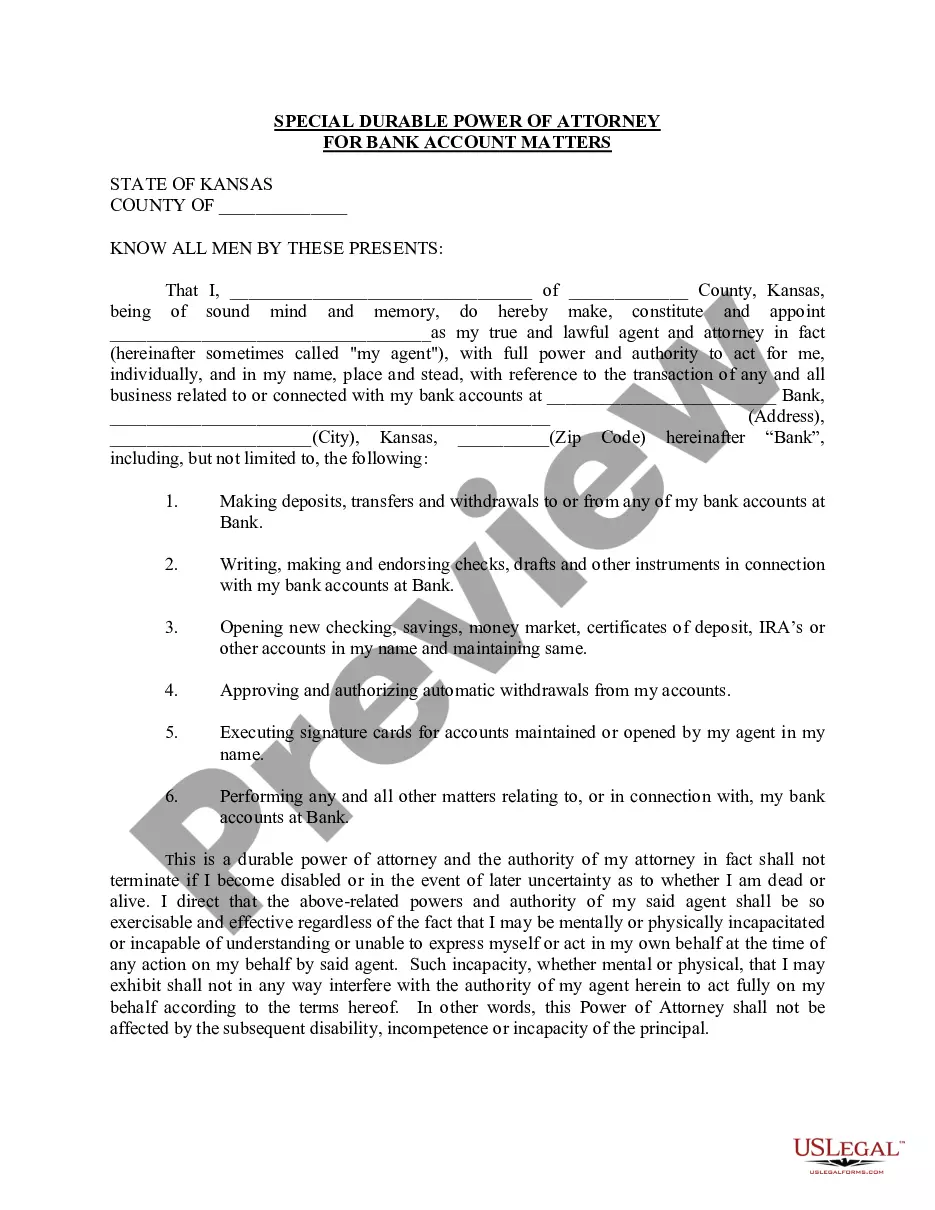

Kansas Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Kansas Special Durable Power Of Attorney For Bank Account Matters?

Searching for a sample of Kansas Special Durable Power of Attorney for Bank Account Issues and completing it might be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state with just a few clicks.

Our lawyers prepare each document, so you only need to fill them in. It’s truly that easy.

Select your plan on the pricing page and create your account. Choose your payment method with a credit card or via PayPal. Download the form in your desired format. You can now print the Kansas Special Durable Power of Attorney for Bank Account Issues template or fill it in using any online editor. Don’t worry about typing errors as your form can be used and submitted, and printed as many times as you like. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- Your saved templates can be found in My documents and are available at any time for later use.

- If you haven’t signed up yet, you will need to register.

- Follow our comprehensive instructions on how to acquire your Kansas Special Durable Power of Attorney for Bank Account Issues template within minutes.

- To obtain a valid form, verify its applicability for your state.

- Review the form using the Preview feature (if available).

- If there is a description, read it to grasp the specifics.

- Click Buy Now if you have located what you are looking for.

Form popularity

FAQ

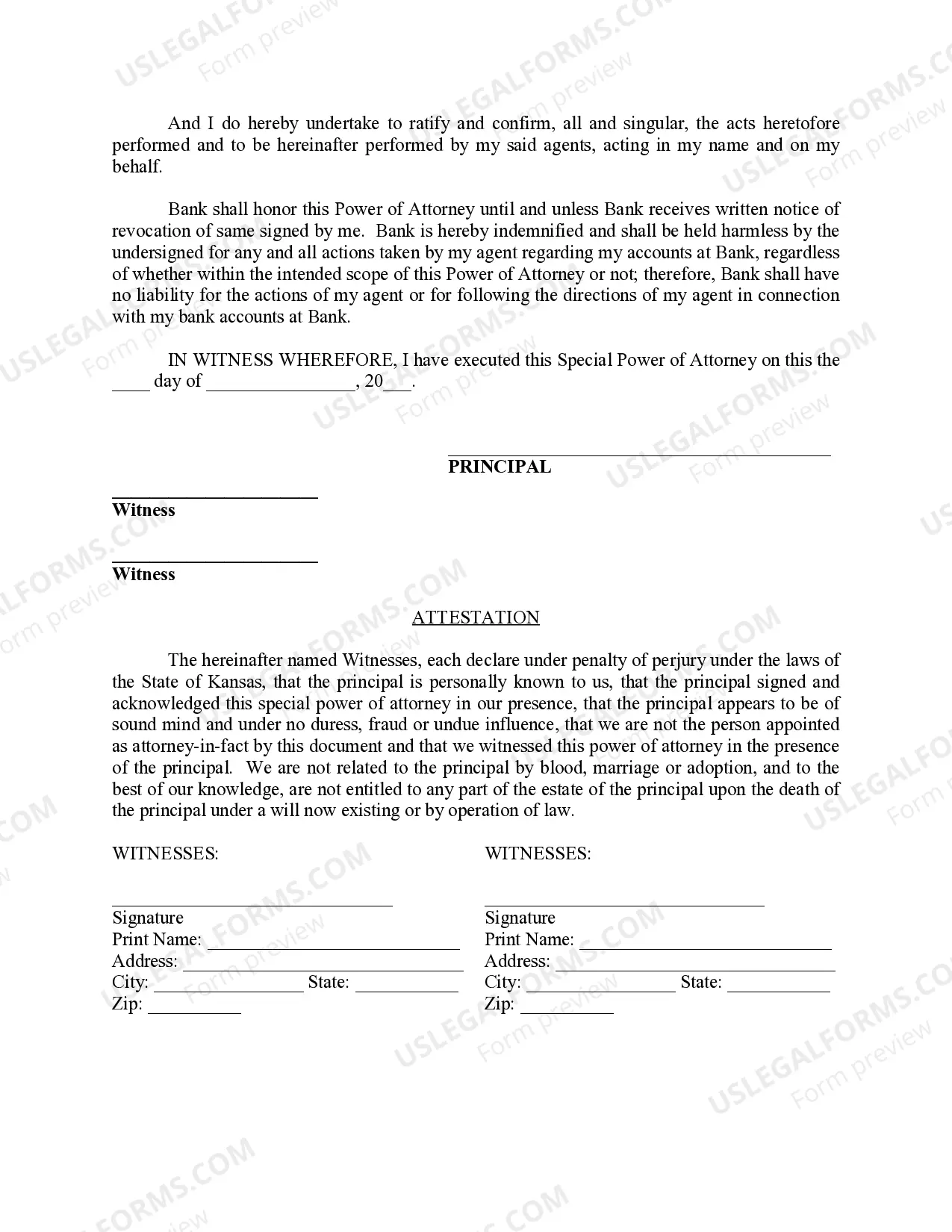

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

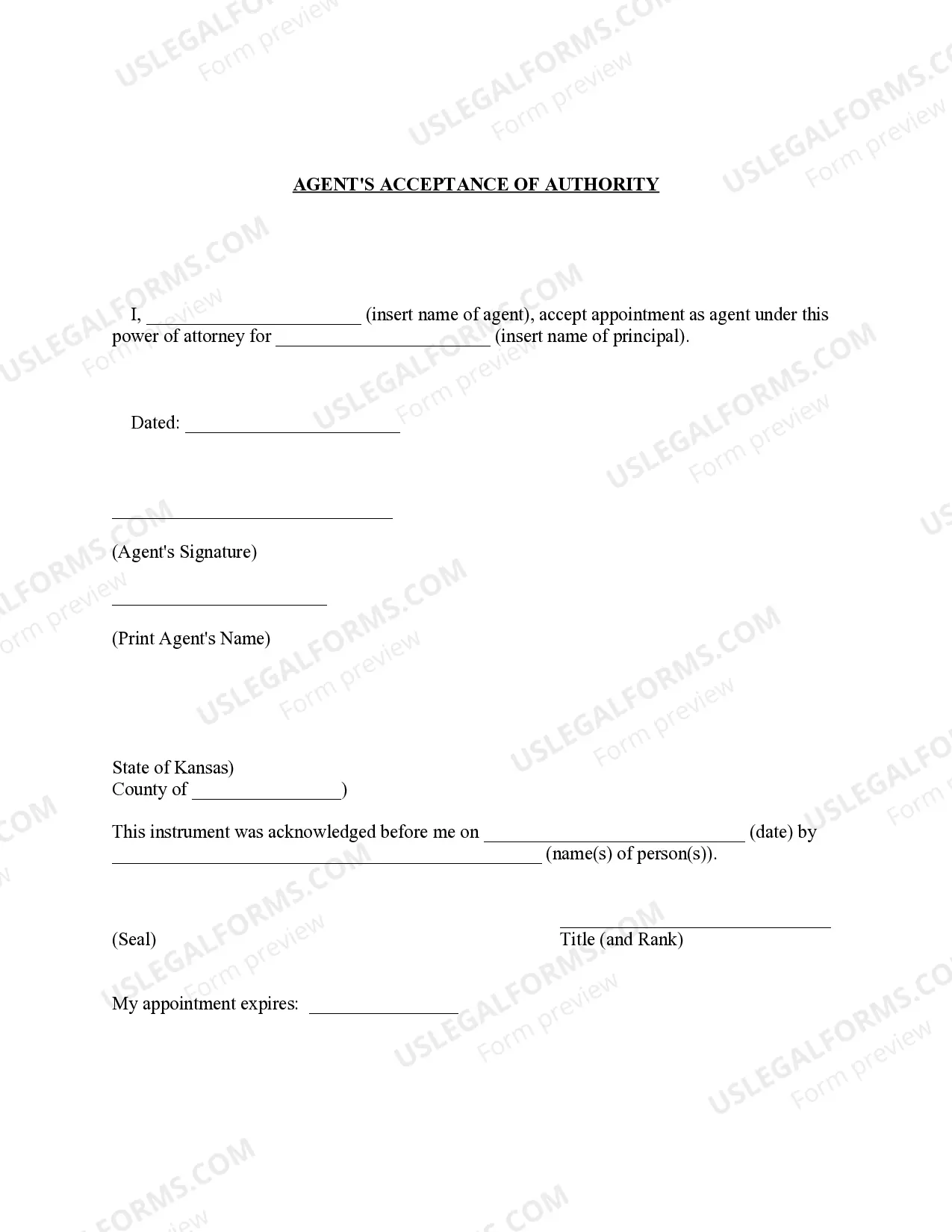

A solicitor or the NSW Trustee and Guardian can prepare a power of attorney for you.The form must be witnessed by a barrister, solicitor, registrar of the Local Court, an employee of the NSW Trustee and Guardian or trustee company, a qualified overseas lawyer or a licenced conveyancer.

A POA/DPOA must be in writing, signed by the principal and acknowledged by a Notary Public. If you are unable to physically execute a POA/DPOA, you may designate an adult to sign on your behalf, in the presence of a Notary Public.Specify all powers granted in the POA/DPOA.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

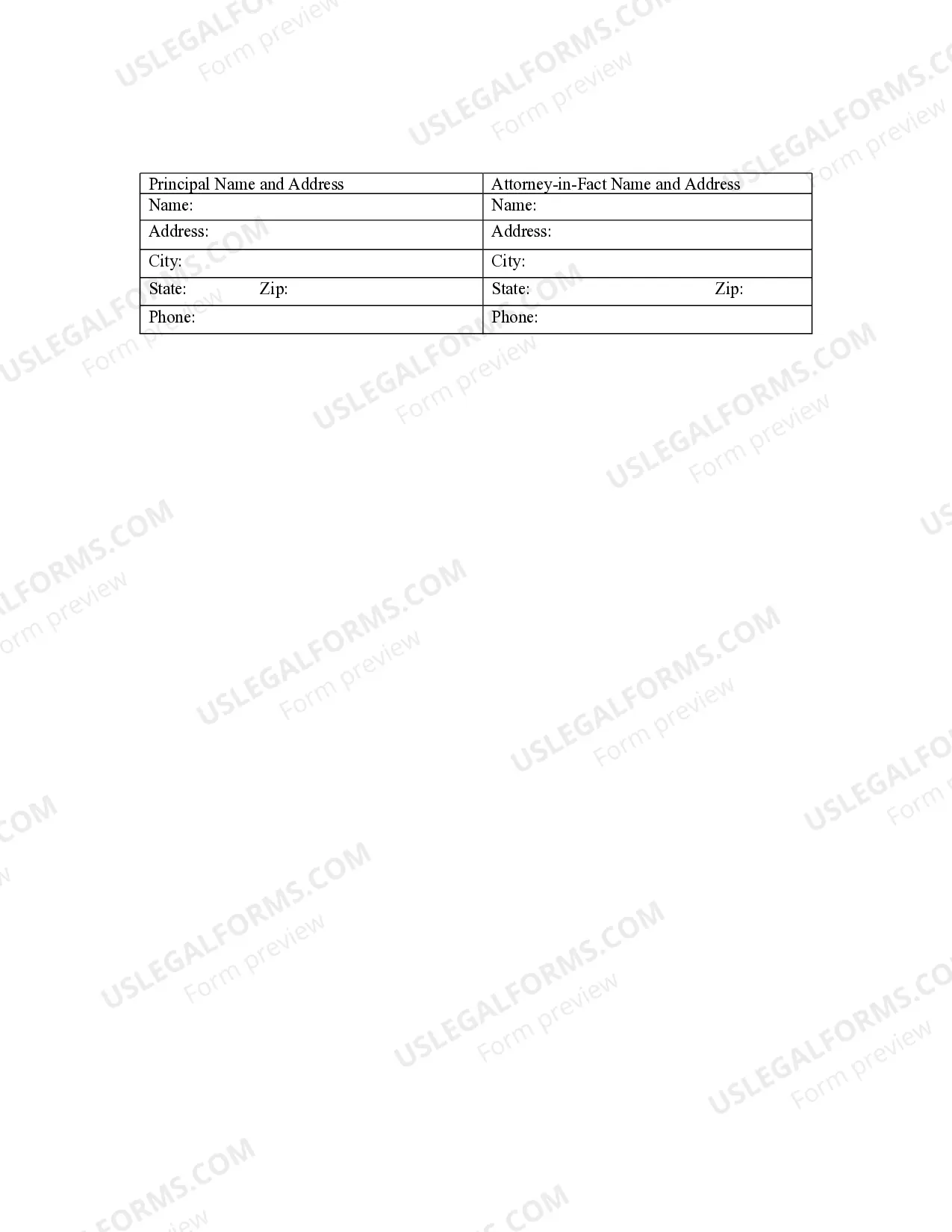

When opening a bank account using a power of attorney, you will have to fill out forms with both your information as well as the information of the account holder. Provide the bank employee with the completed paperwork, your identification and the power of attorney. The bank will make a copy of the power of attorney.