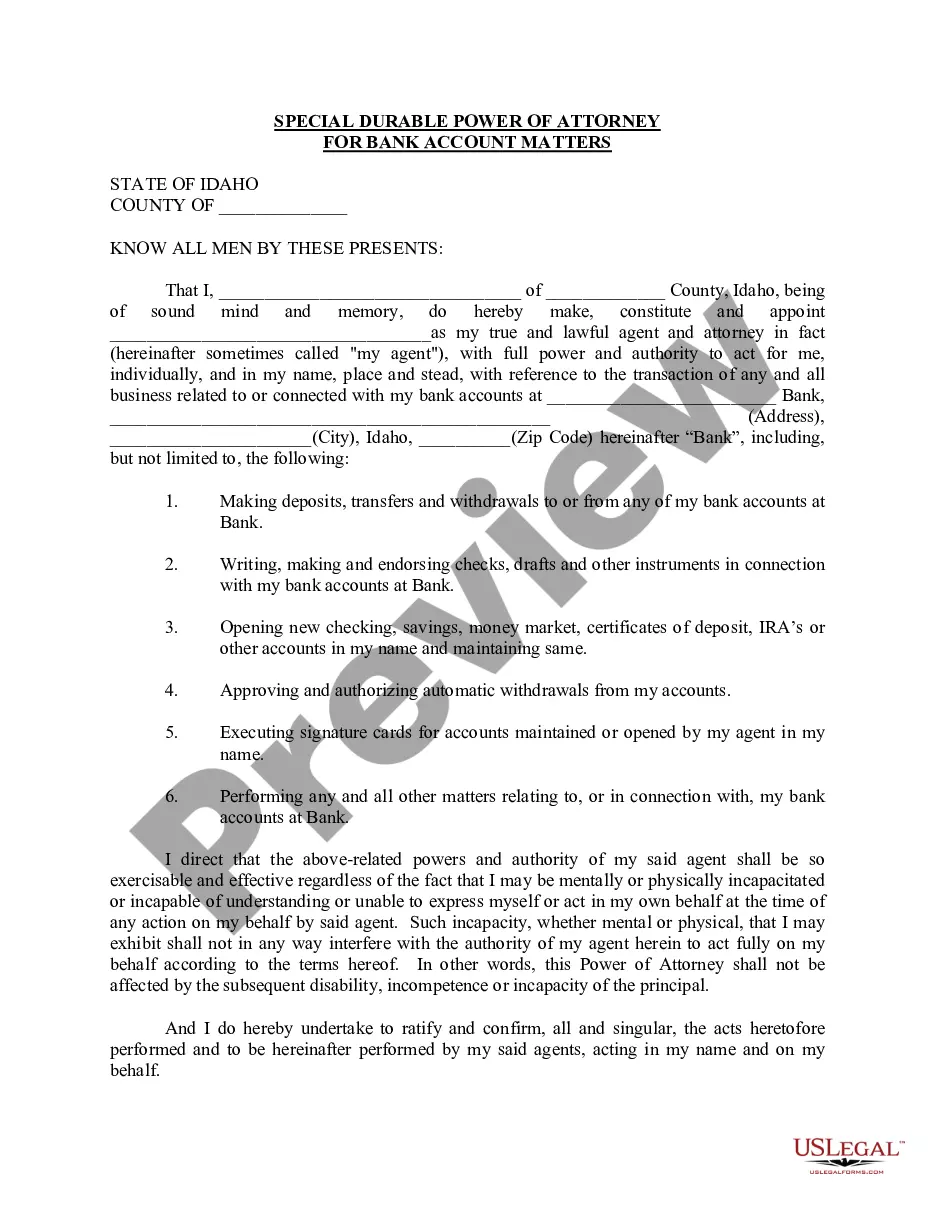

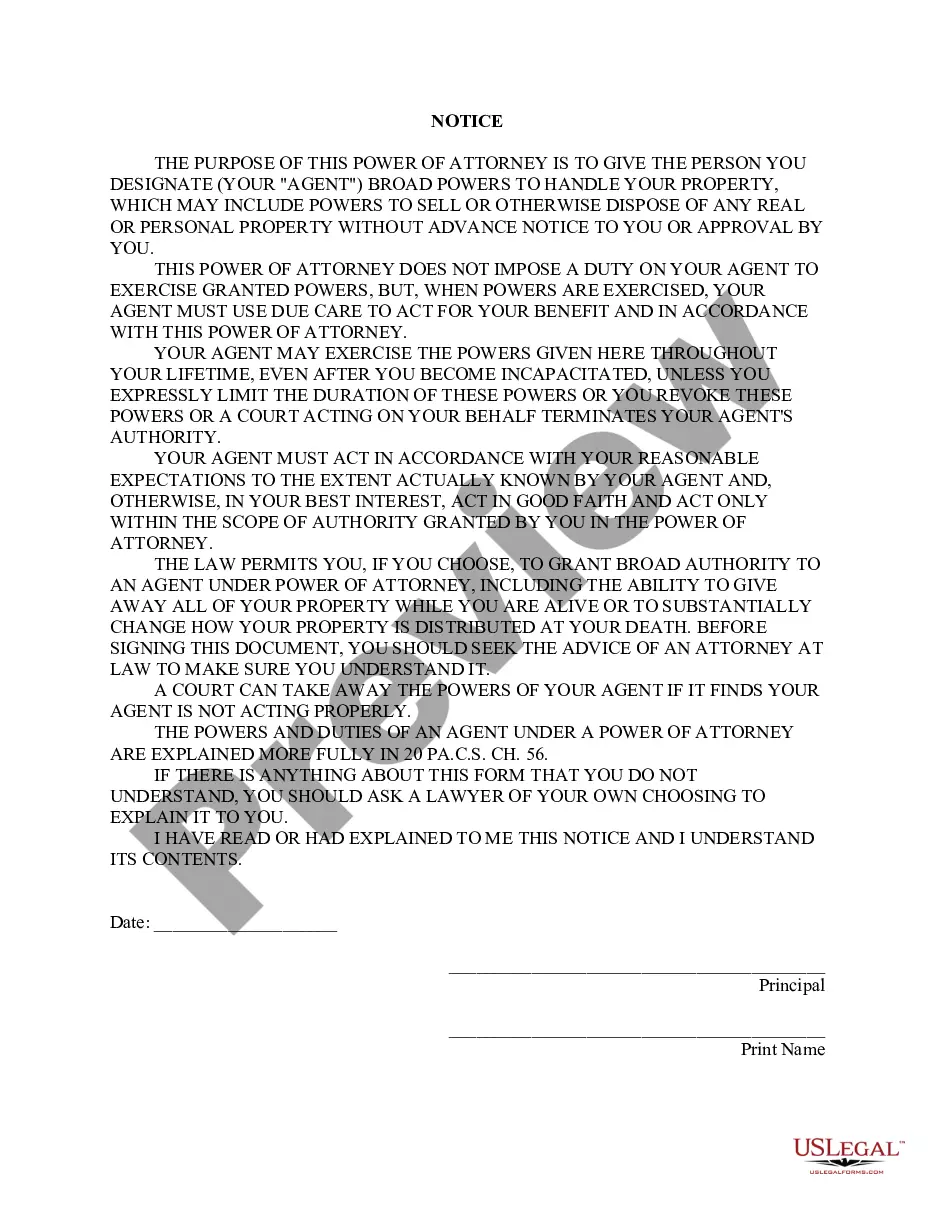

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

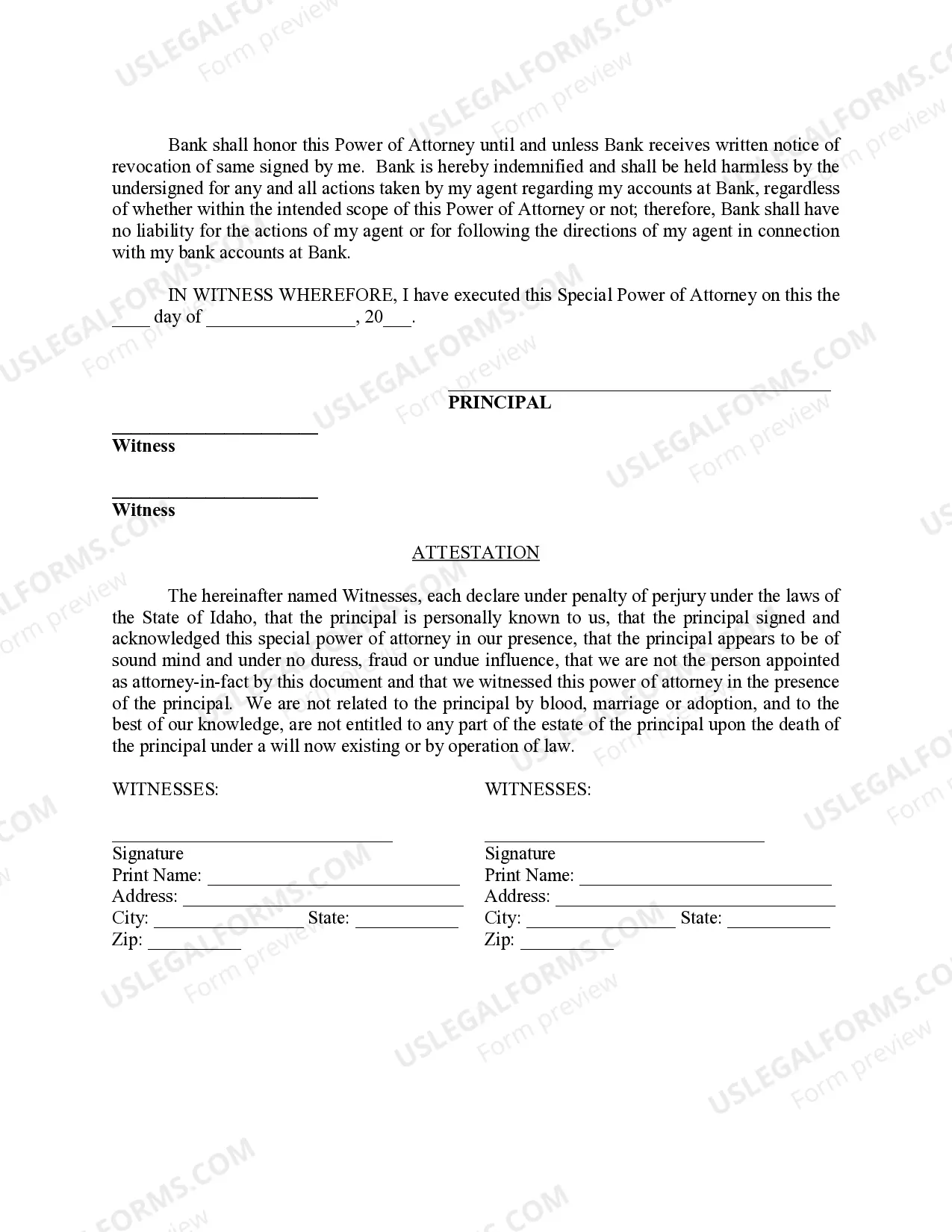

Idaho Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Idaho Special Durable Power Of Attorney For Bank Account Matters?

Finding Idaho Special Durable Power of Attorney for Bank Account Matters paperwork and filling them out can be a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your region with just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It truly is that easy.

You can print the Idaho Special Durable Power of Attorney for Bank Account Matters template or complete it using any online editor. No need to worry about making mistakes, as your template can be utilized, submitted, and printed as many times as you want. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

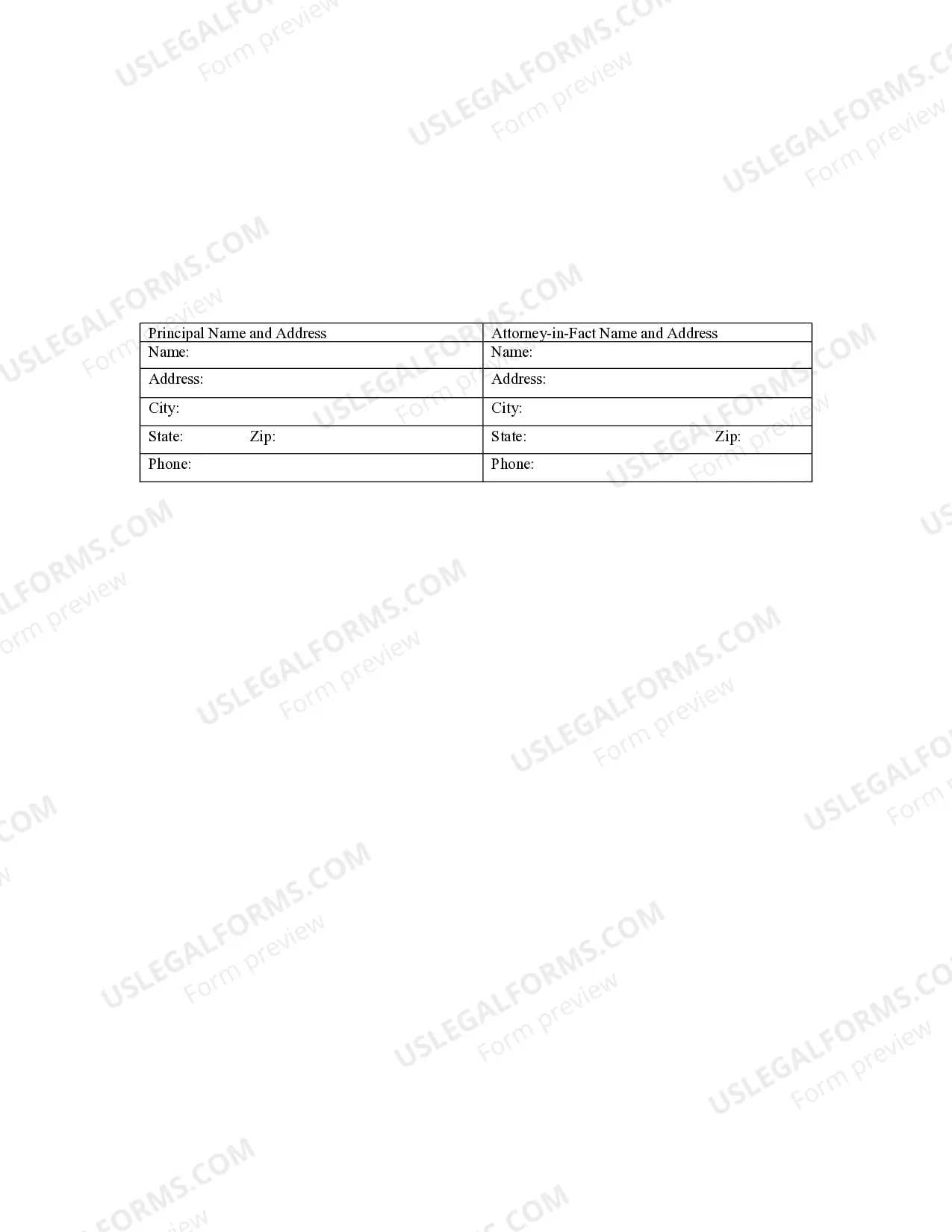

- Log in to your account and go back to the form's webpage to save the template.

- All your saved templates are stored in My documents and they are accessible at all times for future use.

- If you haven't signed up yet, you should create an account.

- Look at our comprehensive guidelines on how to obtain the Idaho Special Durable Power of Attorney for Bank Account Matters form in a few minutes.

- To acquire a qualified sample, verify its suitability for your state.

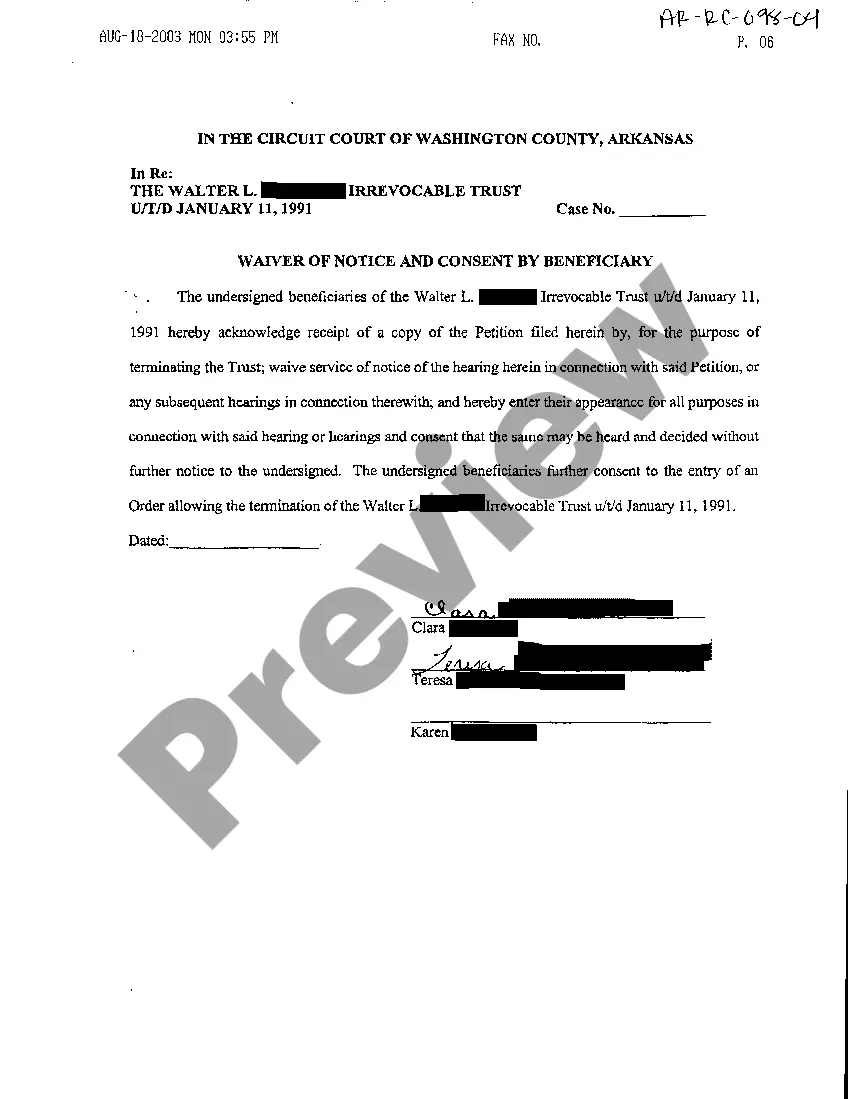

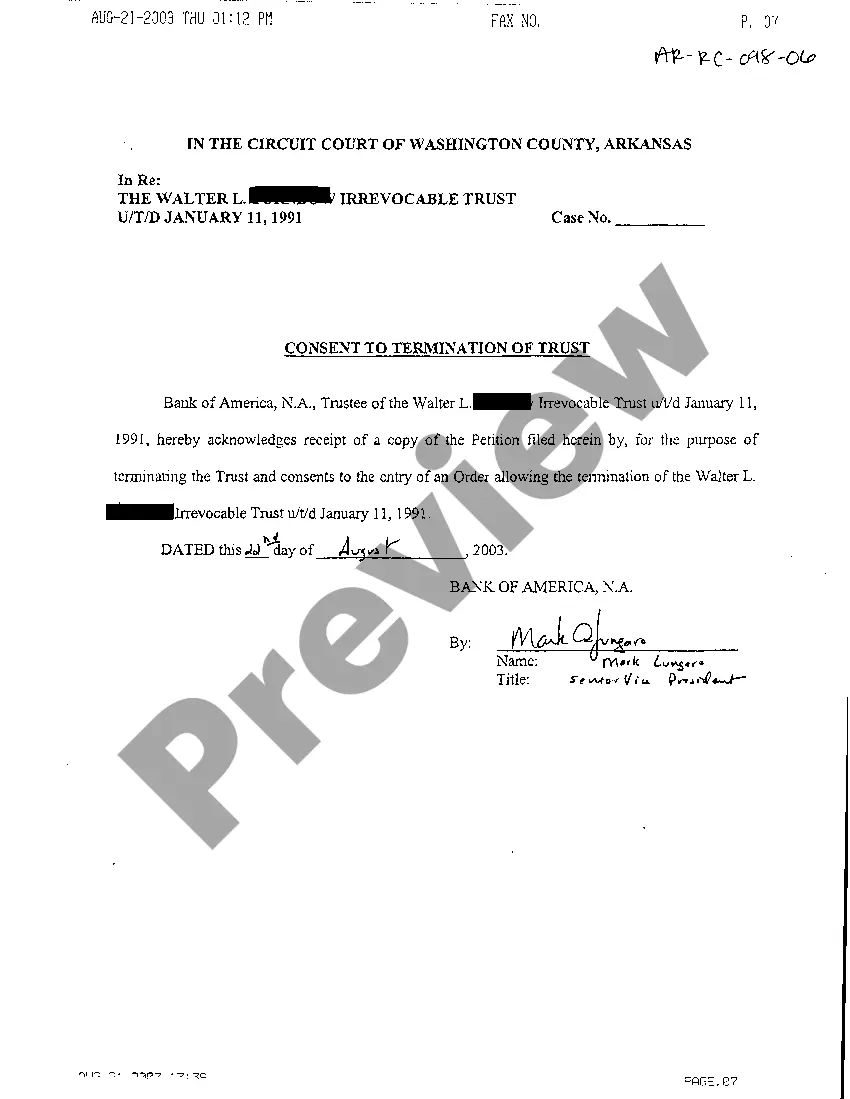

- Examine the sample by utilizing the Preview function (if it’s available).

- If there's an explanation, read it carefully to grasp the essential details.

- Click on the Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and register for an account.

- Select whether you want to pay with a credit card or via PayPal.

- Download the document in your preferred format.

Form popularity

FAQ

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

In Idaho, a durable power of attorney may not necessarily need to be signed in front of a notary public when executed by the principal. A power of attorney does not need to be recorded unless it is being used in connection with a real estate transaction.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Generally, a power of attorney allows you to designate an agent to perform specific functions on your behalf. Under the Texas Estates Code, statutory durable power of attorney can be used to appoint an agent to make certain financial decisions for you should you be unable to do so.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.