The reaffirmation agreement is used to reaffirm a particular debt. Once the debtor signs the agreement, the debtor gives up any protection of the bankruptcy discharge against the particular debt. The debtor is not required to enter into this agreement by any law.

Idaho Reaffirmation Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Reaffirmation Agreement?

Looking for an Idaho Reaffirmation Agreement template and completing them may pose a challenge.

To conserve a significant amount of time, money, and effort, utilize US Legal Forms to discover the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare each and every document, enabling you to simply fill them out. It is incredibly easy.

You can print the Idaho Reaffirmation Agreement template or complete it using any online editor. Do not fret about errors as your form can be utilized and submitted, and printed multiple times as needed. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the template.

- All your saved templates are stored in My documents and they are available at any time for future use.

- If you haven't registered yet, you will need to sign up.

- Review our comprehensive instructions on how to acquire your Idaho Reaffirmation Agreement template in just a few minutes.

- To obtain a valid form, verify its applicability for your state.

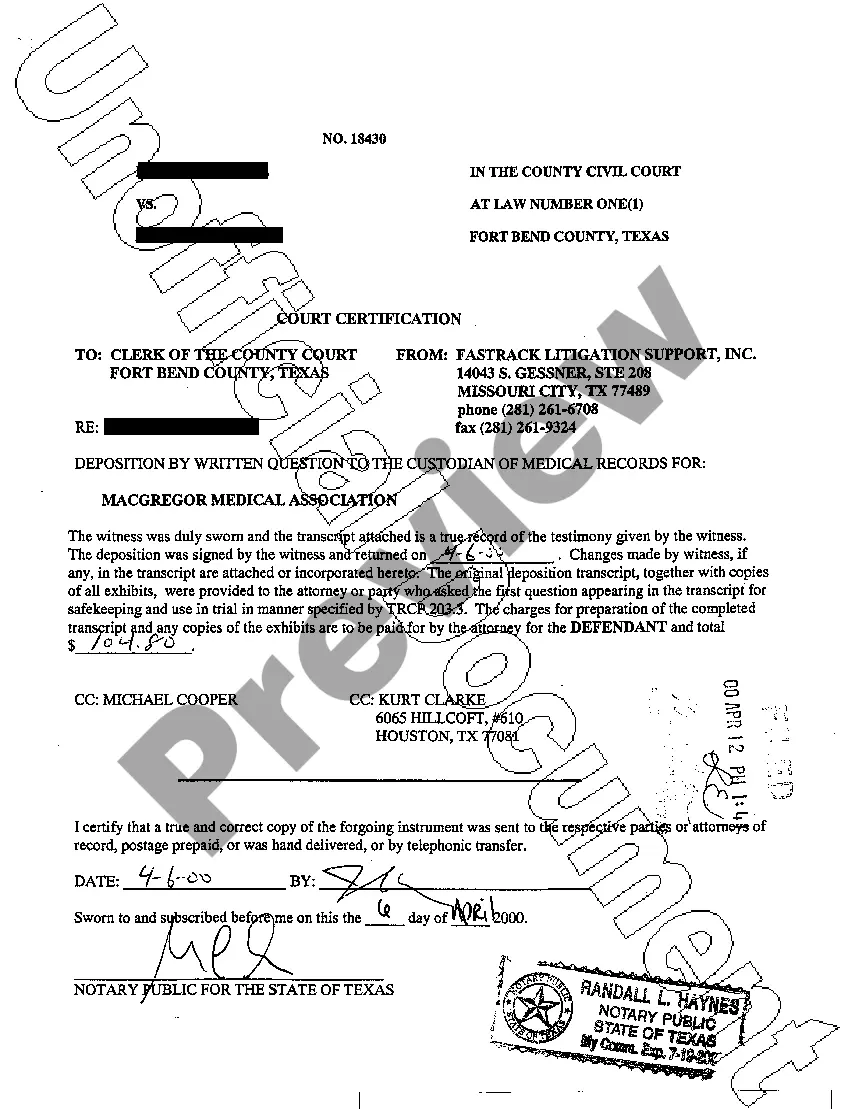

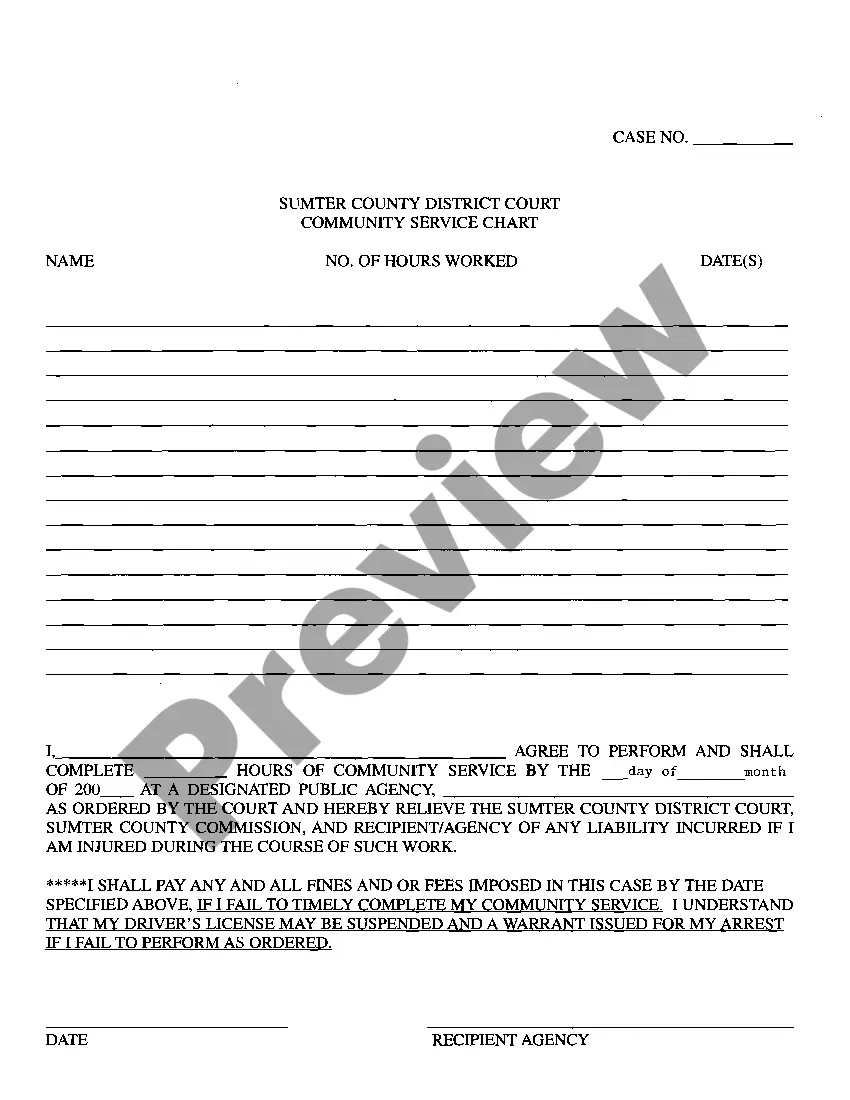

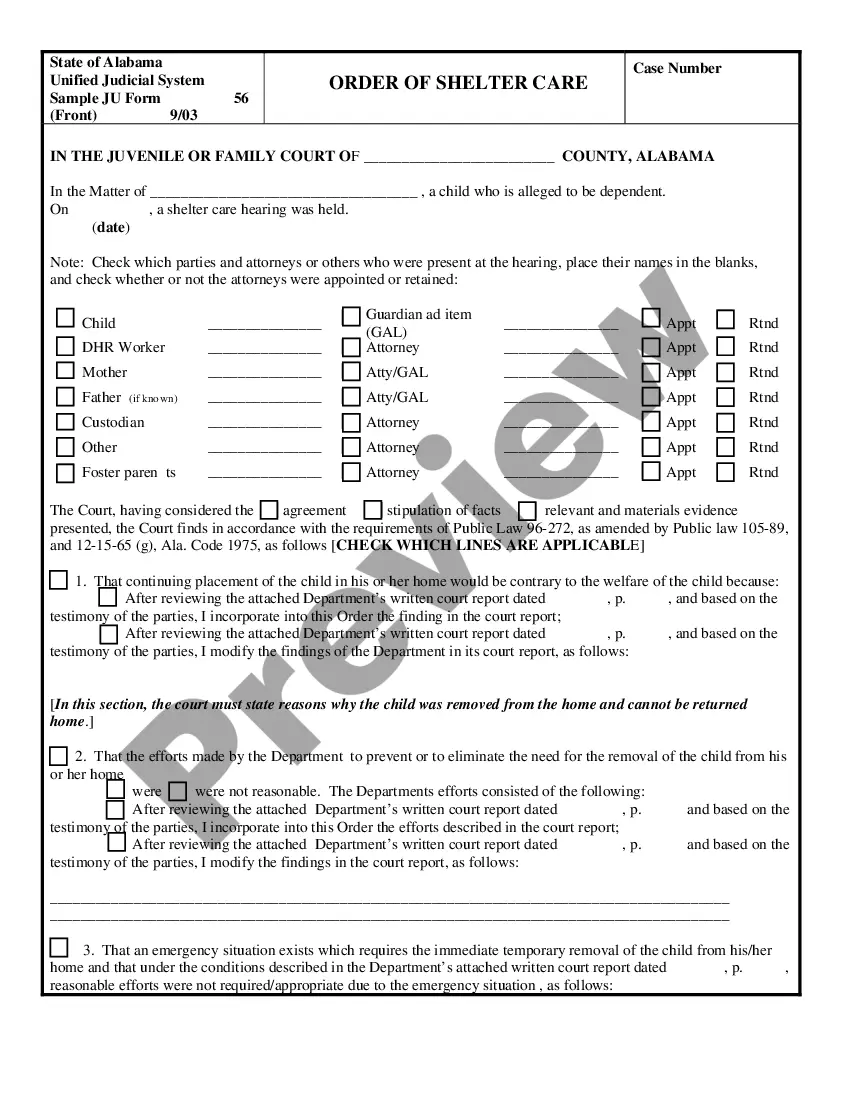

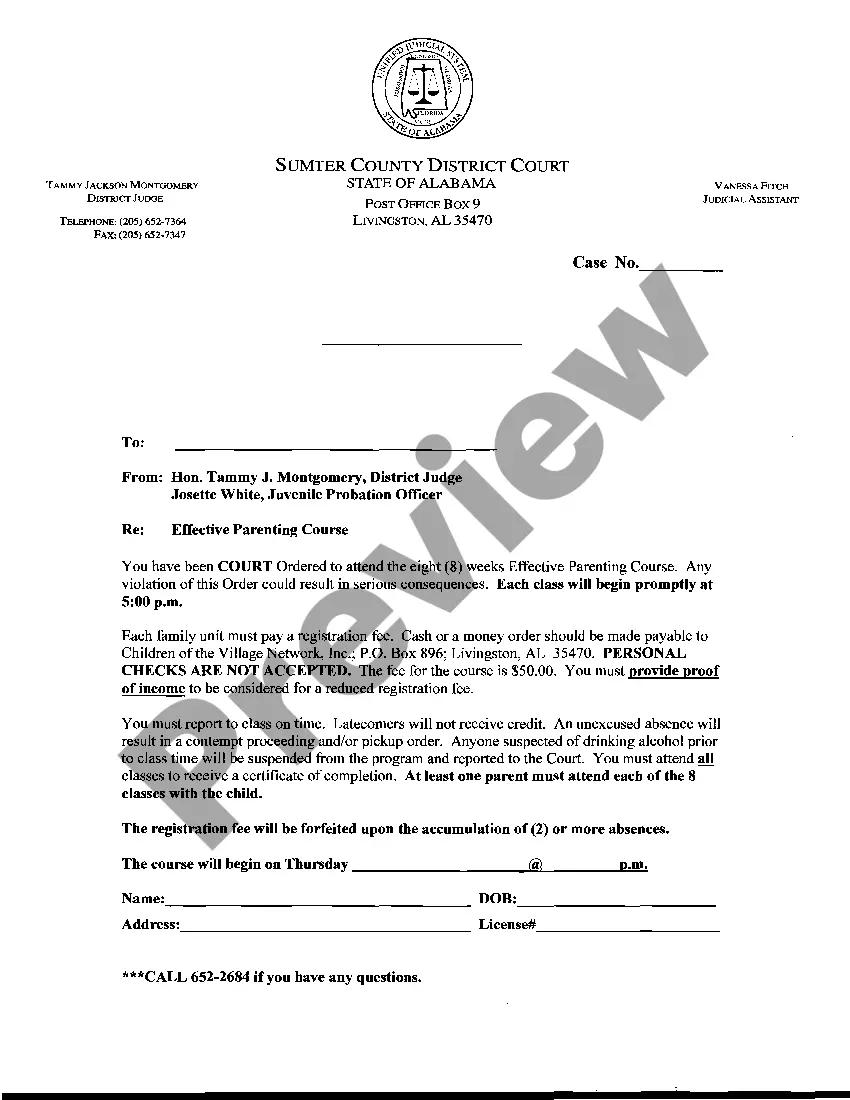

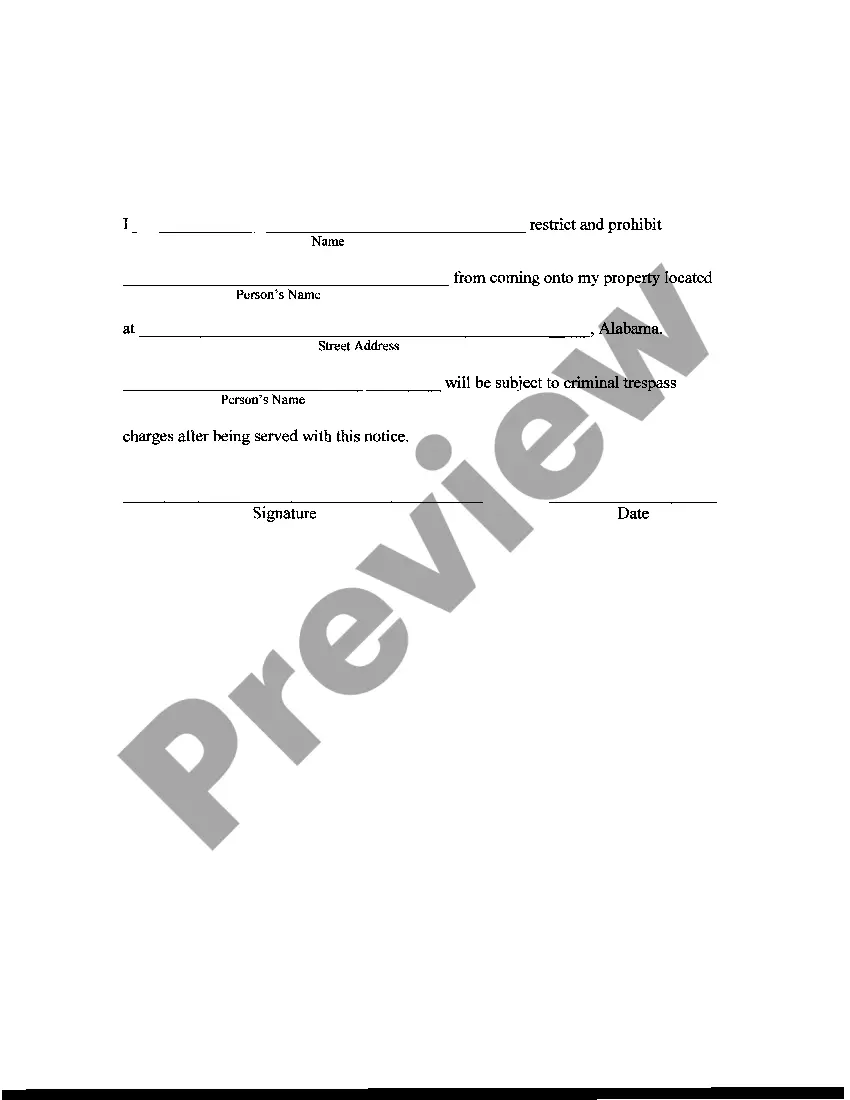

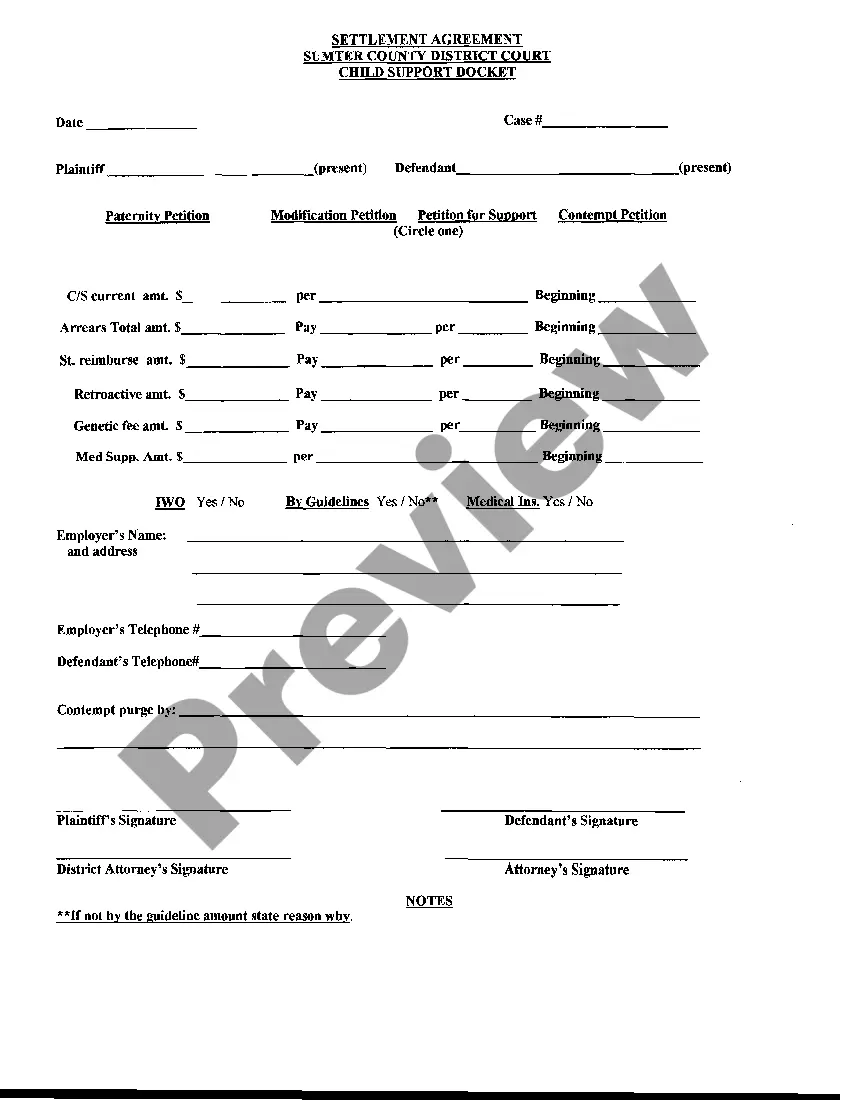

- Examine the example using the Preview functionality (if it's available).

- If there’s a description, read it to comprehend the details.

- Click Buy Now if you found what you are looking for.

- Select your plan on the pricing page and create your account.

- Choose if you prefer to pay via credit card or PayPal.

- Download the file in your desired format.

Form popularity

FAQ

A reaffirmation agreement needs to be filed with the court to show written acceptance of the new debt. These agreements are generally drafted and filed by counsel for the creditor.

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.

Debts arising out of willful and malicious damage to property. debts used to pay nondischargeable tax obligations.

Reaffirming Helps Rebuild Your Credit So timely payments won't help you establish a good credit history after bankruptcy. If you reaffirm the loan, your lender will continue reporting payments.

An executed reaffirmation agree- ment may be filed by any party, including the debtor or a creditor. It must be filed within 60 days after the first date set for the first meeting of creditors in the bankruptcy case unless the deadline is extended by the bankruptcy court.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Alimony and child support. Certain unpaid taxes, such as tax liens. Debts for willful and malicious injury to another person or property. Debts for death or personal injury caused by the debtor's operation of a motor vehicle while intoxicated from alcohol or other substances.

In a Chapter 13 case, the debtor can reaffirm debt,1 but more likely the debtor will use the special powers contained in 11 U.S.C. ? 1322 and 1325 to modify and restructure debt consistent with the debtor's budget.

It is not possible to reaffirm the mortgage loan after the bankruptcy case has discharged and closed.Even if it was possible to reopen the bankruptcy case, vacate the discharge and reaffirm the debt, a bankruptcy judge in California is highly unlikely to sign the order reaffirming the debt.