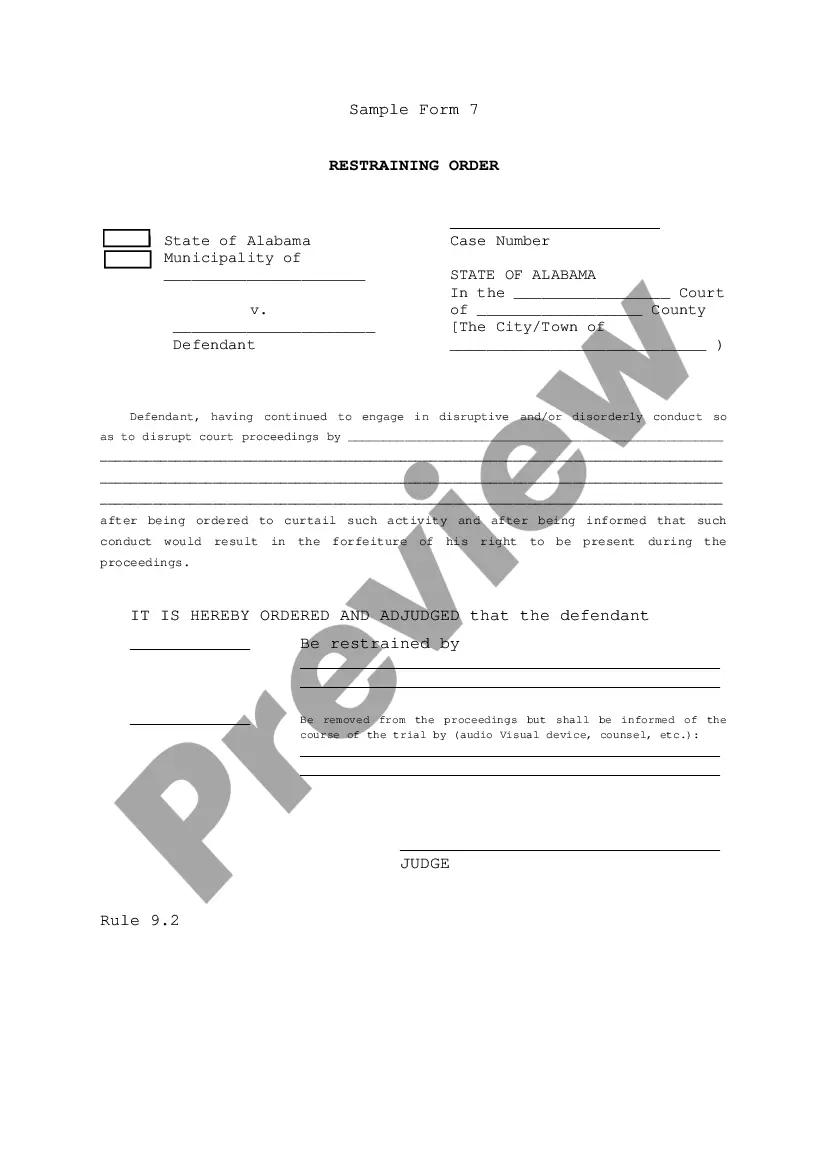

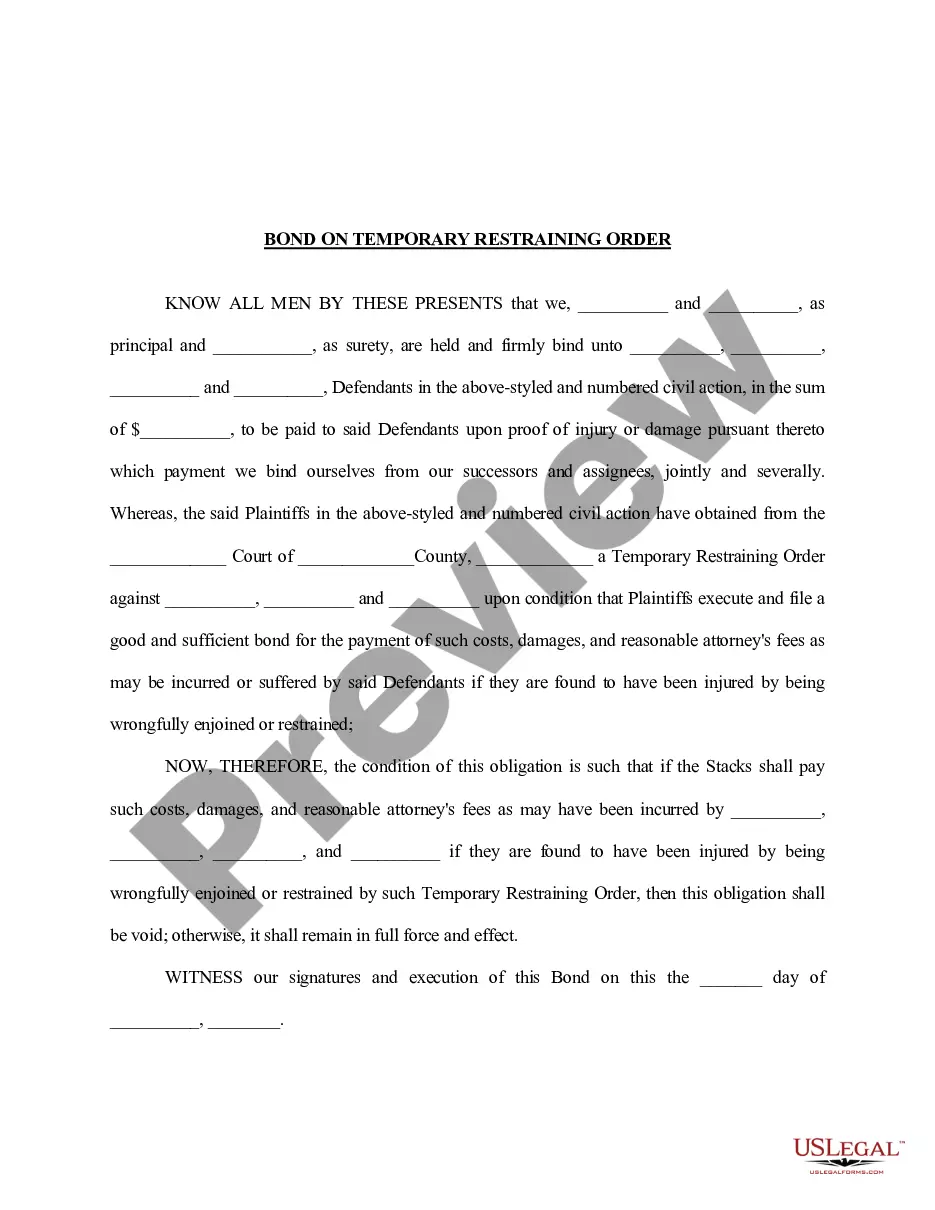

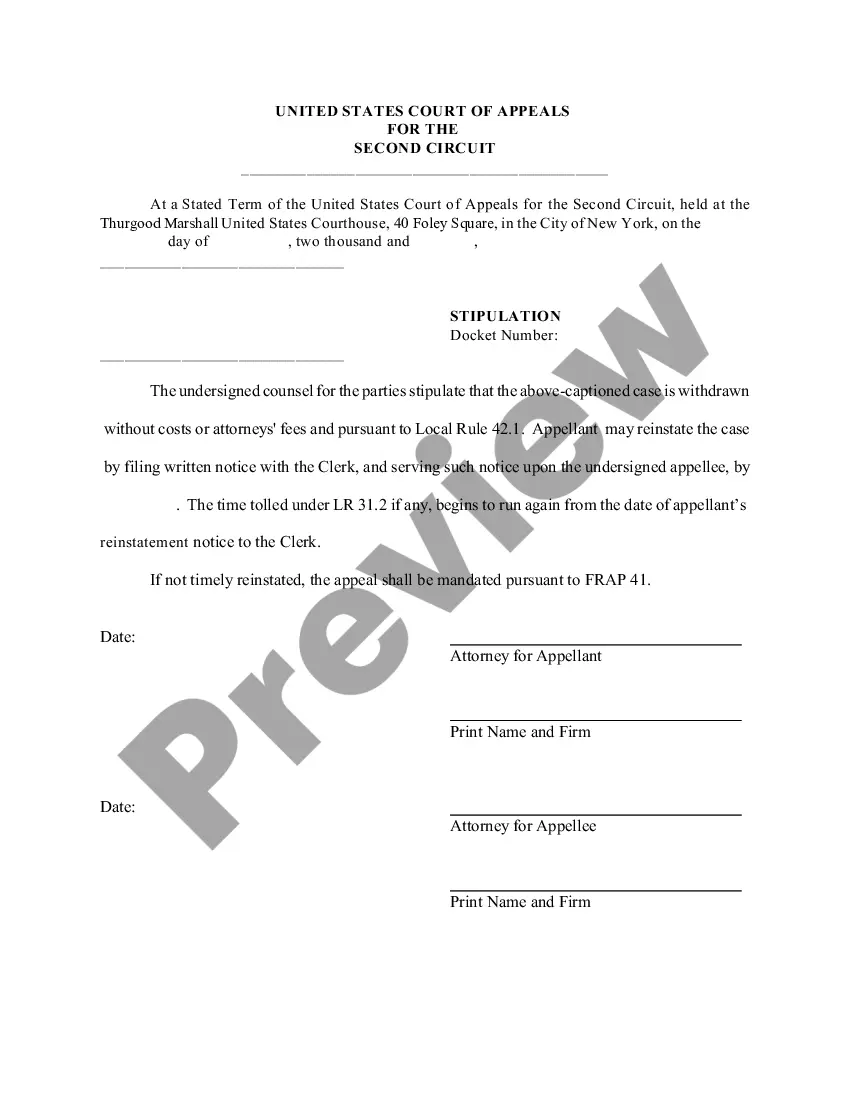

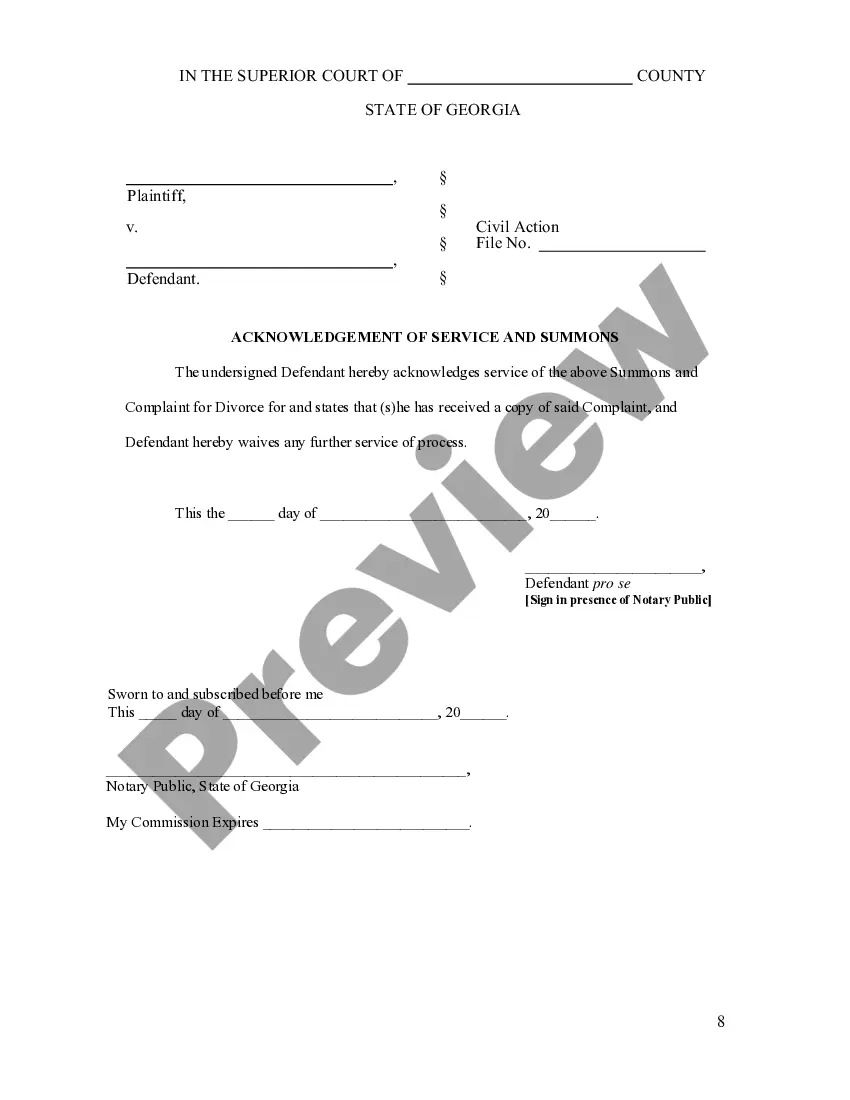

Restrict & Prohibit, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Restrict & Prohibit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Restrict & Prohibit?

Utilizing Alabama Restrict & Prohibit templates crafted by professional attorneys helps you avoid complications when completing paperwork.

Simply download the template from our site, fill it in, and ask a lawyer to validate it.

This can save you significantly more time and effort than hiring legal assistance to prepare a document for you.

Streamline the time taken to complete paperwork with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, just Log In to your account and navigate back to the form webpage.

- Locate the Download button next to the templates you're reviewing.

- After downloading a document, all your stored templates can be found in the My documents section.

- If you lack a subscription, it’s not a significant issue.

- Just follow the instructions below to register for your account online, acquire, and fill out your Alabama Restrict & Prohibit template.

- Verify and ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

The new law regarding unlocking cell phones in Alabama permits consumers to unlock their phones, enabling them to switch carriers easily. This law supports consumer rights and encourages competition among service providers. Residents should be aware of this law to take full advantage of their mobile options without restrictions imposed by their current carriers.

Individuals who have been convicted of certain felonies or who have been adjudicated as mentally incompetent cannot possess firearms in Alabama. This law aims to restrict access to firearms to those who may pose a risk to themselves or others. By understanding these restrictions, residents can ensure they comply with Alabama's firearm regulations.

Yes, restrictive covenants are enforceable in Alabama under certain conditions. These agreements typically apply to businesses and may limit specific actions that former employees can take post-employment. Knowing the enforceability of these covenants is crucial for Alabama residents engaging in business relationships and protecting their interests.

The prohibition law in Alabama historically banned the sale and consumption of alcoholic beverages. This legislation was part of a broader movement that sought to curb alcohol-related issues in society. While the law has evolved over the years, understanding its implications helps residents grasp the significance of Alabama's efforts to regulate behavior within the state.

No, under Alabama's updated legislation, you cannot have your phone in your hand while driving. This law clarifies that holding your phone for any purpose while operating a vehicle is considered illegal. By enforcing this rule, Alabama aims to protect drivers, passengers, and pedestrians alike from the dangers of distracted driving.

The new cell phone law in Alabama focuses on restricting the use of mobile devices while driving. Under this law, drivers are prohibited from holding and using their phones in their hands. This legislation aims to reduce distractions and improve overall road safety, making it imperative for Alabama residents to understand and comply with these restrictions.

Form 40V Alabama is the payment voucher used when submitting your state income tax payment. This form must accompany your payment to ensure it is credited correctly to your tax account. Awareness of its use is important to comply with Alabama restrict & prohibit filing requirements. If you need assistance with form submission, uslegalforms can help streamline that process.

Yes, IRA distributions are generally taxable in Alabama. However, there are specific exemptions and rules that may apply depending on your withdrawal age and circumstances. Understanding how Alabama restrict & prohibit tax laws interact with IRA distributions is crucial for tax planning. For detailed information, uslegalforms offers guidance to help you navigate these tax implications wisely.

Form 40 is for full-time residents of Alabama, while form 40NR is for non-residents with Alabama-sourced income. Understanding these distinctions is essential for correct tax reporting. Each form caters to different residency statuses and income sources, reflecting how Alabama restrict & prohibit tax policies apply. For clarity, you can refer to uslegalforms to guide you through your obligations.

The 40NR form is designed for non-residents of Alabama who owe taxes on income sourced from Alabama. It enables you to report your income accurately and adhere to state regulations. Filing this form is essential, especially as Alabama restrict & prohibit tax regulations apply to non-resident income. Consider using uslegalforms to ensure correct submission.